Aviation asset management market

Aviation asset management market size, share & trends analysis report by end-use (commercial platforms, MRO services), and by service type (leasing services, technical services, regulatory certifications) forecast period (2022-2028). Update Available - Forecast 2025-2035

Aviation asset management market is anticipated to grow at a significant CAGR of 5.9% during the forecast period. Airports have a range of airside and landside assets such as airfields, refueling facilities, runways and taxiways, transit systems, aerobridges, buildings, baggage handling systems, parking garages, and air navigation aids, that require efficient asset management tools for effective maintenance and uninterrupted operation. To maintain these things aviation asset management is required. The rising number of air passengers is growing the aviation asset management market during the forecast period. According to International Civil Aviation Organization (ICAO), in 2019 the total number of passengers carried on scheduled services rose to 4.5 billion which was 3.6% higher than the previous year, also the number of departures reached 38.3 million in 2019, a 1.7 % increase. These instances show the growing trend for air passengers which in return increases the aviatiasset management market also.

Impact of COVID-19 Pandemic on Global AVIATION ASSET MANAGEMENT Market

COVID-19 has forced the countries to do strict lockdown across the globe in almost every industry. Due to this the transportation sector was also hit badly. To stop the spread of the novel coronavirus almost every international border and transportation was closed. The lockdown limitation affected the supply chtransportationtion which caused severe revenue loss to the companies and manufacturing units that were shut down including the aviation asset management companies also. Post COVID-19 the market is anticipated to grow normally as before due to the uplifting of the restrictions and lockdown by the governments, which will boboohe the market to grow normally as the number of air passengers number increases.

Segmental Outlook

The global aviation asset management market is segmented based on end-use and service type. Based on the end-user, the market is segmented into the commerce platforms form and MRO services. Based on the service type, the market is sub-segmented into leasing services, technical services, and regulatory certification. The above-mentioned segments can be customized as per the requirements. Based on end-use the commercial segment is anticipated to hold a considerable share in the aviation asset management market during the forecast period. As the economy of a country increases, air transport also increases as it increases the import and export of goods and growth in the number of air passengers. So the demand for aircraft, management of the airport, a and number of increased SESseases which in return increases and requires the proper management of the airport to manage it, for which aviation asset management companies come into play. These factors considerably contribute to the growth of the aviation asset management market across the globe.

The Leasing Segment is Expected to hold the Significant Share in the Global AVIATION ASSET MANAGEMENT Market during the Forecast Period.

Based on service type, the leasing services segment is anticipated to hold a considerable share in the aviation asset management market during the forecast period. The leasing services include aircraft leasing and other related components such as airframes and engines. Generally, airlines opt to lease aircraft as it reduces ownership costs. For instance, in April 2022, AerCap Holdings N.V. signed lease agreements for ten new Airbus A320neo Aircraft and Two New Airbus A330neo Aircraft with ITA Airways. These aircraft deals will help ITA airways expand its network while advancing its commitment to maintaining an environmentally friendly, fuel-efficient fleet.

Regional Outlooks

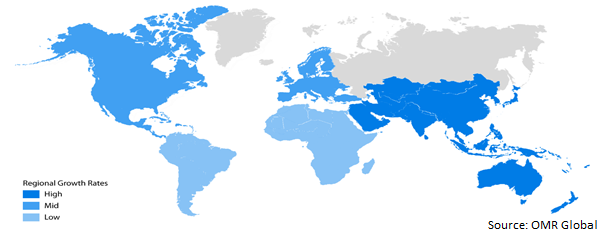

The global aviation asset management market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East & Africa, and Latin America). The market can be analyzed for a particular region or country level as per the requirement. The Asia-Pacific region is anticipated to hold a considerable share in the aviation asset management market during the forecast period as the growth in the air passengers in the region has created the demand for new aircraft and this increase in the demand for new aircraft in the region has boosted the demand for aviation asset management. According to the Ministry of civil aviation, Government of India, on June 15 2022 the total number of passenger were around 691, 348 and the total flight movement was 5,479 which show the increasing number of passengers and flights after and the emic whcreatesasts the demand for aviation asset management. Additionally, under the UDAN (RCS) scheme of the government of India by 2024 they are targeting to build 100 airports, till now they have 67 airports under the scheme. This initiative of the government also contributes to the growth of the aviation asset management market.

Global AVIATION ASSET MANAGEMENT Market Growth, by Region 2022-2028

The Middle East Region in the rest of The world is Expected to Hold a Considerable Share in the Global Aviation Asset Management Market during the Forecast Period.

The Middle East region in the rest of the world is anticipated to hold a considerable share in aviation asset management across the globe. The growing economy and increasing demand for aircraft and growing air passengers are contributing to the growth of the aviation asset management market in the region. A strategic location for business and investment from the government is making the middle east nation into a global hub for air transport as more and more people are visiting UAE for business purposes. According to OEC, In 2020, United Arab Emirates was the world's biggest exporter of Sulphur ($407M), Limestone ($333M), and Scrap Nickel ($264M), also it was number 24 in exports in 2020`. This shows the growing economy and demand increasing the number of flights for the business which in return will increase the demand for the asset aviation management in the region.

Market Players Outlook

The major companies serving the global aviation asset management market include SkyWorks Holdings, LLC, GA Telesis, LLC, AerCap Holdings N.V. (GE Capital Aviation Services), Charles Taylor Ltd, BBAM US LP, and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global aviation asset management market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global Aviation Asset Management Market

• Recovery Scenario of global aviation asset management Market

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. BY Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape (Ascending order)

3.1. Key Company Analysis

3.1.1. AerCap Holdings N.V. (GE Capital Aviation Services)

3.1.1.1. Overview

3.1.1.2. Financial Analysis

3.1.1.3. SWOT Analysis

3.1.1.4. Recent Developments

3.1.2. BBAM US LP

3.1.2.1. Overview

3.1.2.2. Financial Analysis

3.1.2.3. SWOT Analysis

3.1.2.4. Recent Developments

3.1.3. Charles Taylor Ltd.

3.1.3.1. Overview

3.1.3.2. Financial Analysis

3.1.3.3. SWOT Analysis

3.1.3.4. Recent Developments

3.1.4. GA Telesis, LLC

3.1.4.1. Overview

3.1.4.2. Financial Analysis

3.1.4.3. SWOT Analysis

3.1.4.4. Recent Developments

3.1.5. SkyWorks Holdings, LLC

3.1.5.1. Overview

3.1.5.2. Financial Analysis

3.1.5.3. SWOT Analysis

3.1.5.4. Recent Developments

3.2. Key Strategy Analysis

3.3. Impact of Covid-19 on Key Players

4. Market Segmentation

4.1. Global Aviation Asset Management Market by End-Use

4.1.1. Commercial Platform

4.1.2. MRO Services

4.2. Global Aviation Asset Management Market by Service Type

4.2.1. Leasing Services

4.2.2. Technical Services

4.2.3. Regulatory Certifications

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. AerData B.V.

6.2. Arena Aviation Capital Keizersgracht

6.3. ABL Aviation (Ireland) Limited

6.4. Acumen Aviation

6.5. AerData (Boeing Company)

6.6. Airbus S.A.S.

6.7. AMC Aviation Management Corp

6.8. Aviation Asset Management Inc

6.9. DVB Bank SE

6.10. Kestrel Aviation Management Inc.

6.11. Singapore Technologies Engineering Ltd

6.12. SMBC Aviation Capital

6.13. Willis Asset Management Ltd

6.14. WSP Global Inc.

1. GLOBAL AVIATION ASSET MANAGEMENT MARKET RESEARCH AND ANALYSIS BY End-Use, 2021-2028 ($ MILLION)

2. GLOBAL AVIATION ASSET MANAGEMENT for COMMERCIAL PLATFORM MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL AVIATION ASSET MANAGEMENT FOR MRO SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL AVIATION ASSET MANAGEMENT MARKET RESEARCH AND ANALYSIS BY SERVICE TYPE, 2021-2028 ($ MILLION)

5. GLOBAL AVIATION ASSET MANAGEMENT FOR LEASING SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

6. GLOBAL AVIATION ASSET MANAGEMENT FOR TECHNICAL SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7. GLOBAL AVIATION ASSET MANAGEMENT FOR REGULATORY CERTIFICATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

8. GLOBAL AVIATION ASSET MANAGEMENT MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2021-2028 ($ MILLION)

9. NORTH AMERICAN AVIATION ASSET MANAGEMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

10. NORTH AMERICAN AVIATION ASSET MANAGEMENT MARKET RESEARCH AND ANALYSIS BY END-USE, 2021-2028 ($ MILLION)

11. NORTH AMERICAN AVIATION ASSET MANAGEMENT MARKET RESEARCH AND ANALYSIS BY SERVICE TYPE, 2021-2028 ($ MILLION)

12. EUROPEAN AVIATION ASSET MANAGEMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

13. EUROPEAN AVIATION ASSET MANAGEMENT MARKET RESEARCH AND ANALYSIS BY END-USE, 2021-2028 ($ MILLION)

14. EUROPEAN AVIATION ASSET MANAGEMENT MARKET RESEARCH AND ANALYSIS BY SERVICE TYPE, 2021-2028 ($ MILLION)

15. ASIA-PACIFIC AVIATION ASSET MANAGEMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

16. ASIA-PACIFIC AVIATION ASSET MANAGEMENT MARKET RESEARCH AND ANALYSIS BY END-USE, 2021-2028 ($ MILLION)

17. ASIA-PACIFIC AVIATION ASSET MANAGEMENT MARKET RESEARCH AND ANALYSIS BY SERVICE TYPE, 2021-2028 ($ MILLION)

18. REST OF THE WORLD AVIATION ASSET MANAGEMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

19. REST OF THE WORLD AVIATION ASSET MANAGEMENT MARKET RESEARCH AND ANALYSIS BY END-USE, 2021-2028 ($ MILLION)

20. REST OF THE WORLD AVIATION ASSET MANAGEMENT MARKET RESEARCH AND ANALYSIS BY SERVICE TYPE, 2021-2028 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL AVIATION ASSET MANAGEMENT MARKET, 2021-2028 ($ MILLION)

2. IMPACT OF COVID-19 ON GLOBAL AVIATION ASSET MANAGEMENT MARKET BY SEGMENT, 2021-2028 ($ MILLION)

3. RECOVERY OF GLOBAL AVIATION ASSET MANAGEMENT MARKET, 2021-2028 (%)

4. GLOBAL AVIATION ASSET MANAGEMENT MARKET SHARE BY END-USE, 2021 VS 2028 (%)

5. GLOBAL AVIATION ASSET MANAGEMENT FOR COMMERCIAL PLATFORM MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

6. GLOBAL AVIATION ASSET MANAGEMENT FOR MRO SERVICES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

7. GLOBAL AVIATION ASSET MANAGEMENT MARKET SHARE BY SERVICE TYPE, 2021 VS 2028 (%)

8. GLOBAL AVIATION ASSET MANAGEMENT FOR LEASING SERVICES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

9. GLOBAL AVIATION ASSET MANAGEMENT FOR TECHNICAL SERVICES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

10. GLOBAL AVIATION ASSET MANAGEMENT FOR REGULATORY CERTIFICATIONS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

11. GLOBAL AVIATION ASSET MANAGEMENT MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

12. US AVIATION ASSET MANAGEMENT MARKET SIZE, 2021-2028 ($ MILLION)

13. CANADA AVIATION ASSET MANAGEMENT MARKET SIZE, 2021-2028 ($ MILLION)

14. UK AVIATION ASSET MANAGEMENT MARKET SIZE, 2021-2028 ($ MILLION)

15. FRANCE AVIATION ASSET MANAGEMENT MARKET SIZE, 2021-2028 ($ MILLION)

16. GERMANY AVIATION ASSET MANAGEMENT MARKET SIZE, 2021-2028 ($ MILLION)

17. ITALY AVIATION ASSET MANAGEMENT MARKET SIZE, 2021-2028 ($ MILLION)

18. SPAIN AVIATION ASSET MANAGEMENT MARKET SIZE, 2021-2028 ($ MILLION)

19. REST OF EUROPE AVIATION ASSET MANAGEMENT MARKET SIZE, 2021-2028 ($ MILLION)

20. INDIA AVIATION ASSET MANAGEMENT MARKET SIZE, 2021-2028 ($ MILLION)

21. CHINA AVIATION ASSET MANAGEMENT MARKET SIZE, 2021-2028 ($ MILLION)

22. JAPAN AVIATION ASSET MANAGEMENT MARKET SIZE, 2021-2028 ($ MILLION)

23. SOUTH KOREA AVIATION ASSET MANAGEMENT MARKET SIZE, 2021-2028 ($ MILLION)

24. REST OF ASIA-PACIFIC AVIATION ASSET MANAGEMENT MARKET SIZE, 2021-2028 ($ MILLION)

25. REST OF THE WORLD AVIATION ASSET MANAGEMENT MARKET SIZE, 2021-2028 ($ MILLION)