Biobanking Market

Global Biobanking Market Size, Share & Trends Analysis Report by Product Type (Equipment, Consumables, and Services & Software), By Sample Type (Blood Products, Human Tissues, Nucleic Acid, Cell Lines, Biological Fluid, and Human Waste Product), and by Applications (Clinical Research, and Regenerative Medicine) Forecast, 2021-2027 Update Available - Forecast 2025-2035

The global biobanking market is anticipated to grow at a substantial CAGR of 6.7% during the forecast period. The factors that augment the growth of the market include an increase in the number of research activities across the globe for studying different types of diseases including cancer. The growing need for cost-effective drug discovery and development and the increasing popularity of personalized medicine have also been estimated to contribute to the growth of market share. Moreover, funding from government and private ventures in biobanks plays a vital role in the biobanking market. For instance, in March 2017, UK Biobank and GSK announced to generate genetic sequence data from the 500,000 volunteer participants in the UK Biobank resource which enabled researchers to gain valuable insights for the development of new medicines. Moreover, in September 2019, Amgen, AstraZeneca, GlaxoSmithKline, and Johnson & Johnson agreed to pay around $120 million for exclusive genetic data for several people. Such strategies aim to provide valuable insights to the researchers which support the advancements in the development of new medicines for different diseases.

However, strict regulatory framework, high cost of automation, and sues regarding biospecimen sample procurement are some of the restraints that are expected to challenge the growth of the market in the forecast period. Conversely, increasing research in cell and gene therapy, rise in large geriatric population base across the globe, and advancement in technologies are expected to create opportunities for the market players in the forecast period. Biobanks evolution enabled by cloud-based technology is the better way to store, analyze and share biospecimens for effective data management.

Impact of COVID-19 on the Biobanking Market

The biobanking market’s growth was positively affected by the COVID-19 pandemic since December 2019. This was mainly due to the increase in researches across the globe to control the prevalence of COVID-19 and other diseases. Biobanks had to communicate and search globally to order needed supplies to collect and store specimens rapidly. The advancement in clinical trials involving vaccine development and longitudinal studies involving outcomes data has increased the demand for biobanks. Although, the governments have established rapid COVID-19 biobanks across the globe to collect biospecimen. The Ministry of health and welfare was assigned to establish COVID-19 biobanks to collect blood samples from patients that will assist in R&D activities. The labor forces have also increased to maintain efficient biobanks. The market is estimated to see “W” shape growth in the forecast period.

Segmental Outlook

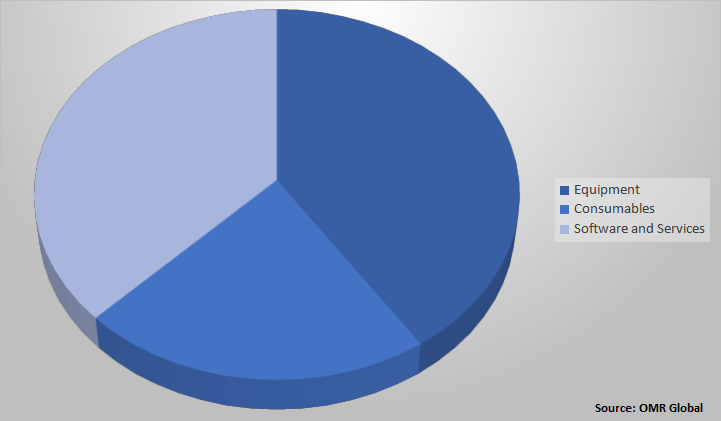

The global biobanking market is segmented based on product type, sample type, and segment. Based on product type segment, the market is segmented into equipment, consumables, and software and services. Among these, the equipment segment is expected to grow with the highest share due to the increase in the new biobanks among various geographies across the globe. Based on the sample type segment, the market is segmented into blood products, human tissues, nucleic acid, cell lines, biological fluid, and human waste products. Further, based on the application segment, the market is bifurcated into clinical research and regenerative medicine.

Biobanking Market Share by Product Type, 2020 (%)

Biobanks Equipment Segment to Hold a Lucrative Share in the Global Bio-Banking market

The equipment segment held one of the largest shares in the global biobanking market in the type segment in 2020. The growth was mainly attributed to the high demand for equipment due to the increasing number of biosamples across the globe. A wide range of equipment such as bio-freezers, bio -refrigerators, and monitoring systems are required for sample collection and storage to perform several types of clinical trials. The services segment is estimated to be one of the fastest-growing segments owing to the need for developing precision medicines.

The clinical research segment and human tissue segment held one of the largest shares in their respective segments in 2020. The blood product segment in the sample type segment was estimated to be one of the fastest-growing segments owing to the rising prevalence of COVID-19 which demanded the huge need for blood samples. Separate facilities were established to set up targeted activities associated with a new collection of blood samples from positive COVID-19 patients.

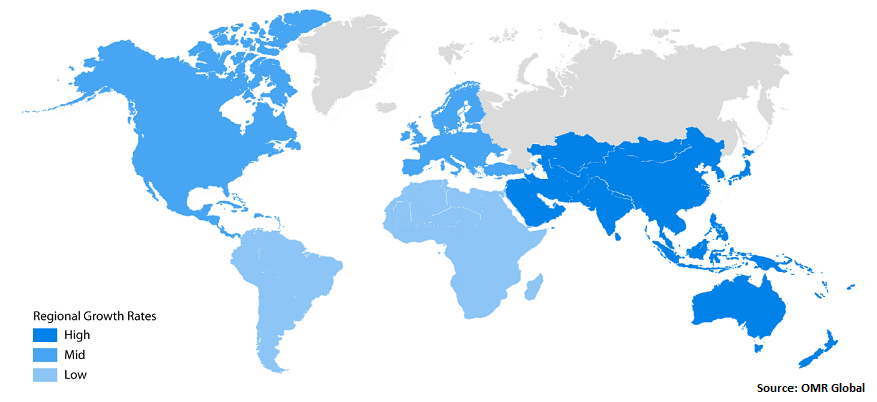

Regional Outlooks

The global biobanking market is analyzed based on the geographical regions that are contributing significantly towards the growth of the market. Based on the geography, the market is segmented into North America, Europe, Asia-Pacific, and the Rest of the World. North America region is estimated to have one of the largest shares in this market. Continuous investment in the collection of datasets to advance disease management, high research in cell and gene therapy, and regenerative medicine, and the presence of prominent players in the region are some of the factors that drive the growth of the market in the region. Asia-Pacific region is estimated to be one of the fastest-growing segments owing to the rise in the number of cancer patients which has led to an increase in research and improving life sciences research infrastructure in emerging economies.

Global Biobanking Market Growth, by Region 2021-2027

Asia-Pacific is projected to highest Contributor to the growth of the Global Biobanking Market

Asia-Pacific is anticipated to be the fastest-growing region in the global Biobanking market. In the region, China, South Korea, Japan, Singapore, and India are showing rapid progress. This is due to the presence of major players who are getting lucrative opportunities in the market. The increase in market growth with the rapid increase in the geriatric population and the rise in healthcare expenditure is to drive the market growth during the forecast period. For instance, according to the World Health Organization, in 2018, the healthcare expenditure was 6.7% of the GDP in the region.

Market Player Outlook

Key players of the biobanking market include Becton, Dickinson and Co., Thermo Fisher Scientific Inc., AstraZeneca plc, Charles River Laboratories, Inc., Boehringer Ingelheim Pharma GmbH & Co. KG, Bristol-Myers Squibb Co., and F. Hoffmann-La Roche Ltd, among others. These key manufacturers are adopting various strategies such as new product launches and approvals, mergers and acquisitions, partnerships and collaborations, and many others to thrive in a competitive environment. For instance, in April 2018, Brooks Automation, Inc. announced the acquisition of BioSpeciMan Corp. for around $5.0 million. The company focused to enhance its storage services for biological sample materials geographically within its growing sample management storage services business.

The Report Covers

- Market value data analysis of 2020 and forecast to 2027.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global biobanking market based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Bio-Banking Market

• Recovery Scenario of Bio-Banking Market Industry

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

3.3. Impact of COVID-19 on Key Players

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Bio-Banking Market by Product Type

5.1.1. Equipment

5.1.2. Consumables

5.1.3. Services&Software

5.2. Global Bio-banking Market by Sample Type

5.2.1. Blood Products

5.2.2. Human Tissues

5.2.3. Nucleic Acid

5.2.4. Cell Lines

5.2.5. Biological Fluid

5.2.6. Human Waste Product

5.3. Global Bio-banking Market by Application

5.3.1. Clinical Research

5.3.2. Regenerative Medicine

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. South Korea

6.3.5. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Abbott Laboratories

7.2. AstraZeneca PLC

7.3. Becton, Dickinson and Co.

7.4. BioChain Institute Inc.

7.5. Biokryo GmbH

7.6. Boehringer Ingelheim Pharma GmbH & Co. KG

7.7. Bristol-Myers Squibb Co.

7.8. Cell&Co.

7.9. Charles River Laboratories International, Inc.

7.10. Danaher Corp.

7.11. F. Hoffmann-La Roche Ltd.

7.12. Hamilton Co.

7.13. Lonza Group

7.14. LVL Technologies GmbH & Co. KG

7.15. Merck KGaA and Co.

7.16. Micronic Europe BV

7.17. Modul-Bio

7.18. Pfizer Inc.

7.19. PromoCell GmbH

7.20. QIAGEN GmbH

7.21. Tecan Trading AG

7.22. Thermo Fisher Scientific Inc.

7.23. Ziath Ltd.

1. GLOBAL BIOBANKING MARKET RESEARCH AND ANALYSIS, 2020-2027 ($ MILLIONS)

2. GLOBAL BIOBANKING MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2020-2027 ($ MILLIONS)

3. GLOBAL BIOBANKING MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2020-2027 ($ MILLIONS)

4. GLOBAL EQUIPMENT FOR BIOBANKING MARKET RESEARCH AND ANALYSIS 2020-2027 ($ MILLIONS)

5. GLOBAL CONSUMABLES FOR BIOBANKING MARKET RESEARCH AND ANALYSIS 2020-2027 ($ MILLIONS)

6. GLOBAL SOFTWARE & SERVICES FOR BIOBANKINGMARKET RESEARCH AND ANALYSIS 2020-2027 ($ MILLIONS)

7. GLOBAL BIOBANKING MARKET RESEARCH AND ANALYSIS BY SAMPLE TYPE, 2020-2027 ($ MILLIONS)

8. GLOBAL BLOOD PRODUCTS IN BIOBANKING MARKET RESEARCH AND ANALYSIS 2020-2027 ($ MILLIONS)

9. GLOBAL HUMAN TISSUES IN BIOBANKING MARKET RESEARCH AND ANALYSIS 2020-2027, ($ MILLIONS)

10. GLOBAL NUCLEIC ACID IN BIOBANKING MARKET RESEARCH AND ANALYSIS 2020-2027, ($ MILLIONS)

11. GLOBAL CELL LINES IN BIOBANKING MARKET RESEARCH AND ANALYSIS 2020-2027, ($ MILLIONS)

12. GLOBAL BIOLOGICAL FLUID IN BIOBANKING MARKET RESEARCH AND ANALYSIS 2020-2027, ($ MILLIONS)

13. GLOBAL HUMAN WASTE PRODUCT IN BIOBANKING MARKET RESEARCH AND ANALYSIS 2020-2027 ($ MILLIONS)

14. GLOBAL BIOBANKING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLIONS)

15. GLOBAL BIOBANKING IN CLINICAL RESEARCH MARKET RESEARCH AND ANALYSIS 2020-2027 ($ MILLIONS)

16. GLOBAL BIOBANKING IN REGENERATIVE MEDICINE MARKET RESEARCH AND ANALYSIS 2020-2027 ($ MILLIONS)

17. NORTH AMERICAN BIOBANKING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLIONS)

18. NORTH AMERICAN BIOBANKING MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2020-2027 ($ MILLIONS)

19. NORTH AMERICAN BIOBANKING MARKET RESEARCH AND ANALYSIS BY SAMPLE TYPE, 2020-2027 ($ MILLIONS)

20. NORTH AMERICAN BIOBANKING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLIONS)

21. EUROPEAN BIOBANKING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLIONS)

22. EUROPEAN BIOBANKING MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2020-2027 ($ MILLIONS)

23. EUROPEAN BIOBANKING MARKET RESEARCH AND ANALYSIS BY SAMPLE TYPE, 2020-2027 ($ MILLIONS)

24. EUROPEAN BIOBANKING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLIONS)

25. ASIA-PACIFIC BIOBANKING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLIONS)

26. ASIA-PACIFIC BIOBANKING MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2020-2027 ($ MILLIONS)

27. ASIA-PACIFIC BIOBANKING MARKET RESEARCH AND ANALYSIS BY SAMPLE TYPE, 2020-2027 ($ MILLIONS)

28. ASIA-PACIFIC BIOBANKING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLIONS)

29. REST OF THE WORLD BIOBANKING MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2020-2027 ($ MILLIONS)

30. REST OF THE WORLD BIOBANKING MARKET RESEARCH AND ANALYSIS BY SAMPLE TYPE, 2020-2027 ($ MILLIONS)

31. REST OF THE WORLD BIOBANKING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLIONS)

1. IMPACT OF COVID-19 ON GLOBAL BIOBANKING MARKET, 2020-2027 ($ MILLION)

2. IMPACT OF COVID-19 ON GLOBAL BIOBANKING MARKET BY SEGMENT, 2020-2027 ($ MILLION)

3. RECOVERY OF GLOBAL BIOBANKING MARKET, 2021-2027 (%)

4. GLOBAL BIOBANKING MARKET SHARE, BY PRODUCT TYPE, 2020 VS 2027 (%)

5. GLOBAL BIOBANKING MARKET SHARE, BY SAMPLE TYPE,2020 VS 2027 (%)

6. GLOBAL BIOBANKING MARKET SHARE, BY APPLICATION, 2020 VS 2027 (%)

7. GLOBAL EQUIPMENT FOR BIOBANKING MARKET SHARE BY REGION, 2020 VS 2027(%)

8. GLOBAL CONSUMABLES FOR BIOBANKING MARKET SHARE BY REGION, 2020 VS 2027(%)

9. GLOBAL SOFTWARE AND SERVICES FOR BIOBANKING MARKET SHARE BY REGION, 2020 VS 2027(%)

10. GLOBAL BLOOD PRODUCTS IN BIOBANKING MARKET SHARE BY REGION, 2020 VS 2027(%)

11. GLOBAL HUMAN TISSUES IN BIOBANKING MARKET SHARE BY REGION, 2020 VS 2027(%)

12. GLOBAL NUCLEIC ACID IN BIOBANKING MARKET SHARE BY REGION, 2020 VS 2027(%)

13. GLOBAL CELL LINES IN BIOBANKING MARKET SHARE BY REGION, 2020 VS 2027(%)

14. GLOBAL BIOLOGICAL FLUID IN BIOBANKING MARKET SHARE BY REGION, 2020 VS 2027(%)

15. GLOBAL HUMAN WASTE PRODUCT IN BIOBANKING MARKET SHARE BY REGION, 2020 VS 2027(%)

16. GLOBAL BIOBANKING IN CLINICAL RESEARCH MARKET SHARE BY REGION, 2020 VS 2027(%)

17. GLOBAL BIOBANKING IN REGENERATIVE MEDICINE MARKET SHARE BY REGION, 2020 VS 2027(%)

18. US BIOBANKING MARKET SIZE, 2020-2027 ($ MILLIONS)

19. CANADA BIOBANKING MARKET SIZE, 2020-2027 ($ MILLIONS)

20. UK BIOBANKING MARKET SIZE, 2020-2027 ($ MILLIONS)

21. FRANCE BIOBANKING MARKET SIZE, 2020-2027 ($ MILLIONS)

22. GERMANY BIOBANKING MARKET SIZE, 2020-2027 ($ MILLIONS)

23. ITALY BIOBANKING MARKET SIZE, 2020-2027 ($ MILLIONS)

24. SPAIN BIOBANKING MARKET SIZE, 2017 AND 2023, ($ MILLIONS)

25. ROE BIOBANKING MARKET SIZE, 2020-2027 ($ MILLIONS)

26. INDIA BIOBANKING MARKET SIZE, 2020-2027 ($ MILLIONS)

27. CHINA BIOBANKING MARKET SIZE, 2020-2027 ($ MILLIONS)

28. JAPAN BIOBANKING MARKET SIZE, 2020-2027 ($ MILLIONS)

29. SOUTH KOREA BIOBANKING MARKET SIZE, 2020-2027 ($ MILLIONS)

30. ROAPAC BIOBANKING MARKET SIZE, 2020-2027 ($ MILLIONS)

31. REST OF THE WORLD BIOBANKING MARKET SIZE, 2020-2027 ($ MILLIONS)