Automotive Steering Systems Market

Global Automotive Steering Systems Market Size, Share & Trends Analysis Report, by Technology (Electronic Steering System, Hydraulic Steering System, and Electro-Hydraulic Steering System), by Mechanism (Collapsible and Rigid), and By End-Users (Passenger Vehicles and Commercial Vehicles) Forecast (2021-2027) Update Available - Forecast 2025-2035

The global automotive steering systems market is anticipated to grow at a significant CAGR of nearly 4.6% during the forecast period (2021-2027). The steering industry is one of the significant industries for all types of vehicle industries. With the introduction of automotive steering system technology, drivers could steer heavy vehicles easily as well as it allows engineers to improve steering response. The growing popularity of self-driving vehicles is rising the demand for the electric power steering systems globally, which will propel the growth of the automotive steering systems market. These systems also reduce weight, which indirectly increases the efficiency of the vehicles.

Impact of COVID-19 Pandemic on Global Automotive Steering Systems Market

The COVID-19 pandemic has disrupted the manufacturing operations of various industries including automotive among others , owing to the imposition of lockdown across the globe by several government. Further, the outbreak has affected the buying behavior of the consumers, as people were more focused towards buying more essential goods. However, post outbreak of COVID-19, the automotive steering systems market has witness significant recovery, as industrial operations such as vehicle manufacturing facilities were reopened and labor swas available. In addition, the developing countries such as India, China, and others has witnessed significant growth in the demand for passenger vehicles due to the changing preference of the consumers post COVID-19 pandemic period. The population of the countries are shifting towards personal vehicles from public transportation, which will drive the

Segmental Outlook

The global automotive steering systems market is segmented based on the technology, mechanism, and end-users. Based on the Technology, the market is segmented into electronic power steering, hydraulic power steering, and electro-hydraulic power steering. Based on the mechanism, the market is bifurcated into collapsible and rigid. Based on the end-users, the market is segmented into passenger vehicles and commercial vehicles.

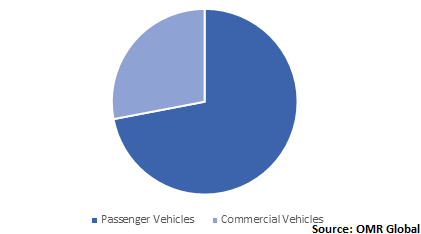

Global Automotive Steering Systems Market Share by End-Users, 2020 (%)

Passenger Vehicles Segment is Estimated to Hold the Major Share in the Global Automotive Steering Systems Market

Based on the end-user industry, the passenger vehicles industry holds the prominent shares in 2020 as compared to commercial vehicles. As per the Organisation Internationale des Constructeurs d'Automobiles (OICA), passenger Vehicles were produced 55,834,456 and commercial vehicles were produced 21,787,126 in 2020. It concludes passenger vehicles have 72% production of the automobile industry. Passenger vehicles have been in demand and still going to be in demand because of economical, easy to use in nature. The high competition has pushed the market players to adopt the technologies like automotive steering to stay in the competition, which directly increased the demands of automotive steering systems. On the other hand, commercial vehicles are used for a specific purpose which reduces its appeal to normal people, but its market is also growing significantly. Since commercial vehicles are probably heavy, which restricts commercial vehicles players to adopt automotive steering due to its limited load-bearing capacity. This affects the market negatively.

Based on the mechanism, collapsible electric power steering is the fastest-growing market. In the steering column, collapsible housing contains a collapsible rotating shaft. For safety, the steering column is designed to collapse in the event of a front-end collision. As global auto OEMs continue expanding into growing and emerging markets, the demand for collapsible steering columns is expected to increase. The market for collapsible steering column systems has been growing rapidly over the past few years due to the rising sales of passenger cars, the expansion of global players in developing economies, and technological advances.

Based on type, the automotive steering system market is segmented into electronic power steering, hydraulic power steering, and electro-hydraulic power steering. Electronic power steering is accounted for the largest share in the global market in 2020. At the time of the accident, the collapsible steering column is a mechanism consisting of an upper column and a lower shaft, with the lower shaft going into housing. This column is mounted in passenger cars and light commercial vehicles. The primary factors driving the growth of collapsible steering columns in EPS systems are the growing development of passenger cars and light commercial vehicles and increasing government norms on road safety.

Regional Outlook

The global automotive steering systems market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Germany, Italy, Spain, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East & Africa, and Latin America).

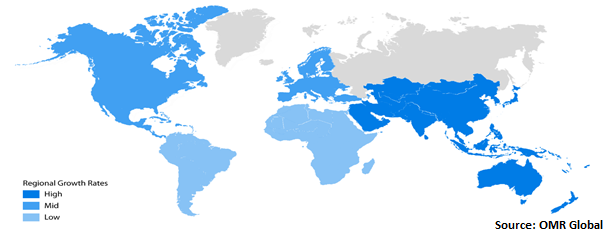

Global Automotive Steering Systems Market Growth by Region, 2021-2027

Asia-Pacific Region Held the Major Market Share in the Global Automotive Steering Systems Market

Among the region, the Asia-Pacific region is estimated to hold the prominent market share of the global automotive steering market, owing to the rapidly rising production of passenger vehicles in countries such as China, India, Japan, and South Korea. The safety and emission norms have become a priority by the government across the Asia Oceania region, the installation of electric power steering has also increased. Moreover, the use of ADAS (Advanced Driver Assist System) features such as lane-keep assist, automated parking, lane changes, and the ability to guide vehicles around obstacles all make EPS (Electric Parking Brake) an ideal choice. The Asia-Pacific is the fastest-growing regional market ADAS in the past few years. For instance, in 2021, Mahindra & Mahindra and Morris Garages launched XUV 700 and Astor, respectively, with ADAS features at affordable prices. Such features will require more electronic installations, which, in turn, is expected to drive the automotive steering system market. The strong presence of automotive steering manufacturers, such as JTEKT Corporation, NSK Ltd., Showa Corporation, and Hyundai Mobis among the region is further expected to drive the growth of the market.

Market Players Outlook

The major companies serving the global Automotive Steering Systems market include China Automotive Systems Inc., JTEKT Corp., Nexteer Automotive Corp., Mando Corp. and ThyssenKrupp AG. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers & acquisitions, partnerships, and collaborations, and geographical expansion, to stay competitive in the market. For instance, In January 2021, Nexteer Automotive invested in Tactile Mobility, a tactile virtual sensing and data company based in Isreal, to enhance the next level “steering feel”. Nexteer expected to elevate its expertise via Tactile Mobility’s real-time data feeds on vehicle environments. Nexteer joined other global automotive companies to collaborate with Tactile Mobility.

The Report Covers

- Market value data analysis of 2020 and forecast to 2027.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global automotive steering systems market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global Automotive Steering Systems Market

• Recovery Scenario of Global Automotive Steering Systems Market

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. BY Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. CHINA AUTOMOTIVE SYSTEMS, INC.

3.1.1.1. Overview

3.1.1.2. Financial Analysis

3.1.1.3. SWOT Analysis

3.1.1.4. Recent Developments

3.1.2. JTEKT Corp.

3.1.2.1. Overview

3.1.2.2. Financial Analysis

3.1.2.3. SWOT Analysis

3.1.2.4. Recent Developments

3.1.3. Mando Corp.

3.1.3.1. Overview

3.1.3.2. Financial Analysis

3.1.3.3. SWOT Analysis

3.1.3.4. Recent Developments

3.1.4. Nexteer Automotive Corp.

3.1.4.1. Overview

3.1.4.2. Financial Analysis

3.1.4.3. SWOT Analysis

3.1.4.4. Recent Developments

3.1.5. ThyssenKrupp AG

3.1.5.1. Overview

3.1.5.2. Financial Analysis

3.1.5.3. SWOT Analysis

3.1.5.4. Recent Developments

3.2. Key Strategy Analysis

3.3. Impact of Covid-19 on Key Players

4. Market Segmentation

4.1. Global Automotive Steering Systems Market by Technology

4.1.1. Electrical Power Steering

4.1.2. Hydraulic Power Steering

4.1.3. Electro-Hydraulic Power Steering

4.2. Global Automotive Steering Systems Market by Mechanism

4.2.1. Collapsible

4.2.2. Rigid

4.3. Global Automotive Steering Systems Market by Vehicle Type

4.3.1. Passenger Cars

4.3.2. Commercial Vehicles

4.3.2.1. Light Commercial Vehicle (LCV)

4.3.2.2. Heavy Commercial Vehicle (HCV)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. D&L Technologies

6.2. Delphi Technologies

6.3. GKN

6.4. Greased Lightning

6.5. Hitachi Astemo

6.6. Hyundai Mobis Co. Ltd.

6.7. Invasion Automotive Products

6.8. Kevin Cook Foundation Inc.

6.9. Kotec America Inc.

6.10. Maclube Oil, Co.

6.11. Mitsubishi Electric Corp.

6.12. NSK Ltd.

6.13. Overnight Same-Day Transport LLC

6.14. Robert Bosch Automotive Steering GmbH

6.15. Showa Corp.

6.16. SIC Autoparts, LLC

6.17. Sona Koyo Steering Systems Ltd.

6.18. Tenneco

6.19. Wire Cloth Filter Manufacturing Co.

6.20. ZF Friedrichshafen AG

1. GLOBAL AUTOMOTIVE STEERING SYSTEMS MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2020-2027 ($ MILLION)

2. GLOBAL ELECTRONIC POWER STEERING MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

3. GLOBAL HYDRAULIC POWER STEERING MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

4. GLOBAL ELECTRO-HYDRAULIC STEERING MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

5. GLOBAL AUTOMOTIVE STEERING SYSTEMS MARKET RESEARCH AND ANALYSIS BY MECHANISM PROCESS, 2020-2027 ($ MILLION)

6. GLOBAL COLLAPSIBLE STEERING SYSTEMS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

7. GLOBAL RIGID STEERING SYSTEMS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

8. GLOBAL AUTOMOTIVE STEERING SYSTEMS MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2020-2027 ($ MILLION)

9. GLOBAL AUTOMOTIVE STEERING SYSTEMS FOR PESSENGER VEHICLES MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

10. GLOBAL AUTOMOTIVE STEERING SYSTEMS FOR COMMERCIAL VEHICLES MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

11. GLOBAL AUTOMOTIVE STEERING SYSTEMS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2020-2027 ($ MILLION)

12. NORTH AMERICAN AUTOMOTIVE STEERING SYSTEMS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

13. NORTH AMERICAN AUTOMOTIVE STEERING SYSTEMS MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2020-2027 ($ MILLION)

14. NORTH AMERICAN AUTOMOTIVE STEERING SYSTEMS MARKET RESEARCH AND ANALYSIS BY MECHANISM PROCESS, 2020-2027 ($ MILLION)

15. NORTH AMERICAN AUTOMOTIVE STEERING SYSTEMS MARKET RESEARCH AND ANALYSIS BY END-USERS INDUSTRY, 2020-2027 ($ MILLION)

16. EUROPEAN AUTOMOTIVE STEERING SYSTEMS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

17. EUROPEAN AUTOMOTIVE STEERING SYSTEMS MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2020-2027 ($ MILLION)

18. EUROPEAN AUTOMOTIVE STEERING SYSTEMS MARKET RESEARCH AND ANALYSIS BY MECHANISM PROCESS, 2020-2027 ($ MILLION)

19. EUROPEAN AUTOMOTIVE STEERING SYSTEMS MARKET RESEARCH AND ANALYSIS BY END-USERS INDUSTRY, 2020-2027 ($ MILLION)

20. ASIA-PACIFIC AUTOMOTIVE STEERING SYSTEMS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

21. ASIA-PACIFIC AUTOMOTIVE STEERING SYSTEMS MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2020-2027 ($ MILLION)

22. ASIA-PACIFIC AUTOMOTIVE STEERING SYSTEMS MARKET RESEARCH AND ANALYSIS BY MECHANISM PROCESS, 2020-2027 ($ MILLION)

23. ASIA-PACIFIC AUTOMOTIVE STEERING SYSTEMS MARKET RESEARCH AND ANALYSIS BY END-USERS INDUSTRY, 2020-2027 ($ MILLION)

24. REST OF THE WORLD AUTOMOTIVE STEERING SYSTEMS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

25. REST OF THE WORLD AUTOMOTIVE STEERING SYSTEMS MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2020-2027 ($ MILLION)

26. REST OF THE WORLD AUTOMOTIVE STEERING SYSTEMS MARKET RESEARCH AND ANALYSIS BY MECHANISM PROCESS, 2020-2027 ($ MILLION)

27. REST OF THE WORLD AUTOMOTIVE STEERING SYSTEMS MARKET RESEARCH AND ANALYSIS BY END-USERS INDUSTRY, 2020-2027 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL AUTOMOTIVE STEERING SYSTEMS MARKET, 2020-2027 ($ MILLION)

2. IMPACT OF COVID-19 ON GLOBAL AUTOMOTIVE STEERING SYSTEMS MARKET BY SEGMENT, 2020-2027 ($ MILLION)

3. RECOVERY OF GLOBAL AUTOMOTIVE STEERING SYSTEMS MARKET, 2021-2027 (%)

4. GLOBAL AUTOMOTIVE STEERING SYSTEMS MARKET SHARE BY TECHNOLOGY, 2020 VS 2027 (%)

5. GLOBAL ELECTRONIC POWER STEERING MARKET REGION BY GEOGRAPHY, 2020 VS 2027 (%)

6. GLOBAL HYDRAULIC POWER STEERING MARKET REGION BY GEOGRAPHY, 2020 VS 2027 (%)

7. GLOBAL ELECTRO-HYDRAULIC POWER STEERING MARKET REGION BY GEOGRAPHY, 2020 VS 2027 (%)

8. GLOBAL AUTOMOTIVE STEERING SYSTEMS MARKET SHARE BY MECHANISM PROCESS, 2020 VS 2027 (%)

9. GLOBAL COLLAPSIBLE STEERING SYSTEMS MARKET REGION BY GEOGRAPHY, 2020 VS 2027 (%)

10. GLOBAL RIGID STEERING SYSTEMS MARKET REGION BY GEOGRAPHY, 2020 VS 2027 (%)

11. GLOBAL AUTOMOTIVE STEERING SYSTEMS MARKET SHARE BY END-USER INDUSTRY, 2020 VS 2027 (%)

12. GLOBAL AUTOMOTIVE STEERING SYSTEMS FOR PESSENGER VEHICLES MARKET REGION BY GEOGRAPHY, 2020 VS 2027 (%)

13. GLOBAL AUTOMOTIVE STEERING SYSTEMS FOR COMMERCIAL VEHICLES MARKET REGION BY GEOGRAPHY, 2020 VS 2027 (%)

14. GLOBAL AUTOMOTIVE STEERING SYSTEMS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

15. US AUTOMOTIVE STEERING SYSTEMS MARKET SIZE, 2020-2027 ($ MILLION)

16. CANADA AUTOMOTIVE STEERING SYSTEMS MARKET SIZE, 2020-2027 ($ MILLION)

17. UK AUTOMOTIVE STEERING SYSTEMS MARKET SIZE, 2020-2027 ($ MILLION)

18. FRANCE AUTOMOTIVE STEERING SYSTEMS MARKET SIZE, 2020-2027 ($ MILLION)

19. GERMANY AUTOMOTIVE STEERING SYSTEMS MARKET SIZE, 2020-2027 ($ MILLION)

20. ITALY AUTOMOTIVE STEERING SYSTEMS MARKET SIZE, 2020-2027 ($ MILLION)

21. SPAIN AUTOMOTIVE STEERING SYSTEMS MARKET SIZE, 2020-2027 ($ MILLION)

22. REST OF EUROPE AUTOMOTIVE STEERING SYSTEMS MARKET SIZE, 2020-2027 ($ MILLION)

23. INDIA AUTOMOTIVE STEERING SYSTEMS MARKET SIZE, 2020-2027 ($ MILLION)

24. CHINA AUTOMOTIVE STEERING SYSTEMS MARKET SIZE, 2020-2027 ($ MILLION)

25. JAPAN AUTOMOTIVE STEERING SYSTEMS MARKET SIZE, 2020-2027 ($ MILLION)

26. SOUTH KOREA AUTOMOTIVE STEERING SYSTEMS MARKET SIZE, 2020-2027 ($ MILLION)

27. REST OF ASIA-PACIFIC AUTOMOTIVE STEERING SYSTEMS MARKET SIZE, 2020-2027 ($ MILLION)

28. REST OF THE WORLD AUTOMOTIVE STEERING SYSTEMS MARKET SIZE, 2020-2027 ($ MILLION)