Bioceramics Market

Global Bioceramics Market Size, Share & Trends Analysis Report, By Product Type (Bio-Inert, Bio-Active, and Bio-Resorbable), By Application (Dental, Orthopedic, and Others) and Forecast, 2020-2026 Update Available - Forecast 2025-2035

The global bioceramics market is estimated to grow at a CAGR of 6.7% during the forecast period. The increasing prevalence of orthopedic disorders and rising awareness regarding dental problems are some vital factors encouraging market growth. With the increasing geriatric population, a significant rise in orthopedic disorders has been witnessed over the years. As per the Global Burden of Disease (GBD) data for noncommunicable diseases, it was shown the profound burden of musculoskeletal health disorders. For musculoskeletal conditions, Disability-adjusted life years (DALYs) grew by 61.6% during the period, 1990 and 2016. Osteoarthritis was stated to have a 104.9% rise in DALYs from 1990 to 2016.

Therefore, there is a significant rise in the demand for bioceramics that can strengthen scientific efforts for tissue regeneration owing to its superior osteogenic capacity. Several new ways were developed to offer supportive care to damaged tissues and fractures that have an important role in tissue engineering and nanomedicine. A comprehensive class of materials referred to as bio-ceramics, are superior materials for several kinds of regenerative and reconstructive medicine. These classes of materials have a crucial role to regenerate lost structures in the skeletomuscular system. There is an emerging demand for inert bioceramics as they are suitable as reinforcing material, bone implants, and bone cement.

Additionally, these bioceramics have been used on heavy load-bearing orthopedic implants as the biocompatible coating material. In the orthopedics field, the adoption of metal implants has significantly increased the quality of life for several patients with orthopedic disorders. Calcium phosphate bioceramics are used in metal implants as a bioactive interface between the surrounding tissue and the bulk metal impart. Bioceramics, including hydroxyapatite (HA), calcium silicate (Ca-Si), and calcium phosphate have been utilized as coating materials on biomedical implants surface. It has superior properties such as biocompatibility, high wear resistance, hardness, corrosion resistance, and more. These properties make this material ideal for use in orthopedic implants. The market has a potential opportunity owing to the emerging focus of nanotechnology in bioceramics.

Market Segmentation

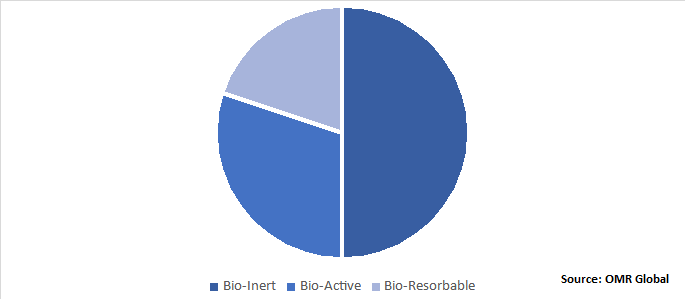

The market is segmented based on product type and application. Based on product type, the market is segmented into bio-inert, bio-active, and bio-resorbable. Based on the application, the market is classified into dental, orthopedic, and others.

Bio-Inert to Hold Potential Share in the Product Type

Significant demand for alumina and zirconia bioceramics as replacement parts in hip and knee surgeries are supporting to accelerate the share of this segment. The features such as inertness of the alumina ceramic, excellent biocompatibility, high wear resistance, excellent corrosion resistance, and high density make it the ceramic of choice. In addition, alumina has high load-bearing properties which makes it an ideal ceramic for dental implants. Zirconia is not as good as alumina in terms of wear resistance and therefore, it is not extensively used in hip joint replacements. However, zirconia ceramics are used often in dentistry and in orthopedics, it is used in some niche products.

Global Bioceramics Market Share by Product Type, 2019 (%)

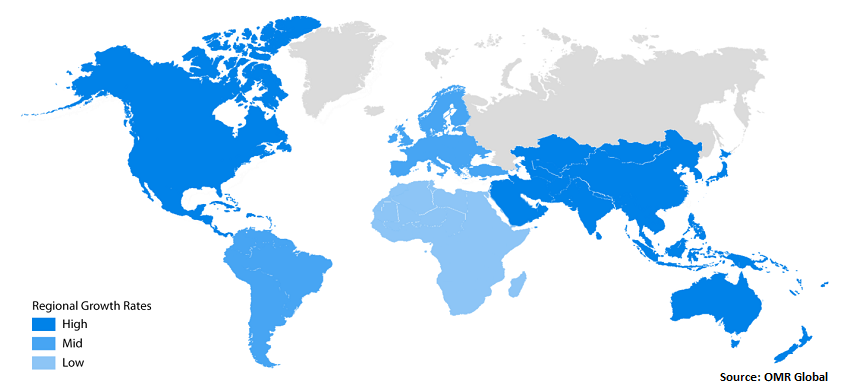

Regional Outlook

Geographically, the market is segmented into North America, Europe, Asia-Pacific, and Rest of the World. Europe Bioceramics market is primarily driven by increasing awareness regarding dental problems and rising orthopedic surgeries in the region. As per the Eurostat, in the EU Member States, the Netherlands ranked first, with 2.8 consultations of a dentist on average annually in 2017, followed by Lithuania and Czechia (1.6 each). Bioceramics are extensively utilized in the field of dentistry as dentures, restorative materials, glass-filled cement, and gold porcelain crowns.

Bioceramics have been utilized as biomaterials for oral and maxillofacial applications owing to their superior bioactivity, wear resistance, and high strength. Asia-Pacific is estimated to witness potential growth during the forecast period, owing to the rising number of orthopedic procedures in the region. The significant availability of the geriatric population is the major cause of the rising orthopedic conditions in the region, which leads to increasing demand for orthopedic procedures, such as spinal fusion, total hip and knee arthroplasty, and more.

Global Bioceramics Market Growth, by Region 2020-2026

Market Players Outlook

Some key players in the market include CeramTec GmbH, CoorsTek, Inc., Kyocera Corp., Morgan Advanced Materials plc, and NGK Spark Plug Co., Ltd. The market players are adopting some crucial strategies including mergers and acquisitions, product launches, and partnerships, and collaborations. For instance, in February 2019, Kyocera Fineceramics GmbH signed an agreement to acquire 100% shares of H.C. Starck subsidiary H.C. Starck Ceramics GmbH, a Germany-based manufacturer of advanced ceramics. In spring 2019, H.C. Starck Ceramics will combine into Kyocera Group, subject to regulatory approval. This acquisition will enable Kyocera to respond faster to clients in Europe.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global bioceramics market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. CeramTec GmbH

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. CoorsTek Inc.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Kyocera Corp.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Morgan Advanced Materials plc

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. NGK Spark Plug Co., Ltd.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.3 Opportunities

5. Market Segmentation

5.1. Global Bioceramics Market by Product Type

5.1.1. Bio-Inert

5.1.1.1. Alumina

5.1.1.2. Zirconia

5.1.1.3. Others

5.1.2. Bio-Active

5.1.2.1. Bioglass

5.1.2.2. Glass Ceramics

5.1.2.3. Others

5.1.3. Bio-Resorbable

5.2. Global Bioceramics Market by Application

5.2.1. Dental

5.2.2. Orthopedics

5.2.3. Others

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Admatec Europe B.V.

7.2. Amedica Corp.

7.3. Berkeley Advanced Biomaterials

7.4. CAM Bioceramics B.V.

7.5. CeramTec GmbH

7.6. Collagen Matrix, Inc.

7.7. CoorsTek, Inc.

7.8. Dentsply Sirona, Inc.

7.9. DOCERAM Medical Ceramics GmbH

7.10. Fujimi Corp.

7.11. H.C. Starck GmbH

7.12. Innovative BioCeramix, Inc.

7.13. Koninklijke DSM N.V.

7.14. Kuraray Europe GmbH

7.15. Kyocera Corp.

7.16. Morgan Advanced Materials plc

7.17. NGK Spark Plug Co., Ltd.

7.18. Paul Rauschert GmbH & Co. KG

7.19. Sagemax Bioceramics, Inc. (Ivoclar Vivadent)

7.20. Saint-Gobain Group

7.21. Straumann AG

7.22. Tosoh Corp.

1. GLOBAL BIOCERAMICS MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2019-2026 ($ MILLION)

2. GLOBAL BIO-INERT MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL BIO-ACTIVE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL BIO-RESORBABLE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

5. GLOBAL BIOCERAMICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

6. GLOBAL BIOCERAMICS IN DENTAL MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

7. GLOBAL BIOCERAMICS IN ORTHOPEDICS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

8. GLOBAL BIOCERAMICS IN OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

9. GLOBAL BIOCERAMICS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

10. NORTH AMERICAN BIOCERAMICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

11. NORTH AMERICAN BIOCERAMICS MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2019-2026 ($ MILLION)

12. NORTH AMERICAN BIOCERAMICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

13. EUROPEAN BIOCERAMICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

14. EUROPEAN BIOCERAMICS MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2019-2026 ($ MILLION)

15. EUROPEAN BIOCERAMICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

16. ASIA-PACIFIC BIOCERAMICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

17. ASIA-PACIFIC BIOCERAMICS MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2019-2026 ($ MILLION)

18. ASIA-PACIFIC BIOCERAMICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

19. REST OF THE WORLD BIOCERAMICS MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2019-2026 ($ MILLION)

20. REST OF THE WORLD BIOCERAMICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

1. GLOBAL BIOCERAMICS MARKET SHARE BY PRODUCT TYPE, 2019 VS 2026 (%)

2. GLOBAL BIOCERAMICS MARKET SHARE BY APPLICATION, 2019 VS 2026 (%)

3. GLOBAL BIOCERAMICS MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

4. US BIOCERAMICS MARKET SIZE, 2019-2026 ($ MILLION)

5. CANADA BIOCERAMICS MARKET SIZE, 2019-2026 ($ MILLION)

6. UK BIOCERAMICS MARKET SIZE, 2019-2026 ($ MILLION)

7. FRANCE BIOCERAMICS MARKET SIZE, 2019-2026 ($ MILLION)

8. GERMANY BIOCERAMICS MARKET SIZE, 2019-2026 ($ MILLION)

9. ITALY BIOCERAMICS MARKET SIZE, 2019-2026 ($ MILLION)

10. SPAIN BIOCERAMICS MARKET SIZE, 2019-2026 ($ MILLION)

11. ROE BIOCERAMICS MARKET SIZE, 2019-2026 ($ MILLION)

12. INDIA BIOCERAMICS MARKET SIZE, 2019-2026 ($ MILLION)

13. CHINA BIOCERAMICS MARKET SIZE, 2019-2026 ($ MILLION)

14. JAPAN BIOCERAMICS MARKET SIZE, 2019-2026 ($ MILLION)

15. REST OF ASIA-PACIFIC BIOCERAMICS MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF THE WORLD BIOCERAMICS MARKET SIZE, 2019-2026 ($ MILLION)