Big Data Analytics in Banking Market

Global Big Data Analytics in Banking Market Size, Share & Trends Analysis Report, By Deployment Type (On-Premise and Cloud), By Application (Fraud Detection and Management, Customer Relationship Management, Feedback Management, Risk Management, and Others), Forecast Period 2021-2027 Update Available - Forecast 2025-2035

The global big data analytics in banking market is anticipated to grow at a CAGR of 28.5% during the forecast period (2021-2027). Banks record millions of transactions in real-time daily. The volume of data generated by the banks creates a challenge for the bankers. To make the recording of this transaction easy, banks use big data analytics that provides the platform for easy recording of the transaction. These data are used by the financial industry in many ways such as for boosting cyber security, cultivating customer loyalty, reducing customer churn, and many more by using innovative offerings to turn the banking experience of the customers more personalized. With the huge volume of data, banks try to find out innovative ideas and risk management solutions. In addition to this, gaining a better understanding of consumers and their preferences can only be done with the help of these data. Due to this, big data analytics in banking market is growing significantly. Furthermore, the increase in the deployment of things on the internet is also propelling the growth of the big data analytics in banking market.

COVID-19 Impact on the Big Data Analytics in Banking Market

The impact of COVID-19 is seen on many industries such as Aerospace & Defence, Agriculture, Food & Beverages, Automobile & Transportation, Chemical & Material, Consumer Goods, Retail & eCommerce, Energy & Power, Pharma & Healthcare, Packaging, Construction, Mining & Gases, Electronics & Semiconductor, and many more. And banking industry isn’t far from it. The COVID-19 has impacted the banking industry significantly as well. The disruptions caused by COVID-19 such as lockdowns, government restrictions, limit the growth of the banking industry. Credit management and customer relationship management were severely impacted. However, due to the digitalization of the banking sector and increase in the internet penetration, the big data analytics market was moderately affected by the COVID-19 crisis.

Segmental Outlook

Big data analytics in banking market is segmented based on deployment type and application. Based on deployment type, the market is classified into on-premise and cloud. Based on the application type, the market is segmented into fraud detection and management, customer relationship management, feedback management, risk management, and others.

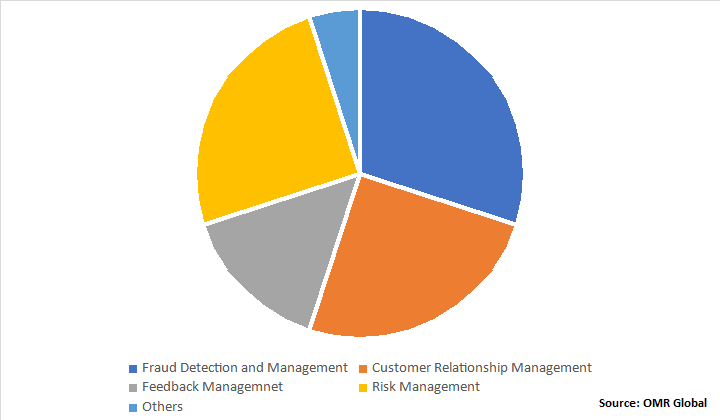

Global Big Data Analytics in Banking Market Share by Application, 2020 (%)

By application segment, fraud detection, and management application hold the largest share in the big data analytics in banking market followed by customer relationship management, risk management, feedback management, and others. In fraud detection and management, big data analytics automates the repetitive test by saving a lot of time and scan 100% of the transactions to detect any fraud. In addition to this, it easily merges, normalizes, and compares the data from different systems.

Regional Outlook

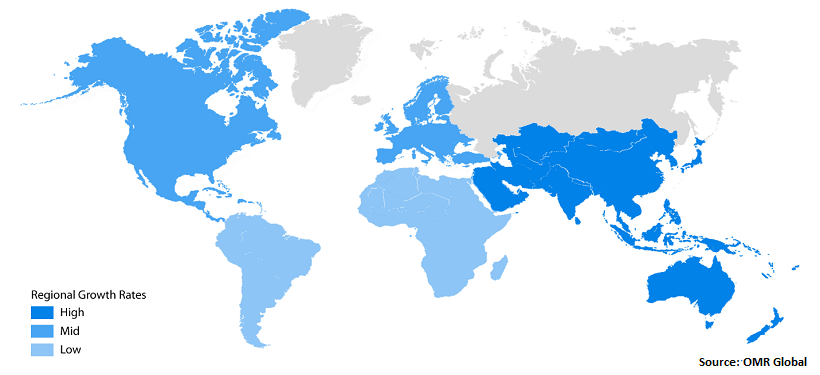

The big data analytics in banking market is further segmented based on geography including North America, Europe, Asia-Pacific, and the Rest of the World (RoW). North America is estimated to hold the largest share in the market globally. The factors driving the growth of the market in the region include the increased financial frauds against the bank and other financial service institutes. In addition to this, the proliferation of digital services is also driving the growth of the market. Furthermore, technological advancements also propel the growth of the market in the North American region. However, Asia-Pacific is estimated to hold a significant CAGR during the forecast period. This is due to factors such as technological advancement and the digitalization of the banking sector.

Global Big Data Analytics in Banking Market Growth By Region, 2021-2027

Market Players Outlook

Key players operating in the big data analytics in banking market include IBM Corp., SAP SE, Oracle Corp., Tableau System, LLC, Microsoft Corp., and others. The market players are focusing on the adoption of various strategies including, technological advancements and product innovation, to stay competitive in the market. For instance, in February 2020 Oracle’s Financial Crime and Compliance Management (FCCM) suite of products added an integrated analytics workbench, 300-plus customer risk indicators, and embedded graph analytics visualizations. These were built to help financial institutions fight money laundering and achieve compliance.

The Report Covers

- Market value data analysis of 2020 and forecast to 2027.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the big data analytics in banking market.

- Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market entry and market expansion strategies.

- Competitive strategies by identifying 'who-stands-where in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global Big Data Analytics in Banking Industry

• Recovery Scenario of Global Big Data Analytics in Banking Industry

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendation

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. IBM Corp.

3.1.1.1. Overview

3.1.1.2. Financial Analysis

3.1.1.3. SWOT Analysis

3.1.2. SAP SE

3.1.2.1. Overview

3.1.2.2. Financial Analysis

3.1.2.3. SWOT Analysis

3.1.3. Oracle Corp.

3.1.3.1. Overview

3.1.3.2. Financial Analysis

3.1.3.3. SWOT Analysis

3.1.4. Tableau Software, LLC

3.1.4.1. Overview

3.1.4.2. Financial Analysis

3.1.4.3. SWOT Analysis

3.1.5. Microsoft Corp.

3.1.5.1. Overview

3.1.5.2. Financial Analysis

3.1.5.3. SWOT Analysis

3.2. Key Strategy Analysis

3.3. Impact of COVID-19 on Key Players

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Big Data Analytics in Banking Market by Deployment Type

5.1.1. On-Premise Based

5.1.2. Cloud-Based

5.2. Global Big Data Analytics in Banking Market by Application

5.2.1. Fraud Detection and Management

5.2.2. Customer Relationship Management

5.2.3. Feedback Management

5.2.4. Risk Management

5.2.5. Other Application

6. Regional Analysis

6.1. North America

6.1.1. US

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. South Korea

6.3.5. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Accenture plc

7.2. Adobe Systems,Inc.

7.3. Alteryx, Inc.

7.4. Amazon.com, Inc.

7.5. Aspire Systems,Inc.

7.6. BigPanda, Inc.

7.7. Fractal Analytics Inc.

7.8. Gainsight, Inc.

7.9. Google, LLC

7.10. Hitachi Solutions, Ltd.

7.11. IBM Corp.

7.12. Microsoft Corp.

7.13. Nimbix, Inc.

7.14. Oracle Corp.

7.15. PeerIQ (CRB Group, Inc.)

7.16. Salesforce.com, Inc.

7.17. SAP SE

7.18. Tableau System, LLC

7.19. Teradata Corp.

7.20. ThetaRay, Ltd.

1. GLOBAL BIG DATA ANALYTICS IN BANKING MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT TYPE, 2020-2027 ($ MILLION)

2. GLOBAL ON-PREMISE BASED BIG DATA ANALYTICS IN BANKING MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

3. GLOBAL CLOUD-BASED BIG DATA ANALYTICS IN BANKING MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

4. GLOBAL BIG DATA ANALYTICS IN BANKING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

5. GLOBAL FRAUD DETECTION AND MANAGEMENT APPLICATION MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

6. GLOBAL CUSTOMER RELATIONSHIP MANAGEMENT APPLICATION MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

7. GLOBAL FEEDBACK MANAGEMENT APPLICATION MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

8. GLOBAL RISK MANAGEMENT APPLICATION MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

9. GLOBAL OTHER APPLICATION MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

10. GLOBAL BIG DATA ANALYTICS IN BANKING MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2020-2027($ MILLION)

11. NORTH AMERICAN BIG DATA ANALYTICS IN BANKING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

12. NORTH AMERICAN BIG DATA ANALYTICS IN BANKING MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT TYPE, 2020-2027 ($ MILLION)

13. NORTH AMERICAN BIG DATA ANALYTICS IN BANKING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

14. EUROPEAN BIG DATA ANALYTICS IN BANKING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

15. EUROPEAN BIG DATA ANALYTICS IN BANKING MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT TYPE, 2020-2027 ($ MILLION)

16. EUROPEAN SMART BIG DATA ANALYTICS IN BANKING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

17. ASIA-PACIFIC BIG DATA ANALYTICS IN BANKING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

18. ASIA-PACIFIC BIG DATA ANALYTICS IN BANKING MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT TYPE, 2020-2027 ($ MILLION)

19. ASIA-PACIFIC BIG DATA ANALYTICS IN BANKING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

20. REST OF THE WORLD BIG DATA ANALYTICS IN BANKING MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT TYPE, 2020-2027 ($ MILLION)

21. REST OF THE WORLD BIG DATA ANALYTICS IN BANKING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

1. IMPACT OF COVID-19 ON BIG DATA ANALYTICS IN BANKING MARKET, 2020-2027($ MILLION)

2. IMPACT OF COVID-19 ON BIG DATA ANALYTICS IN BANKING MARKET BY SEGMENT, 2020-2027($ MILLION)

3. RECOVERY OF BIG DATA ANALYTICS IN BANKING MARKET, 2021-2027(%)

4. GLOBAL BIG DATA ANALYTICS IN BANKING MARKET SHARE BY DEPLOYMENT TYPE, 2020 VS 2027 (%)

5. GLOBAL BIG DATA ANALYTICS IN BANKING MARKET SHARE BY APPLICATION, 2020 VS 2027 (%)

6. GLOBAL BIG DATA ANALYTICS IN BANKING MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

7. GLOBAL ON-PREMISE BASED BIG DATA ANALYTICS IN BANKING MARKET SHARE BY REGION, 2020 VS 2027 (%)

8. GLOBAL CLOUD-BASED BIG DATA ANALYTICS IN BANKING MARKET SHARE BY REGION, 2020 VS 2027 (%)

9. GLOBAL FRAUD DETECTION AND MANAGEMENT APPLICATION SHARE BY REGION, 2020 VS 2027 (%)

10. GLOBAL CUSTOMER RELATIONSHIP MANAGEMENT APPLICATION MARKET SHARE BY REGION, 2020 VS 2027 (%)

11. GLOBAL FEEDBACK MANAGEMENT APPLICATION MARKET SHARE BY REGION, 2020 VS 2027 (%)

12. GLOBAL RISK MANAGEMENT APPLICATION MARKET SHARE BY REGION, 2020 VS 2027 (%)

13. GLOBAL OTHER APPLICATION MARKET SHARE BY REGION, 2020 VS 2027 (%)

14. US BIG DATA ANALYTICS IN BANKING MARKET SIZE, 2020-2027 ($ MILLION)

15. CANADA BIG DATA ANALYTICS IN BANKING MARKET SIZE, 2020-2027 ($ MILLION)

16. UK BIG DATA ANALYTICS IN BANKING MARKET SIZE, 2020-2027 ($ MILLION)

17. FRANCE BIG DATA ANALYTICS IN BANKING MARKET SIZE, 2020-2027 ($ MILLION)

18. GERMANY BIG DATA ANALYTICS IN BANKING MARKET SIZE, 2020-2027 ($ MILLION)

19. ITALY BIG DATA ANALYTICS IN BANKING MARKET SIZE, 2020-2027 ($ MILLION)

20. SPAIN BIG DATA ANALYTICS IN BANKING MARKET SIZE, 2020-2027 ($ MILLION)

21. ROE BIG DATA ANALYTICS IN BANKING MARKET SIZE, 2020-2027 ($ MILLION)

22. INDIA BIG DATA ANALYTICS IN BANKING MARKET SIZE, 2020-2027 ($ MILLION)

23. CHINA BIG DATA ANALYTICS IN BANKING MARKET SIZE, 2020-2027 ($ MILLION)

24. JAPAN BIG DATA ANALYTICS IN BANKING MARKET SIZE, 2020-2027 ($ MILLION)

25. SOUTH KOREA BIG DATA ANALYTICS IN BANKING MARKET SIZE, 2020-2027 ($ MILLION)

26. REST OF ASIA-PACIFIC BIG DATA ANALYTICS IN BANKING MARKET SIZE, 2020-2027 ($ MILLION)

27. REST OF THE WORLD BIG DATA ANALYTICS IN BANKING MARKET SIZE, 2020-2027 ($ MILLION)