Big Data Analytics in Manufacturing Market

Big Data Analytics in Manufacturing Market Size, Share & Trends Analysis Report by Offering (Solutions, and Services), by Deployment (Cloud, On-Premise, and Hybrid), and by Application (Predictive Quality, Anomaly Detection, Supply Chain Management, Production Forecasting, and Others) Forecast Period (2023-2029) Update Available - Forecast 2025-2031

Big data analytics in the manufacturing market is anticipated to grow at a significant CAGR of 14.0% during the forecast period. the increasing number of manufacturing units across the globe, along with the presence of key market players such as IBM, Microsoft, Softserve, and others will further enhance the market growth during the forecast period. For instance, in May 2022, SoftServe was unveiled as a services partner of two new Google Cloud manufacturing solutions. The solutions—Manufacturing Data Engine and Manufacturing Connect—are positioned to accelerate and scale digital transformation projects in the manufacturing sector. Manufacturing Data Engine is an end-to-end solution that processes, contextualizes, and stores factory data on Google Cloud’s data platform, and provide a blueprint for the data.

Big data solutions analyze, collect, and monitor large volumes of unstructured, and structured data generates from a variety of sources such as production units, product quality, factory floors, and others. In addition, machine learning (ML) driven analysis of automated test results such as photographs, X-rays, temperature measurements and other outputs is inherently superior to manual processes for spotting anomalies in product quality. Big data technology supports the manufacturing industry to minimize human error and identify the parameters that improve quality, exponentially increasing the number of products. Hence, owing to its wider benefits, coupled with the increasing application of big data analytics among end-user verticals is anticipated to propel the market growth.

Segmental Outlook

The global big data analytics in the manufacturing market is segmented based on the offering, deployment, and application. Based on offering the market is segmented into solutions, and services. Based on deployment the market is categorized into cloud, hybrid, and on-premise. Based on application, the market is segmented into predictive quality, anomaly detection, supply chain management, production forecasting, and others. Based on deployment the cloud segment is anticipated to grow at a significant rate. Increasing application of cloud-based big data analytics software, in manufacturing units owing to its various benefits, is driving the segment growth. Major benefits offered by the cloud include, it assists in analyzing data in real-time, and enables to make quick and informed decisions.

Based on offering the software segment holds a prominent market share in the market. This can be attributed to the increasing integration of various software in big data analytics tools for measuring business success. With the help of these software solutions, manufacturers can gain valuable insights into their operations, identify inefficiencies, and make data-driven decisions to optimize their production processes. Furthermore, as the volume of data generated in the manufacturing industry continues to grow, there is an increasing need for software solutions that can handle and analyze large datasets efficiently. For instance, in January 2023, Datanomix announced a partnership with Vallen to offer Datanomix big data software to its wide range of manufacturing customers. The information presented by Datanomix solution accelerates time to the information, shortens corrective action cycles, and directly impacts decision-making at exactly the right time.

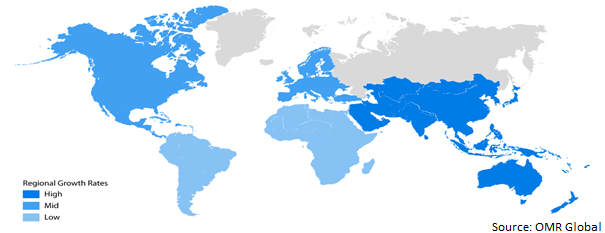

Regional Outlooks

The global big data analytics in the manufacturing market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America. The North American region is anticipated to witness considerable growth in the market. The growth is mainly driven by the presence of large manufacturing units, such as LCS Co., Pilgrim Harp., Print Parts Inc., and Amfas International Inc., that deploy big data analytics, to transform, store, and reduce maintenance costs of the factory data.

Global Big Data Analytics in Manufacturing Market Growth, by Region 2023-2029

The North America Region Dominates the Global Big Data Analytics in Manufacturing Market

The North American region is anticipated to grow at a significant rate in the global big data analytics in the manufacturing market. The growth is mainly attributed owing to the presence of key market players, coupled with the rise in industrialization and an increase in the number of manufacturing units, which requires data-driven decision-making software in the manufacturing sector. For instance, according to the National Institute of Standards and Technology, in 2021, Manufacturing contributed $2.3 trillion to the US GDP amounting to 12.0 % of the total US GDP. Moreover, as per the same source, in 2020, US manufacturing imported 18.2% of its intermediate goods/services, resulting in 10.6% of the output being of foreign origin.

Market Players Outlook

The major companies serving global big data analytics in the manufacturing market include ABB, Emerson Electric, Google, and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, geographical expansions, partnerships, product launches, and collaborations, to stay competitive in the market. For instance, in May 2022, Google Cloud announced the launch of Manufacturing Data Engine and Manufacturing Connect, two new solutions that enable manufacturers to connect historically siloed assets, process and standardize data, and improve visibility from the factory floor to the cloud. Once data is harmonized, the solutions enable three critical AI- and analytics-based use cases–manufacturing analytics and insights, predictive maintenance, and machine-level anomaly detection.

The Report Covers

- Market value data analysis of 2023 and forecast to 2029.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global big data analytics in the manufacturing market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. ByRegion

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight and Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

1.1. Key Company Analysis

3.1. ABB, Ltd.

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Emerson Electric Co.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Google, LLC

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. IBM Corp.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Wipro, Ltd.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Key Strategy Analysis

4. Market Segmentation

4.1. Global Big Data Analytics in Manufacturing Market by Offering

4.1.1. Solution

4.1.2. Services

4.2. Global Big Data Analytics in Manufacturing Market by Deployment Mode

4.2.1. On-Premise

4.2.2. Cloud

4.2.3. Hybrid

4.3. Global Big Data Analytics in Manufacturing Market by Application

4.3.1. Predictive Quality

4.3.2. Anomaly Detection

4.3.3. Supply Chain Management

4.3.4. Production Forecasting

4.3.5. Others

5. Regional Analysis

5.1. North America

5.1.1. US

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Accenture Plc

6.2. Alteryx Inc

6.3. Angoss Software Corp

6.4. Fair Isaac Corp

6.5. Informatica Inc

6.6. Microsoft Corp

6.7. Oracle Corp

6.8. Rockwell Automation, Inc.

6.9. Salesforce, Inc.

6.10. Sap SE

6.11. Sas Insititute Inc

6.12. Splunk Inc.

6.13. Teradata Corp.

6.14. Tibco Software Inc

6.15. Zensar Technologies Ltd

1. GLOBAL BIG DATA ANALYTICS IN MANUFACTURING MARKET RESEARCH AND ANALYSIS BY OFFERING, 2021-2029 ($ MILLION)

2. GLOBAL BIG DATA ANALYTICS SOLUTION MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2029 ($ MILLION)

3. GLOBAL BIG DATA ANALYTICS SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2029 ($ MILLION)

4. GLOBAL BIG DATA ANALYTICS IN MANUFACTURING MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT MODE, 2021-2029 ($ MILLION)

5. GLOBAL ON PREMISE BIG DATA ANALYTICS SOLUTION MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2029 ($ MILLION)

6. GLOBAL CLOUD BIG DATA ANALYTICS SOLUTION MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2029 ($ MILLION)

7. GLOBAL HYBRID BIG DATA ANALYTICS SOLUTION MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2029 ($ MILLION)

8. GLOBAL BIG DATA ANALYTICS IN MANUFACTURING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2029 ($ MILLION)

9. GLOBAL BIG DATA ANALYTICS FOR PREDICTIVE QUALITY MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2029 ($ MILLION)

10. GLOBAL BIG DATA ANALYTICS FOR ANOMALY DETECTION MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2029 ($ MILLION)

11. GLOBAL BIG DATA ANALYTICS FOR SUPPLY CHAIN MANAGEMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2029 ($ MILLION)

12. GLOBAL BIG DATA ANALYTICS FOR PRODUCTION FORECASTING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2029 ($ MILLION)

13. GLOBAL BIG DATA ANALYTICS FOR OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2029 ($ MILLION)

14. GLOBAL BIG DATA ANALYTICS IN MANUFACTURING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2029 ($ MILLION)

15. NORTH AMERICAN BIG DATA ANALYTICS IN MANUFACTURING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2029 ($ MILLION)

16. NORTH AMERICAN BIG DATA ANALYTICS IN MANUFACTURING MARKET RESEARCH AND ANALYSIS BY OFFERING, 2021-2029 ($ MILLION)

17. NORTH AMERICAN BIG DATA ANALYTICS IN MANUFACTURING MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT, 2021-2029 ($ MILLION)

18. NORTH AMERICAN BIG DATA ANALYTICS IN MANUFACTURING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2029 ($ MILLION)

19. EUROPEAN BIG DATA ANALYTICS IN MANUFACTURING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2029 ($ MILLION)

20. EUROPEAN BIG DATA ANALYTICS IN MANUFACTURING MARKET RESEARCH AND ANALYSIS BY OFFERING, 2021-2029 ($ MILLION)

21. EUROPEAN BIG DATA ANALYTICS IN MANUFACTURING MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT, 2021-2029 ($ MILLION)

22. EUROPEAN BIG DATA ANALYTICS IN MANUFACTURING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2029 ($ MILLION)

23. ASIA-PACIFIC BIG DATA ANALYTICS IN MANUFACTURING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2029 ($ MILLION)

24. ASIA-PACIFIC BIG DATA ANALYTICS IN MANUFACTURING MARKET RESEARCH AND ANALYSIS BY OFFERING, 2021-2029 ($ MILLION)

25. ASIA-PACIFIC BIG DATA ANALYTICS IN MANUFACTURING MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT, 2021-2029 ($ MILLION)

26. ASIA-PACIFIC BIG DATA ANALYTICS IN MANUFACTURING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2029 ($ MILLION)

27. REST OF THE WORLD BIG DATA ANALYTICS IN MANUFACTURING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2029 ($ MILLION)

28. REST OF THE WORLD BIG DATA ANALYTICS IN MANUFACTURING MARKET RESEARCH AND ANALYSIS BY OFFERING, 2021-2029 ($ MILLION)

29. REST OF THE WORLD BIG DATA ANALYTICS IN MANUFACTURING MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT, 2021-2029 ($ MILLION)

30. REST OF THE WORLD BIG DATA ANALYTICS IN MANUFACTURING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2029 ($ MILLION)

1. GLOBAL BIG DATA ANALYTICS IN MANUFACTURING MARKET SHARE BY OFFERING, 2021 VS 2029 (%)

2. GLOBAL SOLUTION BIG DATA ANALYTICS IN MANUFACTURING MARKET SHARE BY REGION, 2021 VS 2029 (%)

3. GLOBAL SERVICES BIG DATA ANALYTICS IN MANUFACTURING MARKET SHARE BY REGION, 2021 VS 2029 (%)

4. GLOBAL BIG DATA ANALYTICS IN MANUFACTURING MARKET SHARE BY DEPLOYMENT, 2021 VS 2029 (%)

5. GLOBAL ON-PREMISE BIG DATA ANALYTICS IN MANUFACTURING MARKET SHARE BY REGION, 2021 VS 2029 (%)

6. GLOBAL CLOUD BIG DATA ANALYTICS IN MANUFACTURING MARKET SHARE BY REGION, 2021 VS 2029 (%)

7. GLOBAL HYBRID BIG DATA ANALYTICS IN MANUFACTURING MARKET SHARE BY REGION, 2021 VS 2029 (%)

8. GLOBAL BIG DATA ANALYTICS IN MANUFACTURING MARKET SHARE BY APPLICATION, 2021 VS 2029 (%)

9. GLOBAL BIG DATA ANALYTICS IN MANUFACTURING MARKET SHARE BY REGION, 2021 VS 2029 (%)

10. GLOBAL BIG DATA ANALYTICS FOR PREDICTIVE QUALITY MARKET SHARE BY REGION, 2021 VS 2029 (%)

11. GLOBAL BIG DATA ANALYTICS FOR ANOMALY DETECTION MARKET SHARE BY REGION, 2021 VS 2029 (%)

12. GLOBAL BIG DATA ANALYTICS FOR SUPPLY CHAIN MANAGEMENT MARKET SHARE BY REGION, 2021 VS 2029 (%)

13. GLOBAL BIG DATA ANALYTICS FOR PRODUCTION FORECASTING MARKET SHARE BY REGION, 2021 VS 2029 (%)

14. GLOBAL BIG DATA ANALYTICS FOR OTHERS MARKET SHARE BY REGION, 2021 VS 2029 (%)

15. GLOBAL BIG DATA ANALYTICS IN MANUFACTURING MARKET SHARE BY REGION, 2021 VS 2029 (%)

16. US BIG DATA ANALYTICS IN MANUFACTURING MARKET SIZE, 2021-2029 ($ MILLION)

17. CANADA BIG DATA ANALYTICS IN MANUFACTURING MARKET SIZE, 2021-2029 ($ MILLION)

18. UK BIG DATA ANALYTICS IN MANUFACTURING MARKET SIZE, 2021-2029 ($ MILLION)

19. FRANCE BIG DATA ANALYTICS IN MANUFACTURING MARKET SIZE, 2021-2029 ($ MILLION)

20. GERMANY BIG DATA ANALYTICS IN MANUFACTURING MARKET SIZE, 2021-2029 ($ MILLION)

21. ITALY BIG DATA ANALYTICS IN MANUFACTURING MARKET SIZE, 2021-2029 ($ MILLION)

22. SPAIN BIG DATA ANALYTICS IN MANUFACTURING MARKET SIZE, 2021-2029 ($ MILLION)

23. REST OF EUROPE BIG DATA ANALYTICS IN MANUFACTURING MARKET SIZE, 2021-2029 ($ MILLION)

24. INDIA BIG DATA ANALYTICS IN MANUFACTURING MARKET SIZE, 2021-2029 ($ MILLION)

25. CHINA BIG DATA ANALYTICS IN MANUFACTURING MARKET SIZE, 2021-2029 ($ MILLION)

26. JAPAN BIG DATA ANALYTICS IN MANUFACTURING MARKET SIZE, 2021-2029 ($ MILLION)

27. SOUTH KOREA BIG DATA ANALYTICS IN MANUFACTURING MARKET SIZE, 2021-2029 ($ MILLION)

28. REST OF ASIA-PACIFIC BIG DATA ANALYTICS IN MANUFACTURING MARKET SIZE, 2021-2029 ($ MILLION)

29. REST OF THE WORLD BIG DATA ANALYTICS IN MANUFACTURING MARKET SIZE, 2021-2029 ($ MILLION)