Bio Decontamination Market

Global Bio Decontamination Market Size, Share & Trends Analysis Report by Product Type (Equipment, Consumables and Services), by Agent Type (Nitrogen Dioxide, Hydrogen Peroxide, Peracetic Acid, and Chlorine Dioxide), and by End-User (Hospitals, Pharmaceutical & Medical Device Companies, and Research Institutes) and Forecast 2019-2025 Update Available - Forecast 2025-2031

The global bio-decontamination market is estimated to grow at a CAGR of 5%, during the forecast period. The major factors contributing to the market growth include growing infections in hospitals and laboratories, coupled with the increasing surgical procedures in hospitals. As per the American Society of Plastic Surgeons (ASAPS), surgical procedures accounted for almost 60% of the total expenditures of healthcare, and nonsurgical procedures accounted for 40% of the total expenditures in the US. Thus, increasing surgical procedures encourages the demand for bio-decontamination in hospitals.

Stringent government regulations in healthcare are further contributing to the growth of the bio-decontamination market. The increasing government initiatives towards awareness of health and safety are encouraging the demand for bio-decontamination in the healthcare sector. Increasing incidence of wound infection due to poor hygiene, sanitation; among others are contributing to the growth of the market. The bio-decontamination is used to reduce the infection that arises in the hospitals due to unhygienic conditions caused due to rising surgical procedures. According to the ACC, the incidence of wound infection ranges from 1 to 1.5% in minor dermatological surgical procedures. Infections are inconvenient and painful and lead to failure or delay in wound healing and poor cosmetic outcomes.

Segmental Outlook

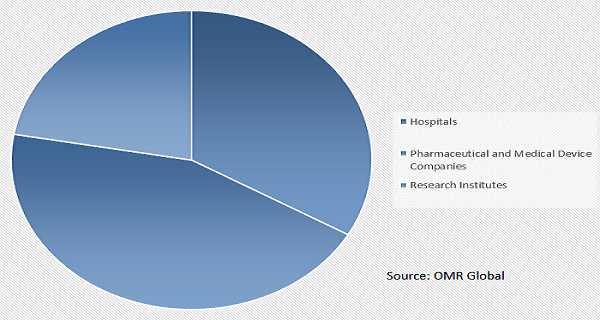

The global bio-decontamination market is classified on the basis of product type, agent type, and end-user. Based on product type, the market is segregated into equipment, consumables, and services. The bio-decontamination equipment segment is projected to have a significant share in the market due to the introduction of new and advanced equipment by the companies and its high application in hospitals. Based on the agent type, the market is segmented into nitrogen dioxide, hydrogen peroxide, peracetic acid, and chlorine dioxide. Based on end-user, the market is segmented into hospitals, pharmaceutical and medical device companies, and research institutes. Among end-users, the hospital segment is estimated to have significant market growth in the global market. The increasing number of surgical procedures and increasing infections is driving the segmental growth in the market.

Global Bio Decontamination Market Share by End-User, 2018(%)

Global bio-decontamination market to be driven by the pharmaceutical & medical device companies

The pharmaceutical and medical device companies’ segment exhibits a significant share in the global market. The market growth is backed by the growing application of bio-decontamination equipment and services in pharmaceutical manufacturing coupled with stringent manufacturing policies and regulations. In pharmaceutical production applications, the bio-decontamination includes the manufacturing of sterile pharmaceuticals and medical device in an aseptic cleanroom. There is a surging demand for innovative drugs and medical devices across the globe which has increased the pharmaceutical medical devices. Therefore, growing pharmaceutical manufacturing increases the adoption of bio-decontamination products and services among pharmaceutical medical device companies that further propel market growth.

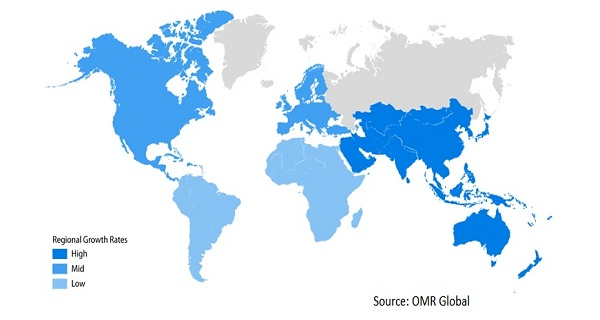

Regional Outlook

The global bio-decontamination market is classified on the basis of geography, including North America, Europe, Asia-Pacific, and the Rest of the World. Asia-Pacific is estimated to have considerable market growth in the global market during the forecast period. The market is mainly driven by the increasing pharmaceutical industry coupled with cohesive government initiatives towards infection control in hospitals. China, Japan, and India contribute significantly to the growth of the market due to increasing healthcare infrastructure and the growing adoption of bio-decontamination services in hospitals and pharmaceutical production.

Global Bio Decontamination Market Growth, by Region 2019-2025

North America contributes a significant share in the global market

North America is projected to have a significant share in the global market. The developed healthcare infrastructure increases the adoption of bio-decontamination in the hospitals and research institutes in the region. As per the CDC, around 2 million hospital patients contract a healthcare-associated infection (HAI) annually, which costs the hospitals over $45 billion every year and leads to the fatality of 100,000 patients in 2017. Significant advancements have been made in antimicrobial surface technology that enables to reduce patient and staff exposure to harmful microorganisms. Due to advancements in the medical field, decontamination products are mostly used in hospitals, which is integrated as antimicrobial to control microbiological contamination caused due to bacteria, viruses, and spores that contribute to the market growth.

Market Players Outlook

The key players in the bio-decontamination market are contributing significantly by providing advanced technology-based products and expanding their geographical presence across the globe. The key market players of the market include Ecolab Inc., Fedegari Autoclavi S.p.A., JCE Biotechnology SAS, STERIS Corp., TOMI Environmental Solutions, Inc., ClorDiSys Solutions, Inc., and The Ecosense Co. These market players adopt various strategies such as product launch, partnerships, collaborations, mergers, and acquisitions to sustain a strong position in the market. For instance, in August 2019, Ecolab Inc. announced the acquisition of Bioquell PLC, that offer hydrogen peroxide vapor bio-decontamination systems and services for the life sciences and healthcare industries. With this acquisition, the company will expand its portfolio in the bio-decontamination segment that further increases the revenue of the company in the market.

The Report Covers

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global bio-decontamination market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

1.2.3. By Stakeholders

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Ecolab Inc.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Fedegari Autoclavi S.p.A.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. JCE Biotechnology SAS

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. STERIS Corp.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. TOMI Environmental Solutions, Inc.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Bio Decontamination Market by Product Type

5.1.1. Equipment

5.1.2. Consumables and Services

5.2. Global Bio Decontamination Market by Agent Type

5.2.1. Nitrogen Dioxide

5.2.2. Hydrogen Peroxide

5.2.3. Peracetic Acid

5.2.4. Chlorine Dioxide

5.3. Global Bio Decontamination Market by End-User

5.3.1. Hospitals

5.3.2. Pharmaceutical and Medical Device Companies

5.3.3. Research Institutes

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Amira S.r.l.

7.2. Astell Scientific Ltd.

7.3. Bio Decontamination Ltd.

7.4. ClorDiSys Solutions, Inc.

7.5. Ecolab Inc.

7.6. Fedegari Autoclavi S.p.A.

7.7. Howorth Air Technology Ltd.

7.8. JCE Biotechnology SAS

7.9. Noxilizer, Inc.

7.10. PMT LLC

7.11. Solidfog Technologies SPRL

7.12. STERIS Corp.

7.13. The Ecosense Co.

7.14. TOMI Environmental Solutions, Inc.

7.15. Vaisala Oyj

1. GLOBAL BIO DECONTAMINATION MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2018-2025 ($ MILLION)

2. GLOBAL BIO DECONTAMINATION EQUIPMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL BIO DECONTAMINATION CONSUMABLES AND SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL BIO DECONTAMINATION MARKET RESEARCH AND ANALYSIS BY AGENT TYPE, 2018-2025 ($ MILLION)

5. GLOBAL NITROGEN DIOXIDE BIO DECONTAMINATION MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

6. GLOBAL HYDROGEN PEROXIDE BIO DECONTAMINATION MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

7. GLOBAL PERACETIC ACID BIO DECONTAMINATION MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

8. GLOBAL CHLORINE DIOXIDE DECONTAMINATION MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

9. GLOBAL BIO DECONTAMINATION MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

10. GLOBAL BIO DECONTAMINATION IN HOSPITALS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

11. GLOBAL BIO DECONTAMINATION IN PHARMACEUTICAL AND MEDICAL DEVICE COMPANIES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

12. GLOBAL BIO DECONTAMINATION IN RESEARCH INSTITUTES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

13. GLOBAL BIO DECONTAMINATION MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

14. NORTH AMERICAN BIO DECONTAMINATION MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2018-2025 ($ MILLION)

15. NORTH AMERICAN BIO DECONTAMINATION MARKET RESEARCH AND ANALYSIS BY AGENT TYPE, 2018-2025 ($ MILLION)

16. NORTH AMERICAN BIO DECONTAMINATION MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

17. EUROPEAN BIO DECONTAMINATION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

18. EUROPEAN BIO DECONTAMINATION MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2018-2025 ($ MILLION)

19. EUROPEAN BIO DECONTAMINATION MARKET RESEARCH AND ANALYSIS BY AGENT TYPE, 2018-2025 ($ MILLION)

20. EUROPEAN BIO DECONTAMINATION MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

21. ASIA-PACIFIC BIO DECONTAMINATION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

22. ASIA-PACIFIC BIO DECONTAMINATION MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2018-2025 ($ MILLION)

23. ASIA-PACIFIC BIO DECONTAMINATION MARKET RESEARCH AND ANALYSIS BY AGENT TYPE, 2018-2025 ($ MILLION)

24. ASIA-PACIFIC BIO DECONTAMINATION MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

25. REST OF THE WORLD BIO DECONTAMINATION MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2018-2025 ($ MILLION)

26. REST OF THE WORLD BIO DECONTAMINATION MARKET RESEARCH AND ANALYSIS BY AGENT TYPE, 2018-2025 ($ MILLION)

27. REST OF THE WORLD BIO DECONTAMINATION MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

1. GLOBAL BIO DECONTAMINATION MARKET SHARE BY PRODUCT TYPE, 2018 VS 2025 (%)

2. GLOBAL BIO DECONTAMINATION MARKET SHARE BY AGENT TYPE, 2018 VS 2025 (%)

3. GLOBAL BIO DECONTAMINATION MARKET SHARE BY END-USER, 2018 VS 2025 (%)

4. GLOBAL BIO DECONTAMINATION MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

5. US BIO DECONTAMINATION MARKET SIZE, 2018-2025 ($ MILLION)

6. CANADA BIO DECONTAMINATION MARKET SIZE, 2018-2025 ($ MILLION)

7. UK BIO DECONTAMINATION MARKET SIZE, 2018-2025 ($ MILLION)

8. FRANCE BIO DECONTAMINATION MARKET SIZE, 2018-2025 ($ MILLION)

9. GERMANY BIO DECONTAMINATION MARKET SIZE, 2018-2025 ($ MILLION)

10. ITALY BIO DECONTAMINATION MARKET SIZE, 2018-2025 ($ MILLION)

11. SPAIN BIO DECONTAMINATION MARKET SIZE, 2018-2025 ($ MILLION)

12. ROE BIO DECONTAMINATION MARKET SIZE, 2018-2025 ($ MILLION)

13. INDIA BIO DECONTAMINATION MARKET SIZE, 2018-2025 ($ MILLION)

14. CHINA BIO DECONTAMINATION MARKET SIZE, 2018-2025 ($ MILLION)

15. JAPAN BIO DECONTAMINATION MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF ASIA-PACIFIC BIO DECONTAMINATION MARKET SIZE, 2018-2025 ($ MILLION)

17. REST OF THE WORLD BIO DECONTAMINATION MARKET SIZE, 2018-2025 ($ MILLION)