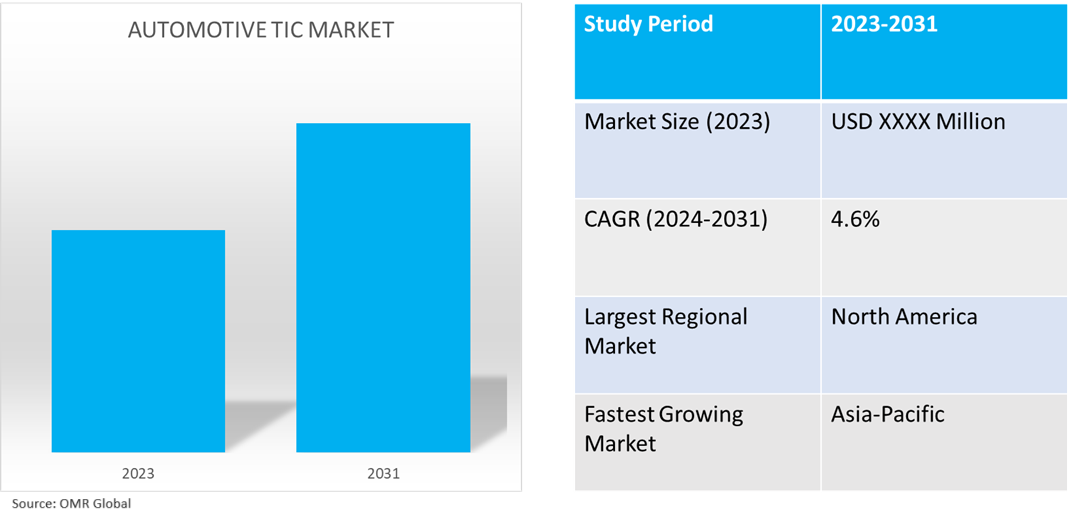

Automotive TIC Market

Automotive TIC Market Size, Share & Trends Analysis Report by Service Type (Testing, Inspection, and Certification), by Vehicle Type (Passenger Vehicle, and Commercial Vehicle), and by Sourcing Type (In-house, and Outsourced), Forecast Period (2024-2031)

Automotive testing, inspection, and certification (TIC) market is anticipated to grow at a CAGR of 4.6% during the forecast period (2024-2031). Automotive TIC comprises a three-stage process of testing, inspecting, and certifying automobiles as per regulatory requirements, safety protocols, and quality standards. The growth of the market is driven by the increasing number of automobiles and stringent regulatory regulations for road safety. The advancements in automotive testing technology, the rise in alternative automotive such as electric vehicles (EVs) and hybrid vehicles (HEVs), and growing concerns for manufacturers on vehicle re-call and aftermarket servicing are further aiding the global market growth.

Market Dynamics

Increasing Vehicle Production

The increase in automobile production has been a key contributor to automotive TIC market growth. In the past decade, the demand for automobiles, including EVs, has exponentially increased with growing urbanization, increasing income levels, and the shifting preference of consumers to upgrade their vehicles among others. The demand has pushed automobile manufacturers to produce and test vehicles as per the highest level of quality and safety standards to fulfill regulatory requirements as well as consumer expectations, which is projected to positively influence the automotive TIC demand. For instance, according to the European Automobile Manufacturers Association (ACEA), in 2022, 85.4 million motor vehicles were produced around the globe, an increase of 5.7% compared to 2021. The production data comprises Greater China (32.0%) with an increase of 2.0% from 2017, Europe (19.0%) with a decrease of 4.0% from 2017, North America (17.0%) with a decrease of 1.0% from 2017, and South Asia (12.0%) with an increase of 3.0% from 2017.

Advancement in Automotive Technology

The advancement in automotive technology such as advanced driver-assistance systems (ADAS) and autonomous vehicles has created new prospects for original equipment manufacturers (OEMs) and automotive TIC companies to upgrade, revise, and modify testing technology to comply with future road safety regulation requirements. The integration of such advanced technology will require rigorous investments, R&D, and innovation in TIC processes. However, the advancement also brings new opportunities for automotive TIC companies to expand their service portfolio as per futuristic trends and grow their businesses. For instance, in May 2024, Skoda Auto inaugurated new facilities for the Emissions Center and a brand-new Simulation Center in Mladá Boleslav. Following investments of nearly $23.6 million, the laboratory will bolster the car manufacturer's in-house development capabilities within the Technical Development department. State-of-the-art technologies allow for the precise and accurate simulation of several climatic conditions, enabling comprehensive tests that mimic real-world operations.

Segmental Outlook

- Based on service type, the market is segmented into testing, inspection, and certification.

- Based on vehicle type, the market is segmented into passenger vehicles and commercial vehicles.

- Based on sourcing type, the market is segmented into in-house and outsourced.

Testing is the Most Prominent Automotive TIC Service Type

Automotive testing holds considerable significance in automotive servicing. The standard testing requirements for new vehicles, components, and materials and diverse testing service requirements such as durability testing, emissions testing, performance testing, noise testing, and vibration testing, among others, drive the testing demand. For instance, TÜV SÜD America Inc. unveiled its new state-of-the-art environmental laboratory in Auburn Hills, MI, reaffirming its unwavering commitment to advancing the highest quality and performance standards in EV battery and system solutions.

Passenger Vehicle Holds Major Share Based on Vehicle Type

The increasing demand for passenger vehicles, novel launches of different passenger vehicle types, integration of advanced technology in passenger vehicles, and the requirement of strict adherence to regulatory requirements in the passenger vehicle segment contribute to the high share of this market segment. For instance, according to the European Automobile Manufacturers Association (ACEA), 66.0 million passenger cars are sold around the globe every year, among which the European Union accounts for 14.1% of global registrations with more than 9.0 million new cars.

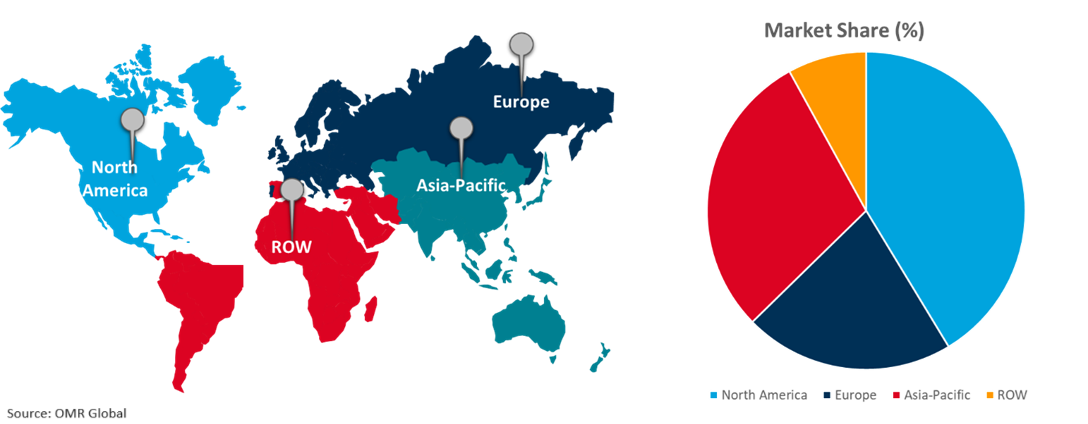

Regional Outlook

The global automotive TIC market is further segmented based on geography including North America (the US, and Canada), Europe (the UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Global Automotive TIC Market Growth by Region 2024-2031

North America Dominates the Global Automotive TIC Market

North America dominates the automotive TIC market owing to regional efforts to standardize road safety through rigorous vehicle testing programs, stringent regulation for automotive TIC, constant investments in automotive TIC R&D. The increasing demand for passenger vehicles in the region, and the presence of major automotive TIC providers such as Intertek Group plc, Société Générale de Surveillance SA., and UL LLC are other contributors to the high share of the regional market. Further, the implementation of regional programs for rating and certifying vehicle safety has widely promoted the implication and adoption of automotive TIC in the region. For instance, the NHTSA's New Car Assessment Program (NCAP) in the US provides comparative data on the safety performance of new vehicles to help consumers make purchasing decisions and drive safety improvements. In addition to star ratings for crash safety and rollover resistance, the NCAP program promotes specific advanced driver assistance systems (ADAS) technologies and identifies vehicles on the market with those systems that meet NCAP performance test standards.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global automotive TIC market include Intertek Group plc, Société Générale de Surveillance SA., and UL LLC. among others. The market players are focusing on capitalizing on growth by adopting strategies such as collaboration, partnerships, and market expansion among others. For instance, in March 2024, Bureau Veritas announced definitive agreements to acquire three players to broaden its position in testing and certification services for the Electrical and Electronics consumer products category in South and North-East Asia, with a total revenue of approximately $21.4 million in 2023.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global automotive TIC market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Industry Trends

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

4. Market Segmentation

4.1. Global Automotive TIC Market by Service Type

4.1.1. Testing

4.1.2. Inspection

4.1.3. Certification

4.2. Global Automotive TIC Market by Vehicle Type

4.2.1. Passenger Vehicle

4.2.2. Commercial Vehicle

4.3. Global Automotive TIC Market by Sourcing Type

4.3.1. In-house

4.3.2. Outsourced

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. Applus Services, S.A

6.2. Bureau Veritas

6.3. Contract Laboratory LLC

6.4. DEKRA

6.5. DNV Group

6.6. EM Topco Ltd.

6.7. Eurofins Scientific SE

6.8. Intertek Group plc

6.9. MISTRAS Group

6.10. Ricardo plc

6.11. Smithers Group Inc.

6.12. Société Générale de Surveillance SA

6.13. The British Standards Institution

6.14. TÜV SÜD

6.15. UL LLC

1. Global Automotive Testing, Inspection, and Certification Market Research and Analysis By Service Type, 2023-2031 ($ Million)

2. Global Automotive Testing Market Research and Analysis By Region, 2023-2031 ($ Million)

3. Global Automotive Inspection Market Research and Analysis By Region, 2023-2031 ($ Million)

4. Global Automotive Certification Market Research and Analysis By Region, 2023-2031 ($ Million)

5. Global Automotive Testing, Inspection, and Certification Market Research and Analysis By Vehicle Type, 2023-2031 ($ Million)

6. Global Automotive Testing, Inspection, and Certification For Passenger Vehicle Market Research and Analysis By Region, 2023-2031 ($ Million)

7. Global Automotive Testing, Inspection, and Certification For Commercial Vehicle Market Research and Analysis By Region, 2023-2031 ($ Million)

8. Global Automotive Testing, Inspection, and Certification Market Research and Analysis By Sourcing Type, 2023-2031 ($ Million)

9. Global In-House Automotive Testing, Inspection, and Certification Market Research and Analysis By Region, 2023-2031 ($ Million)

10. Global Outsourced Automotive Testing, Inspection, and Certification Market Research and Analysis By Region, 2023-2031 ($ Million)

11. Global Automotive Testing, Inspection, and Certification Market Research and Analysis By Region, 2023-2031 ($ Million)

12. North American Automotive Testing, Inspection, and Certification Market Research and Analysis By Country, 2023-2031 ($ Million)

13. North American Automotive Testing, Inspection, and Certification Market Research and Analysis By Service Type, 2023-2031 ($ Million)

14. North American Automotive Testing, Inspection, and Certification Market Research and Analysis By Vehicle Type, 2023-2031 ($ Million)

15. North American Automotive Testing, Inspection, and Certification Market Research and Analysis By Sourcing Type, 2023-2031 ($ Million)

16. European Automotive Testing, Inspection, and Certification Market Research and Analysis By Country, 2023-2031 ($ Million)

17. European Automotive Testing, Inspection, and Certification Market Research and Analysis By Service Type, 2023-2031 ($ Million)

18. European Automotive Testing, Inspection, and Certification Market Research and Analysis By Vehicle Type, 2023-2031 ($ Million)

19. European Automotive Testing, Inspection, and Certification Market Research and Analysis By Sourcing Type, 2023-2031 ($ Million)

20. Asia-Pacific Automotive Testing, Inspection, and Certification Market Research and Analysis By Country, 2023-2031 ($ Million)

21. Asia-Pacific Automotive Testing, Inspection, and Certification Market Research and Analysis By Service Type, 2023-2031 ($ Million)

22. Asia-Pacific Automotive Testing, Inspection, and Certification Market Research and Analysis By Vehicle Type, 2023-2031 ($ Million)

23. Asia-Pacific Automotive Testing, Inspection, and Certification Market Research and Analysis By Sourcing Type, 2023-2031 ($ Million)

24. Rest of The World Automotive Testing, Inspection, and Certification Market Research and Analysis By Region, 2023-2031 ($ Million)

25. Rest of The World Automotive Testing, Inspection, and Certification Market Research and Analysis By Service Type, 2023-2031 ($ Million)

26. Rest of The World Automotive Testing, Inspection, and Certification Market Research and Analysis By Vehicle Type, 2023-2031 ($ Million)

27. Rest of The World Automotive Testing, Inspection, and Certification Market Research and Analysis By Sourcing Type, 2023-2031 ($ Million)

1. Global Automotive Testing, Inspection, and Certification Market Share by Service Type, 2023 Vs 2031 (%)

2. Global Automotive Testing Market Share by Region, 2023 Vs 2031 (%)

3. Global Automotive Inspection Market Share by Region, 2023 Vs 2031 (%)

4. Global Automotive Certification Market Share by Region, 2023 Vs 2031 (%)

5. Global Automotive Testing, Inspection, and Certification Market Share by Vehicle Type, 2023 Vs 2031 (%)

6. Global Automotive Testing, Inspection, and Certification For Passenger Vehicle Market Share by Region, 2023 Vs 2031 (%)

7. Global Automotive Testing, Inspection, and Certification For Commercial Vehicle Market Share by Region, 2023 Vs 2031 (%)

8. Global Automotive Testing, Inspection, and Certification Market Share by Sourcing Type, 2023 Vs 2031 (%)

9. Global In-House Automotive Testing, Inspection, and Certification Market Share by Region, 2023 Vs 2031 (%)

10. Global Outsourced Automotive Testing, Inspection, and Certification Market Share by Region, 2023 Vs 2031 (%)

11. Global Automotive Testing, Inspection, and Certification Market Share by Region, 2023 Vs 2031 (%)

12. US Automotive Testing, Inspection, and Certification Market Size, 2023-2031 ($ Million)

13. Canada Automotive Testing, Inspection, and Certification Market Size, 2023-2031 ($ Million)

14. UK Automotive Testing, Inspection, and Certification Market Size, 2023-2031 ($ Million)

15. France Automotive Testing, Inspection, and Certification Market Size, 2023-2031 ($ Million)

16. Germany Automotive Testing, Inspection, and Certification Market Size, 2023-2031 ($ Million)

17. Italy Automotive Testing, Inspection, and Certification Market Size, 2023-2031 ($ Million)

18. Spain Automotive Testing, Inspection, and Certification Market Size, 2023-2031 ($ Million)

19. Rest of Europe Automotive Testing, Inspection, and Certification Market Size, 2023-2031 ($ Million)

20. India Automotive Testing, Inspection, and Certification Market Size, 2023-2031 ($ Million)

21. China Automotive Testing, Inspection, and Certification Market Size, 2023-2031 ($ Million)

22. Japan Automotive Testing, Inspection, and Certification Market Size, 2023-2031 ($ Million)

23. South Korea Automotive Testing, Inspection, and Certification Market Size, 2023-2031 ($ Million)

24. Rest of Asia-Pacific Automotive Testing, Inspection, and Certification Market Size, 2023-2031 ($ Million)

25. Latin America Automotive Testing, Inspection, and Certification Market Size, 2023-2031 ($ Million)

26. Middle East And Africa Automotive Testing, Inspection, and Certification Market Size, 2023-2031 ($ Million)