Beverage Packaging Market

Global Beverage Packaging Market Size, Share & Trends Analysis Report by Material (Glass, Plastic, Paper, and Metal), By Product (Bottles & Jars, Cans, Pouches, Cartons, Others), and by Beverage (Non-Alcoholic Beverages and Alcoholic Beverage), and Forecast 2020-2026 Update Available - Forecast 2025-2031

The global beverage packaging market is projected to grow at a CAGR of 5.7% during the forecast period. The key factors that drive the market growth include the increased adoption of beverage products across the globe. The growing consumers' awareness regarding the consumption of natural, fresh, and convenient beverage items, along with the continuous changes in the industry drives the growth of the market. The traditional functions of packaging are to protect food and beverages from degradation processes, primarily produced by environmental factors, such as oxygen, light, and moisture, to contain the food, and to provide consumers with ingredient and nutritional information.

Several innovations in packaging have significantly supported in enhancing the shelf-life of the products. This is achieved by developing novel packaging systems to contain problems associated with plastic-based materials. Further, the development of active packaging technologies for better preservation is also contributing to the growth of the market. Some of the important factors to be controlled that can affect the quality of beverage products include pH, the glass transition temperature of the polymeric material, storage temperature, and degree of interaction of volatiles with food constituents.

Segmental Outlook

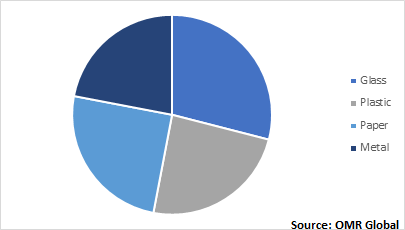

The global beverage packaging market is segmented on the basis of material, product, and beverage. Based on the material, the market is sectioned into glass, plastic, paper, and metal. Plastic is estimated to exhibit significant growth during the forecast period. Based on the product, the market is segmented into bottles & jars, cans, pouches, cartons, and others. The bottles & jars segment is estimated to contribute a prominent share in the market. Based on the beverage, the market is segmented into non-alcoholic beverages (such as water, juices, energy drinks, carbonated drinks, and dairy beverages) and alcoholic beverages. Non-alcoholic beverage tends to contribute a significant share in the market.

Global Beverage Packaging Market by Material Type, 2019 (%)

Plastics to contribute Significant Share Over the Forecast Period

Amongst the material segment of the market, the plastics segment is estimated to contribute significantly to the market. The segmental growth of the market is attributed to the increased use of plastic for beverage packaging. According to PlasticsEurope, the global plastics production reached to 359 million tons in 2018, that is an increase from 348 million tons in 2017. China is the largest producer of plastics and is followed by Europe and North American countries. The use of plastics in beverage packaging has continued to increase due to the low cost of materials and functional advantages such as thermo-sealability, microwave-ability, optical properties, and unlimited sizes & shapes over traditional materials such as glass and tinplate. Thus, such increased use of plastics is projected to encourage the segmental growth of the market over the forecast period. The advent of bioplastics also creates significant growth for the market.

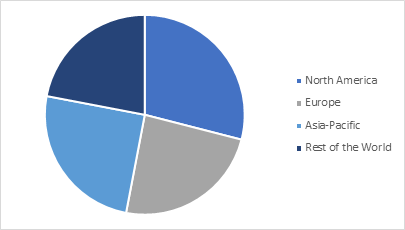

Regional Outlook

The global beverage packaging market is geographically segmented into North America, Europe, Asia-Pacific, and the Rest of the World. North America region is estimated to grow significantly during the forecast period. The regional growth of the market is attributed to the increasing number of beverage consumers in the US and Canada. Further, the Asia-Pacific region is also likely to drive the growth of the market over the forecast period, owing to the change in the consumer preferences of the growing young population towards the branded, premium, and packaged substances. Further, increased alcohol consumption also contributes to the regional growth of the market over the forecast period.

Global Beverage Packaging Market by Region, 2019 (%)

Market Players Outlook

Some of the prominent players operating in the global beverage packaging market include Amcor Plc, Ball Corp., Berry Global, Inc., Crown Holdings Inc., IntraPac International LLC, Mondi Group Plc, Reynolds Group Holdings Ltd., Smurfit Kappa Group, Sonoco Products Co., and Stora Enso Oyj among others. These are the key companies adopting several organic and inorganic growth strategies such as product launches & developments, partnerships, agreements, and acquisitions to strengthen their product portfolios and maintain a competitive position in the global beverage packaging market. For instance, in May 2019, Mondi Group invested $34.3 million in its innovative corrugated packaging plants. This strategic initiative of the company will aid in broadening the product portfolio including cartons, manufacture innovative products, and enhance product quality.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global beverage packaging market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Ball Corp.

3.1.1.1. Overview

3.1.1.2. Financial Analysis

3.1.1.3. SWOT Analysis

3.1.1.4. Recent Developments

3.1.2. Berry Global, Inc.

3.1.2.1. Overview

3.1.2.2. Financial Analysis

3.1.2.3. SWOT Analysis

3.1.2.4. Recent Developments

3.1.3. Mondi Group Plc

3.1.3.1. Overview

3.1.3.2. Financial Analysis

3.1.3.3. SWOT Analysis

3.1.3.4. Recent Developments

3.1.4. Smurfit Kappa Group

3.1.4.1. Overview

3.1.4.2. Financial Analysis

3.1.4.3. SWOT Analysis

3.1.4.4. Recent Developments

3.1.5. Sonoco Products Co.

3.1.5.1. Overview

3.1.5.2. Financial Analysis

3.1.5.3. SWOT Analysis

3.1.5.4. Recent Developments

3.2. Key Strategy Analysis

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Beverage Packaging Market by Material

5.1.1. Glass

5.1.2. Plastic

5.1.3. Paper

5.1.4. Metal

5.2. Global Beverage Packaging Market by Product

5.2.1. Bottles & Jars

5.2.2. Cans

5.2.3. Pouches

5.2.4. Cartons

5.2.5. Others

5.3. Global Beverage Packaging Market by Beverage

5.3.1. Non-Alcoholic Beverages

5.3.2. Alcoholic Beverages

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Amcor Plc

7.2. Ardagh Group SA

7.3. Ball Corp.

7.4. Beatson Clark

7.5. Berry Global, Inc.

7.6. CANPACK Group

7.7. Crown Holdings Inc.

7.8. Gerresheimer AG

7.9. IntraPac International LLC

7.10. Mondi Group Plc

7.11. Nampak Ltd.

7.12. Orora Packaging Australia Pty Ltd

7.13. Owens-Illinois, Inc.

7.14. Reynolds Group Holdings Ltd.

7.15. Silgan Containers LLC

7.16. Smurfit Kappa Group

7.17. Sonoco Products Co.

7.18. Stora Enso Oyj

7.19. Tetra Pak International SA

7.20. Toyo Seikan Group Holdings, Ltd.

7.21. Vidrala SA

1. GLOBAL BEVERAGE PACKAGING MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2019-2026 ($ MILLION)

2. GLOBAL GLASS BEVERAGE PACKAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL PLASTIC BEVERAGE PACKAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL PAPER BEVERAGE PACKAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

5. GLOBAL METAL BEVERAGE PACKAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL BEVERAGE PACKAGING MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2019-2026 ($ MILLION)

7. GLOBAL BEVERAGE BOTTLES & JARS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

8. GLOBAL BEVERAGE CANS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

9. GLOBAL BEVERAGE POUCHES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

10. GLOBAL BEVERAGE CARTONS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

11. GLOBAL OTHER PRODUCT FOR BEVERAGE PACKAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

12. GLOBAL BEVERAGE PACKAGING MARKET RESEARCH AND ANALYSIS BY BEVERAGE, 2019-2026 ($ MILLION)

13. GLOBAL NON-ALCOHOLIC BEVERAGE PACKAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

14. GLOBAL ALCOHOLIC BEVERAGE PACKAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

15. GLOBAL BEVERAGE PACKAGING MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

16. NORTH AMERICAN BEVERAGE PACKAGING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

17. NORTH AMERICAN BEVERAGE PACKAGING MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2019-2026 ($ MILLION)

18. NORTH AMERICAN BEVERAGE PACKAGING MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2019-2026 ($ MILLION)

19. NORTH AMERICAN BEVERAGE PACKAGING MARKET RESEARCH AND ANALYSIS BY BEVERAGE, 2019-2026 ($ MILLION)

20. EUROPEAN BEVERAGE PACKAGING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

21. EUROPEAN BEVERAGE PACKAGING MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2019-2026 ($ MILLION)

22. EUROPEAN BEVERAGE PACKAGING MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2019-2026 ($ MILLION)

23. EUROPEAN BEVERAGE PACKAGING MARKET RESEARCH AND ANALYSIS BY BEVERAGE, 2019-2026 ($ MILLION)

24. ASIA-PACIFIC BEVERAGE PACKAGING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

25. ASIA-PACIFIC BEVERAGE PACKAGING MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2019-2026 ($ MILLION)

26. ASIA-PACIFIC BEVERAGE PACKAGING MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2019-2026 ($ MILLION)

27. ASIA-PACIFIC BEVERAGE PACKAGING MARKET RESEARCH AND ANALYSIS BY BEVERAGE, 2019-2026 ($ MILLION)

28. REST OF THE WORLD BEVERAGE PACKAGING MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2019-2026 ($ MILLION)

29. REST OF THE WORLD BEVERAGE PACKAGING MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2019-2026 ($ MILLION)

30. REST OF THE WORLD BEVERAGE PACKAGING MARKET RESEARCH AND ANALYSIS BY BEVERAGE, 2019-2026 ($ MILLION)

1. GLOBAL BEVERAGE PACKAGING MARKET SHARE BY MATERIAL, 2019 VS 2026 (%)

2. GLOBAL BEVERAGE PACKAGING MARKET SHARE BY PRODUCT, 2019 VS 2026 (%)

3. GLOBAL BEVERAGE PACKAGING MARKET SHARE BY BEVERAGE, 2019 VS 2026 (%)

4. GLOBAL BEVERAGE PACKAGING MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

5. US BEVERAGE PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

6. CANADA BEVERAGE PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

7. UK BEVERAGE PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

8. FRANCE BEVERAGE PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

9. GERMANY BEVERAGE PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

10. ITALY BEVERAGE PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

11. SPAIN BEVERAGE PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

12. ROE BEVERAGE PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

13. INDIA BEVERAGE PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

14. CHINA BEVERAGE PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

15. JAPAN BEVERAGE PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF ASIA-PACIFIC BEVERAGE PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

17. REST OF THE WORLD BEVERAGE PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)