Bike Rental Market

Global Bike Rental Market Size, Share & Trends Analysis Report, by Vehicle Type (Motor Bike and Scooter), By Propulsion Technology (Gasoline, Electric, and Pedal), By Operation Mode (Dockless and Docked) and Forecast, 2020-2026 Update Available - Forecast 2025-2031

The bike rental market is anticipated to showcase an exponential growth rate during the forecast period. Increasing domestic and international tourism, rising migration of the people in different cities are driving the growth of the market. Moreover, the rise in technological advancement and increasing internet penetration is one of the key factors for the growth of the bike rental market. The unorganized bike rental services by small players were operational all across the globe for decades. However, with the technological advancement such as live location tracking of the vehicle, remote locking of the vehicle has increased the feasibility of the bike rental services. Moreover, by the use of modern technology, dockless bike rental has become much easier than earlier.

Besides, the success of ride hailing market all across the globe is also providing confidence to investors toward the bike rental industry. Due to this, startups are securing significant funding with a strong business model. For instance, India based electric bike rental company; Bounce secured a funding of $105 million in January 2020 led by Accel and B Capital Group. However, low awareness, low pricing, and initial cost, charging infrastructure for electric bikes are some of the major challenges for the bike rental industry. In March 2018, ofo Inc., a Chinese based bicycle rental start-up secured a funding of $866 million led by Alibaba Group with overall funding of $2.2 billion, however, the startup is under massive debt and is on the verge of bankruptcy.

Market Segmentation

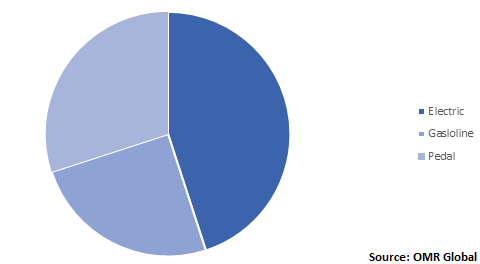

The bike rental market is segmented on the basis of vehicle type, propulsion technology, and operation mode. By vehicle type, the market is further segmented into motorbike and scooters. Scooters are expected to show significant growth during the forecast period with a major market share. It is due to the fact that most of the startups are adding electric scooters to their vehicle fleet. However, the management of the charging infrastructure will be a major challenge for companies. By propulsion technology, the market is segmented into gasoline, electric, and pedal. Electric bike rental will showcase the fastest growth during the forecast period.

Global Bike Rental Market Share by Vehicle Type, 2019 (%)

Based on operation mode the market is bifurcated into dockless and docked. Dockless is expected to have a major market share with a lucrative growth rate. Dockless stations reduce the operating cost of the vehicle and provide ease to users to park their vehicles at multiple locations after the whole rental service gets completed.

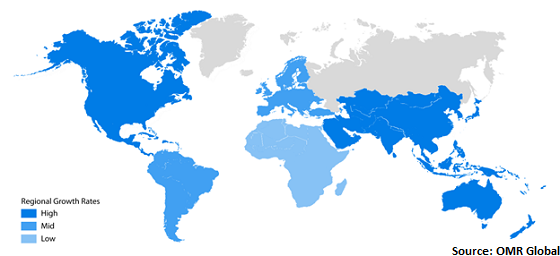

Regional Outlook

Based on geography, the market is further segmented into North America, Europe, Asia-Pacific, and the Rest of the World (RoW). The US, China, Germany, France, India are the prospective market for the bike rental market. A number of rental bike companies are working in North America and Europe including Bird Rides, Inc., Bolt Technology OÜ, CITYSCOOT Co., Cooltra Motosharing, S.L.U, JCDecaux Group, Skip Transport Inc., Nextbike GmbH. Moreover, as India and China are one of the largest markets of two-wheeler, the economies are expected to showcase a lucrative growth during the forecast period. Ola, Didi, Beijing Mobike Technology Co., Ltd., Bycyshare Technologies Pvt. Ltd., Rentrip Services Pvt. Ltd., Hellobike, Bounce, Yulu Bikes are some of the key companies working in Asia-Pacific market.

Global Bike Rental Market Growth, by Region 2020-2026

Market Players Outlook

The market is highly fragmented as a large number of companies are operating in their domestic market with small feet in few cities of a country. However, some established companies in the ride-sharing industry are also active in the market. Some of the key companies operating in the bike rental market include ANI Technologies Pvt. Ltd., Didi Chuxing Technology Co., Lyft, Inc., Wickedride Adventure Services Pvt. Ltd. (Bounce) and so on. These market players are adopting growth strategies including mergers & acquisitions, expansions, partnerships & collaborations, high discounts, and better services to remain competitive in the market. For instance, in October 2019, Uber Technologies, Inc., announced the integration with the French electric scooter service startup Cityscoot. After the integration, a user will be able to locate the Cityscoot fleet in the Uber mobile application. The aim of the Uber is to provide all the vehicle solution in a single mobile application.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global Bike Rental market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdowns

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Uber Technologies, Inc.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Lyft, Inc.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. ANI Technologies Pvt. Ltd

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Didi Chuxing Technology Co.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Wickedride Adventure Services Pvt. Ltd.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.3 Opportunities

5. Market Segmentation

5.1. Global Bike Rental Market By Vehicle Type

5.1.1. Motor Bike

5.1.2. Scooter

5.2. Global Bike Rental Market by Propulsion Technology

5.2.1. Gasoline

5.2.2. Electric

5.2.3. Pedal

5.3. Global Bike Rental Market by Operation Mode

5.3.1. Dockless

5.3.2. Docked

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Rest of North America

6.2. Europe

6.2.1. UK

6.2.2. Italy

6.2.3. France

6.2.4. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. ANI Technologies Pvt. Ltd.

7.2. Beijing Mobike Technology Co., Ltd.

7.3. Bird Rides, Inc.

7.4. Bolt Bikes

7.5. Bycyshare Technologies Pvt. Ltd. (I)

7.6. CITYSCOOT Co. (E)

7.7. Cooltra Motosharing, S.L.U (E)

7.8. CycleHop LLC (NA)

7.9. Didi Chuxing Technology Co.

7.10. JCDecaux Group (E)

7.11. Lyft, Inc.

7.12. Neutron Holdings, Inc. (NA)

7.13. Nextbike GmbH

7.14. Rentrip Services Pvt. Ltd. (I)

7.15. Scoot Rides, Inc. (NA)

7.16. Shanghai Junzheng Network Technology Co., Ltd. (Hellobike)

7.17. Skinny Labs Inc. (NA)

7.18. Skip Transport Inc. (NA)

7.19. Uber Technologies, Inc.

7.20. Wickedride Adventure Services Pvt. Ltd. (Bounce)

7.21. Yulu Bikes Pvt. Ltd. (I)

7.22. Vogo Automotive Pvt. Ltd. (I)

1. GLOBAL BIKE RENTAL MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2019-2026 ($ MILLION)

2. GLOBAL MOTORBIKE RENTAL MARKET RESEARCH AND ANALYSIS, 2019-2026 ($ MILLION)

3. GLOBAL SCOOTER RENTAL MARKET RESEARCH AND ANALYSIS, 2019-2026 ($ MILLION)

4. GLOBAL BIKE RENTAL MARKET RESEARCH AND ANALYSIS BY PROPULSION TECHNOLOGY, 2019-2026 ($ MILLION)

5. GLOBAL GASOLINE BIKE RENTAL MARKET RESEARCH AND ANALYSIS, 2019-2026 ($ MILLION)

6. GLOBAL ELECTRIC BIKE RENTAL MARKET RESEARCH AND ANALYSIS, 2019-2026 ($ MILLION)

7. GLOBAL PEDAL BIKE RENTAL MARKET RESEARCH AND ANALYSIS, 2019-2026 ($ MILLION)

8. GLOBAL BIKE RENTAL MARKET RESEARCH AND ANALYSIS BY OPERATION MODE, 2019-2026 ($ MILLION)

9. GLOBAL DOCKLESS BIKE RENTAL MARKET RESEARCH AND ANALYSIS, 2019-2026 ($ MILLION)

10. GLOBAL DOCKED BIKE RENTAL MARKET RESEARCH AND ANALYSIS, 2019-2026 ($ MILLION)

11. NORTH AMERICAN BIKE RENTAL MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

12. NORTH AMERICAN BIKE RENTAL MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2019-2026 ($ MILLION)

13. NORTH AMERICAN BIKE RENTAL MARKET RESEARCH AND ANALYSIS BY PROPULSION TECHNOLOGY, 2019-2026 ($ MILLION)

14. NORTH AMERICAN BIKE RENTAL MARKET RESEARCH AND ANALYSIS BY OPERATION MODE, 2019-2026 ($ MILLION)

15. EUROPEAN BIKE RENTAL MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

16. EUROPEAN BIKE RENTAL MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2019-2026 ($ MILLION)

17. EUROPEAN BIKE RENTAL MARKET RESEARCH AND ANALYSIS BY PROPULSION TECHNOLOGY, 2019-2026 ($ MILLION)

18. EUROPEAN BIKE RENTAL MARKET RESEARCH AND ANALYSIS BY OPERATION MODE, 2019-2026 ($ MILLION)

19. ASIA PACIFIC BIKE RENTAL MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

20. ASIA PACIFIC BIKE RENTAL MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2019-2026 ($ MILLION)

21. ASIA PACIFIC BIKE RENTAL MARKET RESEARCH AND ANALYSIS BY PROPULSION TECHNOLOGY, 2019-2026 ($ MILLION)

22. ASIA PACIFIC BIKE RENTAL MARKET RESEARCH AND ANALYSIS BY OPERATION MODE, 2019-2026 ($ MILLION)

23. REST OF THE WORLD BIKE RENTAL MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2019-2026 ($ MILLION)

24. REST OF THE WORLD BIKE RENTAL MARKET RESEARCH AND ANALYSIS BY PROPULSION TECHNOLOGY, 2019-2026 ($ MILLION)

25. REST OF THE WORLD BIKE RENTAL MARKET RESEARCH AND ANALYSIS BY OPERATION MODE, 2019-2026 ($ MILLION)

1. GLOBAL BIKE RENTAL MARKET SHARE BY VEHICLE TYPE, 2019 VS 2026 (%)

2. GLOBAL BIKE RENTAL MARKET SHARE BY PROPORTION TECHNOLOGY, 2019 VS 2026 (%)

3. GLOBAL BIKE RENTAL MARKET SHARE BY OPERATION MODE, 2019 VS 2026 (%)

4. GLOBAL BIKE RENTAL MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

5. US BIKE RENTAL MARKET SIZE, 2019-2026 ($ MILLION)

6. CANADA BIKE RENTAL MARKET SIZE, 2019-2026 ($ MILLION)

7. UK BIKE RENTAL MARKET SIZE, 2019-2026 ($ MILLION)

8. FRANCE BIKE RENTAL MARKET SIZE, 2019-2026 ($ MILLION)

9. GERMANY BIKE RENTAL MARKET SIZE, 2019-2026 ($ MILLION)

10. SPAIN BIKE RENTAL MARKET SIZE, 2019-2026 ($ MILLION)

11. ITALY BIKE RENTAL MARKET SIZE, 2019-2026 ($ MILLION)

12. REST OF EUROPE BIKE RENTAL MARKET SIZE, 2019-2026 ($ MILLION)

13. INDIA BIKE RENTAL MARKET SIZE, 2019-2026 ($ MILLION)

14. CHINA BIKE RENTAL MARKET SIZE, 2019-2026 ($ MILLION)

15. JAPAN BIKE RENTAL MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF WORLD BIKE RENTAL MARKET SIZE, 2019-2026 ($ MILLION)