Bauxite Market

Bauxite Market Size, Share & Trends Analysis Report by Grade (Metallurgical-grade, Refractory-grade, Other Grades), by Application (Alumina production, Refractory, Cement, Other Applications) Forecast Period (2024-2031)

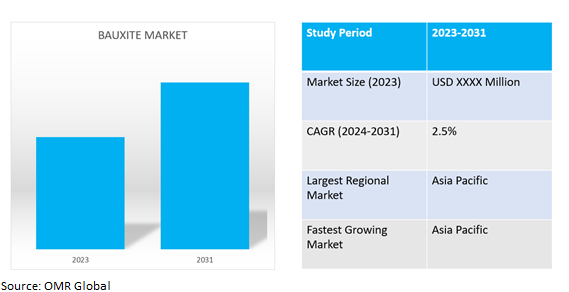

Bauxite market is anticipated to grow at a moderate CAGR of 2.5% during the forecast period (2024-2031). Bauxite is a rock mineral composed mainly of aluminum hydroxide minerals, aluminum oxides, and clay minerals. It is the primary source of aluminum globally and is widely used in various industries such as transportation, construction, packaging, electrical, and machinery

Market Dynamics

Booming Construction Industry

The ongoing urbanization trend worldwide is fueling the construction industry. Aluminum's properties like durability, recyclability, and ease of fabrication make it a popular choice for building facades, roofing, doors, and windows. This translates to a continued rise in demand for bauxite, the main source material for aluminum. As cities expand and require more infrastructure. In the 2024-2025 budget announcement, finance minister Nirmala Sitharaman announced an allocation of Rs 11.11 lakh crore ($134 billion) for infrastructure development worth 3.4% of the GDP. This was up from Rs 10.0 lakh crore assigned in 2023-24. The growing infrastructure budget is further anticipated to create lucrative opportunities to the market demand.

A rising number of Lightweight Vehicles Production

Stricter fuel efficiency regulations globally are pushing car manufacturers towards lightweight materials. Aluminum is a perfect choice due to its high strength-to-weight ratio, making cars lighter and more fuel-efficient. The growing production of electric vehicles globally owing to government push via subsidies is anticipated to offer lucrative opportunities to the growth of the global bauxite market.

Market Segmentation

Our in-depth analysis of the global bauxite market includes the following segments by grade and application:

- Based on grade, the market is bifurcated into metallurgical-grade, refractory-grade and other products.

- Based on application, the market is augmented into alumina production, refractory, cement and other applications

Metallurgical-Grade is Projected to Emerge as the Largest Segment

Based on the grade, the global bauxite marketis sub-segmented intometallurgical-grade, refractory-grade, and other products. Among these, the metallurgical-grade sub-segment is expected to hold the largest share of the market. The primary factor supporting the segment's growth includes surging demand for metallurgical grade bauxite across construction, transportation, and other sectors. As these aluminum-intensive industries continue to flourish, the demand for this specific bauxite grade rises.

Alumina Production Sub-segment to Hold a Considerable Market Share

The Alumina Production sub-segment reigns supreme in the bauxite market due to its critical role as the foundation of aluminum production. Bauxite itself is the primary source material for aluminum, and the ever-growing demand for aluminum across various sectors such as construction, transportation, and packaging is the main driving force behind the bauxite market. As the demand for aluminum products continues to rise, the Alumina Production sub-segment is poised to benefit the most from this growth trajectory in the bauxite market. For instance,March 2024 Century's green aluminum smelter project, located in the Ohio/Mississippi River basins, is a significant investment for the US primary aluminum industry, enhancing domestic supply chains for materials critical for the green energy transition.

Regional Outlook

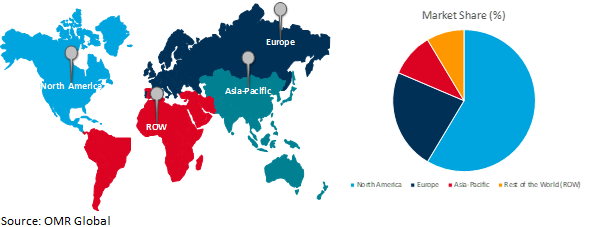

The global bauxite market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Germany, France, Italy, Spain, Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Global Bauxite Market Growth by Region 2024-2031

Asia-Pacific Holds Major Market Share

Among all the countries of Asia-Pacific, Australia reigns supreme in the bauxite market due to its dual role as the world's biggest consumer and producer of aluminum. This creates a massive internal demand for bauxite, the raw material for aluminum production. Furthermore, Australia's rapid industrialization across sectors like construction and transportation heavily relies on aluminum, further amplifying the need for bauxite. This combination of factors solidifies Australia's position as a dominant player in the bauxite market. For instanceAustralia's six bauxite mines supply feedstock for alumina refineries and export markets, with high-grade, shallow deposits contributing to alumina production and exports.

Market Players Outlook

The major companies serving the global bauxite marketincludeAlcoa Corporation.,Rio Tinto,Aluminum Corporation of China Limited (CHALCO), Rusal, NALCO India, Hindalco Industries Ltd., Emirates Global Aluminium PJSC and others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market.

For instance, Hindalco Industries plans to secure Bauxite ore for its proposed 2-million tonnes alumina refinery and 150-MW captive power plant in Kansariguda, Rayagada district, Odisha. The company will enter into a Memorandum of Understanding with Odisha Mining Corporation for long-term supply.

The Report Covers

- Market value data analysis of 2023and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global bauxite market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Alcoa Corp.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Rio Tinto

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Aluminum Corporation of China Limited (CHALCO)

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Bauxite Market by Grade

4.1.1. Metallurgical-grade

4.1.2. Refractory-grade

4.1.3. Other Grades

4.2. Global Bauxite Marketby Application

4.2.1. Alumina Production

4.2.2. Refractory

4.2.3. Cement

4.2.4. Other Application

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Turkey

5.2.4. Norway

5.2.5. Russia

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. Australia

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East & Africa

6. Company Profiles

6.1. Australian Bauxite Ltd.

6.2. Compagnie des Bauxites de Guinée (CBG)

6.3. GRAFIT MADENCILIK SAN. TIC. A.S.

6.4. Iranian Aluminium Co.

6.5. LKAB Minerals

6.6. Norsk Hydro ASA

6.7. Possehl Erzkontor GmbH & Co. KG

6.8. Queensland Alumina Limited Ltd.

6.9. Hindalco Industries Ltd.

6.10. Emirates Global Aluminium PJSC

6.11. Alcoa Corp.

6.12. Alumina Ltd.

6.13. Aluminum Corporation of China Ltd.

6.14. NALCO India

6.15. Norsk Hydro ASA

6.16. Rusal

6.17. South32

1. GLOBAL BAUXITE MARKET RESEARCH AND ANALYSIS BY GRADE, 2023-2031 ($ MILLION)

2. GLOBAL METALLURGICAL-GRADE BAUXITE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL REFRACTORY-GRADE BAUXITE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL OTHER GRADESBAUXITE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL BAUXITE FOR ALUMINA PRODUCTION MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

6. GLOBAL BAUXITE FOR REFRACTORY MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

7. GLOBAL BAUXITE FOR CEMENT MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION

8. GLOBAL BAUXITE FOR OTHER APPLICATION MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

9. GLOBAL BAUXITE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. NORTH AMERICAN BAUXITE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

11. NORTH AMERICAN BAUXITE MARKET RESEARCH AND ANALYSIS BY GRADE, 2023-2031 ($ MILLION)

12. NORTH AMERICAN BAUXITE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

13. EUROPEAN BAUXITE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

14. EUROPEAN BAUXITE MARKET RESEARCH AND ANALYSIS BY GRADE, 2023-2031 ($ MILLION)

15. EUROPEAN BAUXITE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

16. ASIA-PACIFIC BAUXITE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

17. ASIA-PACIFICBAUXITE MARKET RESEARCH AND ANALYSIS BY GRADE, 2023-2031 ($ MILLION)

18. ASIA-PACIFICBAUXITE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

19. REST OF THE WORLD BAUXITE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

20. REST OF THE WORLD BAUXITE MARKETRESEARCH AND ANALYSIS BY GRADE, 2023-2031 ($ MILLION)

21. REST OF THE WORLD BAUXITE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

1. GLOBAL BAUXITE MARKET SHARE BY GRADE, 2023 VS 2031 (%)

2. GLOBAL METALLURGICAL-GRADE BAUXITE MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL REFRACTORY-GRADE BAUXITE MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL OTHER GRADE BAUXITE MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL BAUXITE MARKETSHAREBY APPLICATION, 2023 VS 2031 (%)

6. GLOBAL BAUXITE FOR ALUMINA PRODUCTION MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL BAUXITE FOR REFRACTORY MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL BAUXITE FOR CEMENT MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL BAUXITE FOR OTHER APPLICATIONS MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL BAUXITE MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. US BAUXITE MARKET SIZE, 2023-2031 ($ MILLION)

12. CANADA BAUXITE MARKET SIZE, 2023-2031 ($ MILLION)

13. GERMANY BAUXITE MARKET SIZE, 2023-2031 ($ MILLION)

14. UK BAUXITE MARKET SIZE, 2023-2031 ($ MILLION)

15. FRANCE BAUXITE MARKET SIZE, 2023-2031 ($ MILLION)

16. SPAIN BAUXITE MARKET SIZE, 2023-2031 ($ MILLION)

17. ITALY BAUXITE MARKET SIZE, 2023-2031 ($ MILLION)

18. REST OF EUROPE BAUXITE MARKET SIZE, 2023-2031 ($ MILLION)

19. INDIA BAUXITE MARKET SIZE, 2023-2031 ($ MILLION)

20. CHINA BAUXITE MARKET SIZE, 2023-2031 ($ MILLION)

21. JAPAN BAUXITE MARKET SIZE, 2023-2031 ($ MILLION)

22. SOUTH KOREA BAUXITE MARKET SIZE, 2023-2031 ($ MILLION)

23. REST OF ASIA_PACIFIC BAUXITE MARKET SIZE, 2023-2031 ($ MILLION)

24. LATIN AMERICA BAUXITE MARKET SIZE, 2023-2031 ($ MILLION)

25. MIDDLE EAST & AFRICA BAUXITE MARKET SIZE, 2023-2031 ($ MILLION)