Beer Can Market

Global Beer Can Market Size, Share & Trends Analysis Report by Packaging Type (Aluminum can, Steel / Tin Can) Forecast Period (2020-2026)

Update Available - Forecast 2025-2031

The beer can market is projected to grow at a considerable CAGR of 3.0% during the forecast period (2020-2026). Beer is currently the highest consumed alcoholic beverage across the globe. According to the World Health Organization (WHO), in 2016, the beer holds 51% of the share in the overall alcoholic beverage consumption. The increasing consumption of beer across the globe is anticipated to drive the growth of global beer can market. Cans are anticipated to be a preferred choice of beer manufacturers for doing promotional events such as the release of limited-edition beer cans.

The considerable increase in the demand for highly portable packaging of beer including protection from the external environment such as harmful UV rays is expected to drive the growth of the beer can industry across the globe. An increase in awareness regarding the sustainable form of packaging is anticipated to drive the growth of the beer can market across the globe. However, the shift in preference of consumers towards wine and spirit may restrain the growth of the market across the globe.

Segmental Outlook

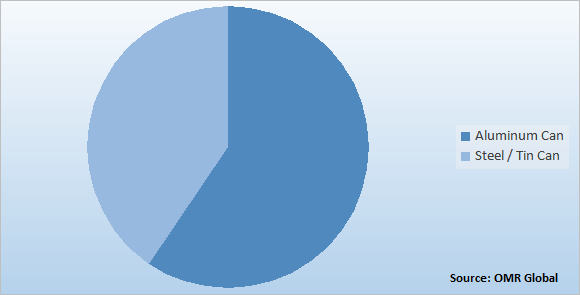

The beer can market is segmented on the basis of packaging type. Based on the packaging type, the beer can market is segmented into the aluminum can and steel/ tin can. The aluminum can is anticipated to hold major market share based on the packaging type. Aluminum cans are considered to be the most sustainable packaging material. Higher recycling rates and more recycled content than competing package types make them suitable choices for the packaging of beers. Lightweight, stackable and strong, allowing brands to package and transport more beverages using less material are the key properties of the aluminum cans which is contributing towards the high share of the aluminum can base on packaging type. The major content of the aluminum cans can be recycled therefore, the rising recycling programs undertaken by the national governments of the US and UK owing to concerns regarding depletion of natural resources are anticipated to fuel the demand for aluminum cans, which in turn will drive the growth of the market segment. The growing concerns related to the use and consumption of sustainable packaging materials for beer packaging is anticipated to promote the growth of the beer can market in North America.

Global Beer Can Market Share By Packaging Type, 2019 (%)

Regional Outlook

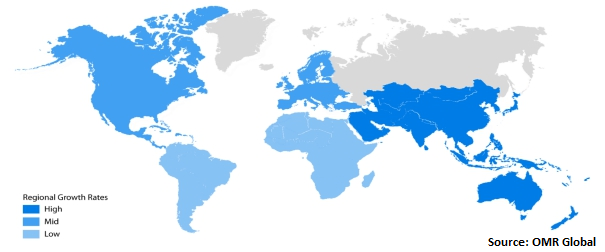

The global beer can market is further segmented on the basis of geography including North America, Europe, Asia-Pacific and Rest of the World. North America is anticipated to hold a major market share in the global beer can market during the forecast period. In Canada, the consumption of beer is maximum with around 45% of the total consumption followed by wine and spirit. The rising consumption of beer in the US and Canada are making a considerable contribution towards the high share of the beer can market in the region. The growing concerns related to the use and consumption of sustainable packaging materials for beer packaging is anticipated to promote the growth of the beer can market in North America. The presence of key market players in the region such as Crown Holdings, Inc., Ball Corp., Daiwa Can Co., and so on in the region is further anticipated to drive the growth of the beer can market in the region by making new product launches.

Global Beer Can Market Growth, by Region 2020-2026

Asia-Pacific will augment with the significant growth rate in the beer can market

Rising disposable income, an increase in the number of millennials, a rise in consumption of beer by the youth population and a significant rise in the demand for gluten-free beer are the key factors contributing towards the growth of the beer can market in the Asia-Pacific region. The increase in the consumption of craft beer in the emerging economies of the region such as China, India, Singapore, and South Korea among others is anticipated to drive the beer can market in the Asia-Pacific region. Heineken, a US-based company, had increased its stake in United Breweries, a Bangalore based India’s largest beer manufacturer. This activity is anticipated to offer high growth potential for the beer packaging industry in the country, which will raise the usage of beer cans.

Market Players Outlook

The key players of the beer can market include Anheuser-Busch InBev, Ardagh Group S.A., Crown Holdings, Inc., Ball Corp., Can-Pack S.A., Toyo Seikan Kaisha, Ltd., Shenzhen Xin Yuheng Can Co., Ltd., Pacific Can China Holdings Ltd., Daiwa Can Co., Orora Packaging Australia Pty Ltd. and so on. These players are actively adopting growth strategies such as merger & acquisition, partnership, collaboration, strategic agreement, and new product launches in order to enhance their market share. For instance, In May 2018, United Breweries Ltd. launched the iconic Dutch beer brand AMSTEL, a new International super-premium strong beer in the Indian market. AMSTEL is a slow-brewed and extra matured lager and is consumed in more than 100 countries across the globe. AMSTEL is available in 650ml bottles and 500ml cans in green, red, and gold colors.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in global beer can market. Based on the availability of data, information related to the products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Ball Corp.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Ardagh Group S.A.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Crown Holdings Inc.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Silgan Containers

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Metal Container Corp.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.1. Opportunities

5. Market Segmentation

5.1. Global Beer Can Market by Packaging Type

5.1.1. Aluminum Can

5.1.2. Steel / Tin Can

6. Regional Analysis

6.1. North America

6.1.1. US

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Anheuser-Busch InBev

7.2. Ardagh Group S.A.

7.3. Ball Corp.

7.4. Can-Pack S.A.

7.5. CPMC Holdings Ltd.

7.6. Crown Holdings, Inc.

7.7. Daiwa Can Co.

7.8. East Asia Beer Packaging Ltd.

7.9. Kaufman Container Co.

7.10. Nampak Bevcan Ltd.

7.11. O.R.G Co., Ltd.

7.12. Orora Packaging Australia Pty Ltd.

7.13. Pacific Can China Holdings, Ltd.

7.14. Shenzhen Xin Yuheng Can Co., Ltd.

7.15. Toyo Seikan Kaisha, Ltd.

1. GLOBAL BEER CAN MARKET RESEARCH AND ANALYSIS BY PACKAGING TYPE, 2019-2026 ($ MILLION)

2. GLOBAL ALUMINUM CAN MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL STEEL / TIN CAN MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. NORTH AMERICAN BEER CAN MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

5. NORTH AMERICAN BEER CAN MARKET RESEARCH AND ANALYSIS BY PACKAGING TYPE, 2019-2026 ($ MILLION)

6. EUROPEAN BEER CAN MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

7. EUROPEAN BEER CAN MARKET RESEARCH AND ANALYSIS BY PACKAGING TYPE, 2019-2026 ($ MILLION)

8. ASIA-PACIFIC BEER CAN MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

9. ASIA-PACIFIC BEER CAN MARKET RESEARCH AND ANALYSIS BY PACKAGING TYPE, 2019-2026 ($ MILLION)

10. REST OF THE WORLD BEER CAN MARKET RESEARCH AND ANALYSIS BY PACKAGING TYPE, 2019-2026 ($ MILLION)

1. GLOBAL BEER CAN MARKET SHARE BY PACKAGING TYPE, 2019 VS 2026 (%)

2. GLOBAL BEER CAN MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

3. THE US BEER CAN MARKET SIZE, 2019-2026 ($ MILLION)

4. CANADA BEER CAN MARKET SIZE, 2019-2026 ($ MILLION)

5. UK BEER CAN MARKET SIZE, 2019-2026 ($ MILLION)

6. FRANCE BEER CAN MARKET SIZE, 2019-2026 ($ MILLION)

7. GERMANY BEER CAN MARKET SIZE, 2019-2026 ($ MILLION)

8. ITALY BEER CAN MARKET SIZE, 2019-2026 ($ MILLION)

9. SPAIN BEER CAN MARKET SIZE, 2019-2026 ($ MILLION)

10. ROE BEER CAN MARKET SIZE, 2019-2026 ($ MILLION)

11. INDIA BEER CAN MARKET SIZE, 2019-2026 ($ MILLION)

12. CHINA BEER CAN MARKET SIZE, 2019-2026 ($ MILLION)

13. JAPAN BEER CAN MARKET SIZE, 2019-2026 ($ MILLION)

14. REST OF ASIA-PACIFIC BEER CAN MARKET SIZE, 2019-2026 ($ MILLION)

15. REST OF THE WORLD BEER CAN MARKET SIZE, 2019-2026 ($ MILLION)