Baggage Handling Systems Market

Baggage Handling Systems Market Size, Share & Trends Analysis Report by Mode of Transport (Airport, Railway, and Marine), by Tracking Technology (Barcode System and RFID System), by Check-In Service Type (Self Check-In and Assisted Check-In), and by Solution (Check-in, Screening, & Loading, Conveying & Sorting, and Unloading & Reclaim) Forecast Period (2023-2030) Update Available - Forecast 2025-2035

Baggage handling systems market is anticipated to grow at a considerable CAGR of 6.4% during the forecast period. Expansion of marine tourism sector along with increase in air passenger traffic has been driving the global baggage handling systems market. The majority of airport authorities are investing in airport infrastructure renewal to provide passengers with a better level of comfort and baggage management. Furthermore, the use of technologies such as radio-frequency identification (RFID) and destination-coded vehicle system (DCV) is assisting the market’s expansion. According to the International Air Transport Association (IATA) and SITA (a baggage handling system manufacturer), global RFID implementation could save the airline industry around $2.8 billion over the next seven years.

Segmental Outlook

The global baggage handling systems market is segmented based on mode of transport, tracking technology, check-in service type, and solution. Based on mode of transport, the market is sub-segmented into airport, railway, and marine. Based on tracking technology, the market is divided into barcode system and RFID system. Based on check-in service type, the market is augmented into self check-in and assisted check-in. Further, based on solution, the market is sub-segmented into check-in, screening, & loading, conveying & sorting, unloading & reclaim. Among the tracking technology, the RFID system sub-segment is expected to hold a considerable share of the market owing to the growing incidence of thefts, which has pushed the deployment of RFID systems at various places including malls, shopping stores, airports, and others.

Airport Sub-Segment is Anticipated to Hold a Prominent Share of the Global Baggage Handling System

Among the mode of transport segment, the airport sub-segment is expected to hold a considerable share of the market. The rising adoption of various strategies such as acquisition by several key market players such as ADELTE Group SL, Air T Inc, Havas, and others to stay competitive in the market is the major factor driving the growth of this market segment. For instance, in February 2022, Havas, a Turkey-based ground handling company acquired MZLZ ground handling services, which operates at Zagreb Airport in Croatia. The acquisition allows Havas control of passenger, ramp, representation and supervision services, flight operation, load control, and communication services as well as cargo and mail services at Zagreb Airport. In addition, the Havas provides service in Zagreb with around 500 employees and a machine park consisting of 176 motorized and 346 wheeled equipments.

Regional Outlooks

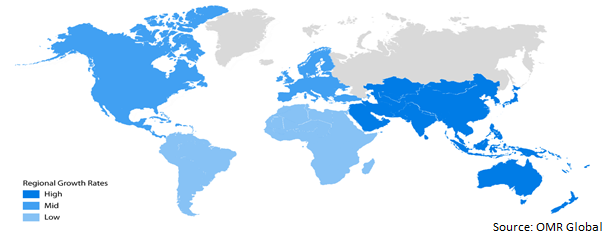

The global baggage handling systems market is further segmented based on geography, including North America (the US and Canada), Europe (Italy, Spain, Germany, France, and others), Asia-Pacific (India, China, Japan, South Korea, and others), and the Rest of the World (the Middle East & Africa and Latin America). Among these, the Asia-Pacific market is anticipated to cater to a considerable growth over the forecast period. A rapid increase in investments in airport infrastructure to cater to the growing passenger traffic in the region over the past decade is a key factor driving the regional market growth. Airports in China, India, Japan, and South Korea have witnessed exponential growth in passenger traffic in the past few years. As a result of this, the airport authorities have increased their investments in the expansion of existing airports and the construction of new airports in the region. In November 2022, Noida International Airport (NIA) signed an agreement with Siemens Logistics India Pvt. Ltd. Under this agreement, Siemens will design, supply, install, commission, operate & maintain the departure and arrival baggage handling system for NIA.

Global Baggage Handling Systems Market Growth, by Region 2023-2030

The North America Region to Hold a Considerable Share in the Global Baggage Handling Systems Market

North America held a considerable share in the global baggage handling systems market. In North America, the US held a major market share. The presence of major airports, the rapidly expanding aviation industry, and increased expenditure on airport ground handling systems in the region are contributing to the regional market growth. For instance, in May 2021, Worldwide Flight Services (WFS) secured ground-handling contracts for three years from around 12 carriers in North America. WFS has been appointed by VivaAerobús for complete handling services. Moreover, WFS offers ramp handling services to Emirates Airlines’ 250 flights annually from DFW to Dubai.

At the same airport, Qatar Airways selected WFS to provide ground handling services for its 520 flights a year to Doha. Additionally, in Las Vegas, WFS secured a cabin cleaning services contract from JetBlue. Meanwhile, Avelo Airlines selected WFS for complete above-and below-wing handling, cabin cleaning, and security services at Bozeman Yellowstone Airport, Eugene Airport (EUG), and Redmond Municipal Airport (RDM). Thereby, is driving the regional baggage handling systems market.

Market Players Outlook

The major companies serving the global baggage handling systems market include Siemens AG, SITA, BEUMER GROUP, Vanderlande Industries, and Leonardo SpA among others. The market players are considerably contributing to the market growth by the adoption of various strategies, including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in March 2023, Siemens Logistics secured a contract to deploy its baggage handling and sorting technology at the new Terminal 2 (T2) in China’s Hefei Xinqiao Airport. Under the contract, Siemens Logistics will deliver its VarioTray Individual Carrier System to ensure seamless baggage handling. The contract scope also includes the supply of the VarioStore early bag store as well as the intelligent BagIQ software. The VarioTray TilterPlus component has been designed to route bags in three directions and enable seamless sorting. A modern early bag store (EBS) system with a storage capacity of 700 spaces, to enhance the transfer baggage process.

The Report Covers

- Market value data analysis of 2022 and forecast to 2030.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global baggage handling systems market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.3. Key Findings

2.4. Recommendations

2.5. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Siemens AG

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. SITA

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. BEUMER GROUP

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Vanderlande Industries

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Leonardo SpA

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Baggage Handling Systems Market by Mode of Transport

4.1.1. Airport

4.1.2. Railway

4.1.3. Marine

4.2. Global Baggage Handling Systems Market by Tracking Technology

4.2.1. Barcode System

4.2.2. RFID System

4.3. Global Baggage Handling Systems Market by Check-in Service Type

4.3.1. Assisted Service

4.3.2. Self Service

4.4. Global Baggage Handling Systems Market by Solution

4.4.1. Check-in, Screening, & Loading

4.4.2. Conveying & Sorting

4.4.3. Unloading & Reclaim

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Air+MAK Industries Inc.

6.2. ALSTEF Group

6.3. ALVEST

6.4. Ansir Systems

6.5. Cavotec SA

6.6. Celebi Airport Services India Pvt. Ltd.

6.7. CIMC TianDa Holdings Co. Ltd

6.8. Daifuku Co. Ltd

6.9. Fives SAS

6.10. G&S Airport Conveyer

6.11. Ground Support Specialists LLC

6.12. Pteris Global Ltd.

6.13. SATS Ltd.

6.14. Textron Inc.

6.15. Tronair Inc.

6.16. Vestergaard Co.

1. GLOBAL BAGGAGE HANDLING SYSTEMS MARKET BY MODE OF TRANSPORT, 2022-2030 ($ MILLION)

2. GLOBAL AIRPORT BAGGAGE HANDLING SYSTEMS MARKET BY REGION, 2022-2030 ($ MILLION)

3. GLOBAL RAILWAY BAGGAGE HANDLING SYSTEMS MARKET BY REGION, 2022-2030 ($ MILLION)

4. GLOBAL MARINE BAGGAGE HANDLING SYSTEMS MARKET BY REGION, 2022-2030 ($ MILLION)

5. GLOBAL BAGGAGE HANDLING SYSTEMS MARKET BY TRACKING TECHNOLOGY, 2022-2030 ($ MILLION)

6. GLOBAL BAGGAGE HANDLING USING BARCODE SYSTEM MARKET BY REGION, 2022-2030 ($ MILLION)

7. GLOBAL BAGGAGE HANDLING USING RFID SYSTEM MARKET BY REGION, 2022-2030 ($ MILLION)

8. GLOBAL BAGGAGE HANDLING SYSTEMS MARKET BY CHECK-IN SERVICE TYPE, 2022-2030 ($ MILLION)

9. GLOBAL SELF CHECK-IN BAGGAGE HANDLING SYSTEM MARKET BY REGION, 2022-2030 ($ MILLION)

10. GLOBAL ASSISTED CHECK-IN BAGGAGE HANDLING SYSTEM MARKET BY REGION, 2022-2030 ($ MILLION)

11. GLOBAL BAGGAGE HANDLING SYSTEMS MARKET BY SOLUTION, 2022-2030 ($ MILLION)

12. GLOBAL BAGGAGE HANDLING SYSTEMS FOR CHECK-IN, SCREENING, & LOADING MARKET BY REGION,2022-2030 ($ MILLION)

13. GLOBAL BAGGAGE HANDLING SYSTEMS FOR CONVEYING & SORTING MARKET BY REGION,2022-2030 ($ MILLION)

14. GLOBAL BAGGAGE HANDLING SYSTEMS FOR UNLOADING & RECLAIM MARKET BY REGION,2022-2030 ($ MILLION)

15. GLOBAL BAGGAGE HANDLING SYSTEMS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2022-2030 ($ MILLION)

16. NORTH AMERICAN BAGGAGE HANDLING SYSTEMS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

17. NORTH AMERICAN BAGGAGE HANDLING SYSTEMS MARKET RESEARCH AND ANALYSIS BY MODE OF TRANSPORT, 2022-2030 ($ MILLION)

18. NORTH AMERICAN BAGGAGE HANDLING SYSTEMS MARKET RESEARCH AND ANALYSIS BY TRACKING TECHNOLOGY, 2022-2030 ($ MILLION)

19. NORTH AMERICAN BAGGAGE HANDLING SYSTEMS MARKET RESEARCH AND ANALYSIS BY CHECK-IN SERVICE TYPE, 2022-2030 ($ MILLION)

20. NORTH AMERICAN BAGGAGE HANDLING SYSTEMS MARKET RESEARCH AND ANALYSIS BY SOLUTION, 2022-2030 ($ MILLION)

21. EUROPEAN BAGGAGE HANDLING SYSTEMS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

22. EUROPEAN BAGGAGE HANDLING SYSTEMS MARKET RESEARCH AND ANALYSIS BY MODE OF TRANSPORT, 2022-2030 ($ MILLION)

23. EUROPEAN BAGGAGE HANDLING SYSTEMS MARKET RESEARCH AND ANALYSIS BY TRACKING TECHNOLOGY, 2022-2030 ($ MILLION)

24. EUROPEAN BAGGAGE HANDLING SYSTEMS MARKET RESEARCH AND ANALYSIS BY CHECK-IN SERVICE TYPE, 2022-2030 ($ MILLION)

25. EUROPEAN BAGGAGE HANDLING SYSTEMS MARKET RESEARCH AND ANALYSIS BY SOLUTION, 2022-2030 ($ MILLION)

26. ASIA-PACIFIC BAGGAGE HANDLING SYSTEMS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

27. ASIA-PACIFIC BAGGAGE HANDLING SYSTEMS MARKET RESEARCH AND ANALYSIS BY MODE OF TRANSPORT, 2022-2030 ($ MILLION)

28. ASIA-PACIFIC BAGGAGE HANDLING SYSTEMS MARKET RESEARCH AND ANALYSIS BY TRACKING TECHNOLOGY, 2022-2030 ($ MILLION)

29. ASIA-PACIFIC BAGGAGE HANDLING SYSTEMS MARKET RESEARCH AND ANALYSIS BY CHECK-IN SERVICE TYPE, 2022-2030 ($ MILLION)

30. ASIA-PACIFIC BAGGAGE HANDLING SYSTEMS MARKET RESEARCH AND ANALYSIS BY SOLUTION, 2022-2030 ($ MILLION)

31. REST OF THE WORLD BAGGAGE HANDLING SYSTEMS MARKET RESEARCH AND ANALYSIS BY MODE OF TRANSPORT, 2022-2030 ($ MILLION)

32. REST OF THE WORLD BAGGAGE HANDLING SYSTEMS MARKET RESEARCH AND ANALYSIS BY TRACKING TECHNOLOGY, 2022-2030 ($ MILLION)

33. REST OF THE WORLD BAGGAGE HANDLING SYSTEMS MARKET RESEARCH AND ANALYSIS BY CHECK-IN SERVICE TYPE, 2022-2030 ($ MILLION)

34. REST OF THE WORLD BAGGAGE HANDLING SYSTEMS MARKET RESEARCH AND ANALYSIS BY SOLUTION, 2022-2030 ($ MILLION)

1. GLOBAL BAGGAGE HANDLING SYSTEMS MARKET SHARE BY MODE OF TRANSPORT, 2022 VS 2030 (%)

2. GLOBAL AIRPORT BAGGAGE HANDLING SYSTEMS MARKET BY REGION, 2022 VS 2030 (%)

3. GLOBAL RAILWAY BAGGAGE HANDLING SYSTEMS MARKET BY REGION, 2022 VS 2030 (%)

4. GLOBAL MARINE BAGGAGE HANDLING SYSTEMS MARKET BY REGION, 2022 VS 2030 (%)

5. GLOBAL BAGGAGE HANDLING SYSTEMS MARKET SHARE BY TRACKING TECHNOLOGY, 2022 VS 2030 (%)

6. GLOBAL BAGGAGE HANDLING USING BARCODE SYSTEMS MARKET BY REGION, 2022 VS 2030 (%)

7. GLOBAL BAGGAGE HANDLING USING RFID SYSTEMS MARKET BY REGION, 2022 VS 2030 (%)

8. GLOBAL BAGGAGE HANDLING SYSTEMS MARKET SHARE BY CHECK-IN SERVICE TYPE, 2022 VS 2030 (%)

9. GLOBAL SELF CHECK-IN BAGGAGE HANDLING SYSTEMS MARKET BY REGION, 2022 VS 2030 (%)

10. GLOBAL ASSISTED CHECK-IN BAGGAGE HANDLING SYSTEMS MARKET BY REGION, 2022 VS 2030 (%)

11. GLOBAL BAGGAGE HANDLING SYSTEMS MARKET SHARE BY SOLUTION, 2022 VS 2030 (%)

12. GLOBAL BAGGAGE HANDLING SYSTEMS FOR CHECK-IN, SCREENING, & LOADING MARKET BY REGION, 2022 VS 2030 (%)

13. GLOBAL BAGGAGE HANDLING SYSTEMS FOR CONVEYING & SORTING MARKET BY REGION, 2022 VS 2030 (%)

14. GLOBAL BAGGAGE HANDLING SYSTEMS FOR UNLOADING & RECLAIM MARKET BY REGION, 2022 VS 2030 (%)

15. GLOBAL BAGGAGE HANDLING SYSTEMS FOR OTHERS MARKET BY REGION, 2022 VS 2030 (%)

16. GLOBAL BAGGAGE HANDLING SYSTEMS MARKET SHARE BY GEOGRAPHY, 2022 VS 2030, (%)

17. US BAGGAGE HANDLING SYSTEMS MARKET SIZE, 2022-2030 ($ MILLION)

18. CANADA MARKET BAGGAGE HANDLING SYSTEMS MARKET SIZE, 2022-2030 ($ MILLION)

19. UK BAGGAGE HANDLING SYSTEMS MARKET SIZE, 2022-2030 ($ MILLION)

20. GERMANY BAGGAGE HANDLING SYSTEMS MARKET SIZE, 2022-2030 ($ MILLION)

21. SPAIN BAGGAGE HANDLING SYSTEMS MARKET SIZE, 2022-2030 ($ MILLION)

22. FRANCE BAGGAGE HANDLING SYSTEMS MARKET SIZE, 2022-2030 ($ MILLION)

23. ITALY BAGGAGE HANDLING SYSTEMS MARKET SIZE, 2022-2030 ($ MILLION)

24. REST OF EUROPE BAGGAGE HANDLING SYSTEMS MARKET SIZE, 2022-2030 ($ MILLION)

25. INDIA BAGGAGE HANDLING SYSTEMS MARKET SIZE, 2022-2030 ($ MILLION)

26. CHINA BAGGAGE HANDLING SYSTEMS MARKET SIZE, 2022-2030 ($ MILLION)

27. JAPAN BAGGAGE HANDLING SYSTEMS MARKET SIZE, 2022-2030 ($ MILLION)

28. REST OFASIA-PACIFIC BAGGAGE HANDLING SYSTEMS MARKET SIZE, 2022-2030 ($ MILLION)

29. REST OF WORLD BAGGAGE HANDLING SYSTEMS MARKET SIZE, 2022-2030 ($ MILLION)