Baggage Scanner Market

Global Baggage Scanner Market Size, Share & Trends Analysis Report by Type (Channel Scanning Machine and Portable Scanning Machine), by Technology (X-ray baggage Scanner, 3D X-ray Baggage Scanner, Dual View Baggage Scanner, and Single View Baggage Scanner), and by Application (Airport, Railway Stations, Border Checkpoints, and Others) Forecast 2021-2027

The global baggage scanner market is anticipated to grow at a significant CAGR of 5.8% during the forecast period. Security personnel can use a baggage scanner to create a picture of what's inside your bags and check anything that appears suspicious. The 3D baggage scanner is used to provide high-resolution 3D images that enable operators to make more accurate assessment of a bag’s contents. The 3D baggage scanner aids to create more informed on-screen inspection and resolution, resulting in a more effective flow of passengers through security and a lower cost of security operation. Moreover, the advancement in technologies has also reduced the burden on operators, which provide more efficient results and outputs, which ultimately result in better security outcomes, improved passenger experience, operational efficiency, and reduced operational costs. Such factors are responsible for driving the growth of the baggage scanner market over the forecast period.

For instance, in October 2020, 3D X-Ray had launched the AXIS-CXi, a cabinet-based X-ray screening system that utilizes the same color differentiating image technology used in airport baggage screening. The AXIS-CXi is a huge step forward in mailroom scanning, as color-differentiated images that enables operators to determine shape, size, and the nature of the materials being scanned. For example, orange color shows organics, such as explosives, chemicals, and drugs, as well as more innocent items such as foodstuffs. Blue shows metals, such as guns, knives, and potential IED components. Green shows inorganic materials like those used in homemade explosives. Greyscale is used for the recognition of shapes and the form of objects. This allows the operator, with very little training, to analyze items more accurately, quickly, and easily.

Impact of COVID-19 Pandemic on Global Baggage Scanner Market

The global baggage scanner market is significantly impacted by the COVID-19 pandemic. The lockdown across the globe impacted factories’ operational activities, due to which manufacturers struggled to develop new products. In addition, government of several countries globally closed the border and imposed various travel restrictions, due to which the baggage scanner has been negatively impacted. However, the market is expected to cater “V” shaped recovery, as the travel has been re-initiated post-pandemic in 2021. Further, the baggage scanner market is expected to be grow rapidly after the pandemic compared to any other markets due to the mandate regulations and policies for baggage scanning, which created opportunities for the market in the pandemic.

Segmental Outlook

The global baggage scanner market is segmented based on type, technology, and application. Based on the type, the market is bifurcated into channel scanning machine and portable scanning machine. Based on the technology, the market is sub-segmented into the X-ray baggage scanner, 3D X-ray baggage scanner, dual view baggage scanner, and single view baggage scanner. Based on the application, the market is augmented into airports, railway stations, border checkpoints, and others. Among all segments, the 3D X-ray baggage scanner is expected to hold a prominent share in the market due to its high flexibility in scanning and provides high image performance.

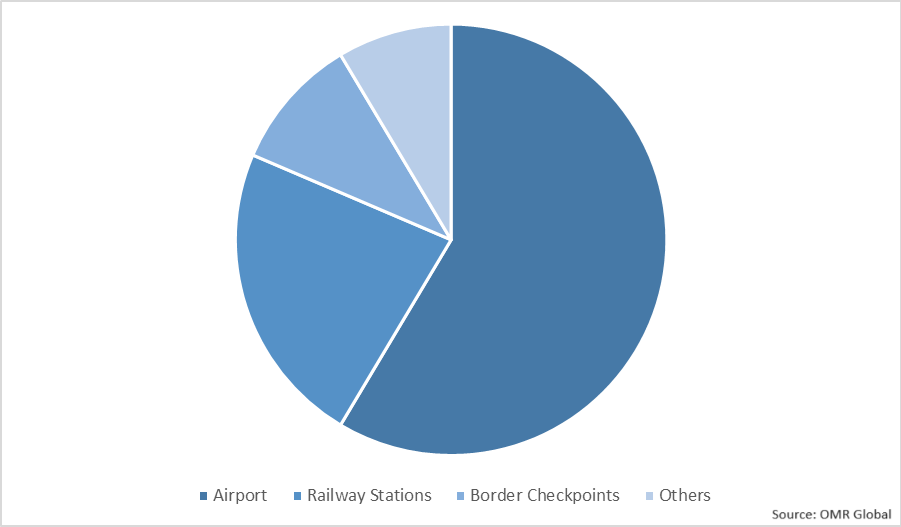

Global Baggage Scanner Market Share by Applications, 2020 (%)

The Airport Segment is Expected to Hold a Considerable Share in the Global Baggage Scanner Market

Among all segments, the airport is expected to hold a considerable share in the market over the forecast. The increase in the airport and air passenger traffic are the factors contributing to the baggage scanner market growth across the globe. Moreover, the rise in cybercrime and terrorist attacks are forcing factors to adopt baggage scanners to enhance public safety which is positively favoring the market. As per the Global Terrorism Index report 2020, the most impacted countries by terrorism are Afghanistan, Iraq, Nigeria, Syria, and Somalia. Additionally, the far-right terrorism has been increased by 41% from 2019 to 2020, in the Western Hemisphere. Thus, further increasing the requiremet ad demand of baggage scanner to prevent hazardous terrorist attacks globally.

Regional Outlooks

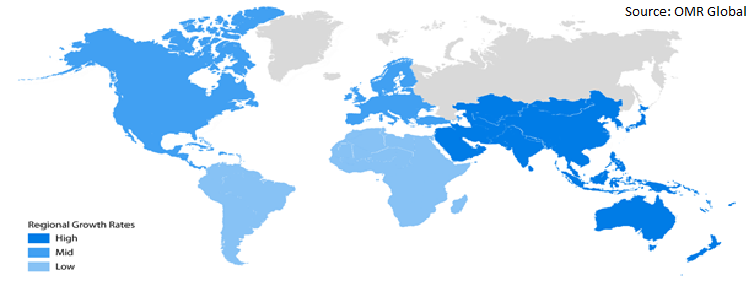

The global baggage scanner market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East & Africa, and Latin America). The market can be analyzed for a particular region or country level as per the requirement. North America is expected to hold a prominent share in the baggage scanner market in the forecast due to strict regulations catering to maintain and improve the public safety. Owing to this, baggage scanner provides the highest threat detection capability which will contribute to the growth of the market.

Global Baggage Scanner Market Growth, by Region 2021-2027

The Asia-Pacific Region Anticipated to Hold Significant Share in the Global Baggage Scanner Market

Asia-Pacific region is witnessed to contribute healthy growth in the global baggage scanner market. Due to growing terrorist threats and the need for public safety, the region is adopting baggage scanner machines to enhance public safety. For instance, in February 2020, Kolkata airport launched 3D scanning on one of the three portals in the international wing. The inline baggage screening system (ILBS) will eliminate the need to get checked-in baggage scanned by X-ray machines before they are deposited at check-in counters.

Market Players Outlook

The major companies serving the global baggage scanner market include ADS Group, Autoclear, Detectorall Co. Ltd., Rapiscan Systems, Inc., Vanderlande Industries BV, Astrophysics Inc., BEUMER Group, Braun & Co. Ltd., C.E.I.A. SpA, KritiKal Solutions Inc. and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers & acquisitions, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in June 2021, the Rapiscan systems launched Rapiscan 920CT that is a checkpoint X-ray screening system for aviation cabin baggage. It provides the highest resolution full 3D image allowing the highest degree of on-Screen inspection and resolution (OSIR) for the operator reducing the need to manually search open bags. The 920CT utilizes a patented Dual-Energy technology and sophisticated algorithm providing the highest level of automatic detection of highly dense items as well as automatic detection of explosives based on the most stringent global regulatory requirement.

The Report Covers

- Market value data analysis of 2020 and forecast to 2027.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global baggage scanner market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global Baggage Scanner Market

• Recovery Scenario of Global Baggage Scanner Market

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. BY Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. ADS Group Ltd.

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Autoclear

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Detectorall Co., Ltd.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Rapiscan Systems

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Vanderlande Industries BV

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Key Strategy Analysis

3.7. Impact of Covid-19 on Key Players

4. Market Segmentation

4.1. Global Baggage Scanner Market by Type

4.1.1. Channel Scanning Machine

4.1.2. Portable Scanning Machine

4.2. Global Baggage Scanner Market by Technology

4.2.1. X-ray Baggage Scanner

4.2.2. 3D X-ray Baggage Scanner

4.2.3. Dual View Baggage Scanner

4.2.4. Single View Baggage Scanner

4.3. Global Baggage Scanner Market by Application

4.3.1. Airports

4.3.2. Railway Stations

4.3.3. Border Checkpoints

4.3.4. Others (Public Sectors, Ports, and Educational Institutions)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Ammeraal Beltech Holding B.V.

6.2. Alstef Group SAS

6.3. Astrophysics Inc.

6.4. BEUMER Group

6.5. Braun & Co. Ltd.

6.6. C.E.I.A. SpA

6.7. Daifuku Co., Ltd.

6.8. G&S Airport Conveyer

6.9. Kapri Corp.

6.10. Kosan Crisplant a/s

6.11. KritiKal Solutions Inc.

6.12. OSI Systems, Inc.

6.13. Pteris Global Ltd.

6.14. Seimens Logistics GmbH

6.15. Shanghai Eastimage Co. Ltd.

6.16. The Automated Technology Group

1. GLOBAL BAGGAGE SCANNER MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

2. GLOBAL BAGGAGE SCANNER BY CHANNEL SCANNING MACHINE MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

3. GLOBAL BAGGAGE SCANNER BY PORTABLE SCANNING MACHINE MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

4. GLOBAL BAGGAGE SCANNER MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2020-2027 ($ MILLION)

5. GLOBAL X-RAY BAGGAGE SCANNER MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

6. GLOBAL 3D X-RAY BAGGAGE SCANNER MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

7. GLOBAL DUAL VIEW BAGGAGE SCANNER MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

8. GLOBAL SINGLE BAGGAGE SCANNER MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

9. GLOBAL BAGGAGE SCANNER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

10. GLOBAL BAGGAGE SCANNER IN AIRPORTS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

11. GLOBAL BAGGAGE SCANNER IN RAILWAY STATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

12. GLOBAL BAGGAGE SCANNER IN BORDER CHECKPOINTS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

13. GLOBAL BAGGAGE SCANNER IN OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

14. GLOBAL BAGGAGE SCANNER MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2020-2027 ($ MILLION)

15. NORTH AMERICAN BAGGAGE SCANNER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

16. NORTH AMERICAN BAGGAGE SCANNER MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

17. NORTH AMERICAN BAGGAGE SCANNER MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2020-2027 ($ MILLION)

18. NORTH AMERICAN BAGGAGE SCANNER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

19. EUROPEAN BAGGAGE SCANNER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

20. EUROPEAN BAGGAGE SCANNER MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

21. EUROPEAN BAGGAGE SCANNER MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2020-2027 ($ MILLION)

22. EUROPEAN BAGGAGE SCANNER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

23. ASIA-PACIFIC BAGGAGE SCANNER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

24. ASIA-PACIFIC BAGGAGE SCANNER MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

25. ASIA-PACIFIC BAGGAGE SCANNER MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2020-2027 ($ MILLION)

26. ASIA-PACIFIC BAGGAGE SCANNER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

27. REST OF THE WORLD BAGGAGE SCANNER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

28. REST OF THE WORLD BAGGAGE SCANNER MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

29. REST OF THE WORLD BAGGAGE SCANNER MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2020-2027 ($ MILLION)

30. REST OF THE WORLD BAGGAGE SCANNER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL BAGGAGE SCANNER MARKET, 2020-2027 ($ MILLION)

2. IMPACT OF COVID-19 ON GLOBAL BAGGAGE SCANNER MARKET BY SEGMENT, 2020-2027 ($ MILLION)

3. RECOVERY OF GLOBAL BAGGAGE SCANNER MARKET, 2021-2027 (%)

4. GLOBAL BAGGAGE SCANNER MARKET SHARE BY TYPE, 2020 VS 2027 (%)

5. GLOBAL BAGGAGE SCANNER BY CHANNEL SCANNING MACHIEN MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

6. GLOBAL BAGGAGE SCANNER BY PORTABLE SCANNING MACHINE MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

7. GLOBAL BAGGAGE SCANNER MARKET SHARE BY TECHNOLOGY, 2020 VS 2027 (%)

8. GLOBAL X-RAY BAGGAGE SCANNER MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

9. GLOBAL 3D X-RAY BAGGAGE SCANNER MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

10. GLOBAL DUAL BAGGAGE SCANNER MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

11. GLOBAL SINGLE BAGGAGE SCANNER MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

12. GLOBAL BAGGAGE SCANNER MARKET SHARE BY APPLICATION, 2020 VS 2027 (%)

13. GLOBAL BAGGAGE SCANNER IN AIRPORTS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

14. GLOBAL BAGGAGE SCANNER IN RAILWAY STATIONS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

15. GLOBAL BAGGAGE SCANNER IN BORDER CHECKPOINTS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

16. GLOBAL BAGGAGE SCANNER FOR OTHERS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

17. GLOBAL BAGGAGE SCANNER MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

18. US BAGGAGE SCANNER MARKET SIZE, 2020-2027 ($ MILLION)

19. CANADA BAGGAGE SCANNER MARKET SIZE, 2020-2027 ($ MILLION)

20. UK BAGGAGE SCANNER MARKET SIZE, 2020-2027 ($ MILLION)

21. FRANCE BAGGAGE SCANNER MARKET SIZE, 2020-2027 ($ MILLION)

22. GERMANY BAGGAGE SCANNER MARKET SIZE, 2020-2027 ($ MILLION)

23. ITALY BAGGAGE SCANNER MARKET SIZE, 2020-2027 ($ MILLION)

24. SPAIN BAGGAGE SCANNER MARKET SIZE, 2020-2027 ($ MILLION)

25. REST OF EUROPE BAGGAGE SCANNER MARKET SIZE, 2020-2027 ($ MILLION)

26. INDIA BAGGAGE SCANNER MARKET SIZE, 2020-2027 ($ MILLION)

27. CHINA BAGGAGE SCANNER MARKET SIZE, 2020-2027 ($ MILLION)

28. JAPAN BAGGAGE SCANNER MARKET SIZE, 2020-2027 ($ MILLION)

29. SOUTH KOREA BAGGAGE SCANNER MARKET SIZE, 2020-2027 ($ MILLION)

30. REST OF ASIA-PACIFIC BAGGAGE SCANNER MARKET SIZE, 2020-2027 ($ MILLION)

31. REST OF THE WORLD BAGGAGE SCANNER MARKET SIZE, 2020-2027 ($ MILLION)