Business-to-Business (B2B) Digital Payment Market

Business-to-Business (B2B) Digital Payment Market Size, Share & Trends Analysis Report by Solution (Payment Gateway, Payment Processing, Mobile Payment Application and Others), by Payment Method (Bank Cards, Digital Wallet, Net Banking, and Others), by Industry Verticals (BFSI, Healthcare, IT & Telecom, Travel and Hospitality, Media & Entertainment, Retail & E-Commerce, Transportation, and Others), and by Transaction Type (Domestic and Cross-border) Forecast Period (2023-2030) Update Available - Forecast 2025-2035

B2B digital payment market is anticipated to grow at a CAGR of 15.8% during the forecast period. The primary factor boosting the market growth includes the increase in customer preference for real-time payments globally. Innovative payment methods including peer-to-peer platforms, digital wallets, and blockchain-based payments have all been made possible by the expansion of the fintech industry. These developments have helped to diversify the available B2B digital payment methods. Businesses have been urged to use safe and compliant payment systems by evolving legislation regarding financial transactions and data protection. Additionally, government initiatives are expected increase the demand of online payment and services in B2B globally. These is the another factor fueling the B2B digital payment market.

Segmental Outlook

The global B2B digital payment market is segmented based on the solution, payment method, industry vertical, and technology. Based on the solution, the market is segmented into payment gateway, payment processing, mobile payment application and others. Based on the payment method, the market is sub-segmented into bank cards, digital wallet, net banking and others. Further, based on industry vertical, the market is segmented into BFSI, healthcare, IT & telecom, travel and hospitality, media & entertainment, retail & e-commerce, transportation, and others. Based on transaction type, the market is segmented into domestic and cross-border. Among the transaction type, cross border sub-segment is anticipated to hold a considerable share of the market, cross-border transactions are crucial to international trade since they let companies exchange money and goods/services across borders. In the past, these transactions have had trouble with things like expensive fees, expensive currency conversions, and lengthy settlement timeframes. However, the expansion of online payment methods.

The Bank Cards Sub-Segment is Anticipated to Hold a Prominent Share in the Global B2B Digital Payment Market

Rising demand for cash alternatives and availability of economical credit cards across the globe boost the growth of the global credit card payment. There are many different credit cards available, including business, secured, prepaid, and digital cards, from issuing banks and other financial institutions. With the advent of near-field communication (NFC) technology, customers may quickly and securely make purchases by merely tapping their credit cards on payment terminals and due to the COVID-19, this tendency has intensified as customers and businesses look for contactless alternatives to reduce physical touch. In addition, various corporate organizations are providing credit cards to their employees for keeping tracks on employee spending on travel, purchases of inventory or supplies, and other responsibilities, which is propelling the growth of the market. Debit card usage has also grown so pervasive in a number of nations that it has completely replaced or surpassed cheque and, in some cases, cash transaction volume.

Virtual cards produce distinctive data for every transaction, enhancing security and lowering the possibility of fraud. This is especially important in the B2B sector, where secrecy and trustworthiness are key. Virtual cards are also useful for supplier relationships since they allow for quick and secure payments. Their interaction with accounting software makes reconciliation and reporting easier while providing better financial control.

Regional Outlook

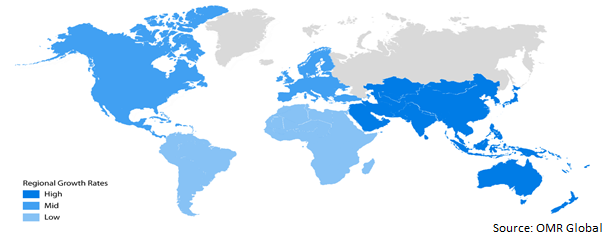

The global B2B digital payment market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East &Africa, and Latin America). Among these, the North American regional market is expected to grow considerably over the forecast period owing to the growing number of e-commerce platforms in the region, in turn contributing to the growth of the online transaction as consumers are increasingly preferring to make online purchases using their digital wallet or credit cards instead of cash or debit cards.

Global B2B Digital Payment Market Growth by Region 2023-2030

The Asia-Pacific Region is Expected to grow with Highest Share in the Global B2B Digital Payment Market

Asia-Pacific region is expected to grow with highest CAGR in the B2B digital payment market during the forecast period. China, Japan, India, ANZ, and the rest of Asia-Pacific are contributing significantly in the B2B digital payment market in the region. Cross-border payments solution have been created to handle the region's expanding commerce. As per International Trade Administration (ITA) China is the largest e-commerce market globally, generating almost 50 percent of the world’s transactions. China’s cross-border e-commerce imports and exports increased 15% Y-o-Y to $273 billion in 2021. In the first quarter this year, cross-border e-commerce trade scale hit $60 billion, according to the PRC Ministry of Commerce. Additionally due to growing penetration of smartphone, mobile payment use has increased, and traditional banks have responded by providing online banking specifically designed for companies. According to India Brand Equity Foundation (IBEF) India smartphone base has also increased significantly and is expected to reach 1 billion by 2026. This has helped India’s digital sector and it is expected to reach $1 trillion by 2030. This rapid rise in internet users and smartphone penetration coupled with rising incomes has assisted the growth of India’s e-commerce sector. Despite advancements, problems with interoperability and insecurity persist, highlighting the necessity of further development in the B2B payment ecosystem.

Market Players Outlook

The major companies serving the global B2B digital payment market include PayPal Inc., Fiserv, Inc., Mastercard International, Inc., Stripe, Inc., Visa, Inc., and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in June 2023, FIS announced a partnership with Visa to enable eligible Worldpay from FIS UK merchants to accept payments by using the Visa Instalments checkout functionality for the first time. With the help of Visa Instalments, partner Visa card issuers may provide their eligible cardholders with flexible and clear instalment payment alternatives at the point of sale.

The Report Covers

- Market value data analysis of 2022 and forecast to 2030.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global B2B digital payment market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.3. By Segments

1.4. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.3. Key Findings

2.4. Recommendations

2.5. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Fiserv, Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Mastercard International, Inc.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. PayPal, Inc.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Stripe, Inc.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Visa, Inc.

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global B2B Digital Payment Market by Solution

4.1.1. Payment Gateway

4.1.2. Payment Processing

4.1.3. Mobile payment Application

4.1.4. Others (Transaction Risk Management and Payment Security & Fraud Management)

4.2. Global B2B Digital Payment Market by Payment method

4.2.1. Bank Cards (Credit Card, Debit Card, Virtual Card)

4.2.2. Digital Wallet

4.2.3. Net Banking

4.2.4. Others (Digital Currencies, Point of Sales)

4.3. Global B2B Digital Payment Market by Industry Vertical

4.3.1. BFSI

4.3.2. Retail and E-Commerce

4.3.3. Healthcare

4.3.4. IT and Telecom

4.3.5. Travel and Hospitality

4.3.6. Media & Entertainment

4.3.7. Transportation

4.3.8. Others (Government and Public Sector, Manufacturing)

4.4. Global B2B Digital Payment Market by Transaction Type

4.4.1. Domestic

4.4.2. Cross-Border

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. ACI Worldwide, Inc.

6.2. BharatPe

6.3. EBANX

6.4. FIS

6.5. Global Payments Inc.

6.6. Helcim, Inc.

6.7. HighRadius Corp.

6.8. USPAY Group, LLC

6.9. MatchMove Pay Pte Ltd.

6.10. Payoneer Inc.

6.11. Pay Set Limited

6.12. Paystand Paystand, Inc.

6.13. Paytm

6.14. Ramp Business Corp.

6.15. Rapyd Financial Network Ltd.

6.16. Razorpay

6.17. Ripple

6.18. Stax

6.19. Terra

1. GLOBAL B2B DIGITAL PAYMENT MARKET RESEARCH AND ANALYSIS BY SOLUTION, 2022-2030 ($ MILLION)

2. GLOBAL B2B DIGITAL PAYMENT GATEWAY MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

3. GLOBAL B2B DIGITAL PAYMENT PROCESSING MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

4. GLOBAL B2B DIGITAL MOBILE APPLICATION MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

5. GLOBAL B2B DIGITAL PAYMENT OTHER SOLUTION MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

6. GLOBAL B2B DIGITAL PAYMENT MARKET RESEARCH AND ANALYSIS BY PAYMENT METHOD, 2022-2030 ($ MILLION)

7. GLOBAL B2B DIGITAL PAYMENT VIA BANK CARDS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

8. GLOBAL B2B DIGITAL PAYMENT VIA DIGITAL WALLET MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

9. GLOBAL B2B DIGITAL PAYMENT VIA NET BANKING MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

10. GLOBAL B2B DIGITAL PAYMENT VIA OTHER PAYMENT GATEWAYS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

11. GLOBAL B2B DIGITAL PAYMENT MARKET RESEARCH AND ANALYSIS BY INDUSTRY VERTICAL, 2022-2030 ($ MILLION)

12. GLOBAL B2B DIGITAL PAYMENT FOR BFSI MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

13. GLOBAL B2B DIGITAL PAYMENT FOR RETAIL AND E-COMMERCE MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

14. GLOBAL B2B DIGITAL PAYMENT FOR HEALTHCARE MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

15. GLOBAL B2B DIGITAL PAYMENT FOR IT & TELECOM MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

16. GLOBAL B2B DIGITAL PAYMENT FOR TRAVEL AND HOSPITALITY MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

17. GLOBAL B2B DIGITAL PAYMENT FOR MEDIA & ENTERTAINMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

18. GLOBAL B2B DIGITAL PAYMENT FOR TRANSPORTATION MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

19. GLOBAL B2B DIGITAL PAYMENT FOR OTHER INDUSTRY VERTICALS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

20. GLOBAL B2B DIGITAL PAYMENT MARKET RESEARCH AND ANALYSIS BY TRANSACTION TYPE, 2022-2030 ($ MILLION)

21. GLOBAL DOMESTIC B2B DIGITAL PAYMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

22. GLOBAL CROSS-BORDER B2B DIGITAL PAYMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

23. GLOBAL B2B DIGITAL PAYMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

24. NORTH AMERICAN B2B DIGITAL PAYMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

25. NORTH AMERICAN B2B DIGITAL PAYMENT MARKET RESEARCH AND ANALYSIS BY SOLUTION, 2022-2030 ($ MILLION)

26. NORTH AMERICAN B2B DIGITAL PAYMENT MARKET RESEARCH AND ANALYSIS BY PAYMENT METHOD, 2022-2030 ($ MILLION)

27. NORTH AMERICAN B2B DIGITAL PAYMENT MARKET RESEARCH AND ANALYSIS BY INDUSTRY VERTICAL, 2022-2030 ($ MILLION)

28. NORTH AMERICAN B2B DIGITAL PAYMENT MARKET RESEARCH AND ANALYSIS BY TRANSACTION TYPE, 2022-2030 ($ MILLION)

29. EUROPEAN B2B DIGITAL PAYMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

30. EUROPEAN B2B DIGITAL PAYMENT MARKET RESEARCH AND ANALYSIS BY SOLUTION, 2022-2030 ($ MILLION)

31. EUROPEAN B2B DIGITAL PAYMENT MARKET RESEARCH AND ANALYSIS BY PAYMENT METHOD, 2022-2030 ($ MILLION)

32. EUROPEAN B2B DIGITAL PAYMENT MARKET RESEARCH AND ANALYSIS BY INDUSTRY VERTICAL, 2022-2030 ($ MILLION)

33. EUROPEAN B2B DIGITAL PAYMENT MARKET RESEARCH AND ANALYSIS BY TRANSACTION TYPE, 2022-2030 ($ MILLION)

34. ASIA-PACIFIC B2B DIGITAL PAYMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

35. ASIA-PACIFIC B2B DIGITAL PAYMENT MARKET RESEARCH AND ANALYSIS BY SOLUTION, 2022-2030 ($ MILLION)

36. ASIA-PACIFIC B2B DIGITAL PAYMENT MARKET RESEARCH AND ANALYSIS BY PAYMENT METHOD, 2022-2030 ($ MILLION)

37. ASIA-PACIFIC B2B DIGITAL PAYMENT MARKET RESEARCH AND ANALYSIS BY INDUSTRY VERTICAL, 2022-2030 ($ MILLION)

38. ASIA-PACIFIC B2B DIGITAL PAYMENT MARKET RESEARCH AND ANALYSIS BY TRANSACTION TYPE, 2022-2030 ($ MILLION)

39. REST OF THE WORLD B2B DIGITAL PAYMENT MARKET RESEARCH AND ANALYSIS BY SOLUTION, 2022-2030 ($ MILLION)

40. REST OF THE WORLD B2B DIGITAL PAYMENT MARKET RESEARCH AND ANALYSIS BY PAYMENT METHOD, 2022-2030 ($ MILLION)

41. REST OF THE WORLD B2B DIGITAL PAYMENT MARKET RESEARCH AND ANALYSIS BY INDUSTRY VERTICAL, 2022-2030 ($ MILLION)

42. REST OF THE WORLD B2B DIGITAL PAYMENT MARKET RESEARCH AND ANALYSIS BY TRANSACTION TYPE, 2022-2030 ($ MILLION)

1. GLOBAL B2B DIGITAL PAYMENT MARKET SHARE BY SOLUTION, 2022 VS 2030 (%)

2. GLOBAL B2B DIGITAL PAYMENT GATEWAY MARKET SHARE BY REGION, 2022 VS 2030 (%)

3. GLOBAL B2B DIGITAL PAYMENT PROCESSING MARKET SHARE BY REGION, 2022 VS 2030 (%)

4. GLOBAL B2B DIGITAL MOBILE APPLICATION MARKET SHARE BY REGION, 2022 VS 2030 (%)

5. GLOBAL OTHER B2B DIGITAL PAYMENT SOLUTION MARKET SHARE BY REGION, 2022 VS 2030 (%)

6. GLOBAL B2B DIGITAL PAYMENT MARKET RESEARCH AND ANALYSIS BY PAYMENT METHOD, 2022 VS 2030 (%)

7. GLOBAL B2B DIGITAL PAYMENT VIA BANK CARDS MARKET SHARE BY REGION, 2022 VS 2030 (%)

8. GLOBAL B2B DIGITAL PAYMENT VIA DIGITAL WALLET MARKET SHARE BY REGION, 2022 VS 2030 (%)

9. GLOBAL B2B DIGITAL PAYMENT VIA NET BANKING MARKET SHARE BY REGION, 2022 VS 2030 (%)

10. GLOBAL B2B DIGITAL PAYMENT VIA OTHER MARKET SHARE BY REGION, 2022 VS 2030 (%)

11. GLOBAL B2B DIGITAL PAYMENT MARKET RESEARCH AND ANALYSIS BY INDUSTRY VERTICAL, 2022 VS 2030 (%)

12. GLOBAL B2B DIGITAL PAYMENT FOR BFSI MARKET SHARE BY REGION, 2022 VS 2030 (%)

13. GLOBAL B2B DIGITAL PAYMENT FOR RETAIL AND E-COMMERCE MARKET SHARE BY REGION, 2022 VS 2030 (%)

14. GLOBAL B2B DIGITAL PAYMENT FOR HEALTHCARE MARKET SHARE BY REGION, 2022 VS 2030 (%)

15. GLOBAL B2B DIGITAL PAYMENT FOR IT AND TELECOM MARKET SHARE BY REGION, 2022 VS 2030 (%)

16. GLOBAL B2B DIGITAL PAYMENT FOR TRAVEL AND HOSPITALITY MARKET SHARE BY REGION, 2022 VS 2030 (%)

17. GLOBAL B2B DIGITAL PAYMENT FOR MEDIA & ENTERTAINMENT MARKET SHARE BY REGION, 2022 VS 2030 (%)

18. GLOBAL B2B DIGITAL PAYMENT FOR TRANSPORTATION MARKET SHARE BY REGION, 2022 VS 2030 (%)

19. GLOBAL B2B DIGITAL PAYMENT FOR OTHER INDUSTRY VERTICALS MARKET SHARE BY REGION, 2022 VS 2030 (%)

20. GLOBAL DOMESTIC B2B DIGITAL PAYMENT MARKET SHARE BY REGION, 2022 VS 2030 (%)

21. GLOBAL CROSS-BORDER B2B DIGITAL PAYMENT MARKET SHARE BY REGION, 2022 VS 2030 (%)

22. GLOBAL B2B DIGITAL PAYMENT MARKET SHARE BY REGION, 2022 VS 2030 (%)

23. US B2B DIGITAL PAYMENT MARKET SIZE, 2022-2030 ($ MILLION)

24. CANADA B2B DIGITAL PAYMENT MARKET SIZE, 2022-2030 ($ MILLION)

25. UK B2B DIGITAL PAYMENT MARKET SIZE, 2022-2030 ($ MILLION)

26. FRANCE B2B DIGITAL PAYMENT MARKET SIZE, 2022-2030 ($ MILLION)

27. GERMANY B2B DIGITAL PAYMENT MARKET SIZE, 2022-2030 ($ MILLION)

28. ITALY B2B DIGITAL PAYMENT MARKET SIZE, 2022-2030 ($ MILLION)

29. SPAIN B2B DIGITAL PAYMENT MARKET SIZE, 2022-2030 ($ MILLION)

30. REST OF EUROPE B2B DIGITAL PAYMENT MARKET SIZE, 2022-2030 ($ MILLION)

31. INDIA B2B DIGITAL PAYMENT MARKET SIZE, 2022-2030 ($ MILLION)

32. CHINA B2B DIGITAL PAYMENT MARKET SIZE, 2022-2030 ($ MILLION)

33. JAPAN B2B DIGITAL PAYMENT MARKET SIZE, 2022-2030 ($ MILLION)

34. SOUTH KOREA B2B DIGITAL PAYMENT MARKET SIZE, 2022-2030 ($ MILLION)

35. REST OF ASIA-PACIFIC B2B DIGITAL PAYMENT MARKET SIZE, 2022-2030 ($ MILLION)

36. REST OF THE WORLD B2B DIGITAL PAYMENT MARKET SIZE, 2022-2030 ($ MILLION)