Bioanalytical Testing Services Market

Bioanalytical Testing Services Market Size, Share & Trends Analysis Report, By Molecule (Large Molecule and Small Molecule), By Test (Pharmacokinetic Test, Pharmacodynamic Test, Bioequivalence Test, Bioavailability Test, and ADME Test), By Application (Oncology, Neurology, Infectious Diseases, Gastroenterology, Cardiology, and Others), By End-User (Pharmaceutical and Biopharmaceutical Companies, Contract Development and Manufacturing Organizations, Contract Research Organizations, and Others), Forecast Period (2022-2028) Update Available - Forecast 2025-2035

Bioanalytical testing services market is anticipated to grow at a CAGR of 10.6% during the forecast period. Bioanalytics is an important tool in drug discovery and development for analysing the concentration of drugs and their metabolites as well as various pharmacodynamic biomarkers in biological fluids. Bioanalytical testing services are used to measure the levels of various biomolecules in the sample. These tests are often used to diagnose and monitor diseases, and to evaluate the effectiveness of treatments. Bioanalytical tests can be performed on blood, urine, or other body fluids, and can measure the levels of proteins, enzymes, hormones, and other biomolecules. When a new drug is introduced bioanalytical testing results constitute the foundational block toward drug approval by FDA.

Moreover, the rising prevalence of chronic diseases and the increasing frequency of outsourcing R&D activities by the major pharmaceutical companies are some key factors driving the demand for bioanalytical testing services. Innovation and new product developments are expected to further boost the demand for these services. For instance, in June 2022, Waters Corp. announced a collaboration with BioInfra, a pioneering contract research organization company for the pharmaceutical and clinical fields, to jointly establish the ASEAN Academy for Bioanalysis. The academy is dedicated to providing scientists with the hands-on knowledge required to design and perform a variety of bioanalytical methods, which are vital throughout every stage of drug discovery and development.

Segmental Outlook

The global bioanalytical testing services market is segmented based on the molecule, test, application and end-user. Based on the molecule, the market is segmented into the large molecule and small molecule. Based on the test, the market is segmented into the pharmacokinetic test, pharmacodynamic test, bioequivalence test, bioavailability test, and ADME test. Based on the application, the market is segmented into oncology, neurology, infectious diseases, gastroenterology, cardiology, and others. Based on the end-user, the market is segmented into pharmaceutical and biopharmaceutical companies, contract development and manufacturing organizations, contract research organizations, and others.

Small Molecule to Witness Significant Share in the Global Bioanalytical Testing Services Market During the Forecast Period.

The small molecule segment is expected to hold a potential share in the market during the forecast period. Generic and branded drug compounds are mostly small molecules. Generic manufacturers have to conduct and submit bioanalytical testing results to FDA for filing the patent. This, in, turn, drives the adoption of bioanalytical testing for small molecules. On the other hand, the large molecule segment is expected to register the fastest CAGR during the forecast period. This is due to a rich pipeline of amino acid-based molecules or biologics. In addition, testing of these molecules requires advanced analytical instruments, and infrastructure, which is available from bioanalytical services providers. Hence, outsourcing bioanalytical testing of these molecules is likely to be the prevailing trend during the forecast period.

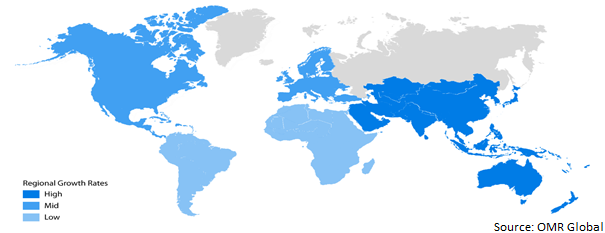

Regional Outlook

The global bioanalytical testing services market is further segmented based on geography including North America (the US and Canada), Europe (UK, Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East &Africa and Latin America). The market can be analyzed for a particular region or country level as per the requirement. North America, followed by Europe, and Asia Pacific region dominated the global bioanalytical services market. Factors such as the rise in the demand for bioanalytical services, the large number of ongoing clinical trials, and the presence of high-end pharmaceutical companies are leading drivers of the bioanalytical testing services in the North American region.

Global Bioanalytical Testing Services Market Growth, by Region 2022-2028

Market Players Outlook

The major companies serving the global bioanalytical testing services market include Charles River Laboratories Inc., Eurofins Scientific SE, SGS SA, Medpace, Inc., and Wuxi AppTec Co., Ltd. The market players are contributing to the market growth by the adoption of various strategies including mergers and acquisitions, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in June 2022, Charles River Laboratories Inc. acquired Explora BioLabs Holdings, Inc., a provider of contract vivarium research services, based in San Diego, CA, US for approximately $295 million. Explora BioLabs currently operates more than 15 preclinical vivarium facilities, offering AAALAC-accredited rental space in Southern California, San Francisco, and Boston-Cambridge bio hubs, with a planned expansion in Seattle in 2022. In May 2022, Charles River Laboratories International, Inc. paired with the drug discovery technology firm on Logica, an artificial intelligence (AI) tool designed to accelerate the development of new treatments.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global bioanalytical testing services market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Charles River Laboratories Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Eurofins Scientific SE

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. SGS SA

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Medpace, Inc.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. WuXi AppTec Co., Ltd.,

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Bioanalytical Testing Services Market by Molecule

4.1.1. Large Molecule

4.1.2. Small Molecule

4.2. Global Bioanalytical Testing Services Market by Test

4.2.1. Pharmacokinetic Test

4.2.2. Pharmacodynamic Test

4.2.3. Bioequivalence Test

4.2.4. Bioavailability Test

4.2.5. ADME Test

4.3. Global Bioanalytical Testing Services Market by Application

4.3.1. Oncology

4.3.2. Neurology

4.3.3. Infectious Diseases

4.3.4. Gastroenterology

4.3.5. Cardiology

4.3.6. Others

4.4. Global Bioanalytical Testing Services Market by End-User

4.4.1. Pharmaceutical and Biotech Companies

4.4.2. Contract Development and Manufacturing Organizations

4.4.3. Contract Research Organizations

4.4.4. Others

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Absorption Systems LLC

6.2. Almac Group

6.3. Bioneeds India Pvt. Ltd.

6.4. CD BioSciences

6.5. Covance, Inc.

6.6. ICON plc

6.7. Intertek Group Plc

6.8. Laboratory Corporation of America Holdings

6.9. Pace Analytical Services LLC

6.10. Parexel International Corp.

6.11. PPD, Inc.

6.12. Sartorius AG

6.13. Syneos Health

6.14. Toxikon

6.15. Vipragen Biosciences Private Ltd.

1. GLOBAL BIOANALYTICAL TESTING SERVICES MARKET RESEARCH AND ANALYSIS BY MOLECULE, 2021-2028 ($ MILLION)

2. GLOBAL BIOANALYTICAL TESTING SERVICES MARKET FOR LARGE MOLECULE RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL BIOANALYTICAL TESTING SERVICES MARKET FOR SMALL MOLECULE RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL BIOANALYTICAL TESTING SERVICES MARKET RESEARCH AND ANALYSIS BY TEST, 2021-2028 ($ MILLION)

5. GLOBAL PHARMACOKINETIC TEST SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

6. GLOBAL PHARMACODYNAMIC TEST SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7. GLOBAL BIOEQUIVALENCE TEST SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

8. GLOBAL BIOAVILABILITY TEST MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

9. GLOBAL ADME TESTING SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

10. GLOBAL BIOANALYTICAL TESTING SERVICES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

11. GLOBAL BIOANALYTICAL TESTING SERVICES FOR ONCOLOGY MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

12. GLOBAL BIOANALYTICAL TESTING SERVICES FOR NEUROLOGY MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

13. GLOBAL BIOANALYTICAL TESTING SERVICES FOR INFECTIOUS DISEASES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

14. GLOBAL BIOANALYTICAL TESTING SERVICES FOR GASTROENTEROLOGY MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

15. GLOBAL BIOANALYTICAL TESTING SERVICES FOR CARDIOLOGY MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

16. GLOBAL BIOANALYTICAL TESTING SERVICES FOR OTHER APPLICATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

17. GLOBAL BIOANALYTICAL TESTING SERVICES MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

18. GLOBAL BIOANALYTICAL TESTING SERVICES IN PHARMACEUTICAL AND BIOTECH COMPANIES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

19. GLOBAL BIOANALYTICAL TESTING SERVICES IN CONTRACT DEVELOPMENT AND MANUFACTURING ORGANIZATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

20. GLOBAL BIOANALYTICAL TESTING SERVICES IN CONTRACT RESEARCH ORGANIZATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

21. GLOBAL BIOANALYTICAL TESTING SERVICES MARKET IN OTHER END-USERS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

22. GLOBAL BIOANALYTICAL TESTING SERVICES MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2021-2028 ($ MILLION)

23. NORTH AMERICAN BIOANALYTICAL TESTING SERVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

24. NORTH AMERICAN BIOANALYTICAL TESTING SERVICES MARKET RESEARCH AND ANALYSIS BY MOLECULE, 2021-2028 ($ MILLION)

25. NORTH AMERICAN BIOANALYTICAL TESTING SERVICES MARKET RESEARCH AND ANALYSIS BY TEST, 2021-2028 ($ MILLION)

26. NORTH AMERICAN BIOANALYTICAL TESTING SERVICES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

27. NORTH AMERICAN BIOANALYTICAL TESTING SERVICES MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

28. EUROPEAN BIOANALYTICAL TESTING SERVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

29. EUROPEAN BIOANALYTICAL TESTING SERVICES MARKET RESEARCH AND ANALYSIS BY MOLECULE, 2021-2028 ($ MILLION)

30. EUROPEAN BIOANALYTICAL TESTING SERVICES MARKET RESEARCH AND ANALYSIS BY TEST, 2021-2028 ($ MILLION)

31. EUROPEAN BIOANALYTICAL TESTING SERVICES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

32. EUROPEAN BIOANALYTICAL TESTING SERVICES MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

33. ASIA-PACIFIC BIOANALYTICAL TESTING SERVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

34. ASIA-PACIFIC BIOANALYTICAL TESTING SERVICES MARKET RESEARCH AND ANALYSIS BY MOLECULE, 2021-2028 ($ MILLION)

35. ASIA-PACIFIC BIOANALYTICAL TESTING SERVICES MARKET RESEARCH AND ANALYSIS BY TEST, 2021-2028 ($ MILLION)

36. ASIA-PACIFIC BIOANALYTICAL TESTING SERVICES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

37. ASIA-PACIFIC BIOANALYTICAL TESTING SERVICES MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

38. REST OF THE WORLD BIOANALYTICAL TESTING SERVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

39. REST OF THE WORLD BIOANALYTICAL TESTING SERVICES MARKET RESEARCH AND ANALYSIS BY MOLECULE, 2021-2028 ($ MILLION)

40. REST OF THE WORLD BIOANALYTICAL TESTING SERVICES MARKET RESEARCH AND ANALYSIS BY TEST, 2021-2028 ($ MILLION)

41. REST OF THE WORLD BIOANALYTICAL TESTING SERVICES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

42. REST OF THE WORLD BIOANALYTICAL TESTING SERVICES MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

1. GLOBAL BIOANALYTICAL TESTING SERVICES MARKET SHARE BY MOLECULE, 2021 VS 2028 (%)

2. GLOBAL BIOANALYTICAL TESTING SERVICES FOR LARGE MOLECULE MARKET SHARE BY REGION, 2021 VS 2028 (%)

3. GLOBAL BIOANALYTICAL TESTING SERVICES FOR SMALL MOLECULE MARKET SHARE BY REGION, 2021 VS 2028 (%)

4. GLOBAL BIOANALYTICAL TESTING SERVICES MARKET SHARE BY TEST, 2021 VS 2028 (%)

5. GLOBAL PHARMACOKINETIC TEST SERVICES MARKET BY REGION, 2021 VS 2028 (%)

6. GLOBAL PHARMACODYNAMIC TEST SERVICES MARKET BY REGION, 2021 VS 2028 (%)

7. GLOBAL BIOEQUIVALENCE TEST SERVICES MARKET BY REGION, 2021 VS 2028 (%)

8. GLOBAL BIOAVAILABILITY TEST SERVICES MARKET BY REGION, 2021 VS 2028 (%)

9. GLOBAL ADME TEST SERVICES MARKET BY REGION, 2021 VS 2028 (%)

10. GLOBAL BIOANALYTICAL TESTING SERVICES MARKET SHARE BY APPLICATION, 2021 VS 2028 (%)

11. GLOBAL BIOANALYTICAL TESTING SERVICES FOR ONCOLOGY MARKET SHARE BY REGION, 2021 VS 2028 (%)

12. GLOBAL BIOANALYTICAL TESTING SERVICES FOR NEUROLOGY MARKET SHARE BY REGION, 2021 VS 2028 (%)

13. GLOBAL BIOANALYTICAL TESTING SERVICES FOR INFECTIOUS DISEASES MARKET SHARE BY REGION, 2021 VS 2028 (%)

14. GLOBAL BIOANALYTICAL TESTING SERVICES FOR GASTROENTEROLOGY MARKET SHARE BY REGION, 2021 VS 2028 (%)

15. GLOBAL BIOANALYTICAL TESTING SERVICES FOR CARDIOLOGY MARKET SHARE BY REGION , 2021 VS 2028 (%)

16. GLOBAL BIOANALYTICAL TESTING SERVICES FOR OTHER APPLICATIONS MARKET SHARE BY REGION, 2021 VS 2028 (%)

17. GLOBAL BIOANALYTICAL TESTING SERVICES MARKET SHARE BY END-USER, 2021 VS 2028 (%)

18. GLOBAL BIOANALYTICAL TESTING SERVICES FOR PHARMACEUTICAL AND BIOPHARMACEUTICAL COMPANIES MARKET SHARE BY REGION, 2021 VS 2028 (%)

19. GLOBAL BIOANALYTICAL TESTING SERVICES FOR CONTRACT DEVELOPMENT AND MANUFACTURING ORGANIZATIONS MARKET SHARE BY REGION, 2021 VS 2028 (%)

20. GLOBAL BIOANALYTICAL TESTING SERVICES FOR CONTRACT RESEARCH ORGANIZATIONS MARKET SHARE BY REGION, 2021 VS 2028 (%)

21. GLOBAL BIOANALYTICAL TESTING SERVICES FOR OTHER END-USERS MARKET SHARE BY REGION, 2021 VS 2028 (%)

22. GLOBAL BIOANALYTICAL TESTING SERVICES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

23. US BIOANALYTICAL TESTING SERVICES MARKET SIZE, 2021-2028 ($ MILLION)

24. CANADA BIOANALYTICAL TESTING SERVICES MARKET SIZE, 2021-2028 ($ MILLION)

25. UK BIOANALYTICAL TESTING SERVICES MARKET SIZE, 2021-2028 ($ MILLION)

26. FRANCE BIOANALYTICAL TESTING SERVICES MARKET SIZE, 2021-2028 ($ MILLION)

27. GERMANY BIOANALYTICAL TESTING SERVICES MARKET SIZE, 2021-2028 ($ MILLION)

28. ITALY BIOANALYTICAL TESTING SERVICES MARKET SIZE, 2021-2028 ($ MILLION)

29. SPAIN BIOANALYTICAL TESTING SERVICES MARKET SIZE, 2021-2028 ($ MILLION)

30. REST OF EUROPE BIOANALYTICAL TESTING SERVICES MARKET SIZE, 2021-2028 ($ MILLION)

31. INDIA BIOANALYTICAL TESTING SERVICES MARKET SIZE, 2021-2028 ($ MILLION)

32. CHINA BIOANALYTICAL TESTING SERVICES MARKET SIZE, 2021-2028 ($ MILLION)

33. JAPAN BIOANALYTICAL TESTING SERVICES MARKET SIZE, 2021-2028 ($ MILLION)

34. SOUTH KOREA BIOANALYTICAL TESTING SERVICES MARKET SIZE, 2021-2028 ($ MILLION)

35. REST OF ASIA-PACIFIC BIOANALYTICAL TESTING SERVICES MARKET SIZE, 2021-2028 ($ MILLION)

36. REST OF THE WORLD BIOANALYTICAL TESTING SERVICES MARKET SIZE, 2021-2028 ($ MILLION)