Banana Flour Market

Banana Flour Market Size, Share & Trends Analysis Report by Nature (Organic, and Conventional), by Processing (Freeze Dried, Spray/Dum Dried, Sun Dried, and Other), by Form (Ripen, and Unripen), and by End-User (Food Industry, Beverages, and Retail/Household) Forecast Period (2022-2028) Update Available - Forecast 2025-2031

Banana flour market is anticipated to grow at a significant CAGR of 7.2% during the forecast period. The rising use of gluten-free products as an alternative to wheat flour is boosting the demand for banana flour across the globe. Gluten products such as wheat flour can cause many side effects such as fatigue, unintentional weight loss, malnutrition, bloating, alternating constipation, diarrhoea, intestinal damage, and others. According to Beyond Celian Organization, around 1 in 133 Americans, or about 1% of the US population, has celiac disease, and in Italy, it is found to be around 1.6%. and also it states that around 83% of Americans who have celiac disease are undiagnosed or misdiagnosed.

Celiac disease (Gluten) is an autoimmune disease that is triggered by consuming gluten and results in damage to the small intestine. Gluten is a protein found in wheat, barley and rye, as well as foods made from these grains, including bran, bulgur, durum, couscous, and graham flour. On the other hand, banana flour contains insoluble fibre that acts as a prebiotic to promote good bacteria and heal the digestive system. This can keep the bowel movements regular and reduce symptoms of Irritable Bowel Syndrome (IBS) and constipation. It can also prevent colon cancer and reduce the symptoms of diarrhoea. The gluten-free diet is used to get cured, hence people are shifting towards alternate products such as banana flour, which boosts the demand for the banana flour market during the forecast period.

Segmental Outlook

The global banana flour market is segmented based on nature, processing form, and end-use. Based on nature, the market is segmented into organic and conventional. Based on form, the market is sub-segmented into ripen and unripen. Based on processing the market is segmented into freeze dried, spray/ dum dried, sun-dried, and others. Based on end-use the market is segmented into the food industry, beverage, and retail/household. The above-mentioned segments can be customized as per the requirements.

Based on nature, the organic banana flour sub-segment is anticipated to grow at the fastest rate during the forecast period. Owing to the rising awareness about organic products and increasing health awareness, banana flour made with organic ingredients is becoming increasingly popular among consumers who are looking for chemical- and pesticide-free products. Due to the many nutritional values of organic banana fruit organic banana flour is in high demand and is boosting the demand for organic flour. According to the Food and Agriculture Organization of the UN, the Dominican Republic is the largest producer of organic bananas across the globe, representing more than 55% of the global organic banana production. Further, approximately, 95% of Dominican organic bananas are shipped to the European Union (EU), making up nearly 50% of its supply. This shows the high demand for organic bananas in Europe and USand then the flour making companies make organic flour for consumers to use in other food products.

Regional Outlooks

The global banana flour market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East & Africa, and Latin America). The market can be analyzed for a particular region or country level as per the requirement. North America is anticipated to grow at the fastest rate during the forecast period. Owing to the rising use of banana flour to prepare infant food is spurring the growth of the market. Banana flour offers several benefits including improving immunity, providing potassium and other vital nutrients, being easy to digest, decreasing the risk of infectious diseases such as cough and cold, and developing a healthy brain in babies. According to the Observatory of Economic Complexity (OEC), in 2020, the top importers of Bananas were the US ($2.58 billion, followed by China ($959 million), Japan ($902 million), Germany ($796 million), and Netherlands ($779 million). Hence showcases the increasing demand for bananas across the region.

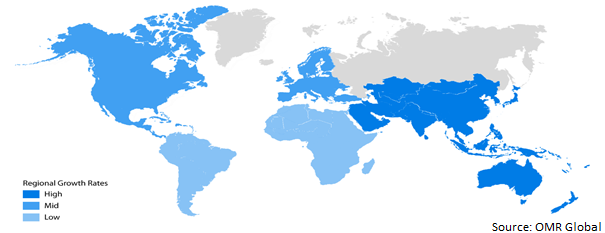

Global Banana Flour Market Growth, by Region 2022-2028

The Asia-Pacific Region is Expected to Hold the Considerable Share in the Global Banana Flour Market

The Asia-Pacific region is expected to hold a considerable share in the global banana flour market during the forecast period. Owing to the leading producer of bananas globally countries such as China, Indonesia, Phillippines, India and others produce most of the bananas which is boosting the demand for banana flour in Asia-Pacific. Asia-Pacific is one of the most populous regions with the largest food and beverage consumer base. In Asia-Pacific, wheat products are consumed more, such as wheat flour and its products which cause celiac diseases in many peoples who are allergic to gluten, however banana flour is gluten-free and have many other nutrients also which increases the demand in the market. Banana flour is becoming a healthy and gluten-free alternative to the traditional grain flour commonly consumed in the region. As a result, these factors are expected to fuel banana flour demand over the forecast period. According to the Food and Agriculture Organization of the United Nations (UN), the largest producer of bananas in Asia-Pacific is India and China followed by other countries like Indonesia and others. According to APEDA data 2019, India accounts for 10% of the world fruit production with first rank in the production of banana and sapota.

Market Players Outlook

The major companies serving the global banana flour market include Edward & Sons Trading Co., KADAC Pty Ltd., Natural Evolution (Europe) Ltd., NuNaturals, Inc., Woodland Foods and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in April 2022, iTi Tropicals launched organic green banana flour to serve as a gluten-free flour replacement in packaged foods where wheat flour typically is used. The flour originates from India and is light brown with little to no banana flavour.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global banana flour market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Edward & Sons Trading Co.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. KADAC Pty Ltd.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Natural Evolution (Europe) Ltd.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. NuNaturals, Inc.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Woodland Foods

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Banana Flour Market by Nature

4.1.1. Organic

4.1.2. Conventional

4.2. Global Banana Flour Market by Processing

4.2.1. Freeze Dried

4.2.2. Spray/ Dum Dried

4.2.3. Sun Dried

4.2.4. Others

4.3. Global Banana Flour Market by Form

4.3.1. Ripen

4.3.2. Unripen

4.4. Global Banana Flour Market by End-Use

4.4.1. Food Industry

4.4.2. Beverages

4.4.3. Retail/ Household

4.4.4. Others

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. APKA Industries

6.2. Ceres Enterprises Ltd.

6.3. Diana Food S.A.S.

6.4. Hearthy Foods

6.5. International Agriculture Group.

6.6. Kanegrade Ltd.

6.7. Kokos Natural

6.8. Paradise Fruits Solutions GmbH & Co. KG

6.9. Pereg Gourmet Spices

6.10. Seawind Foods

6.11. Stawi Foods and Fruits Ltd.

6.12. The Divine Foods

1. GLOBAL BANANA FLOUR MARKET RESEARCH AND ANALYSIS BY NATURE, 2021-2028 ($ MILLION)

2. GLOBAL ORGANIC BANANA FLOUR MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL CONVENTIONAL BANANA FLOUR MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL BANANA FLOUR MARKET RESEARCH AND ANALYSIS BY FORM, 2021-2028 ($ MILLION)

5. GLOBAL RIPEN BANANA FLOUR MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

6. GLOBAL UNRIPEN BANANA FLOUR MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7. GLOBAL BANANA FLOUR MARKET RESEARCH AND ANALYSIS BY PROCESSING, 2021-2028 ($ MILLION)

8. GLOBAL FREEZE DRIED BANANA FLOUR MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

9. GLOBAL SPRAY/ DUM DRIED BANANA FLOUR MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

10. GLOBAL SUN-DRIED BANANA FLOUR MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

11. GLOBAL OTHERS BANANA FLOUR MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

12. GLOBAL BANANA FLOUR MARKET RESEARCH AND ANALYSIS BY END-USE, 2021-2028 ($ MILLION)

13. GLOBAL BANANA FLOUR FOR FOOD INDUSTRY MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

14. GLOBAL BANANA FLOUR FOR BEVERAGES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

15. GLOBAL BANANA FLOUR FOR RETAIL/ HOUSEHOLD MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

16. GLOBAL BANANA FLOUR FOR OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

17. GLOBAL BANANA FLOUR MARKET RESEARCH AND ANALYSIS BY REGIONREGION, 2021-2028 ($ MILLION)

18. NORTH AMERICAN BANANA FLOUR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

19. NORTH AMERICAN BANANA FLOUR MARKET RESEARCH AND ANALYSIS BY NATURE, 2021-2028 ($ MILLION)

20. NORTH AMERICAN BANANA FLOUR MARKET RESEARCH AND ANALYSIS BY FORM, 2021-2028 ($ MILLION)

21. NORTH AMERICAN BANANA FLOUR MARKET RESEARCH AND ANALYSIS BY PROCESSING, 2021-2028 ($ MILLION)

22. NORTH AMERICAN BANANA FLOUR MARKET RESEARCH AND ANALYSIS BY END-USE, 2021-2028 ($ MILLION)

23. EUROPEAN BANANA FLOUR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

24. EUROPEAN BANANA FLOUR MARKET RESEARCH AND ANALYSIS BY NATURE, 2021-2028 ($ MILLION)

25. EUROPEAN BANANA FLOUR MARKET RESEARCH AND ANALYSIS BY FORM, 2021-2028 ($ MILLION)

26. EUROPEAN BANANA FLOUR MARKET RESEARCH AND ANALYSIS BY PROCESSING, 2021-2028 ($ MILLION)

27. EUROPEAN BANANA FLOUR MARKET RESEARCH AND ANALYSIS BY END-USE, 2021-2028 ($ MILLION)

28. ASIA-PACIFIC BANANA FLOUR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

29. ASIA-PACIFIC BANANA FLOUR MARKET RESEARCH AND ANALYSIS BY NATURE, 2021-2028 ($ MILLION)

30. ASIA-PACIFIC BANANA FLOUR MARKET RESEARCH AND ANALYSIS BY FORM, 2021-2028 ($ MILLION)

31. ASIA-PACIFIC BANANA FLOUR MARKET RESEARCH AND ANALYSIS BY PROCESSING, 2021-2028 ($ MILLION)

32. ASIA-PACIFIC BANANA FLOUR MARKET RESEARCH AND ANALYSIS BY END-USE, 2021-2028 ($ MILLION)

33. REST OF THE WORLD BANANA FLOUR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

34. REST OF THE WORLD BANANA FLOUR MARKET RESEARCH AND ANALYSIS BY NATURE, 2021-2028 ($ MILLION)

35. REST OF THE WORLD BANANA FLOUR MARKET RESEARCH AND ANALYSIS BY FORM, 2021-2028 ($ MILLION)

36. REST OF THE WORLD BANANA FLOUR MARKET RESEARCH AND ANALYSIS BY PROCESSING, 2021-2028 ($ MILLION)

37. REST OF THE WORLD BANANA FLOUR MARKET RESEARCH AND ANALYSIS BY END-USE, 2021-2028 ($ MILLION)

1. GLOBAL BANANA FLOUR MARKET SHARE BY NATURE, 2021 VS 2028 (%)

2. GLOBAL ORGANIC BANANA FLOUR MARKET SHARE BY REGIONREGION, 2021 VS 2028 (%)

3. GLOBAL CONVENTIONAL BANANA FLOUR MARKET SHARE BY REGION, 2021 VS 2028 (%)

4. GLOBAL BANANA FLOUR MARKET SHARE BY FORM, 2021 VS 2028 (%)

5. GLOBAL RIPEN BANANA FLOUR MARKET SHARE BY REGION, 2021 VS 2028 (%)

6. GLOBAL UNRIPEN BANANA FLOUR MARKET SHARE BY REGION, 2021 VS 2028 (%)

7. GLOBAL BANANA FLOUR MARKET SHARE BY PROCESSING, 2021 VS 2028 (%)

8. GLOBAL FREEZE DRIED FLOUR MARKET SHARE BY REGION, 2021 VS 2028 (%)

9. GLOBAL SPRAY/ DUM DRIED FLOUR MARKET SHARE BY REGION, 2021 VS 2028 (%)

10. GLOBAL SUN-DRIED FLOUR MARKET SHARE BY REGION, 2021 VS 2028 (%)

11. GLOBAL OTHERS FLOUR MARKET SHARE BY REGION, 2021 VS 2028 (%)

12. GLOBAL BANANA FLOUR MARKET SHARE BY END-USE, 2021 VS 2028 (%)

13. GLOBAL BANANA FLOUR FOR FOOD INDUSTRY MARKET SHARE BY REGION, 2021 VS 2028 (%)

14. GLOBAL BANANA FLOUR FOR BEVERAGES MARKET SHARE BY REGION, 2021 VS 2028 (%)

15. GLOBAL BANANA FLOUR FOR RETAIL/ HOUSEHOLD MARKET SHARE BY REGION, 2021 VS 2028 (%)

16. GLOBAL BANANA FLOUR FOR OTHERS MARKET SHARE BY REGION, 2021 VS 2028 (%)

17. GLOBAL BANANA FLOUR MARKET SHARE BY REGION, 2021 VS 2028 (%)

18. US BANANA FLOUR MARKET SIZE, 2021-2028 ($ MILLION)

19. CANADA BANANA FLOUR MARKET SIZE, 2021-2028 ($ MILLION)

20. UK BANANA FLOUR MARKET SIZE, 2021-2028 ($ MILLION)

21. FRANCE BANANA FLOUR MARKET SIZE, 2021-2028 ($ MILLION)

22. GERMANY BANANA FLOUR MARKET SIZE, 2021-2028 ($ MILLION)

23. ITALY BANANA FLOUR MARKET SIZE, 2021-2028 ($ MILLION)

24. SPAIN BANANA FLOUR MARKET SIZE, 2021-2028 ($ MILLION)

25. REST OF EUROPE BANANA FLOUR MARKET SIZE, 2021-2028 ($ MILLION)

26. INDIA BANANA FLOUR MARKET SIZE, 2021-2028 ($ MILLION)

27. CHINA BANANA FLOUR MARKET SIZE, 2021-2028 ($ MILLION)

28. JAPAN BANANA FLOUR MARKET SIZE, 2021-2028 ($ MILLION)

29. SOUTH KOREA BANANA FLOUR MARKET SIZE, 2021-2028 ($ MILLION)

30. REST OF ASIA-PACIFIC BANANA FLOUR MARKET SIZE, 2021-2028 ($ MILLION)

31. REST OF THE WORLD BANANA FLOUR MARKET SIZE, 2021-2028 ($ MILLION)