Biocides Market

Global Biocides Market Size, Share & Trends Analysis Report By Type (Halogen compounds, Metallic compounds, Organosulfurs, Organic acids, Phenolics, and Others), By Application (Water treatment, Personal care, Wood preservation, Food & beverage, and Others) Forecast Period, 2020-2026 Update Available - Forecast 2025-2031

The biocides market is anticipated to grow at a CAGR of 5.2% during the forecast period. Biocides are widely used in the production of antimicrobial disinfectants, sterilizers, and sanitizers that aids in stopping or eliminating the spread of disease and infections. Biocides are also widely used as a disinfectant of the machine equipment in the industries. In addition to this, biocides are also being used in the treatment of drinking water, which reduces the risk of many diseases such as typhoid fever, cholera, and various other waterborne diseases. The aforementioned reasons are anticipated to positively impact the growth of the biocides market during the forecast period.

Moreover, the use of biocides also aids in extending the shelf lives of the products and promotes sustainability by reducing waste. Hence, the antimicrobial biocides are utilized widely to preserve woods from decay caused by pests, mold, and mildew which in turn is expected to drive the biocides market shares. However, the use of biocides raises several environmental issues that are anticipated to hamper the growth of the biocides market during the forecast period.

Segmental Outlook

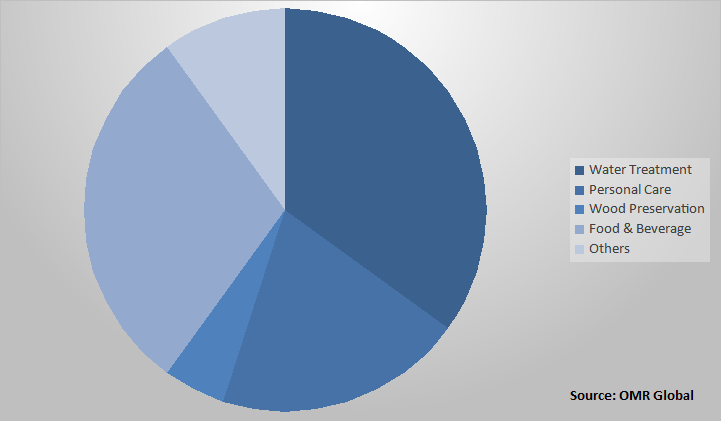

The global biocides market is segmented based on type and application. On the basis of type, the market is sub-segmented into halogen compounds, metallic compounds, organosulfur, organic acids, phenolics, and others. Further, based on the application the market is sub-segmented into water treatment, personal care, wood preservation, food & beverage, and others.

The water treatment segment will witness a lucrative growth rate

The water treatment segment is anticipated to grow with a significant CAGR in the biocides market owing to the increasing demand for safe drinking water. In addition to this, several global health organizations such as the World Health Organization (WHO) are running various initiatives in the developing economies to promote the reach of safe drinking water. Additionally, biocides are also used for the treatment of swimming pools, sewage treatment, and industrial wastewater treatment which will significantly drive the biocides market growth during the forecast period.

Global Biocides Market Share by Application, 2020 (%)

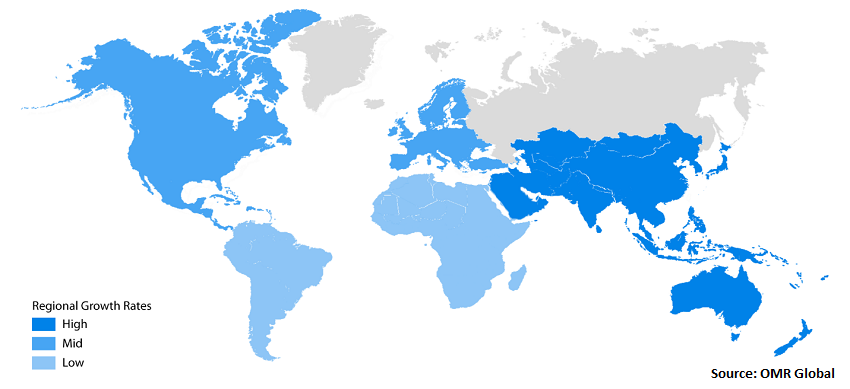

Regional Outlooks

The global biocides market is further segmented based on geography into North America, Europe, Asia-Pacific, and the Rest of the World. North America is expected to hold a significant market share during the forecast period. It is due to the cohesive government regulation related to the safety of food products in its end-user industries. The US is the major country contributing to the market. Europe is also expected to contribute considerably to the market. Germany, UK, France are some of the major economies contributing to the regional market.

Global Biocides Market Growth, by Region 2020-2026

Asia-Pacific will augment with the fastest growth rate in the biocides market

Asia-Pacific is anticipated to show the fastest growth rate in the biocides market owing to the high prevalence of waterborne diseases across the region which in turn is increasing the adoption of biocides for water treatment. In addition to this, Asia-Pacific has a huge number of manufacturing industries that produce tons of wastewater per day. Strict government regulations related to the treatment of wastewater in emerging economies such as China, India, and ASEAN countries will lead industries to use biocides for water treatment. Moreover, investment by the government for the wastewater treatment plant for cleaning the rivers is also expected to provide considerable growth to the biocide application in the region. In addition, the popularity of livestock farming and agricultural activities is considerably high across the region which is anticipated to increase the biocides market shares.

Market Players Outlook

The key players of the biocides market include Akzo Nobel N.V., BASF SE, Clariant International Ltd., the Lubrizol Corp., and others. The market players are considerably contributing to the market growth by the adoption of various strategies including merger, & acquisition, collaborations with government, funding to the start-ups, and new product launches to stay competitive in the market.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global biocides market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Business Functions and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Akzo Nobel N.V.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. BASF SE

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Clariant International Ltd.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. The DOW Chemical Company

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. The Lubrizol Corp.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.1. Opportunities

5. Market Segmentation

5.1. Global Biocides Market by Type

5.1.1. Halogen compounds

5.1.2. Metallic compounds

5.1.3. Organosulfurs

5.1.4. Organic acids

5.1.5. Phenolics

5.1.6. Others

5.2. Global Biocides Market by Application

5.2.1. Water treatment

5.2.2. Personal care

5.2.3. Wood preservation

5.2.4. Food & beverage

5.2.5. Others

6. Regional Analysis

6.1. North America

6.1.1. US

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Akzo Nobel N.V.

7.2. Albemarle Corp.

7.3. Baker Hughes Co.

7.4. BASF SE

7.5. Clariant International Ltd.

7.6. Cortec Corp.

7.7. EcolabInc.

7.8. IRO GROUP INC.

7.9. Italmatch Chemicals S.p.A

7.10. Kemira Oyj

7.11. LanxessAG

7.12. Melzer Chemicals Pvt. Ltd.

7.13. Solvay SA

7.14. Suez Water Technologies & Solutions

7.15. DuPont de Nemours, Inc

7.16. The Lubrizol Corp.

7.17. Thor Group Ltd.

7.18. Troy Corp.

7.19. Valtris Specialty Chemicals Ltd.

7.20. Veolia Water Solutions & Technologies

1. GLOBAL BIOCIDES MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

2. GLOBAL HALOGEN COMPOUNDS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL METALLIC COMPOUNDS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL ORGANOSULFURS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

5. GLOBAL ORGANIC ACIDS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL PHENOLICS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

7. GLOBAL OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

8. GLOBAL BIOCIDES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

9. GLOBAL WATER TREATMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

10. GLOBAL PERSONAL CARE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

11. GLOBAL WOOD PRESERVATION MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

12. GLOBAL FOOD & BEVERAGE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

13. GLOBAL OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

14. GLOBAL BIOCIDES MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

15. NORTH AMERICA BIOCIDES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

16. NORTH AMERICAN BIOCIDES MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

17. NORTH AMERICAN BIOCIDES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

18. EUROPE BIOCIDES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

19. EUROPE BIOCIDES MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

20. EUROPE BIOCIDES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

21. ASIA-PACIFIC BIOCIDES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

22. ASIA-PACIFIC BIOCIDES MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

23. ASIA-PACIFIC BIOCIDES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

24. REST OF THE WORLD BIOCIDES MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

25. REST OF THE WORLD BIOCIDES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

1. GLOBAL BIOCIDES MARKET SHARE BY TYPE, 2019 VS 2026 (%)

2. GLOBAL BIOCIDES MARKET SHARE BY APPLICATION, 2019 VS 2026 (%)

3. GLOBAL BIOCIDES MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

4. GLOBAL HALOGEN COMPOUNDS MARKET SHARE BY REGION, 2019 VS 2026 (%)

5. GLOBAL METALLIC COMPOUNDS MARKET SHARE BY REGION, 2019 VS 2026 (%)

6. GLOBAL ORGANOSULFURS MARKET SHARE BY REGION, 2019 VS 2026 (%)

7. GLOBAL ORGANIC ACIDS MARKET SHARE BY REGION, 2019 VS 2026 (%)

8. GLOBAL PHENOLICS MARKET SHARE BY REGION, 2019 VS 2026 (%)

9. GLOBAL OTHERS COMPOUND MARKET SHARE BY REGION, 2019 VS 2026 (%)

10. GLOBAL WATER TREATMENT MARKET SHARE BY REGION, 2019 VS 2026 (%)

11. GLOBAL PERSONAL CARE MARKET SHARE BY REGION, 2019 VS 2026 (%)

12. GLOBAL WOOD PRESERVATION MARKET SHARE BY REGION, 2019 VS 2026 (%)

13. GLOBAL FOOD & BEVERAGE MARKET SHARE BY REGION, 2019 VS 2026 (%)

14. GLOBAL OTHERS APPLICATION MARKET SHARE BY REGION, 2019 VS 2026 (%)

15. US BIOCIDES MARKET SIZE, 2019-2026 ($ MILLION)

16. CANADA BIOCIDES MARKET SIZE, 2019-2026 ($ MILLION)

17. UK BIOCIDES MARKET SIZE, 2019-2026 ($ MILLION)

18. FRANCE BIOCIDES MARKET SIZE, 2019-2026 ($ MILLION)

19. GERMANY BIOCIDES MARKET SIZE, 2019-2026 ($ MILLION)

20. ITALY BIOCIDES MARKET SIZE, 2019-2026 ($ MILLION)

21. SPAIN BIOCIDES MARKET SIZE, 2019-2026 ($ MILLION)

22. REST OF EUROPE BIOCIDES MARKET SIZE, 2019-2026 ($ MILLION)

23. INDIA BIOCIDES MARKET SIZE, 2019-2026 ($ MILLION)

24. CHINA BIOCIDES MARKET SIZE, 2019-2026 ($ MILLION)

25. JAPAN BIOCIDES MARKET SIZE, 2019-2026 ($ MILLION)

26. REST OF ASIA-PACIFIC BIOCIDES MARKET SIZE, 2019-2026 ($ MILLION)

27. REST OF THE WORLD BIOCIDES MARKET SIZE, 2019-2026 ($ MILLION)