Automotive Tire Market

Global Automotive Tire Market Size, Share & Trends Analysis Report By Rim Size (10-14 inches, 15-21 inches, More than 20 inches), By Vehicle Type (Two-Wheeler, Passenger Car, Light & Medium Commercial Vehicle, Heavy Commercial Vehicle, and Others), By Road Application (Summer Tire, Winter Tire, All-Season Tire, High-Performance Tire, and Other), By Construction (Radial Tire, and Bias & Belted Bias Cross Ply Tire), By Sales Channel (OEM, and Aftermarket) Forecast 2021-2027 Update Available - Forecast 2025-2035

The global market for automotive tires is projected to have a considerable CAGR during the forecast period. Post-COVID-19, the market will be driven by the increasing automobile production & sales, advancement in tire manufacturing technology, and the rise in competition among tire manufacturers. Besides, the demand for next-generation high-performance tires is growing due to the less noise and long durability provided by these tires, which, in turn, further drive the growth of the market. Furthermore, cohesive government initiatives to improve road safety are also anticipated to fuel the market growth in the future years. For instance, in February 2021, the UK Government passed a new law according to which, tires that are more than 10 years old cannot be used on the front steered axles of HGVs, buses, coaches, and all single wheels fitted to a minibus (9 to 16 passenger seats) to improve the road safety in the country.

However, fluctuating price of raw material, and chances of accident due to tire bursting are the major concern for the market. Continuous development by the major market players in the manufacturing technology & material and investment for the manufacturing of new plants are also expected to provide an opportunity for market growth in the near future.

Segmental Outlook

The global automotive tire market is segmented into rim size, vehicle type, road application, construction, and sales channel. Based on rim size, the market is classified into 10-14 inches, 15-21 inches, and more than 20 inches. Further, on the basis of vehicle type, the market is segmented into two-wheelers, passenger cars, light & medium commercial vehicles, heavy commercial vehicles, and others. By road application, the market is sub-segmented into summer tires, winter tires, high-performance tires, and other (all-terrain tires). The All-season tire segment is expected to hold a considerable market share during the forecast period. All-season tires offer thicker treads and provide great tread life than summer and winter tires, due to which demand for these tires increases. Similarly, by construction, the market is bifurcated into the radial tire, and bias & belted bias cross-ply tire. By the sales channel, the market is bifurcated into OEM and aftermarket.

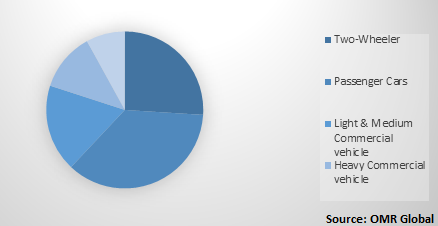

Global Automotive Tire Market Share by Vehicle Type, 2020(%)

The passenger car segment will dominate the market during the forecast period.

Passenger car segment holds the largest market share in 2020, and it is anticipated to dominate the market during the forecast period. The factor attributed to the growth of this segment is due to the high demand for passenger cars across the globe. Apart from this, the rising demand for SUVs and CUVs across the globe, in recent years, is further expected to drive the demand for tires in this category.

Regional Outlook

Geographically, the global automotive tire market is classified into four major regions including North America (the US and Canada), Europe (UK, Germany, France, Italy, Spain, Russia, and Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, ASEAN and Rest of Asia-Pacific), and Rest of the World (Latin America and the Middle East and Africa (MEA)). North America is anticipated to hold a considerable market share during the forecast period. Massive automotive market, the high price of tires, high consumer spending are the major factors driving the market in North American region. Europe is expected to be a lucrative market with a major contribution from Germany, UK, Italy, and France.

Global Automotive Tire Market Growth, by Region 2021-2027

Asia-pacific will hold the largest share in the automotive tire market

By region, Asia-Pacific will dominate in the global tire market. The major countries contributing to the tire market in Asia-Pacific include China, Japan, South Korea, and India. The factors that are boosting the growth of the market in the region include the growing automotive market, the increasing popularity of next-generation, high-performance tires. The presence of mass manufacturers of vehicles and high investment by them to set up production units in the region also drives the automotive tire market. For instance, in March 2021, India’s ride-hailing company Ola (ANI Technologies Pvt Ltd.) has announced to set up a new electric two-wheeler plant in Tamil Nadu with a production capacity of 10 million units per annum. The company is investing more than $320 million for the plant and is expected to be completed by mid-2022.

Market Players Outlook

The key players in the automotive tire market contributing significantly by providing different types of products and increasing their geographical presence across the globe. The key players of the market are Bridgestone Corp., The Goodyear Tire & Rubber Co., Continental AG, Michelin Group, Hankook Tire & Technology Co., Ltd, Sumitomo Rubber Industries, Pirelli & C. S.p.A., The Yokohama Rubber Co., Ltd, and other. To survive in the market, these market players adopt different marketing strategies such as mergers & acquisitions, R&D, product launches, and geographical expansions so on. For instance, in March 2021, Apollo Tyres Ltd., has launched the Apterra Cross range of tires for the compact and midsize SUV segments. The new tire range is developed at Apollo Tyres' manufacturing facility in Oragadam, Tamil Nadu. The company will be able to expand its product portfolio in the SUV segment by this new launch.

The Report Covers

- Market value data analysis of 2020 and forecast to 2027.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global Automotive Tire market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where in the market.