Aviation Market

Global Aviation Market Size, Share & Trends Analysis Report, By Flight Type (International Flights and Domestic Flights), By Travel Class (First Class, Business Class, and Economy Class) and Forecast, 2020-2026 Update Available - Forecast 2025-2035

The aviation market is expected to show an exponential growth rate in the next couple of years after the COVID-19 pandemic and later is expected to grow at a lucrative growth rate till 2026. In 2020, the aviation market is expected to shrink due to the COVID-19 pandemic and a number of measures have to be maintained for the safe journey. With the decreasing effect of the COVID-19 pandemic, the aviation market is expected to regain its pace in the next couple of years. Some of the major factors that were driving the aviation market include increasing disposable income of the people all across the globe, the introduction of low-fare airlines, increasing global economic activities, new travel trends, and many more. Moreover, replacement of aging commercial aircraft was also contributing significantly to the market growth.

As per the International Air Transport Association (IATA), the aviation industry contributed $2.7 trillion to global GDP in 2018 and was supporting 65 million jobs. The global aviation industry was growing significantly before the COVID-19 pandemic, marked by strong growth especially in certain emerging markets, and healthy consolidation in more mature regions. After the end of the COVID-19 pandemic, similar trends are expected to continue during the forecast period. However, due to the COVID-19 pandemic, the market has plummeted to an extreme level that a number of airlines have filed for bankruptcy in recent months which includes Virgin Australia, Compass Airlines, and Trans States Airlines which is a major challenge for the market. Amid the pandemic, the US government has provided a $58 billion bailout package to the US airline companies which include loan and loan guarantees for passenger airlines which is aiding the industry to regain its place.

Market Segmentation

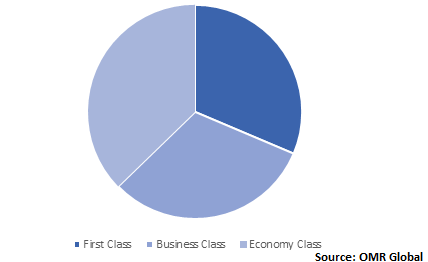

The global aviation market is segmented based on flight type and travel class. The flight type segment is bifurcated into international flights and domestic flights. During the forecast period, domestic flights are expected to show a major market growth rate. On the basis of travel class, the market is segmented into first class, business class, and economy class. The economy class will grow with a lucrative growth rate during the forecast period.

Global Aviation Market Share by Travel Class, 2019 (%)

Regional Outlook

The global aviation market is segmented into North America, Europe, Asia-Pacific, and the Rest of the World (RoW). As per the World Bank Organization, in 2018, around 4.2 billion passengers were carried around globally. Emerging countries such as Vietnam and India had doubled the annual air passenger just in four years. In 2019, the US was the largest aviation global player followed by China, UK, Spain, and Japan respectively. However, according to the International Air Transport Association (IATA) as the COVID-19 pandemic has been controlled up to a certain level in China and the cases are increasing in the US; China has become the largest aviation market in April 2020. Once, the US begins its air activity, the US is expected to regain its top position.

As per IATA, once the aviation sector gets normal, China is expected to replace the US as the largest global aviation market by 2024. Whereas, India is projected to take over the UK for third place by 2025, while Indonesia and Japan will be ranked 5th and 7th respectively. Additionally, it is estimated that for air travel around 817 million new passengers will be added to account for a total of 1.3 billion passengers by 2035 in China. Around, 322 million new additional passengers will add to account a total of 442 million in India.

Global Aviation Market Growth, by Region 2020-2026

Market Players Outlook

The major players operating in the market include Air China Ltd., Air France–KLM S.A, American Airlines Group Inc., British Airways plc, China Eastern Airlines Corp. Ltd., China Southern Airlines Co., Ltd., Delta Air Lines, Inc., Deutsche Lufthansa AG, Japan Airlines Co., Ltd., Qatar Airways Group, The Emirates Group, and United Airlines, Inc. The market players are adopting growth strategies, including mergers & acquisitions, and partnerships & collaborations, reducing expenses to survive in the market. For instance, amid the pandemic, most of the airlines are not returning cash while canceling the airline tickets instead are providing vouchers and offering them to reschedule the journey to the second half of 2020 and in 2021. As per the office of the US Senator for Massachusetts, US airlines have more than $10 billion of customer’s cash in the form of vouchers.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global Aviation market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdowns

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Delta Air Lines, Inc.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. American Airlines Group Inc.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Deutsche Lufthansa AG

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. United Airlines, Inc.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Air France–KLM S.A

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.3 Opportunities

5. Market Segmentation

5.1. Global Aviation Market by Flight Type

5.1.1. International Flights

5.1.2. Domestic Flights

5.2. Global Aviation Market by Travel Class

5.2.1. First Class

5.2.2. Business Class

5.2.3. Economy Class

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

6.4.1. Middle East & Africa

6.4.2. Latin America

7. Company Profiles

7.1. Aena SME, S.A.

7.2. Air China Ltd.

7.3. Air France–KLM S.A

7.4. Air India Ltd.

7.5. AirAsia Berhad

7.6. American Airlines Group Inc.

7.7. British Airways plc

7.8. China Eastern Airlines Corp. Ltd.

7.9. China Southern Airlines Co., Ltd.

7.10. Delta Air Lines, Inc.

7.11. Deutsche Lufthansa AG

7.12. InterGlobe Aviation Ltd. (IndiGo)

7.13. Japan Airlines Co., Ltd.

7.14. Juneyao Airlines Co., Ltd.

7.15. Norwegian Air Shuttle ASA

7.16. Qantas Airways Ltd.

7.17. Qatar Airways Group

7.18. Singapore Airlines Ltd.

7.19. Swiss International Air Lines AG

7.20. The Emirates Group

7.21. United Airlines, Inc.

7.22. Virgin Atlantic Airways Ltd.

1. GLOBAL AVIATION MARKET RESEARCH AND ANALYSIS BY FLIGHT TYPE, 2019-2026 ($ MILLION)

2. GLOBAL INTERNATIONAL FLIGHTS MARKET RESEARCH AND ANALYSIS, 2019-2026 ($ MILLION)

3. GLOBAL DOMESTIC FLIGHTS MARKET RESEARCH AND ANALYSIS, 2019-2026 ($ MILLION)

4. GLOBAL AVIATION MARKET RESEARCH AND ANALYSIS BY TRAVEL CLASS, 2019-2026 ($ MILLION)

5. GLOBAL FIRST CLASS MARKET RESEARCH AND ANALYSIS, 2019-2026 ($ MILLION)

6. GLOBAL BUSINESS CLASS MARKET RESEARCH AND ANALYSIS, 2019-2026 ($ MILLION)

7. GLOBAL ECONOMY CLASS MARKET RESEARCH AND ANALYSIS, 2019-2026 ($ MILLION)

8. NORTH AMERICAN AVIATION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

9. NORTH AMERICAN AVIATION MARKET RESEARCH AND ANALYSIS BY FLIGHT TYPE, 2019-2026 ($ MILLION)

10. NORTH AMERICAN AVIATION MARKET RESEARCH AND ANALYSIS BY TRAVEL CLASS, 2019-2026 ($ MILLION)

11. EUROPEAN AVIATION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

12. EUROPEAN AVIATION MARKET RESEARCH AND ANALYSIS BY FLIGHT TYPE, 2019-2026 ($ MILLION)

13. EUROPEAN AVIATION MARKET RESEARCH AND ANALYSIS BY TRAVEL CLASS, 2019-2026 ($ MILLION)

14. ASIA PACIFIC AVIATION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

15. ASIA PACIFIC AVIATION MARKET RESEARCH AND ANALYSIS BY FLIGHT TYPE, 2019-2026 ($ MILLION)

16. ASIA PACIFIC AVIATION MARKET RESEARCH AND ANALYSIS BY TRAVEL CLASS, 2019-2026 ($ MILLION)

17. REST OF THE WORLD AVIATION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

18. REST OF THE WORLD AVIATION MARKET RESEARCH AND ANALYSIS BY FLIGHT TYPE, 2019-2026 ($ MILLION)

19. REST OF THE WORLD AVIATION MARKET RESEARCH AND ANALYSIS BY TRAVEL CLASS, 2019-2026 ($ MILLION)

1. GLOBAL AVIATION MARKET SHARE BY FLIGHT TYPE, 2019 VS 2026 (%)

2. GLOBAL AVIATION MARKET SHARE BY TRAVEL CLASS, 2019 VS 2026 (%)

3. GLOBAL AVIATION MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

4. US AVIATION MARKET SIZE, 2019-2026 ($ MILLION)

5. CANADA AVIATION MARKET SIZE, 2019-2026 ($ MILLION)

6. UK AVIATION MARKET SIZE, 2019-2026 ($ MILLION)

7. FRANCE AVIATION MARKET SIZE, 2019-2026 ($ MILLION)

8. GERMANY AVIATION MARKET SIZE, 2019-2026 ($ MILLION)

9. ITALY AVIATION MARKET SIZE, 2019-2026 ($ MILLION)

10. SPAIN AVIATION MARKET SIZE, 2019-2026 ($ MILLION)

11. REST OF EUROPE AVIATION MARKET SIZE, 2019-2026 ($ MILLION)

12. INDIA AVIATION MARKET SIZE, 2019-2026 ($ MILLION)

13. CHINA AVIATION MARKET SIZE, 2019-2026 ($ MILLION)

14. JAPAN AVIATION MARKET SIZE, 2019-2026 ($ MILLION)

15. REST OF ASIA-PACIFIC AVIATION MARKET SIZE, 2019-2026 ($ MILLION)

16. LATIN AMERICA AVIATION MARKET SIZE, 2019-2026 ($ MILLION)

17. MIDDLE EAST & AFRICA AVIATION MARKET SIZE, 2019-2026 ($ MILLION)