Battery Leasing Service Market

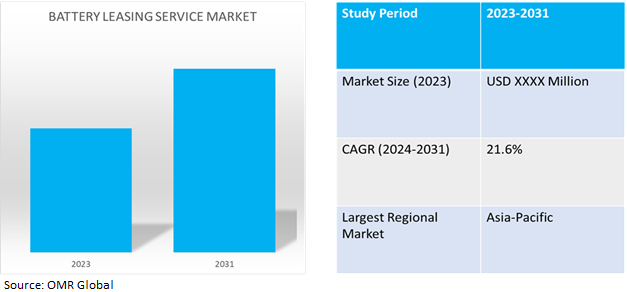

Battery Leasing Service Market Size, Share & Trends Analysis Report by Business Model (Subscription Service, and Pay-Per-Use Model), by Battery type (Lithium-Ion (Li-Ion), and Nickel Metal Hybrid), and by Vehicle type (Passenger Vehicle, and Commercial Vehicle). Forecast Period (2024-2031).

Battery leasing service Market is anticipated to grow at a significant CAGR of 21.6% during the forecast period (2024-2031). Battery leasing is an alternative to a traditional acquaintance of battery along with the vehicle, wherein, a consumer can lease the battery instead of purchasing it. The market has seen phenomenal growth in recent years contributed by high EV adoption, advancement in battery technology, and focus by Original Equipment Manufacturer (OEMs) on reducing vehicle cost, and positive government policies.

Market Dynamics

Rising Sales of Battery Electric Vehicles (BEVs)

The battery leasing service industry has seen a positive upward trend due to rising sales of battery EVs, as sales for BEVs constantly increase consumers as well as OEMs are looking for alternatives to reduce battery maintenance cost of vehicles. For instance, according to IEA (International Energy Association), in 2022, increasing sales pushed the total number of electric cars on the world's roads to 26 million, up 60.0% relative to 2021, with battery electric vehicles (BEVs) accounting for over 70.0% of total annual growth, as in previous years. As a result, about 70.0% of the global stock of electric cars in 2022 were BEVs.

Battery Material Alternatives and Cost Reduction

In recent years, alternatives to Li-ion batteries have been emerging which has provided OEMs with alternatives to switch battery materials while reducing cost. Further, lithium carbonate prices have been steadily increasing over the past two years. In 2021, prices multiplied four- to five-fold, and the trend continued in 2022, with prices nearly doubling between 2022 `and 2023. At the beginning of 2023, lithium prices stood six times above their average over the 2015-2020 period paving the way for the development of alternative materials. Notably, sodium-ion (Na-ion), battery is currently the only viable chemistry that does not contain lithium. The significance of alternate material development is to reduce cost, and increase lifespan of batteries for battery leasing service companies, as leasing companies are liable for maintenance and repair of batteries, resulting in low-cost offerings. For instance, according to (IEA) the Na-ion battery developed by China’s CATL is estimated to cost 30% less than an LFP battery. Conversely, Na-ion batteries do not have the same energy density as their Li-ion counterpart (respectively 75 to 160 Wh/kg compared to 120 to 260 Wh/kg). This could make Na-ion relevant for urban vehicles with a lower range, or for stationary storage, but could be more challenging to deploy in locations where consumers prioritize maximum range autonomy, or where charging is less accessible.

Market Segmentation

Our in-depth analysis of the global battery leasing service market includes the following segments by component, battery type, and application:

- Based on components, the market is bifurcated into subscription service and pay-per-use model.

- Based on battery type, the market is bifurcated into lithium-ion (li-ion), and nickel metal hybrid.

- Based on vehicle type, the market is bifurcated into passenger vehicles, and commercial vehicles.

Subscription Service to remains as the Largest Segment

Based on the business model type, the global battery leasing service market is sub-segmented into subscription services and pay-as-per-use models. Most battery leasing companies prefer to run on a subscription services as it is more viable than pay per use model. Subscription fees are to be paid by the consumer without reduction in amount relative to battery degradation, which is more feasible for leasing companies saving them cost on battery replacement and providing constant income over the years, till battery reaches replacement levels.

Lithium-Ion Battery type is still the largest sub-segment

The majority of global EVs are powered by lithium-ion batteries developed by China. It is the most suitable energy storage device for powering EVs owing to their attractive properties including high energy efficiency, lack of memory effect, long cycle life, high energy density, and high power density. For instance, as per IEA, in 2022, Lithium Nickel Manganese Cobalt Oxide (NMC) remained the dominant battery chemistry with a market share of 60.0%, followed by Lithium Iron Phosphate (LFP) with a share of just under 30.0%, and Nickel Cobalt Aluminum Oxide (NCA) with a share of about 8.0%.

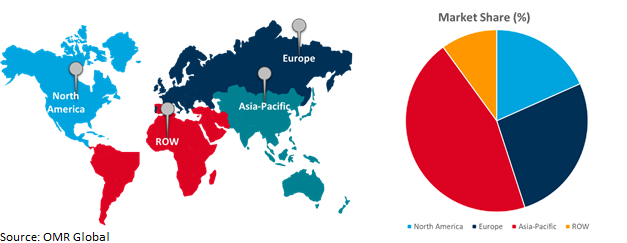

Regional Outlook

The global battery leasing service market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia- Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Global Battery Leasing Service Market Growth by Region 2024-2031

Asia-Pacific to Dominate Global Battery Leasing Service Market

Asia-Pacific is the biggest hub for EVs as well as battery manufacturing globally with countries such as China, India, Taiwan, and South Korea leading global EV and battery supply chains. Governments in the region have also invested heavily to create EV infrastructure and manufacturing capacities for domestic and global consumption. Most OEMs in the region have their eco-system for vehicle manufacturing, charging infrastructure, and battery leasing including BYD, and Hyundai. Kia, and Tata. The region is expected to grow exponentially, with strong EV demand, government investment and policies, increasing EV infrastructure, and exports

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global battery leasing service market include Tesla, Inc., Contemporary Amperex Technology Co., Ltd., BYD Co. Ltd., Renault Group, and NIO NextEV Ltd. among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global battery leasing service market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. BYD Motors, Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Contemporary Amperex Technology Co., Ltd.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. NIO Ltd.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Renault Group

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Tesla, Inc.

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Battery Leasing Service Market by Business Model

4.1.1. Subscription Service

4.1.2. Pay-Per-Use Model

4.2. Global Battery Leasing Service Market by Battery Type

4.2.1. Lithium-ion (Li-ion)

4.2.2. Nickel Metal Hybrid

4.3. Global Battery Leasing Service Market by Vehicle Type

4.3.1. Passenger Vehicle

4.3.2. Commercial Vehicle

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. The Middle East and Africa

6. Company Profiles

6.1. Ampup, Inc.

6.2. Aulton New Energy Automotive Technology Co., Ltd.

6.3. BATTERY SMART

6.4. Cassetex

6.5. E-Chargeup Solutions Pvt Ltd.

6.6. Esmito Solutions Pvt. Ltd

6.7. Gogoro Inc.

6.8. Kia Corp.

6.9. Lithion Power Pvt. Ltd

6.10. OYIKA Pte Ltd.

6.11. Shenzhen Immotor Technology Limited

6.12. Sun Monility Pvt. Ltd.

1. GLOBAL BATTERY LEASING SERVICE MARKET RESEARCH AND ANALYSIS BY BUSINESS MODEL, 2023-2031 ($ MILLION)

2. GLOBAL SUBSCRIPTION BATTERY LEASING SERVICE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL PAY-PER-USE BATTERY LEASING SERVICE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL BATTERY LEASING SERVICE MARKET RESEARCH AND ANALYSIS BY BATTERY TYPE, 2023-2031 ($ MILLION)

5. GLOBAL BATTERY LEASING SERVICE FOR LITHIUM-ION (LI-ION) BATTERIES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL BATTERY LEASING SERVICE FOR NICKEL METAL HYBRID BATTERIES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL BATTERY LEASING SERVICE MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2023-2031 ($ MILLION)

8. GLOBAL PASSENGER VEHICLE BATTERY LEASING SERVICE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL COMMERCIAL VEHICLE BATTERY LEASING SERVICE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL BATTERY LEASING SERVICE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. NORTH AMERICAN BATTERY LEASING SERVICE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

12. NORTH AMERICAN BATTERY LEASING SERVICE MARKET RESEARCH AND ANALYSIS BY BUSINESS MODEL, 2023-2031 ($ MILLION)

13. NORTH AMERICAN BATTERY LEASING SERVICE MARKET RESEARCH AND ANALYSIS BY BATTERY TYPE, 2023-2031 ($ MILLION)

14. NORTH AMERICAN BATTERY LEASING SERVICE MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2023-2031 ($ MILLION)

15. EUROPEAN BATTERY LEASING SERVICE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

16. EUROPEAN BATTERY LEASING SERVICE MARKET RESEARCH AND ANALYSIS BY BUSINESS MODEL, 2023-2031 ($ MILLION)

17. EUROPEAN BATTERY LEASING SERVICE MARKET RESEARCH AND ANALYSIS BY BATTERY TYPE, 2023-2031 ($ MILLION)

18. EUROPEAN BATTERY LEASING SERVICE MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2023-2031 ($ MILLION)

19. ASIA-PACIFIC BATTERY LEASING SERVICE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

20. ASIA-PACIFIC BATTERY LEASING SERVICE MARKET RESEARCH AND ANALYSIS BY BUSINESS MODEL, 2023-2031 ($ MILLION)

21. ASIA-PACIFIC BATTERY LEASING SERVICE MARKET RESEARCH AND ANALYSIS BY BATTERY TYPE, 2023-2031 ($ MILLION)

22. ASIA-PACIFIC BATTERY LEASING SERVICE MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2023-2031 ($ MILLION)

23. REST OF THE WORLD BATTERY LEASING SERVICE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

24. REST OF THE WORLD BATTERY LEASING SERVICE MARKET RESEARCH AND ANALYSIS BY BUSINESS MODEL, 2023-2031 ($ MILLION)

25. REST OF THE WORLD BATTERY LEASING SERVICE MARKET RESEARCH AND ANALYSIS BY BATTERY TYPE, 2023-2031 ($ MILLION)

26. REST OF THE WORLD BATTERY LEASING SERVICE MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2023-2031 ($ MILLION)

1. GLOBAL BATTERY LEASING SERVICE MARKET SHARE BY BUSINESS MODEL, 2023 VS 2031 (%)

2. GLOBAL SUBSCRIPTION BATTERY LEASING SERVICE MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL PAY-PER-USE BATTERY LEASING SERVICE MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL BATTERY LEASING SERVICE MARKET SHARE BY BATTERY TYPE, 2023 VS 2031 (%)

5. GLOBAL BATTERY LEASING SERVICE FOR LITHIUM-ION (LI-ION) BATTERIES MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL BATTERY LEASING SERVICE FOR NICKEL METAL HYBRID BATTERIES MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL BATTERY LEASING SERVICE MARKET SHARE BY VEHICLE TYPE, 2023 VS 2031 (%)

8. GLOBAL PASSENGER VEHICLE BATTERY LEASING SERVICE MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL COMMERCIAL VEHICLE BATTERY LEASING SERVICE MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL BATTERY LEASING SERVICE MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. US BATTERY LEASING SERVICE MARKET SIZE, 2023-2031 ($ MILLION)

12. CANADA BATTERY LEASING SERVICE MARKET SIZE, 2023-2031 ($ MILLION)

13. UK BATTERY LEASING SERVICE MARKET SIZE, 2023-2031 ($ MILLION)

14. FRANCE BATTERY LEASING SERVICE MARKET SIZE, 2023-2031 ($ MILLION)

15. GERMANY BATTERY LEASING SERVICE MARKET SIZE, 2023-2031 ($ MILLION)

16. ITALY BATTERY LEASING SERVICE MARKET SIZE, 2023-2031 ($ MILLION)

17. SPAIN BATTERY LEASING SERVICE MARKET SIZE, 2023-2031 ($ MILLION)

18. REST OF EUROPE BATTERY LEASING SERVICE MARKET SIZE, 2023-2031 ($ MILLION)

19. INDIA BATTERY LEASING SERVICE MARKET SIZE, 2023-2031 ($ MILLION)

20. CHINA BATTERY LEASING SERVICE MARKET SIZE, 2023-2031 ($ MILLION)

21. JAPAN BATTERY LEASING SERVICE MARKET SIZE, 2023-2031 ($ MILLION)

22. SOUTH KOREA BATTERY LEASING SERVICE MARKET SIZE, 2023-2031 ($ MILLION)

23. REST OF ASIA-PACIFIC BATTERY LEASING SERVICE MARKET SIZE, 2023-2031 ($ MILLION)

24. LATIN AMERICA BATTERY LEASING SERVICE MARKET SIZE, 2023-2031 ($ MILLION)

25. THE MIDDLE EAST AND AFRICA BATTERY LEASING SERVICE MARKET SIZE, 2023-2031