Baby Diaper Market

Baby Diaper Market Size, Share & Trends Analysis Report Market by Product Type (Cloth Diaper and Disposable Diaper), by Distribution Channel (Supermarkets/Hypermarkets, Convenience/Grocery Stores, Pharmacy/Drug Stores, Online Retail Channels, and Others) Forecast Period (2023-2030) Update Available - Forecast 2025-2035

Baby diaper market is anticipated to grow at a considerable CAGR of 4.3% during the forecast period. The rising baby’s population along with availability of comfortable diapers is a major factor driving the global baby diaper market. Besides that, the growing disposable income of the people, the rising female working population, and the increasing rate of literacy that determine the living standards and consumption patterns of families are further contributed to the growth of the global baby diaper market. Consumers' growing health and hygiene concerns for their babies is likely to drive the market during the forecast period. Ongoing advancements in the fabric used in a diaper, absorption capabilities, and special user-friendly features of diapers have led to competitors gaining a higher market share.

Increasing demand for natural and hygienic products is offering new opportunities for market players to develop bio-based disposable diapers. Key players are indulged in the adoption of innovative diaper technology. Eco-friendly/bio-degradable diapers, electronic diapers, organic diapers, and pant-style diaper are some of the key trends in the global baby diaper market.

Segmental Outlook

The global baby diaper market is segmented based on product type and distribution channel. Based on product type, the market is bifurcated into cloth diaper and disposable diaper. Based on distribution channel, the market is sub-segmented into supermarkets/hypermarkets, convenience/grocery stores, pharmacy/drug stores, online retail channels, and other.

The Cloth Diaper Sub-Segment to Exhibit a Considerable Growth

One of the major drivers is the increasing awareness and concern for environmental sustainability. As more people become conscious of the impact of disposable diapers on the environment, they are turning to cloth diapers as a greener alternative. These diapers can be reused multiple times, reducing the amount of waste that ends up in landfills. Another significant driver is the growing preference for natural and chemical-free products. Parents and caregivers are becoming more cautious about the materials that come into contact with their babies' delicate skin. Cloth diapers, made from soft and breathable fabrics, offer a natural and hypoallergenic option that minimizes the risk of irritation and allergies.

There are new and emerging market players that are further contributing to the market with their innovative natural product preferences. For instance, in January 2023, Amrita Saigal, the founder of Kudos, a sustainable diaper company, secured a $250,000 investment on the popular show "Shark Tank." Saigal's mission to create environmentally friendly and chemical-free diapers caught the attention of investor Mark Cuban and guest shark Gwyneth Paltrow. Kudos, which generated $850,000 in revenue in its first year, uses cotton and other sustainable materials in its disposable diapers. The investors were impressed by Saigal's track record and her dedication to pursuing her entrepreneurial ideas. With plans to expand into other product lines and online retailers, Kudos aims to become a household name.

Regional outlooks

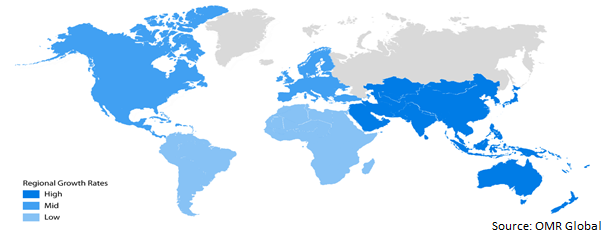

The global baby diaper market is further segmented based on geography, including North America (the US and Canada), Europe (Italy, Spain, Germany, France, and others), Asia-Pacific (India, China, Japan, South Korea, and others), and the Rest of the World (the Middle East & Africa and Latin America). Among these, North America regional market is expected to hold a considerable share in the global baby diaper market.

Global Baby diaper Market Growth by Region 2023-2030

The Asia-Pacific Region is Expected to Exhibit the Fastest Growth in the Global Baby diaper Market

Among all the regions, the Asia-Pacific region is expected to witness the highest growth over the forecast period. The growing number of working women in the population across the region is a key factor driving the market growth. World Bank data indicates that the female labor participation rate in East Asia-Pacific has increased significantly from 43.7% in 2016 to 43.94 % in 2021. In the Asia-Pacific, China alone records the birth of approximately 18 million babies every year. The high number of baby birth has made significant contribution to the China’s baby diaper market. The declaration of the third-child policy in China has played a great role in increasing the demand for baby diapers. Apart from these, a wider distribution network and easy availability of numerous brands in the local markets is further driving the regional market growth.

Market Players Outlook

The major companies serving the global baby diaper market include The Procter & Gamble Co. (P&G), Kimberly-Clark Corp., Unicharm Corp., Johnson & Johnson, and Kao Corp. among others. The market players are considerably contributing to the market growth by the adoption of various strategies, including mergers and acquisitions, partnerships, collaborations, and new product launches, to stay competitive in the market. For instance, in December 2022, TerraCycle's Loop, known for its circular reuse platform, launched the first cloth diaper service in the continental US. The Loop Diaper Service offers delivery, pick-up, and professional cleaning, providing a convenient and eco-friendly option for parents. Customers can choose from various diaper bundles, receive reusable diapers and inserts, and schedule pick-ups for dirty diapers. Loop's advanced cleaning methods ensure safety and quality standards. This expansion aligns with Loop's mission to shift from single-use packaging to reusable alternatives.

The Report Covers

- Market value data analysis of 2022 and forecast to 2030.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global baby diaper market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Kao Corp.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Kimberly-Clark Corp.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. The Procter & Gamble Company (P&G)

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Baby Diaper Market by Product Type

4.1.1. Cloth Diaper

4.1.2. Disposable Diaper

4.2. Global Baby Diaper Market by Distribution Channel

4.2.1. Hypermarket & Supermarket

4.2.2. Convenience/ Grocery Stores

4.2.3. Online

4.2.4. Pharmacy/Drugstore

4.2.5. Other

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Daio Paper Corp.

6.2. Domtar Corp.

6.3. DYPER Inc.

6.4. Essity AB

6.5. Essity Aktiebolag

6.6. First Quality Enterprises Inc.

6.7. Hengan International

6.8. Johnson & Johnson

6.9. Millie Moon

6.10. Nuggles Designs Canada

6.11. Ontex Group

6.12. Sumo GmbH

6.13. The Hain Celestial Group, Inc.

6.14. The Honest Company, Inc.

6.15. Unicharm Corp.

6.16. Winc Design Ltd.

1. GLOBAL BABY DIAPER MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2022-2030 ($ MILLION)

2. GLOBAL CLOTH BABY DIAPER MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

3. GLOBAL DISPOSABLE BABY DIAPER MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

4. GLOBAL BABY DIAPER MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2022-2030 ($ MILLION)

5. GLOBAL BABY DIAPER IN HYPERMARKET & SUPERMARKET MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

6. GLOBAL BABY DIAPER IN CONVENIENCE/ GROCERY STORES MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

7. GLOBAL BABY DIAPER IN ONLINE MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

8. GLOBAL BABY DIAPER IN PHARMACY/DRUGSTORE MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

9. GLOBAL BABY DIAPER IN OTHER DISTRIBUTION CHANNELS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

10. GLOBAL BABY DIAPER MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

11. NORTH AMERICAN BABY DIAPER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

12. NORTH AMERICAN BABY DIAPER MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2022-2030 ($ MILLION)

13. NORTH AMERICAN BABY DIAPER MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2022-2030 ($ MILLION)

14. EUROPEAN BABY DIAPER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

15. EUROPEAN BABY DIAPER MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2022-2030 ($ MILLION)

16. EUROPEAN BABY DIAPER MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2022-2030 ($ MILLION)

17. ASIA-PACIFIC BABY DIAPER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

18. ASIA-PACIFIC BABY DIAPER MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2022-2030 ($ MILLION)

19. ASIA-PACIFIC BABY DIAPER MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2022-2030 ($ MILLION)

20. REST OF THE WORLD BABY DIAPER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

21. REST OF THE WORLD BABY DIAPER MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2022-2030 ($ MILLION)

22. REST OF THE WORLD BABY DIAPER MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2022-2030 ($ MILLION)

1. GLOBAL BABY DIAPER MARKET SHARE BY PRODUCT TYPE, 2022 VS 2030(%)

2. GLOBAL CLOTH BABY DIAPER MARKET SHARE BY REGION, 2022 VS 2030(%)

3. GLOBAL DISPOSABLE BABY DIAPER MARKET SHARE BY REGION, 2022 VS 2030(%)

4. GLOBAL BABY DIAPER MARKET SHARE BY DISTRIBUTION CHANNEL, 2022 VS 2030(%)

5. GLOBAL BABY DIAPER IN HYPERMARKET & SUPERMARKET MARKET SHARE BY REGION, 2022 VS 2030(%)

6. GLOBAL BABY DIAPER IN CONVENIENCE/ GROCERY STORES MARKET SHARE BY REGION, 2022 VS 2030(%)

7. GLOBAL BABY DIAPER IN ONLINE MARKET SHARE BY REGION, 2022 VS 2030(%)

8. GLOBAL BABY DIAPER IN PHARMACY/ DRUGSTORE MARKET SHARE BY REGION, 2022 VS 2030(%)

9. GLOBAL BABY DIAPER IN OTHER DISTRIBUTION CHANNEL MARKET SHARE BY REGION, 2022 VS 2030(%)

10. GLOBAL BABY DIAPER MARKET SHARE BY REGION, 2022 VS 2030(%)

11. US BABY DIAPER MARKET SIZE, 2022-2030 ($ MILLION)

12. CANADA BABY DIAPER MARKET SIZE, 2022-2030 ($ MILLION)

13. UK BABY DIAPER MARKET SIZE, 2022-2030 ($ MILLION)

14. FRANCE BABY DIAPER MARKET SIZE, 2022-2030 ($ MILLION)

15. GERMANY BABY DIAPER MARKET SIZE, 2022-2030 ($ MILLION)

16. ITALY BABY DIAPER MARKET SIZE, 2022-2030 ($ MILLION)

17. SPAIN BABY DIAPER MARKET SIZE, 2022-2030 ($ MILLION)

18. REST OF EUROPE BABY DIAPER MARKET SIZE, 2022-2030 ($ MILLION)

19. INDIA BABY DIAPER MARKET SIZE, 2022-2030 ($ MILLION)

20. CHINA BABY DIAPER MARKET SIZE, 2022-2030 ($ MILLION)

21. JAPAN BABY DIAPER MARKET SIZE, 2022-2030 ($ MILLION)

22. SOUTH KOREA BABY DIAPER MARKET SIZE, 2022-2030 ($ MILLION)

23. REST OF ASIA-PACIFIC BABY DIAPER MARKET SIZE, 2022-2030 ($ MILLION)

24. REST OF THE WORLD BABY DIAPER MARKET SIZE, 2022-2030 ($ MILLION)