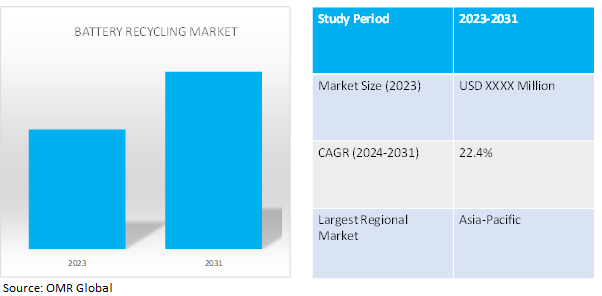

Battery Recycling Market

Battery Recycling Market Size, Share & Trends Analysis Report by Battery Type (Lithium-ion, Lead-Acid, Nickel Based, and Other), by Source (Automotive, Industrial, and Commercial) Forecast Period (2024-2031)

Battery recycling market is anticipated to grow at a significant of 22.4% during the forecast period (2024-2031). Battery recycling is a recycling activity that aims to reduce the number of batteries being disposed as municipal solid waste. Batteries contain a number of heavy metals and toxic chemicals and disposing of them by the same process as regular household waste has raised concerns over soil contamination and water pollution.

Market Dynamics

Rising Investment in Battery Recycling Plants

The rising investments in the battery recycling plants are driving the growth of the global battery recycling market. For instance, in May 2024, UK-based recycling company EMR announced to acquire a significant stake in Australian-owned Renewable Metals as part of a deal that will see a novel demonstration-scale battery shredding and critical minerals refining plant built in the UK. As per EMR the process can deliver higher recovery rates without producing sodium sulfate and is better suited to handling the variability in end-of-life lithium-ion battery chemistries.

Growing End-User Industries

The growing end-user industries such as consumer electronics, industrial applications, and automobiles are spurring the growth of the market to reduce the battery waste. Automobile application of the battery recycling industry is expected to witness growth owing to the increasing demand for lithium-ion batteries for electric vehicles due to their high efficiency, long life, and low maintenance. There is a lack of resources for the production of a new battery as compared to the projected demand from different end-user industries. The process of battery recycling is important to recover valuable material as well as to efficiently manage waste to eliminate hazardous environmental impacts. The use of recovered metal for the production of recycled batter aids in the reduction of carbon emissions to a large extent.

Market Segmentation

Our in-depth analysis of the global Battery Recycling market includes the following segments by battery type and source:

- Based on battery type, the market is sub-segmented into lithium-ion, lead-acid, nickel based, and others.

- Based on source, the market is sub-segmented into automotive, industrial, and consumer electronics.

Lead-acid Batteries to hold Considerable Share in the Market

Lead-acid battery recycling is expected to considerable share in the global battery recycling market. Lead-acid batteries are highly recyclable and more than 95.0% of lead can be recycled during the recycling process. These properties of lead-acid battery recycling tend to drive demand soon. Further, the lithium-ion battery is expected to witness a considerable growth rate during the forecast period. The use of lithium-ion batteries is expected to increase in portable devices and electric vehicles owing to low maintenance and higher efficiency. For instance, in September 2021, Birla Carbon announced its entry into the energy systems market with its participation at The Battery Show 2021. Birla Carbon’s new portfolio of conductive carbons is designed for the lithium-ion and lead-acid battery markets enabling customization in formulation and performance in a variety of segments, including automotive, telecoms, motive power, energy storage systems, and electric bikes.

Regional Outlook

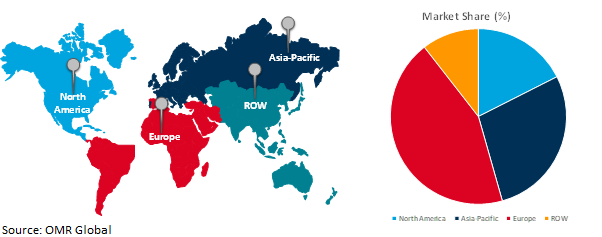

The global battery recycling market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Global Battery Recycling Market Growth by Region 2024-2031

Asia-Pacific Holds Major Market Share

Asia-Pacific holds major share in the global battery recycling market. The growing focus of regional players on battery recycling is a key factor driving the growth of the regional market. For instance, in January 2024, South Korean shipping and logistics company Hyundai Glovis Co. has signed a share subscription agreement (SSA) related to equity investment with the domestic battery recycling ER. ER has a preprocessing technology for battery recycling. Through the latest equity investment, Hyundai Glovis now holds the rights to use ER's preprocessing techs and facilities. Growing demand for recycled batteries to meet the growing battery demand is further contributing to the regional market growth.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global battery recycling market include Accurec Recycling GmbH, Glencore PLC, Princeton NuEnergy Inc., Li-Cycle Holdings Corp., and Recyclico Battery Materials Inc. among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers and acquisitions to stay competitive in the market. Funding for startups by major manufacturers is also contributing to the global market growth. For instance, in April 2024, Metastable Materials, a Bengaluru-based startup focused on lithium-ion battery recycling announced to establish a new factory in the coming two years. The company uses a chemical-free technology to extract valuable materials from used batteries, including copper, cobalt, nickel, and lithium. The company claims that this method leads to a high recovery rate of over 90.0%, positioning itself as a potentially sustainable solution to the growing electronic waste problem.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global battery recycling market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Accurec Recycling GmbH

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Glencore Plc

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Li-Cycle Holdings Corp.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Battery Recycling Market by Battery Type

4.1.1. Lithium-ion

4.1.2. Lead-Acid

4.1.3. Nickel-based

4.1.4. Other

4.2. Global Battery Recycling Market by Source

4.2.1. Automotive

4.2.2. Industrial

4.2.3. Consumer Electronics

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East & Africa

6. Company Profiles

6.1. American Manganese Inc.

6.2. Battery Solutions, LLC

6.3. COM2 Recycling Solutions

6.4. Clarios (Brookfield Business Partners)

6.5. East Penn Manufacturing Co.

6.6. Ecobat, LLC

6.7. Eco-Bat Technologies Ltd. (G&P Batteries)

6.8. GlobalTech Environmental

6.9. Gopher Resource

6.10. Gravita India Ltd.

6.11. Li-Cycle Corp.

6.12. Raw Materials Co. Inc.

6.13. Recupyl SAS

6.14. Retriev Technologies

6.15. Terrapure Environmental

6.16. Tes-Amm Singapore Pte Ltd.

1. GLOBAL BATTERY RECYCLING MARKET RESEARCH AND ANALYSIS BY BATTERY TYPE, 2023-2031 ($ MILLION)

2. GLOBAL LITHIUM-ION BATTERY RECYCLING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL LEAD-ACID BATTERY RECYCLING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL NICKEL-BASED BATTERY RECYCLING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL OTHER BATTERY RECYCLING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL BATTERY RECYCLINGMARKET RESEARCH AND ANALYSIS BY SOURCE, 2023-2031 ($ MILLION)

7. GLOBAL AUTOMOTIVE BATTERY RECYCLING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL INDUSTRIAL BATTERY RECYCLING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL CONSUMER ELECTRONICS BATTERY RECYCLING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL BATTERY RECYCLING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. NORTH AMERICAN BATTERY RECYCLING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

12. NORTH AMERICAN BATTERY RECYCLING MARKET RESEARCH AND ANALYSIS BY BATTERY TYPE, 2023-2031 ($ MILLION)

13. NORTH AMERICAN BATTERY RECYCLING MARKET RESEARCH AND ANALYSIS BY SOURCE, 2023-2031 ($ MILLION)

14. EUROPEAN BATTERY RECYCLING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

15. EUROPEAN BATTERY RECYCLING MARKET RESEARCH AND ANALYSIS BY BATTERY TYPE, 2023-2031 ($ MILLION)

16. EUROPEAN BATTERY RECYCLING MARKET RESEARCH AND ANALYSIS BY SOURCE, 2023-2031 ($ MILLION)

17. ASIA-PACIFIC BATTERY RECYCLING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

18. ASIA-PACIFIC BATTERY RECYCLING MARKET RESEARCH AND ANALYSIS BY BATTERY TYPE, 2023-2031 ($ MILLION)

19. ASIA-PACIFIC BATTERY RECYCLING MARKET RESEARCH AND ANALYSIS BY SOURCE, 2023-2031 ($ MILLION)

20. REST OF THE WORLD BATTERY RECYCLING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

21. REST OF THE WORLD BATTERY RECYCLING MARKET RESEARCH AND ANALYSIS BY BATTERY TYPE, 2023-2031 ($ MILLION)

22. REST OF THE WORLD BATTERY RECYCLING MARKET RESEARCH AND ANALYSIS BY SOURCE, 2023-2031 ($ MILLION)

1. GLOBAL BATTERY RECYCLINGMARKETSHARE BY BATTERY TYPE, 2023 VS 2031 (%)

2. GLOBAL LITHIUM-ION BATTERY RECYCLING MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL LEAD-ACID BATTERY RECYCLING MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL NICKEL BASED BATTERY RECYCLING MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL OTHER BATTERY RECYCLING MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL BATTERY RECYCLING MARKET SHARE BY SOURCE, 2023 VS 2031 (%)

7. GLOBAL AUTOMOTIVE BATTERY RECYCLING MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL INDUSTRIAL BATTERY RECYCLING MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL CONSUMER ELECTRONICS BATTERY RECYCLING MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL BATTERY RECYCLING MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. US BATTERY RECYCLING MARKET SIZE, 2023-2031 ($ MILLION)

12. CANADA BATTERY RECYCLING MARKET SIZE, 2023-2031 ($ MILLION)

13. UK BATTERY RECYCLING MARKET SIZE, 2023-2031 ($ MILLION)

14. FRANCE BATTERY RECYCLING MARKET SIZE, 2023-2031 ($ MILLION)

15. GERMANY BATTERY RECYCLING MARKET SIZE, 2023-2031 ($ MILLION)

16. ITALY BATTERY RECYCLING MARKET SIZE, 2023-2031 ($ MILLION)

17. SPAIN BATTERY RECYCLING MARKET SIZE, 2023-2031 ($ MILLION)

18. REST OF EUROPE BATTERY RECYCLING MARKET SIZE, 2023-2031 ($ MILLION)

19. INDIA BATTERY RECYCLING MARKET SIZE, 2023-2031 ($ MILLION)

20. CHINA BATTERY RECYCLING MARKET SIZE, 2023-2031 ($ MILLION)

21. JAPAN BATTERY RECYCLING MARKET SIZE, 2023-2031 ($ MILLION)

22. SOUTH KOREA BATTERY RECYCLING MARKET SIZE, 2023-2031 ($ MILLION)

23. REST OF ASIA-PACIFIC BATTERY RECYCLING MARKET SIZE, 2023-2031 ($ MILLION)

24. LATIN AMERICA BATTERY RECYCLING MARKET SIZE, 2023-2031 ($ MILLION)

25. MIDDLE EAST AND AFRICA BATTERY RECYCLING MARKET SIZE, 2023-2031 ($ MILLION)