Beef Market

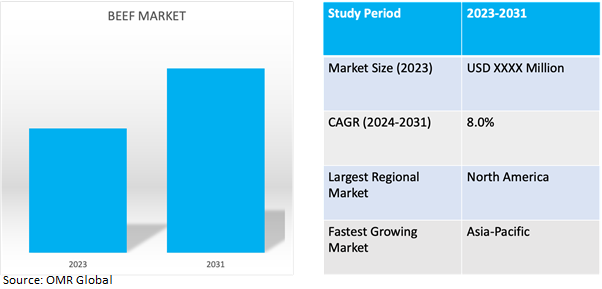

Beef Market Size, Share & Trends Analysis Report by Cut Type (Ground, Roasts and Steaks) and by Distribution Channel (Retail Sales, HoReCa and Butcher Shops) Forecast Period (2024-2031)

Beef market is anticipated to grow at a considerable CAGR of 8.0% during the forecast period (2024-2031).Beef industry includes the trade and consumption of beef globally that encompasses the production, distribution, and consumption of beef products across various regions and countries.

Market Dynamics

Harmony in Food: Bridging Sustainability and Health

Sustainability and health trends represent two significant factors in global beef market. In March 2022 the Global Roundtable for Sustainable Beef (GRSB) introduced the Beef Carbon Footprint Guideline, a measure aimed at enhancing consistency in calculating the carbon footprint of the beef industry. As a scientific advisory council focused on sustainability within the global beef sector, GRSB's initiative seeks to drive improvements in environmental practices across the industry.

Surge in Demand for High-Quality Beef

Increased demand for high-quality beef signifies a significant shift in consumer preferences towards beef products with superior taste, nutritional value, and perceived quality. The desire for tender, flavorful beef from grain-fed cattle, which is often associated with higher quality is further aiding to the demand for high-quality beef. Consumers also prioritize the nutritional content of beef, opting for products perceived as healthier and more nutritious. Culinary trends, health and wellness considerations, and concerns about food safety and transparency further contribute to this demand. Established brands and producers known for consistently delivering high-quality beef products benefit from brand loyalty and trust. For instance, March 2021, marked an announcement from National Beef Packing Company, LLC, detailing plans to enhance its production capabilities in Iowa. By expanding its facilities in the region, the company aims to tap into a local source of high-quality grain-fed cattle, positioning itself for further growth and efficiency.

Market Segmentation

Our in-depth analysis of the global beef market includes the following segments by cut type and distribution channel:

- Based on cut type, the market is sub-segmented into ground, roasts and steaks.

- Based on distribution channel, the market is sub-segmented into retail sales, horeca and butcher shops.

Ground Cut is Projected to Emerge as the Largest Segment

Based on the cut type, the global beef market is sub-segmented into industrial ground, roasts and steaks. Among these, the ground sub-segment is expected to hold the largest share of the market. The primary factor supporting the segment's growth includes its versatility and convenience. Ground beef, also known as minced beef, is a highly adaptable ingredient that can be used in a wide variety of dishes, including burgers, meatballs, tacos, pasta sauces, and casseroles. Its versatility makes it appealing to consumers looking for quick and easy meal options that can be prepared in various ways to suit different tastes and preferences.

Retail Sales to Hold a Considerable Market Share

Retail sales dominate a significant portion of the global beef market due to factors such as the convenience of purchasing beef alongside other groceries in one convenient location, such as supermarkets and hypermarkets. These outlets offer a diverse array of beef products, ranging from various cuts to pre-marinated options, catering to a wide range of preferences. Strategic promotional efforts, including discounts and marketing campaigns, further drive beef sales by incentivizing purchases. Additionally, retailers prioritize stringent quality standards and food safety regulations, ensuring the freshness and safety of beef products and consumer trust.

Regional Outlook

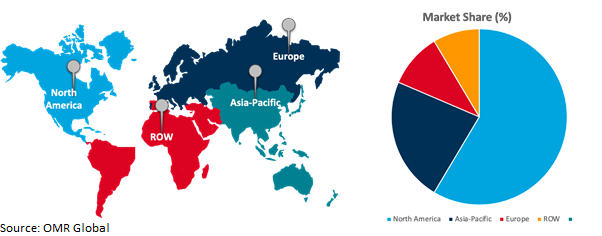

The globalbeefmarket is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Asia-Pacific eo Exhibit the Highest CAGR During Forecast Period

The Asia-Pacific region emerges as the fastest-growing segment due to booming populations and escalating incomes in countries such as China and India, consumer demand for protein-rich diets, including beef, is on the ascent. Urbanization and Westernization further fuel this trend as dietary patterns shift towards increased meat consumption, particularly in urban centres and among the burgeoning middle class population. Economic prosperity and trade liberalization initiatives have opened doors to the importation of beef from countries renowned for quality, meeting the evolving preferences of discerning consumers.

Global Beef Market Growth by Region 2024-2031

North America Holds Major Market Share

Among all the regions, North America holds a significant share due to its robust production infrastructure, characterized by vast grazing lands, advanced agricultural technologies, and efficient practices, ensuring large-scale beef production. Renowned for quality and variety, North American beef meets diverse consumer preferences with options like grain-fed, grass-fed, and organic cuts. Leveraging trade agreements and established networks, the region exports beef worldwide, particularly to Asia and beyond. For instance, in December 2023, Ducks Unlimited and ABS Global joined forces with Trust In Beef, a coalition aimed at enhancing technical capabilities within the beef industry. Their partnership strengthens the existing coalition, which includes prominent entities such as Merck Animal Health, National Cattlemen’s Beef Association, Enogen/Syngenta, Tyson Foods, and the U.S. Roundtable for Sustainable Beef. Through this collaboration, Ducks Unlimited and ABS Global contribute their expertise to further elevate Trust In Beef's initiatives and advance sustainability efforts in the beef supply chain.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global Beefmarket includeThe Kroger Co., Marfrig Global Foods S.A., w, Sysco Corp., JBS S.A. and others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in January 2024, US CattleTrace and IMI Global, two prominent organizations in the cattle industry, established a strategic alliance aimed at bolstering contact tracing efforts within the sector. US CattleTrace, renowned for its commitment to building a rapid contact tracing database, joins forces with IMI Global, the nation's largest third-party cattle verification company. Through this collaboration, U.S. CattleTrace aims to expedite the development of its contact tracing database, while also supporting IMI Global's mission to enhance value for American beef producers.

The Report Covers

- Market value data analysis of 2023and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global beefmarket. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Kerry Group

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Marfrig Global Foods S.A.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. The Kroger Co.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Beef Market by Cut Type

4.1.1. Ground

4.1.2. Roasts

4.1.3. Steaks

4.2. Global Beef Market by Distribution Channel

4.2.1. Retail Sales

4.2.2. Hotels, Restaurants And Catering (HoReCa)

4.2.3. Butcher Shops

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. The Middle East & Africa

6. Company Profiles

6.1. Agri Beef Co.

6.2. American Foods Group, LLC

6.3. AUSTRALIAN AGRICULTURAL CO. Ltd.

6.4. BRF

6.5. Cargill, Incorporated

6.6. Central Valley Meat

6.7. Danish Crown

6.8. JBS S.A.

6.9. Miratorg Agribusiness Holding (Miratorg)

6.10. National Beef Packing Co., LLC

6.11. NH Foods Ltd.

6.12. Perdue Farms Inc.

6.13. Smithfield Foods Inc.

6.14. Strauss Brands LLC

6.15. Sysco Corp.

6.16. Tyson Foods, Inc.

6.17. Vion Food Group (Vion N.V.)

1. GLOBAL BEEFMARKET RESEARCH AND ANALYSIS BY CUT TYPE, 2023-2031 ($ MILLION)

2. GLOBAL GROUNDBEEFMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL ROASTSBEEFMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL STEAKSBEEFMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL BEEF MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

6. GLOBAL BEEF IN RETAIL SALESMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBALBEEFIN HORECAMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL BEEF IN BUTCHER SHOPSMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL BEEFMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. NORTH AMERICAN BEEFMARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

11. NORTH AMERICAN BEEFMARKET RESEARCH AND ANALYSIS BY CUT TYPE, 2023-2031 ($ MILLION)

12. NORTH AMERICAN BEEFMARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

13. EUROPEAN BEEFMARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

14. EUROPEAN BEEFMARKET RESEARCH AND ANALYSIS BY CUT TYPE, 2023-2031 ($ MILLION)

15. EUROPEAN BEEFMARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

16. ASIA-PACIFIC BEEFMARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

17. ASIA-PACIFICBEEFMARKET RESEARCH AND ANALYSIS BY CUT TYPE, 2023-2031 ($ MILLION)

18. ASIA-PACIFICBEEFMARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

19. REST OF THE WORLD BEEFMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

20. REST OF THE WORLD BEEFMARKET RESEARCH AND ANALYSIS BY CUT TYPE, 2023-2031 ($ MILLION)

21. REST OF THE WORLD BEEFMARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

1. GLOBAL BEEFMARKETSHARE BY CUT TYPE, 2023 VS 2031 (%)

2. GLOBAL GROUNDBEEFMARKETSHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL ROASTSBEEFMARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL STEAKSBEEFMARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL BEEFMARKET SHAREBY DISTRIBUTION CHANNEL, 2023 VS 2031 (%)

6. GLOBAL BEEFIN RETAIL SALESMARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBALBEEFIN HORECAMARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL BEEF IN BUTCHER SHOPSMARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL BEEFMARKETSHARE BY REGION, 2023 VS 2031 (%)

10. US BEEFMARKET SIZE, 2023-2031 ($ MILLION)

11. CANADA BEEFMARKET SIZE, 2023-2031 ($ MILLION)

12. UK BEEFMARKET SIZE, 2023-2031 ($ MILLION)

13. FRANCE BEEFMARKET SIZE, 2023-2031 ($ MILLION)

14. GERMANY BEEFMARKET SIZE, 2023-2031 ($ MILLION)

15. ITALY BEEFMARKET SIZE, 2023-2031 ($ MILLION)

16. SPAIN BEEFMARKET SIZE, 2023-2031 ($ MILLION)

17. REST OF EUROPE BEEFMARKET SIZE, 2023-2031 ($ MILLION)

18. INDIA BEEFMARKET SIZE, 2023-2031 ($ MILLION)

19. CHINA BEEFMARKET SIZE, 2023-2031 ($ MILLION)

20. JAPAN BEEFMARKET SIZE, 2023-2031 ($ MILLION)

21. SOUTH KOREA BEEFMARKET SIZE, 2023-2031 ($ MILLION)

22. REST OF ASIA-PACIFIC BEEFMARKET SIZE, 2023-2031 ($ MILLION)

23. LATIN AMERICABEEFMARKET SIZE, 2023-2031 ($ MILLION)

24. MIDDLE EAST AND AFRICABEEFMARKET SIZE, 2023-2031 ($ MILLION)