Ayurveda Market

Ayurveda Market Size, Share & Trends Analysis Report by Form (Herbal, Mineral, and Herbo-Mineral), by Application (Medical/Therapy, and Personal), by Distribution Channel (Retail Stores, Supermarkets, and Online Marketplaces), and by End-User (Healthcare, and Academia & Research), Forecast Period (2024-2031)

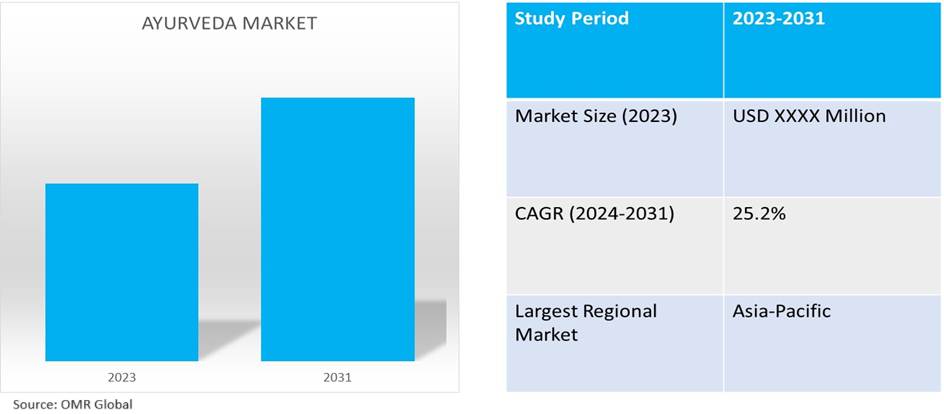

Ayurveda market is anticipated to grow at a CAGR of 25.2% during the forecast period (2024-2031). Ayurveda is a framework of holistic healthcare approaches that originated in India, focusing on the balance between the mind, body, and spirit. The market growth is majorly dependent on rising demand for natural and organic products, ample support from state-run organizations, and growing awareness of the benefits of Ayurveda.

Market Dynamics

Rising Demand for Natural and Organic Products

Consumers are increasingly seeking natural and organic alternatives to conventional medicines owing to changing dynamics for medicinal treatments, a shift towards organic and sustainable products, and the potential risk of chemical-based treatment, among others. Ayurveda, with its emphasis on herbal remedies and holistic wellness practices, resonates with this growing trend, which is expected to benefit the industry. For instance, according to the AYUSH export report 2023, India has steadily increased its presence in the global trade of the herbal medicinal sector. Exports in the sector expanded from $0.86 billion in 2017 to $1.26 billion in 2021, registering a robust growth of 7.8%. Overall, the USA (34.9%), EU (18.7%), and UAE (5.5%) are the major markets for all three categories of Ayush exports, contributing to 59.1% of all Ayush exports in 2021.

Growth of Ayurvedic Personal Care & Wellness Industry

Globally, increased awareness of the side effects of chemical-based personal care products, increasing availability and accessibility of ayurvedic products, rising preference for consuming natural and organic products, and embracing traditional wisdom in the Asia-Pacific region have stimulated demand for ayurvedic personal care and wellness products. For instance, according to the Confederation of Indian Industry (CII), the Ayurvedic beauty and wellness market in India is expected to grow by 15.0% in 2020. This move corresponds to a larger global trend toward natural and sustainable living. Indians are increasingly discovering the benefits of Ayurveda, an ancient Indian medical practice that promotes total well-being.

Market Segmentation

- Based on formulation, the market is segmented into herbal, mineral, and herbo-mineral.

- Based on application, the market is bifurcated into medical/therapy and personal care.

- Based on distribution channel, the market is segmented into retail stores, supermarkets, and online marketplaces.

- Based on end-user, the market is segmented into healthcare, and academia & research.

Online Marketplace Segment Is Expected To Grow Over The Coming Years

The primary factors supporting segmental growth include the convenience and accessibility of online markets, global reach, targeted marketing, and rising internet penetration. This segment caters to consumers with a wide product range while also offering better opportunities for product innovation and delivery methods compared to traditional retail channels, which has instigated international brands as well as local manufacturers to register an online presence for business growth. For instance, in February 2022, Amazon India announced the launch of a separate storefront for Ayurvedic products on their marketplace (Amazon.in). The storefront was officially launched at a virtual event by Shri Sarbananda Sonowal, Hon'ble Union Cabinet Minister, Ministry of Ayush, and will increase visibility of unique Ayurvedic products such as juices, skin-care supplements, immunity boosters, oils, and more from small businesses and direct-to-consumer brands.

Healthcare is Projected to Emerge as the Largest Segment

The healthcare segment is expected to hold the largest share of the market. The primary factors supporting the segment's growth include the integration of Ayurvedic therapies with traditional medicine, the popularity of Panchakarma treatment centers, increasing credibility of Ayurvedic treatments, standardization and regulation of the industry, and a focus on developing world-class Ayurvedic wellness and preventative care systems. For instance, in December 2022, the All India Institute of Ayurveda (AIIA) entered an MoU with the University of Medical Sciences in Cuba and extended its agreement with REAA (Rosenberg European Academy of Ayurveda) in Germany for another five years with the aim of extending traditional wellness systems at global levels.

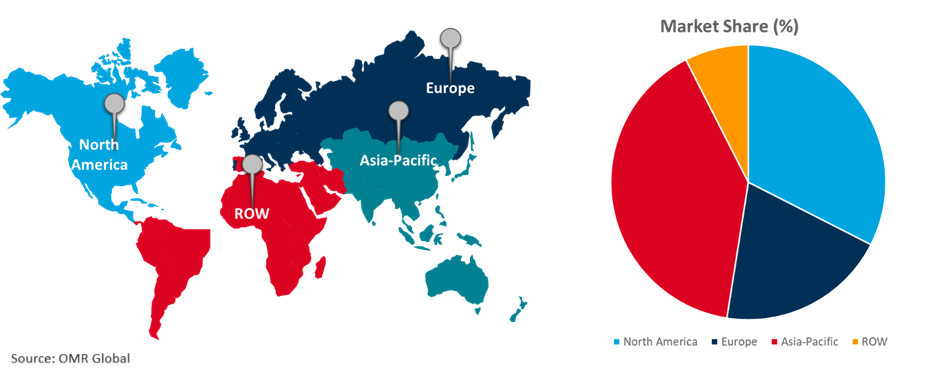

Regional Outlook

The global Ayurveda market is further segmented based on geography including North America (the US, and Canada), Europe (the UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Global Ayurveda Market Growth by Region 2024-2031

Asia-Pacific Holds Substantial Market Share in Ayurveda Market

The Asia-Pacific region is dominating the global Ayurveda market owing to the origination of Ayurveda in the region. The development of modern Ayurveda infrastructure studies & research in the region, increasing support from governments, and growing exports of herbal products from the region towards western countries are further aiding to the regional market growth. For instance, in February 2024, the National Institute of Ayurveda, Jaipur, under the Ministry of Ayush of the Government of India and the Department of Thai Traditional and Alternative Medicine of the Ministry of Public Health of the Government of the Kingdom of Thailand signed a Memorandum of Understanding (MoU) on the establishment of an Academic Collaboration in Ayurveda and Thai Traditional Medicine in New Delhi.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global Ayurveda market include Patanjali Ayurveda Ltd., Kerala Ayurveda Ltd., Himalaya, Vicco Laboratories, and Dabur Ltd., among others. The market players are focusing on capitalizing on growth by adopting strategies such as collaboration, partnerships, and market expansion among others. For instance, in May 2022, the Ayurveda Company (T.A.C), a D2C company in the natural beauty and wellness space, expanded its product portfolio with the launch of T.A.C Junior, an exclusive baby care line comprised entirely of Ayurvedic goods.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global Ayurveda market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Dabur Ltd.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Kerala Ayurveda Ltd.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Patanjali Ayurveda Ltd.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Ayurveda Market by Formulation

4.1.1. Herbal

4.1.2. Mineral

4.1.3. Herbo-Mineral

4.2. Global Ayurveda Market by Application

4.2.1. Medical/Therapy

4.2.2. Personal Care

4.3. Global Ayurveda Market by Distribution Channel

4.3.1. Retail Stores

4.3.2. Supermarkets

4.3.3. Online Marketplaces

4.4 Global Ayurveda Market by End-User

4.4.1 Healthcare

4.4.2 Academia and Research

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. Amrutanjan Health Care Ltd.

6.2. Arizone International LLP.

6.3. Baidyanath Ayurved

6.4. Bio Veda Action Research Co.

6.5. Cholayil Pvt. Ltd.

6.6. Emami Ltd.

6.7. Elzac Herbals India

6.8. Hamdard Laboratories

6.9. Himalaya Wellness Co.

6.10. Kairali Ayurvedic Group

6.11. Native Remedies

6.12. Naturally Direct

6.13. Nutricore Biosciences

6.14. Natreon Inc.

6.15. Patanjali Ayurveda

6.16. Sandu Pharmaceuticals Ltd

6.17. Vicco Laboratories

1. GLOBAL AYURVEDA MARKET RESEARCH AND ANALYSIS BY FORMULATION, 2023-2031 ($ MILLION)

2. GLOBAL HERBAL AYURVEDA MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL MINERAL AYURVEDA MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL HERBO-MINERAL AYURVEDA MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL AYURVEDA MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

6. GLOBAL AYURVEDA FOR MEDICAL/THERAPY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL AYURVEDA FOR PERSONAL CARE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL AYURVEDA MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

9. GLOBAL AYURVEDA PRODUCT SALE IN RETAIL STORES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL AYURVEDA PRODUCT SALE IN SUPERMARKETS INDUSTRY RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL AYURVEDA ONLINE MARKETPLACE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL AYURVEDA MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

13. GLOBAL AYURVEDA FOR HEALTHCARE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL AYURVEDA FOR ACADEMIA AND RESEARCH MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. GLOBAL AYURVEDA MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

16. NORTH AMERICAN AYURVEDA MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

17. NORTH AMERICAN AYURVEDA MARKET RESEARCH AND ANALYSIS BY FORMULATION, 2023-2031 ($ MILLION)

18. NORTH AMERICAN AYURVEDA MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

19. NORTH AMERICAN AYURVEDA MARKET RESEARCH AND ANALYSIS BY INDICATION, 2023-2031 ($ MILLION)

20. NORTH AMERICAN AYURVEDA MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

21. NORTH AMERICAN AYURVEDA MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

22. EUROPEAN AYURVEDA MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

23. EUROPEAN AYURVEDA MARKET RESEARCH AND ANALYSIS BY FORMULATION, 2023-2031 ($ MILLION)

24. EUROPEAN AYURVEDA MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

25. EUROPEAN AYURVEDA MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

26. EUROPEAN AYURVEDA MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

27. ASIA-PACIFIC AYURVEDA MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

28. ASIA-PACIFIC AYURVEDA MARKET RESEARCH AND ANALYSIS BY FORMULATION, 2023-2031 ($ MILLION)

29. ASIA-PACIFIC AYURVEDA MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

30. ASIA-PACIFIC AYURVEDA MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

31. ASIA-PACIFIC AYURVEDA MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

32. REST OF THE WORLD AYURVEDA MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

33. REST OF THE WORLD AYURVEDA MARKET RESEARCH AND ANALYSIS BY FORMULATION, 2023-2031 ($ MILLION)

34. REST OF THE WORLD AYURVEDA MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

35. REST OF THE WORLD AYURVEDA MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

36. REST OF THE WORLD AYURVEDA MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

1. GLOBAL AYURVEDA MARKET SHARE BY FORMULATION, 2023 VS 2031 (%)

2. GLOBAL HERBAL AYURVEDA MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL MINERAL AYURVEDA MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL HERBO-MINERAL AYURVEDA MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL AYURVEDA MARKET SHARE BY APPLICATION, 2023 VS 2031 (%)

6. GLOBAL AYURVEDA FOR MEDICAL/THERAPY MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL AYURVEDA FOR PERSONAL CARE MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL AYURVEDA MARKET SHARE BY DISTRIBUTION CHANNEL, 2023 VS 2031 (%)

9. GLOBAL AYURVEDA PRODUCT SALES IN RETAIL STORES MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL AYURVEDA PRODUCT SALES IN SUPERMARKETS INDUSTRY SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL AYURVEDA ONLINE MARKETPLACE MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL AYURVEDA MARKET SHARE BY END-USER, 2023 VS 2031 (%)

13. GLOBAL AYURVEDA FOR HEALTHCARE MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. GLOBAL AYURVEDA FOR ACADEMIA AND RESEARCH MARKET SHARE BY REGION, 2023 VS 2031 (%)

15. GLOBAL AYURVEDA MARKET SHARE BY REGION, 2023 VS 2031 (%)

16. US AYURVEDA MARKET SIZE, 2023-2031 ($ MILLION)

17. CANADA AYURVEDA MARKET SIZE, 2023-2031 ($ MILLION)

18. UK AYURVEDA MARKET SIZE, 2023-2031 ($ MILLION)

19. FRANCE AYURVEDA MARKET SIZE, 2023-2031 ($ MILLION)

20. GERMANY AYURVEDA MARKET SIZE, 2023-2031 ($ MILLION)

21. ITALY AYURVEDA MARKET SIZE, 2023-2031 ($ MILLION)

22. SPAIN AYURVEDA MARKET SIZE, 2023-2031 ($ MILLION)

23. REST OF EUROPE AYURVEDA MARKET SIZE, 2023-2031 ($ MILLION)

24. INDIA AYURVEDA MARKET SIZE, 2023-2031 ($ MILLION)

25. CHINA AYURVEDA MARKET SIZE, 2023-2031 ($ MILLION)

26. JAPAN AYURVEDA MARKET SIZE, 2023-2031 ($ MILLION)

27. SOUTH KOREA AYURVEDA MARKET SIZE, 2023-2031 ($ MILLION)

28. REST OF ASIA-PACIFIC AYURVEDA MARKET SIZE, 2023-2031 ($ MILLION)

29. LATIN AMERICA AYURVEDA MARKET SIZE, 2023-2031 ($ MILLION)

30. MIDDLE EAST AND AFRICA AYURVEDA MARKET SIZE, 2023-2031 ($ MILLION)