Bio-Implant Market

Global Bio-Implant Market Size, Share & Trends Analysis Report by Types (Cardiovascular, Dental & Prosthetic Implants, Orthopedic/Joint Reconstruction & Replacements, Spinal implants, and Others), By Material (Ceramics, Polymers, Alloys, and Biomaterials Metal), and Forecast 2019-2025 Update Available - Forecast 2025-2035

The global bio-implant market is anticipated to grow at a CAGR of over 5% during the forecast period. The bio-implant is specifically used for the alignment of distorted organ or joints and in the replacement procedures. Bio-implant materials available in the market are diverse in nature and are chosen according to the requirements. The success of any bio implant depends on certain factors such as the biomaterial chosen, biomechanics, biological tissue, and body serviceability.

Additionally, factors such as increasing incidences of diabetes, cardiovascular diseases, and dental problems will also drive the Bio-implant market as they have the potential application of bio-implant. Additionally, increasing road accidents will also lead to fuel the bio-implant market across the globe. However, the limited awareness of bio-implant in developing economies as compared to developed economies coupled with its high cost will present as a challenging factor for the bio-implant market growth.

Segmental Outlook

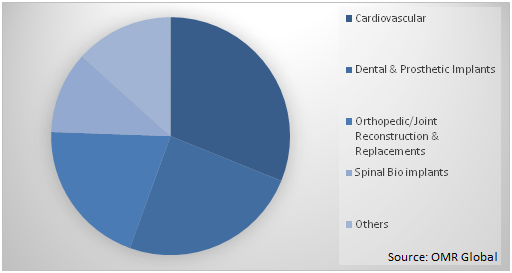

The global bio-implant market is segmented on the basis of the types and material. Based on the type, the market is sub-segmented into cardiovascular, dental &prosthetic implants, orthopedic/joint reconstruction &replacements, spinal implants, and others. Based on the material, the market is sub-segmented into ceramics, polymers, alloys, and biomaterials metal. The biomaterial metal segment is estimated to hold a prominent share in the market. These materials have higher tensile strength and high resistance to corrosion as compared to other materials such as ceramic.

Global Bio-implant Market Share by type, 2018 (%)

Cardiovascular to Contribute a Prominent Share

Based on the types segment, cardiovascular sub-segment is anticipated to hold a significant share in the bio-implant market. The prominent share of the segment in the market is attributed to the increasing cardiovascular conditions across the globe. According to World health Organization (WHO) in 2016, an estimated of 17.9 million people faced fatality due to cardiovascular disease across the globe. This share represents 31% of all global fatalities.

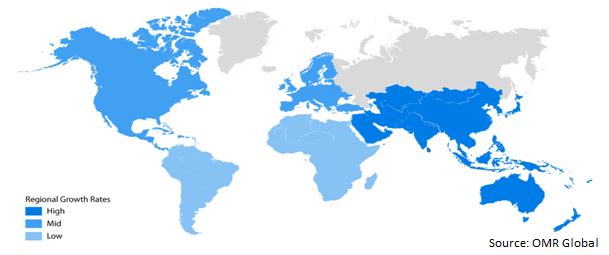

Regional Outlooks

The global bio-implant market is further segmented based on geography into North America, Europe, Asia-Pacific, and the Rest of the World. North America is expected to hold the largest market share in the bio-implant during the forecast period. The well developed and technologically advanced healthcare sector is anticipated to drive the bio-implant market in the region. Moreover, the increasing cases of ophthalmic disease across the region is anticipated to drive the global bio-implant market. As per the American Academy of Ophthalmology, around 2.9 million Americans of age 40 and older have low vision and nearly 4.2 million Americans age 40 and older are visually impaired.

Global Bio-implant Market Growth by Region, 2019-2025

Asia-Pacific will Augment with the Fastest Growth Rate in the Bio-Implant Market

Asia-Pacific is anticipated to exhibit the fastest growth rate in the bio-Implant market due to the growing healthcare sector researches across the region. Additionally, the increase in number of surgical procedures that requires implants coupled with surge in adoption of advanced medical technologies across the region further give a boost to the regional growth of the market. As per the Organization for Economic Co-operation and Development (OECD) in 2017, about 1.4 million orthopaedic procedures including hip and knee replacement were performed in the US.

Market Players Outlook

Some of the key players of the bio-implant market include Zimmer Biomet Holdings, Inc., Smith & Nephew plc, Medtronic PLC, Orthofix Medical Inc., Cochlear Ltd., Arthrex Inc., Boston Scientific Corp., DENTSPLY SIRONA Inc., Wright Medical Group N.V., OSSIO Inc., and others. The market players are considerably contributing to the market growth by adopting various strategies including new product launch, mergers, and acquisitions, collaborations to stay competitive in the market.

Recent Activities

- In March 2020, OSSIO, Inc., announced the FDA clearance of its bio-integrative implants called OSSIO fiber Hammertoe Fixation System. The Fixation will be intended for maintenance of alignment and fixation of bone fractures, osteotomies, arthrodesis and bone grafts. These integrative implants will be disposable, sterile instrumentation and will be available in various sizes.

- In January 2019, OSSIO, Inc., received the FDA clearance between OSSIO fiber Bone Pin Family. It was later released for use in the foot and ankle segment for the treatment of common forefoot conditions, such as hammertoe, where hardware removal surgeries are prevalent. The implant is made from a proprietary natural mineral fiber matrix. The bio-integrative material properties of the implant provide physician with a more biologically friendly way to restore the stability and mobility of the patient.

- In October 2017, Smith & Nephew plc has entered into a definitive agreement to acquire Rotation Medical Inc., a developer of a novel tissue regeneration technology for shoulder rotator cuff repair, for an initial cash consideration of $125 million and up to $85 million over the next five years.

The Report Covers

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global Bio-implant market. Based on the availability of data, information related to products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Key Strategy Analysis

3.2. Key Company Analysis

3.2.1. Medtronic Plc

3.2.1.1. Overview

3.2.1.2. Financial Analysis

3.2.1.3. SWOT Analysis

3.2.1.4. Recent Developments

3.2.2. Smith & Nephew plc

3.2.2.1. Overview

3.2.2.2. Financial Analysis

3.2.2.3. SWOT Analysis

3.2.2.4. Recent Developments

3.2.3. Orthofix Medical, Inc.

3.2.3.1. Overview

3.2.3.2. Financial Analysis

3.2.3.3. SWOT Analysis

3.2.3.4. Recent Developments

3.2.4. Zimmer Biomet Holdings, Inc.

3.2.4.1. Overview

3.2.4.2. Financial Analysis

3.2.4.3. SWOT Analysis

3.2.4.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Bio-implants Market by Types

5.1.1. Cardiovascular

5.1.2. Dental &Prosthetic Implants

5.1.3. Orthopedic/Joint Reconstruction &Replacements

5.1.4. Spinal implants

5.1.5. Others

5.2. Global Bio-implants Market by Material

5.2.1. Ceramics

5.2.2. Polymers

5.2.3. Alloys

5.2.4. Biomaterials Metal

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. aap Implantate AG

7.2. Abbott Laboratories Inc.

7.3. Arthrex Inc.

7.4. Alpha-Bio Tec. Ltd.

7.5. BIOTRONIK SE & Co. KG

7.6. Boston Scientific Corp.

7.7. Cochlear Ltd.

7.8. Dentsply Sirona Inc.

7.9. Depuy Synthes Products LLC (Johnson & Johnson Medical, Inc.)

7.10. Exactech, Inc.

7.11. Invibio Ltd.

7.12. KLS Martin Group

7.13. Medtronic Plc

7.14. Nobel Biocare Services AG

7.15. Organogenesis Holdings Inc.

7.16. Orthofix Medical Inc.

7.17. OSSIO Inc.

7.18. Smith & Nephew plc

7.19. Stryker Corp

7.20. Wright Medical Group N.V.

7.21. Zimmer Biomet Holdings, Inc.

1. GLOBAL BIO-IMPLANTS MARKET RESEARCH AND ANALYSIS BY TYPES, 2018-2025 ($ MILLION)

2. GLOBAL CARDIOVASCULAR BIO-IMPLANTS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL DENTAL &PROSTHETIC BIO-IMPLANTS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL ORTHOPEDIC/JOINT RECONSTRUCTION & REPLACEMENT BIO-IMPLANTS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

5. GLOBAL SPINAL BIO-IMPLANTS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

6. GLOBAL OTHER BIO-IMPLANTS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

7. GLOBAL BIO-IMPLANTS MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2018-2025 ($ MILLION)

8. GLOBAL CERAMICS BIO-IMPLANTS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

9. GLOBAL POLYMERS BIO-IMPLANTS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

10. GLOBAL ALLOYS BIO-IMPLANTS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

11. GLOBAL METAL BIO-IMPLANTS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

12. GLOBAL BIO-IMPLANTS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

13. NORTH AMERICAN BIO-IMPLANTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

14. NORTH AMERICAN BIO-IMPLANTS MARKET RESEARCH AND ANALYSIS BY TYPES, 2018-2025 ($ MILLION)

15. NORTH AMERICAN BIO-IMPLANTS MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2018-2025 ($ MILLION)

16. EUROPEAN BIO-IMPLANTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

17. EUROPEAN BIO-IMPLANTS MARKET RESEARCH AND ANALYSIS BY TYPES, 2018-2025 ($ MILLION)

18. EUROPEAN BIO-IMPLANTS MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2018-2025 ($ MILLION)

19. ASIA-PACIFIC BIO-IMPLANTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

20. ASIA-PACIFIC BIO-IMPLANTS MARKET RESEARCH AND ANALYSIS BY TYPES, 2018-2025 ($ MILLION)

21. ASIA-PACIFIC BIO-IMPLANTS MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2018-2025 ($ MILLION)

22. REST OF THE WORLD BIO-IMPLANTS MARKET RESEARCH AND ANALYSIS BY TYPES, 2018-2025 ($ MILLION)

23. REST OF THE WORLD BIO-IMPLANTS MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2018-2025 ($ MILLION)

1. GLOBAL BIO-IMPLANTS MARKET SHARE BY TYPES, 2018 VS 2025 (%)

2. GLOBAL BIO-IMPLANTS MARKET SHARE BY MATERIAL, 2018 VS 2025 (%)

3. GLOBAL BIO-IMPLANTS MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

4. US BIO-IMPLANTS MARKET SIZE, 2018-2025 ($ MILLION)

5. CANADA BIO-IMPLANTS MARKET SIZE, 2018-2025 ($ MILLION)

6. UK BIO-IMPLANTS MARKET SIZE, 2018-2025 ($ MILLION)

7. FRANCE BIO-IMPLANTS MARKET SIZE, 2018-2025 ($ MILLION)

8. GERMANY BIO-IMPLANTS MARKET SIZE, 2018-2025 ($ MILLION)

9. ITALY BIO-IMPLANTS MARKET SIZE, 2018-2025 ($ MILLION)

10. SPAIN BIO-IMPLANTS MARKET SIZE, 2018-2025 ($ MILLION)

11. ROE BIO-IMPLANTS MARKET SIZE, 2018-2025 ($ MILLION)

12. INDIA BIO-IMPLANTS MARKET SIZE, 2018-2025 ($ MILLION)

13. CHINA BIO-IMPLANTS MARKET SIZE, 2018-2025 ($ MILLION)

14. JAPAN BIO-IMPLANTS MARKET SIZE, 2018-2025 ($ MILLION)

15. REST OF ASIA-PACIFIC BIO-IMPLANTS MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF THE WORLD BIO-IMPLANTS MARKET SIZE, 2018-2025 ($ MILLION)