Battery Cell Market

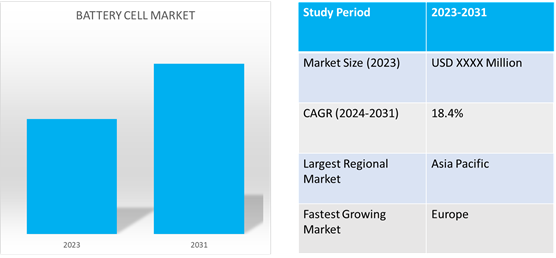

Battery Cell Market Size, Share & Trends Analysis Report by Type of Battery (Primary Cells and Secondary Cells), by End-User Industry (Automotive, Electronics,Energy, Aerospace & Defense and Healthcare) Forecast Period (2024-2031) Update Available - Forecast 2025-2031

Battery cell market is anticipated to grow at a significant CAGR of 18.4% during the forecast period. The global market growth is driven by the high demand for battery cell among end-user industries including automotive, electronics, and healthcare among others.

Market Dynamics

The rapid growth of the global Electric Vehicle(EV) market

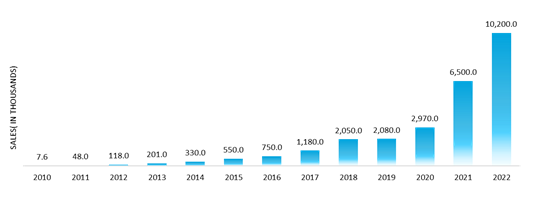

The expansion of the EV market is a key contributor tothe growth of the battery cell market. As EV demand rises, so does the need for battery cells to power these vehicles. As per the data from the International Energy Agency(IEA),The electric car market has experienced rapid expansion, with sales surpassing 10 million in 2022. Approximately 14.0% of all new car sales in 2022 were electric, marking an increase from approximately 9.0% in 2021 and less than 5.0% in 2020.

Additionally, the growing focus on improved battery technology to enhance EV performance and range is driving innovation within the battery cell market. Government regulations promoting electric vehicle adoption further contribute to increased demand for battery cells. Overall, the growth of the EV market serves as a significant catalyst for the expansion of the battery cell market.

Global EV sales, in thousands

Source: International Energy Agency(IEA)

Volatility in raw material prices and manufacturing costs has affected overall market growth

In recent years battery cell raw material prices have seen notable volatility in prices owing to external factors such as rising geopolitical tensions, supply chain disruptions, and COVID-19 which affected the overall growth of the battery cell market. According to the data from IEA, cell production costs rose in 2022 compared to 2021, reaching levels seen in 2019. This increase can be attributed partly to rising material prices, which contribute significantly to cell prices, and electricity price hikes affecting manufacturing costs. However, efficiency improvements in pack manufacturing have countered some of these cost increases. According to Bloomberg New Energy Finance (BNEF), pack manufacturing costs are expected to decline further, by approximately 20% by 2025, while cell production costs are projected to decrease by only 10% from their 2021 lows.

Such unpredictability can disrupt supply chains, causing delays and affecting consumer demand. Additionally, smaller manufacturers may face challenges in adapting to sudden cost changes, potentially leading to market consolidation. Overall, managing these uncertainties is crucial for sustained growth in the battery cell market.

Market Segmentation

Our in-depth analysis of the global battery cell market includes the following segments by type of battery and end-user industry:

- Based on type of battery, the market is sub-segmented into primary cells and secondary cells

- Based on end-user industry, the market is sub-segmented into automotive, electronics, energy, aerospace and defense and healthcare industries

PrimaryCells ContributeThe Highest Share in the Global Battery Cells Market

Among the types of batteries,the primary cell batteries contribute the highest share. The demand for primary battery cells is growing significantly, primarily due to growing applications of portable electronics and remote devices, such as smartphones, tablets, and wearables among others. Additionally,ongoing advancements in battery technology, mainly related to enhanced performance and efficiency in primary cells is further contributing to growing demand for primary cells.For instance, in November 2022, researchers at MIT invented an process which could enable up to a 50% increase in useful lifetime, or a corresponding decrease in size and weight for a given amount of power or energy capacity in primary cells, while also improving safety, with little or no increase in cost. According to the source, this development could help in fewer battery replacements in applications such as pacemakers and other medical devices, as well as long-distance drones and remote sensors.However, the primary cells industry has suffered considerable setbacks primarily due to its contribution to battery wastage,leading to regulatory scrutiny. But, considering recent positive developments in global battery recycling and waste management economy, the primary cells market is expected to experience growth in forecasting period.

Automotive Industry Holds Highest Share Among End-User Industries

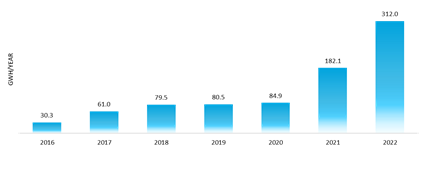

Among end-user industries, automotive segment is expected to hold highest share primarly due to growth of global EV sector. According to the data form IEA, Global EV battery demand increased by about 65.0% in 2022, reaching around 550 GWh, about the same level as EV battery production. The lithium-ionautomotive battery manufacturing capacity in 2022 was roughly 1.5 TWh for theyear, implying a utilisation rate of around 35.0% compared to about 43.0% in 2021. Battery demand is set to increase significantly by 2030, reaching over 3 TWh inthe STEPS and about 3.5 TWh in the APS. To meet that demand, more than 50 gigafactories (each with 35 GWh of annual production capacity) would beneeded by 2030 in the Stated Policies Scenario (STEPS) in addition to today’s battery production capacity. This increases to close to 65 new gigafactories to meet 2030 demand in the Announced Pledges Scenario (APS).

With growing demand, major market players and governments are investing aggressively in R&D of battery technology, increasing manufacturing capabalities to cater demand from automakers, eventually contributing to growth of battery cells market.

Regional Outlook

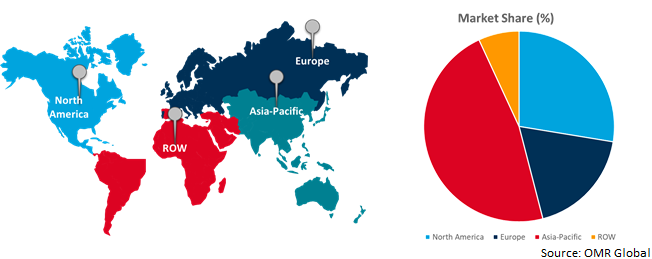

The global battery cell market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America).

Asia PacificHolds Highest Share In Global Battery Cell Market

Asia Pacific holds the highest share ofthe global battery cell market share. The key factor contributing to the growth of the market presence of major battery cell manufacturers such as Panasonic, LG Chem, Samsung SDI, and CATL, a well-established supply chain and availability of low-cost labor. Additionally, Asia Pacific is leading global EV adoption, particularly in major regional economiessuch as China, India, Japan, and South Korea, driving demand for battery cells. According to the data from IEA, in 2022, China was leading the global electric car sales, capturing approximately 60.0% of the market share. In 2022, India, Thailand, and Indonesia experienced significant growth in electric car sales. Collectively, these countries saw sales more than triple compared to 2021, reaching a total of 80,000 units. Thailand observed electric car sales accounting for slightly over 3.0% of total sales in 2022, while India and Indonesia averaged around 1.5% each during the same period.

Additionally, favorable government policies, and the region's prominence in consumer electronics manufacturing further boost demand for battery cells used in various devices. Overall, Asia Pacific's strong manufacturing ecosystem and supportive regulatory environment position it as a key player in the global battery cell market.

China Battery Demand, 2016-2022

Source: IEA

Global Battery Cell Market Growth by Region 2024-2031

Europe is the Fastest Growing Battery Cell market

- The region has implemented strict environmental regulations in recent years, which has pushed demand for sustainable solutions in various end-user industries such as EVs, and renewable energy systems among others, eventually driving growth for the battery cell market

- European companies and research institutions are investing in R&D, actively enhancing battery chemistries, boosting energy density, and driving down costs. This positions European battery cells as increasingly competitive on the global stage. For instance, in October 2023, Concentrating on battery cell technology, German firm FEV expanded its service offerings with the addition of a battery cell laboratory at its headquarters in Aachen, Germany. According to the company, the facility will specialize in analyzing and benchmarking battery cells for performance, longevity, and safety, while also facilitating cell development initiatives.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global battery cellmarket are Toshiba Corporation,LG Chem Ltd., Duracell Inc.,and Tesla, Inc. among others. With growing demand, market players are focusing on capitalizing on growth by adopting strategies such as collaboration, partnerships, and market expansion among others. For instance, in November 2023 Stellantis revealed its intention to construct a battery plant for EVs in Europe in collaboration with China's CATL. This venture marks the European carmaker's fourth battery plant in the region, aiming to drive down costs and enhance the affordability of EVs. The initial agreement between the two companies outlines the supply of lithium iron phosphate (LFP) battery cells and modules for Stellantis' EV manufacturing in Europe. Additionally, they are exploring the possibility of establishing a 50-50 joint venture in the region.

The Report Covers

- Market value data analysis of 2023and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global battery cell market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. BYD Company Ltd.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Contemporary Amperex Technology Co., Ltd. (CATL)

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Panasonic Corp.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Samsung SDI Co., Ltd.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Tesla, Inc.

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Battery Cell Market by Type of Battery

4.1.1. Primary Cells

4.1.2. Secondary Cells

4.2. Global Battery Cell Market by End-User Industry

4.2.1. Automotive

4.2.2. Electronics

4.2.3. Energy

4.2.4. Aerospace & Defense

4.2.5. Healthcare

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. AESC GROUP LTD.

6.2. Chevron Corp.

6.3. Duracell Inc.

6.4. East Penn Manufacturing Company

6.5. EnerSys

6.6. EVE Energy Co., Ltd.

6.7. GS Yuasa International Ltd.

6.8. Hitachi Chemical Co., Ltd.

6.9. Johnson Controls International plc

6.10. Kokam Battery Manufacturing Co., LTD.

6.11. Leoch International Technology Ltd.

6.12. LG Chem Ltd.

6.13. Microvast, Inc.

6.14. Saft Groupe SAS

6.15. Shenzhen BAK Battery Co., Ltd.

6.16. SK Inc.

6.17. Tianjin Lishen Battery Joint-Stock Co., Ltd.

6.18. Toshiba Corp.

6.19. VARTA AG

6.20. Wanxiang Group Corp.

1. GLOBAL BATTERY CELL MARKET RESEARCH AND ANALYSIS BY TYPE OF BATTERY, 2023-2031 ($ MILLION)

2. GLOBALPRIMARY BATTERY CELL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL SECONDARY BATTERY CELL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL BATTERY CELL MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2023-2031 ($ MILLION)

5. GLOBAL BATTERY CELL FOR AUTOMOTIVE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBALBATTERY CELL FOR ELECTRONICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL BATTERY CELL FOR ENERGY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL BATTERY CELL FOR AEROSPACE & DEFENSE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL BATTERY CELL FOR HEALTHCARE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL BATTERY CELL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. NORTH AMERICAN BATTERY CELL MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

12. NORTH AMERICAN BATTERY CELL MARKET RESEARCH AND ANALYSIS BY TYPE OF BATTERY, 2023-2031 ($ MILLION)

13. NORTH AMERICAN BATTERY CELL MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2023-2031 ($ MILLION)

14. EUROPEAN BATTERY CELL MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

15. EUROPEAN BATTERY CELL MARKET RESEARCH AND ANALYSIS BY TYPE OF BATTERY, 2023-2031 ($ MILLION)

16. EUROPEAN BATTERY CELL MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2023-2031 ($ MILLION)

17. ASIA-PACIFIC BATTERY CELL MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

18. ASIA-PACIFICBATTERY CELL MARKET RESEARCH AND ANALYSIS BY TYPE OF BATTERY, 2023-2031 ($ MILLION)

19. ASIA-PACIFICBATTERY CELL MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2023-2031 ($ MILLION)

20. REST OF THE WORLD BATTERY CELL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

21. REST OF THE WORLD BATTERY CELL MARKET RESEARCH AND ANALYSIS BY TYPE OF BATTERY, 2023-2031 ($ MILLION)

22. REST OF THE WORLD BATTERY CELL MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2023-2031 ($ MILLION)

1. GLOBAL BATTERY CELL MARKETSHAREBY TYPE OF BATTERY, 2023 VS 2031 (%)

2. GLOBAL PRIMARY BATTERY CELL MARKETSHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL SECONDARY BATTERY CELL MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL BATTERY CELL MARKET SHAREBY END-USER INDUSTRY, 2023 VS 2031 (%)

5. GLOBAL BATTERY CELLFOR AUTOMOTIVE MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBALBATTERY CELL FOR ELECTRONICS MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL BATTERY CELL FOR ENERGY MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL BATTERY CELL FOR AEROSPACE & DEFENSE MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL BATTERY CELL FOR HEALTHCARE MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL BATTERY CELL MARKETSHARE BY REGION, 2023 VS 2031 (%)

11. US BATTERY CELL MARKET SIZE, 2023-2031 ($ MILLION)

12. CANADA BATTERY CELL MARKET SIZE, 2023-2031 ($ MILLION)

13. UK BATTERY CELL MARKET SIZE, 2023-2031 ($ MILLION)

14. FRANCE BATTERY CELL MARKET SIZE, 2023-2031 ($ MILLION)

15. GERMANY BATTERY CELL MARKET SIZE, 2023-2031 ($ MILLION)

16. ITALY BATTERY CELL MARKET SIZE, 2023-2031 ($ MILLION)

17. SPAIN BATTERY CELL MARKET SIZE, 2023-2031 ($ MILLION)

18. REST OF EUROPE BATTERY CELL MARKET SIZE, 2023-2031 ($ MILLION)

19. INDIA BATTERY CELL MARKET SIZE, 2023-2031 ($ MILLION)

20. CHINA BATTERY CELL MARKET SIZE, 2023-2031 ($ MILLION)

21. JAPAN BATTERY CELL MARKET SIZE, 2023-2031 ($ MILLION)

22. SOUTH KOREA BATTERY CELL MARKET SIZE, 2023-2031 ($ MILLION)

23. REST OF ASIA-PACIFIC BATTERY CELL MARKET SIZE, 2023-2031 ($ MILLION)

24. REST OF THE WORLD BATTERY CELL MARKET SIZE, 2023-2031 ($ MILLION)

25. LATIN AMERICA BATTERY CELL MARKET SIZE, 2023-2031 ($ MILLION)

26. MIDDLE EAST AND AFRICA BATTERY CELL MARKET SIZE, 2023-2031 ($ MILLION)