Battery Energy Storage System Market

Battery Energy Storage System Market Size, Share & Trends Analysis Report by Type (Lithium-ion Batteries, Advanced Lead-Acid Batteries, Flow Batteries, and Others), Application (Utility, Commercial and Industrial, and Residential), Ownership (Customer, Third-Party Owned, and Utility Owned) By Energy Capacity (Below 100 MWh, Between 100 MWh & 500 MWh, and Above 500 MWh) and Connection Type (On-grid, and Off-grid) Forecast Period (2025-2035)

Industry Overview

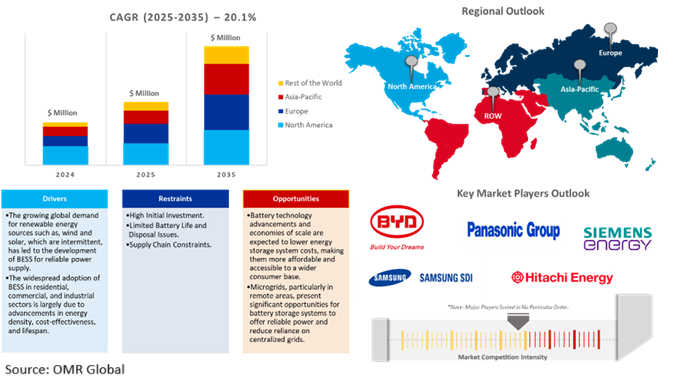

Battery energy storage system (BESS) market is anticipated to grow at a CAGR of 20.1% during the forecast period (2025-2035). The demand for BESS is increasing due to renewable energy adoption, grid modernization, and rising cost efficiency. BESS balances energy supply and demand, stabilizes the grid, and improves resilience. Technological advancements make it competitive and useful for off-grid and remote power solutions.

Market Dynamics

Renewable Energy Integration

Renewable energy integration involves upgrading substations and transmission systems to manage intermittent power delivery, ensuring grid stability, and driving market growth. According to the US Energy Information Administration, in November 2024, from 2003 to 2023, spending on electricity transmission systems rose significantly, reaching $27.7 billion. These systems include the components necessary to carry high-voltage electricity over long distances to local distribution grids. In 2023, utilities allocated $6.1 billion to distribution substation equipment, marking an 184% increase since 2003 and a 15% rise compared to 2022. This investment aims to improve resilience against extreme weather, manage renewable energy intermittency, and enhance voltage control during emergencies. Although energy storage accounts for a smaller share of distribution infrastructure spending, it grew from $97 million in 2022 to $723 million in 2023, supporting power quality and backup power needs as more renewable resources are integrated.

Grid Modernization and Digitalization

Grid modernization in the EU, China, Japan, India, and the US is driving an increasing demand for efficient energy storage solutions like BESS for stabilizing operations, storing surplus renewable energy, and enhancing grid resilience. According to the International Energy Agency (IEA), in 2023, it is estimated in recent years, several countries have announced significant investments to modernize and digitalize their power grids. The European Commission's "Digitalisation of the energy system" aims for EUR 584 billion in investments by 2030, with EUR 170 billion allocated for digital technologies. China plans USD 442 billion in grid expansion from 2021 to 2025, while Japan has set aside USD 155 billion for smart power grids. India's initiative involves INR 3.03 trillion (~USD 38 billion) to enhance distribution infrastructure, and the US has introduced the USD 10.5 billion GRIP Program for grid resilience. Canada is contributing USD 100 million through its Smart Grid Program to advance smart grid technologies.

Market Segmentation

- Based on the type, the market is segmented into lithium-ion batteries, advanced lead-acid batteries, flow batteries, and other types (sodium-sulfur batteries, nickel-cadmium batteries).

- Based on the application, the market is segmented into utility, commercial and industrial, and residential.

- Based on the ownership, the market is segmented into customer-owned, third-party-owned, and utility-owned.

- Based on the energy capacity, the market is segmented into below 100 MWh, between 100 MWh & 500 MWh, and above 500 MWh.

- Based on the connection type, the market is segmented into on-grid and off-grid.

Lithium-ion Batteries Segment to Lead the Market with the Largest Share

Advancements in manufacturing techniques and increased production efficiency have led to a reduction in the costs of lithium-ion batteries, increasing their accessibility and being widely adopted across various sectors including electric vehicle (EV), renewable energy storage, and consumer electronics. In August 2024, Vatrer Power introduced its All-in-One Lithium Battery Energy Storage System, a greener solution for residential and commercial users. The system uses advanced Lithium Iron Phosphate (LiFePO4) battery technology, with a nominal voltage of 51.2V and 100Ah capacity. It can be connected to 1 to 6 modules in parallel, expanding the total system capacity to 30kWh.

Above 500 MWh: A Key Segment in Market Growth

Energy storage systems (ESS) with capacities exceeding 500 MWh are utilized in large-scale grid applications to incorporate renewable energy sources such as solar and wind. The systems contribute to maintaining grid stability, enhancing energy reliability, and facilitating efficient distribution across different regions. They help balance supply and demand, provide power during off-peak periods, decrease the necessity for additional power plants during peak hours, act as backup power for essential infrastructure, enable the development of microgrids in remote areas, and assist in the transition to a low-carbon energy grid.

Regional Outlook

The global battery energy storage system market is further divided by geography, including North America (the US and Canada), Europe (the UK, Germany, France, Italy, Spain, Russia, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, Australia and New Zealand, ASEAN Countries, and the Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America)

Energy Storage for Renewable Energy Integration and Grid Stability in North America

The demand for cleaner and more reliable sources of energy continues to rise, driving the attention that countries and companies pay to energy storage solutions to further strengthen their energy security and cut back on imports. Energy storage technologies such as large-scale battery systems are thus highly relevant to utilizing renewable energy more efficiently. Large-scale battery systems make it possible to store surplus power produced at times of high generation and utilize this during higher-demand periods. These investments prove all the more essential for a shift to more sustainable energy systems, including better integration of renewable sources such as solar and wind power into the grid. For instance, in June 2024, RWE completed three large battery energy storage projects in the US, which have a capacity of 190 MW. The largest is in Texas with a 100 MW battery and 300 MW solar array, while Big Star has an 80 MW battery and 200 MW solar farm.

Asia-Pacific Region Dominates the Market with Major Share

Asia-Pacific holds a significant share owing to the growth of the EV market is largely attributed to the expansion of EV charging infrastructure, which has increased consumer confidence in transitioning to electric vehicles. According to the India Brand Equity Foundation, in December 2024, the electric vehicle market in India grew 26.5% in 2024 as compared to the previous year, with 1.94 million units sold, according to Vahan data from the Ministry of Road Transport and Highways (MoRTH). This growth pushed the EV penetration rate to 7.46%, from 6.39% in 2023. However, petrol vehicles remained the most dominant, accounting for 73.69% of the 26.04 million vehicles sold during the same period.

Market Players Outlook

The major companies operating in the global battery energy storage system market include BYD Co. Ltd., Panasonic Corp., Samsung SDI, Hitachi Energy, Siemens Energy, and others. Market players are leveraging partnerships, collaborations, mergers and acquisition strategies for business expansion and innovative product development to maintain their market positioning.

Recent Developments

- In January 2025, SECI introduced a 125 MW/500 MWh standalone BESS in the state of Kerala to increase integration of renewables. The project handled by SECI will be brought under the BOO model; it has achieved a minimum of 85% AC-to-AC round-trip efficiency. This project is through the Viability Gap Funding mechanism.

- In November 2024, GEAPP and the Government of Malawi contracted for a 20 MW battery energy storage system in Lilongwe, Malawi. The facility will be its first on the continent for GEAPP and has received up to $20 million in grant funding from ESCOM.

- In August 2024, Aggreko introduced two new mid-node battery energy storage systems in its Greener Upgrades portfolio of temporary power solutions. These integrated solutions fit the requirements of North American customers, especially larger projects, who want more sustainable, efficient energy sources and cater to multiple industries. The newest inventions of Aggreko can be applied on- or off-grid while saving emissions, energy usage, and expense. The 250 kW/575 kWh and 500 kW/250 kWh systems are easily integrated into existing power systems or used in hybrid power solutions.

- In August 2024, Catalyze launched its first standalone BESS project in the Bronx, one of the first megawatt-scale BESS projects approved through New York City's permitting process. The project was comprised of 4 Tesla MegaPacks that supplied electricity to the grid under the Value of Distributed Energy Resources stack arrangement and dispatched electricity to manage seasonal demand.

- In August 2024, Vatrer Power introduced its All-in-One Lithium Battery Energy Storage System. This solution has paved the way to a greener future while ensuring efficient and reliable energy solutions for residential as well as commercial users. It is an innovative product in the technology of energy storage.

- In June 2024, India's NTPC floated a 500MWh BESS tender for 250MW/500MWh of battery storage in Madhya Pradesh and Maharashtra. The competition is offering lower costs.

- In June 2024, Generac Power Systems acquired the business unit PowerPlay Battery Energy Storage Systems, a business unit of SunGard Solutions, an EPC company that specializes in turnkey Battery Energy Storage Systems for commercial and industrial applications up to 7 MWh.

- In June 2024, Trina Storage launched a cell-to-AC BESS solution in the US, signing the first German project deal. The 10MWh battery storage product includes full cell-to-AC system integration from a single vendor.

- In April 2024, Bitech Technologies acquired and merged into its fold subsidiary company Texas-based Bridgelink Development-Emergen Energy LLC to exercise complete control of a pipeline of power totaling 5.8 GW where the major percentage are battery energy storage systems and solar projects.

- In March 2024, GridStor secured a 450 MW/900 MWh project in Galveston County, Texas, from Balanced Rock Power. The Evelyn Battery Energy Storage project is coming on at a pivotal moment for Texas electricity demand.

- In January 2024, Myer EPS acquired the leading firm in battery energy storage systems (BESS), and Storage Power Solutions and unveiled EnerShed, the dedicated line of BESS solutions. This acquisition helps propel Myers EPS forward in high-growth, regulatory-driven energy efficiency categories that enable customers to save money by using clean, renewable energy, reducing reliance on the energy grid, and meeting California's Title 24 solar plus storage regulations.

The Report Covers

- Market value data analysis of 2024 and forecast to 2035.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global battery energy storage system market. Based on the availability of data, information related to new products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Industry Overview

• Current Industry Analysis and Growth Potential Outlook

• Global Battery Energy Storage System Market Sales Analysis – Type| Application | Ownership| Energy Capacity | Connection Type | Region ($ Million)

• Battery Energy Storage System Market Sales Performance of Top Countries

1.2. Research Methodology

• Primary Research Approach

• Secondary Research Approach

1.3. Market Snapshot

2. Market Overview and Insights

2.1. Scope of the Study

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Battery Energy Storage System Fordustry Trends

2.2.2. Market Recommendations

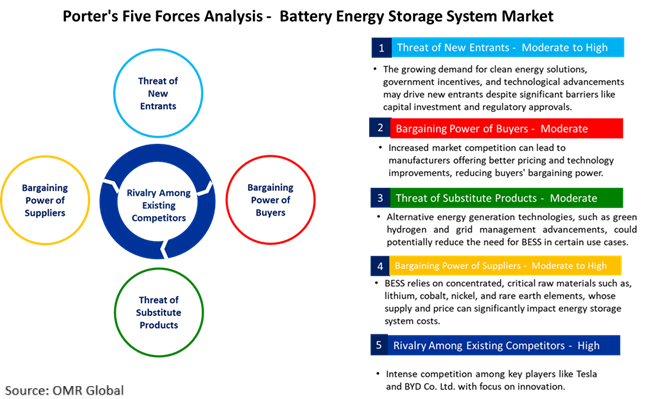

2.3. Porter's Five Forces Analysis for the Battery Energy Storage System Market

2.3.1. Competitive Rivalry

2.3.2. Threat of New Entrants

2.3.3. Bargaining Power of Suppliers

2.3.4. Bargaining Power of Buyers

2.3.5. Threat of Substitutes

3. Market Determinants

3.1. Market Drivers

3.1.1. Drivers For Global Battery Energy Storage System Market: Impact Analysis

3.2. Market Pain Points and Challenges

3.2.1. Restraints For Global Battery Energy Storage System Market: Impact Analysis

3.3. Market Opportunities

4. Competitive Landscape

4.1. Competitive Dashboard – Battery Energy Storage System Market Revenue and Share by Manufacturers

• Battery Energy Storage System Product Comparison Analysis

• Top Market Player Ranking Matrix

4.2. Key Company Analysis

4.3. BYD Co. Ltd.

4.3.1. Overview

4.3.2. Product Portfolio

4.3.3. Financial Analysis (Subject to Data Availability)

4.3.4. SWOT Analysis

4.3.5. Business Strategy

4.4. Panasonic Corp.

4.4.1. Overview

4.4.2. Product Portfolio

4.4.3. Financial Analysis (Subject to Data Availability)

4.4.4. SWOT Analysis

4.4.5. Business Strategy

4.5. Samsung SDI

4.5.1. Overview

4.5.2. Product Portfolio

4.5.3. Financial Analysis (Subject to Data Availability)

4.5.4. SWOT Analysis

4.5.5. Business Strategy

4.6. Hitachi Energy Ltd.

4.6.1. Overview

4.6.2. Product Portfolio

4.6.3. Financial Analysis (Subject to Data Availability)

4.6.4. SWOT Analysis

4.6.5. Business Strategy

4.7. Siemens Energy

4.7.1. Overview

4.7.2. Product Portfolio

4.7.3. Financial Analysis (Subject to Data Availability)

4.7.4. SWOT Analysis

4.7.5. Business Strategy

4.8. Top Winning Strategies by Market Players

4.8.1. Merger and Acquisition

4.8.2. Product Launch

4.8.3. Partnership And Collaboration

5. Global Battery Energy Storage System Market Sales Analysis by Type ($ Million)

5.1. Lithium-ion Batteries

5.2. Advanced Lead-Acid Batteries

5.3. Flow Batteries

5.4. Other Types (Sodium-Sulfur Battery, Nickel-Cadmium Battery)

6. Global Battery Energy Storage System Market Sales Analysis by Application ($ Million)

6.1. Utility

6.2. Commercial and Industrial

6.3. Residential

7. Global Battery Energy Storage System Market Sales Analysis by Ownership ($ Million)

7.1. Customer Owned

7.2. Third-Party Owned

7.3. Utility Owned

8. Global Battery Energy Storage System Market Sales Analysis by Energy Capacity ($ Million)

8.1. Below 100 MWh

8.2. Between 100 MWh & 500 MWh

8.3. Above 500 MWh

9. Global Battery Energy Storage System Market Sales Analysis by Connection Type ($ Million)

9.1. On-grid

9.2. Off-grid

10. Regional Analysis

10.1. North American Battery Energy Storage System Market Sales Analysis – Type| Application | Application| Ownership| Energy Capacity | Connection Type | Country ($ Million)

• Macroeconomic Factors for North America

10.1.1. United States

10.1.2. Canada

10.2. European Battery Energy Storage System Market Sales Analysis – Type| Application | Application| Ownership| Energy Capacity | Connection Type | Country ($ Million)

• Macroeconomic Factors for Europe

10.2.1. UK

10.2.2. Germany

10.2.3. Italy

10.2.4. Spain

10.2.5. France

10.2.6. Russia

10.2.7. Rest of Europe

11. Asia-Pacific Battery Energy Storage System Market Sales Analysis – – Type| Application | Application| Ownership| Energy Capacity | Connection Type | Country ($ Million)

• Macroeconomic Factors for Asia-Pacific

11.1.1. China

11.1.2. Japan

11.1.3. South Korea

11.1.4. India

11.1.5. Australia & New Zealand

11.1.6. ASEAN Countries (Thailand, Indonesia, Vietnam, Singapore, And Other)

11.1.7. Rest of Asia-Pacific

11.2. Rest of the World Battery Energy Storage System Market Sales Analysis – Application| Type | Application| Energy Capacity | Country ($ Million)

• Macroeconomic Factors for the Rest of the World

11.2.1. Latin America

11.2.2. Middle East and Africa

12. Company Profiles

12.1. ABB Ltd

12.1.1. Quick Facts

12.1.2. Company Overview

12.1.3. Product Portfolio

12.1.4. Business Strategies

12.2. AES Corp.

12.2.1. Quick Facts

12.2.2. Company Overview

12.2.3. Product Portfolio

12.2.4. Business Strategies

12.3. Black & Veatch Corp.

12.3.1. Quick Facts

12.3.2. Company Overview

12.3.3. Product Portfolio

12.3.4. Business Strategies

12.4. BYD Co. Ltd.

12.4.1. Quick Facts

12.4.2. Company Overview

12.4.3. Product Portfolio

12.4.4. Business Strategies

12.5. Contemporary Amperex Technology Co., Limited.

12.5.1. Quick Facts

12.5.2. Company Overview

12.5.3. Product Portfolio

12.5.4. Business Strategies

12.6. Enerox GmbH

12.6.1. Quick Facts

12.6.2. Company Overview

12.6.3. Product Portfolio

12.6.4. Business Strategies

12.7. EnerSys

12.7.1. Quick Facts

12.7.2. Company Overview

12.7.3. Product Portfolio

12.7.4. Business Strategies

12.8. EVE Energy Storage Co., Ltd.

12.8.1. Quick Facts

12.8.2. Company Overview

12.8.3. Product Portfolio

12.8.4. Business Strategies

12.9. Exide Technologies

12.9.1. Quick Facts

12.9.2. Company Overview

12.9.3. Product Portfolio

12.9.4. Business Strategies

12.10. Fluence Energy, LLC

12.10.1. Quick Facts

12.10.2. Company Overview

12.10.3. Product Portfolio

12.10.4. Business Strategies

12.11. GE Vernova Group

12.11.1. Quick Facts

12.11.2. Company Overview

12.11.3. Product Portfolio

12.11.4. Business Strategies

12.12. Genista Energy

12.12.1. Quick Facts

12.12.2. Company Overview

12.12.3. Product Portfolio

12.12.4. Business Strategies

12.13. Hitachi Energy Ltd.

12.13.1. Quick Facts

12.13.2. Company Overview

12.13.3. Product Portfolio

12.13.4. Business Strategies

12.14. HOPPECKE Carl Zoellner & Sohn GmbH

12.14.1. Quick Facts

12.14.2. Company Overview

12.14.3. Product Portfolio

12.14.4. Business Strategies

12.15. LG Energy Solution Ltd.

12.15.1. Quick Facts

12.15.2. Company Overview

12.15.3. Product Portfolio

12.15.4. Business Strategies

12.16. Panasonic Corp.

12.16.1. Quick Facts

12.16.2. Company Overview

12.16.3. Product Portfolio

12.16.4. Business Strategies

12.17. Samsung SDI

12.17.1. Quick Facts

12.17.2. Company Overview

12.17.3. Product Portfolio

12.17.4. Business Strategies

12.18. Siemens AG

12.18.1. Quick Facts

12.18.2. Company Overview

12.18.3. Product Portfolio

12.18.4. Business Strategies

12.19. Tata Power Solar Systems Ltd.

12.19.1. Quick Facts

12.19.2. Company Overview

12.19.3. Product Portfolio

12.19.4. Business Strategies

12.20. TotalEnergies

12.20.1. Quick Facts

12.20.2. Company Overview

12.20.3. Product Portfolio

12.20.4. Business Strategies

12.21. VARTA AG

12.21.1. Quick Facts

12.21.2. Company Overview

12.21.3. Product Portfolio

12.21.4. Business Strategies

12.22. VRB ENERGY

12.22.1. Quick Facts

12.22.2. Company Overview

12.22.3. Product Portfolio

12.22.4. Business Strategies

1. Global Battery Energy Storage System Market Research And Analysis By Type, 2024-2035 ($ Million)

2. Global Lithium-ion Battery Energy Storage System Market Research And Analysis By Region, 2024-2035 ($ Million)

3. Global Advanced Lead-Acid Battery Energy Storage System Market Research And Analysis By Region, 2024-2035 ($ Million)

4. Global Flow Battery Energy Storage System Market Research And Analysis By Region, 2024-2035 ($ Million)

5. Global Other Type Battery Energy Storage System Market Research And Analysis By Region, 2024-2035 ($ Million)

6. Global Battery Energy Storage System Market Research And Analysis By Application, 2024-2035 ($ Million)

7. Global Battery Energy Storage System For Utility Market Research And Analysis By Region, 2024-2035 ($ Million)

8. Global Battery Energy Storage System For Commercial and Industrial Market Research And Analysis By Region, 2024-2035 ($ Million)

9. Global Battery Energy Storage System For Residential Market Research And Analysis By Region, 2024-2035 ($ Million)

10. Global Battery Energy Storage System Market Research And Analysis By Ownership, 2024-2035 ($ Million)

11. Global Customer-Owned Battery Energy Storage System Market Research And Analysis By Region, 2024-2035 ($ Million)

12. Global Third-Party Owned Battery Energy Storage System Market Research And Analysis By Region, 2024-2035 ($ Million)

13. Global Utility Owned Battery Energy Storage System Market Research And Analysis By Region, 2024-2035 ($ Million)

14. Global Battery Energy Storage System Market Research And Analysis By Energy Capacity, 2024-2035 ($ Million)

15. Global Battery Energy Storage System Below 100 MWh Market Research And Analysis By Region, 2024-2035 ($ Million)

16. Global Battery Energy Storage System Between 100 MWh & 500 MWh Market Research And Analysis By Region, 2024-2035 ($ Million)

17. Global Battery Energy Storage System Above 500 MWh Market Research And Analysis By Region, 2024-2035 ($ Million)

18. Global Battery Energy Storage System Market Research And Analysis By Connection Type, 2024-2035 ($ Million)

19. Global On-Grid Battery Energy Storage System Market Research And Analysis By Region, 2024-2035 ($ Million)

20. Global On-Grid Battery Energy Storage System Market Research And Analysis By Region, 2024-2035 ($ Million)

21. Global Battery Energy Storage System Market Research And Analysis By Region, 2024-2035 ($ Million)

22. North American Battery Energy Storage System Market Research And Analysis By Country, 2024-2035 ($ Million)

23. North American Battery Energy Storage System Market Research And Analysis By Type, 2024-2035 ($ Million)

24. North American Battery Energy Storage System Market Research And Analysis By Application, 2024-2035 ($ Million)

25. North American Battery Energy Storage System Market Research And Analysis By Ownership, 2024-2035 ($ Million)

26. North American Battery Energy Storage System Market Research And Analysis By Energy Capacity, 2024-2035 ($ Million)

27. North American Battery Energy Storage System Market Research And Analysis By Connection Type, 2024-2035 ($ Million)

28. European Battery Energy Storage System Market Research And Analysis By Country, 2024-2035 ($ Million)

29. European Battery Energy Storage System Market Research And Analysis By Type, 2024-2035 ($ Million)

30. European Battery Energy Storage System Market Research And Analysis By Application, 2024-2035 ($ Million)

31. European Battery Energy Storage System Market Research And Analysis By Ownership, 2024-2035 ($ Million)

32. European Battery Energy Storage System Market Research And Analysis By Energy Capacity, 2024-2035 ($ Million)

33. European Battery Energy Storage System Market Research And Analysis By Connection Type, 2024-2035 ($ Million)

34. Asia-Pacific Battery Energy Storage System Market Research And Analysis By Country, 2024-2035 ($ Million)

35. Asia-Pacific Battery Energy Storage System Market Research And Analysis By Type, 2024-2035 ($ Million)

36. Asia-Pacific Battery Energy Storage System Market Research And Analysis By Application, 2024-2035 ($ Million)

37. Asia-Pacific Battery Energy Storage System Market Research And Analysis By Ownership, 2024-2035 ($ Million)

38. Asia-Pacific Battery Energy Storage System Market Research And Analysis By Energy Capacity, 2024-2035 ($ Million)

39. Asia-Pacific Battery Energy Storage System Market Research And Analysis By Connection Type, 2024-2035 ($ Million)

40. Rest Of The World Battery Energy Storage System Market Research And Analysis By Region, 2024-2035 ($ Million)

41. Rest Of The World Battery Energy Storage System Market Research And Analysis By Type, 2024-2035 ($ Million)

42. Rest Of The World Battery Energy Storage System Market Research And Analysis By Application, 2024-2035 ($ Million)

43. Rest Of The World Battery Energy Storage System Market Research And Analysis By Ownership, 2024-2035 ($ Million)

44. Rest Of The World Battery Energy Storage System Market Research And Analysis By Energy Capacity, 2024-2035 ($ Million)

45. Rest Of The World Battery Energy Storage System Market Research And Analysis By Connection Type, 2024-2035 ($ Million)

1. Global Battery Energy Storage System Market Share By Type, 2024 Vs 2035 (%)

2. Global Lithium-ion Battery Energy Storage System Market Share By Region, 2024 Vs 2035 (%)

3. Global Advanced Lead-Acid Battery Energy Storage System Market Share By Region, 2024 Vs 2035 (%)

4. Global Flow Battery Energy Storage System Market Share By Region, 2024 Vs 2035 (%)

5. Global Other Type Battery Energy Storage System Market Share By Region, 2024 Vs 2035 (%)

6. Global Battery Energy Storage System Market Share By Application, 2024 Vs 2035 (%)

7. Global Battery Energy Storage System For Utility Market Share By Region, 2024 Vs 2035 (%)

8. Global Battery Energy Storage System For Commercial and Industrial Market Share By Region, 2024 Vs 2035 (%)

9. Global Battery Energy Storage System For Residential Market Share By Region, 2024 Vs 2035 (%)

10. Global Battery Energy Storage System Market Share By Ownership, 2024 Vs 2035 (%)

11. Global Customer-Owned Battery Energy Storage System Market Share By Region, 2024 Vs 2035 (%)

12. Global Third-Party Owned Battery Energy Storage System Market Share By Region, 2024 Vs 2035 (%)

13. Global Utility Owned Battery Energy Storage System Market Share By Region, 2024 Vs 2035 (%)

14. Global Battery Energy Storage System Market Share By Energy Capacity, 2024 Vs 2035 (%)

15. Global Battery Energy Storage System Below 100 MWh Market Share By Region, 2024 Vs 2035 (%)

16. Global Battery Energy Storage System Between 100 MWh & 500 MWh Market Share By Region, 2024 Vs 2035 (%)

17. Global Battery Energy Storage System Above 500 MWh Market Share By Region, 2024 Vs 2035 (%)

18. Global Battery Energy Storage System Market Share By Connection Type, 2024 Vs 2035 (%)

19. Global On-Grid Battery Energy Storage System Market Share By Region, 2024 Vs 2035 (%)

20. Global Off-Grid Battery Energy Storage System Market Share By Region, 2024 Vs 2035 (%)

21. Global Battery Energy Storage System Market Share By Region, 2024 Vs 2035 (%)

22. US Battery Energy Storage System Market Size, 2024-2035 ($ Million)

23. Canada Battery Energy Storage System Market Size, 2024-2035 ($ Million)

24. UK Battery Energy Storage System Market Size, 2024-2035 ($ Million)

25. France Battery Energy Storage System Market Size, 2024-2035 ($ Million)

26. Germany Battery Energy Storage System Market Size, 2024-2035 ($ Million)

27. Italy Battery Energy Storage System Market Size, 2024-2035 ($ Million)

28. Spain Battery Energy Storage System Market Size, 2024-2035 ($ Million)

29. Russia Battery Energy Storage System Market Size, 2024-2035 ($ Million)

30. Rest Of Europe Battery Energy Storage System Market Size, 2024-2035 ($ Million)

31. India Battery Energy Storage System Market Size, 2024-2035 ($ Million)

32. China Battery Energy Storage System Market Size, 2024-2035 ($ Million)

33. Japan Battery Energy Storage System Market Size, 2024-2035 ($ Million)

34. Australia and New Zealand Battery Energy Storage System Market Size, 2024-2035 ($ Million)

35. ASEAN Battery Energy Storage System Market Size, 2024-2035 ($ Million)

36. South Korea Battery Energy Storage System Market Size, 2024-2035 ($ Million)

37. Rest Of Asia-Pacific Battery Energy Storage System Market Size, 2024-2035 ($ Million)

38. Latin America Battery Energy Storage System Market Size, 2024-2035 ($ Million)

39. Middle East And Africa Battery Energy Storage System Market Size, 2024-2035 ($ Million)