Biocomponent Fiber Market

Biocomponent Fiber Market Size, Share & Trends Analysis Report by Material (PE/PP, PE/PET, Co-PET/PET and Polyester/PBT5), by Structure Types (Sheath-core, Side-by-Side, Islands in the Sea, and Other Structure Types), and by End-user Industry (Non-Woven Textiles, Automotive, Hygiene, Construction, Medical and Other End-user Industries) Forecast Period (2024-2031)

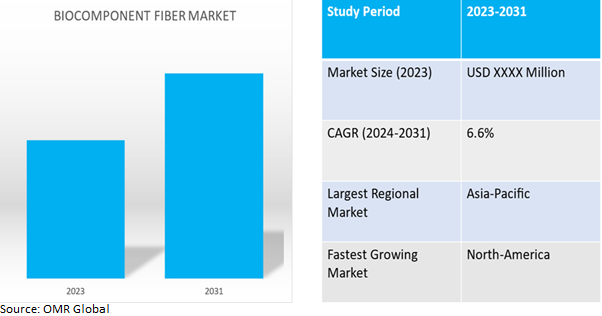

Biocomponent fiber market is anticipated to grow at a considerable CAGR of 6.6% during the forecast period (2024-2031). Bicomponent fiber is a specialized type of textile fiber composed of two different polymer components within a single filament. It offers unique properties and performance characteristics, making it highly versatile for various textile applications.

Market Dynamics

Growing Demand for Sustainable Fibers

The primary growth potential in the global bicomponent fiber market is closely linked to the increasing need for sustainable fibers, which aligns with the global trend toward adopting environmentally responsible practices. The use of bicomponent fibers presents itself as a possible approach to address these concerns in light of the increasing emphasis on sustainability from both consumers and industries. The use of recycled materials to produce bicomponent fibers represents a significant aspect of this opportunity. In addition, manufacturers have the potential to repurpose post-consumer or post-industrial waste, specifically plastics, by transforming them into bicomponent fibers. This practice helps alleviate the strain on landfills and decreases the demand for virgin resources.

Additionally, the recycled bicomponent fibers are highly appealing to consumers who prioritize environmental sustainability and actively seek out products with minimal environmental impact. Moreover, the bicomponent fibers made from biodegradable materials have considerable potential in various industries where disposability is prevalent, particularly in the realm of single-use hygiene products. These fibers' natural degradation process efficiently addresses environmental concerns while contributing significantly to larger sustainability goals.

Growing Demand for Hygiene and Healthcare Products

The global bicomponent fiber market is further driven by the increasing demand for hygiene and healthcare products. Changes in population structure, shopper tastes, and an emphasis on personal cleanliness and wellness all contribute to the product's rising popularity. In addition, the aging population across different regions worldwide is a key factor driving the demand. The growing population of elderly individuals has led to a substantial rise in the demand for products specifically designed for their needs, such as adult diapers and incontinence products. Bicomponent fibers play a crucial role in these products, providing essential qualities such as softness, exceptional absorbency, and efficient moisture management. The qualities above are instrumental in ensuring the optimal comfort, dignity, and hygiene level for elderly users, effectively addressing a pressing requirement within this expanding demographic segment.

Market Segmentation

Our in-depth analysis of the global biorefinery market includes the following segments by type, product, and technology:

- Based on material, the market is sub-segmented into PE/PP, PE/PET, Co-PET/PET and Polyester/PBT5.

- Based on structure types, the market is bifurcated into sheath-core, side-by-side, islands in the sea, and other structure types.

- Based on end-user industry, the market is augmented into non-woven textiles, automotive, hygiene, construction, medical and other end-user industries.

Hygiene is Projected to Emerge as the Largest Segment

Hygiene is projected to emerge as the largest segment as well as the fastest-growing segment of the market during the forecast period. Rising health and hygiene awareness among people around the world is fueling the growth in the demand for various hygiene products, such as feminine products, baby diapers, and wipes. Also, the demand for disposable hygiene products, such as diapers and sanitary napkins, has been growing in line with the world's population increase. Key requirements for hygiene products, such as softness, better fluid absorption, low irritation to the skin, high strength, and high bulkiness, are efficiently fulfilled by bicomponent fiber.

In April 2023, Millie Moon baby diapers announced their launch in Canada. Millie Moon claims to be a clean, luxury diaper brand offering high-performance and beautifully crafted diapers and sensitive wipes at affordable prices. The company also claims that the materials in its Luxury Diapers are extremely soft on babies' skin and engineered with CloudTouch Softness for optimum comfort.

Co-PET/PET Sub-segment to Hold a Considerable Market Share

Based on the material type, Co-PET/PET dominates the bicomponent fiber market in terms of both, value and volume shipments. Co-PET/PET is used in a wide range of applications in the non-woven industry having a melt temperature below 110°C. Desirable strength, lightweight, better dyeability, wrinkle-resistance, cost-effective nature, and excellent wash wear properties are key capabilities of the product category. PE/PP bicomponent fiber has superior properties, such as enhanced softness, bulkiness, and liquid absorption properties, which have led to its significant demand in the US and Western European countries.

Regional Outlook

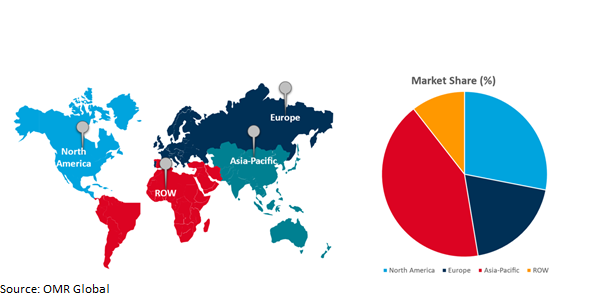

The global biocomponent fiber market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America). North-America is the fastest-growing category as the region's well-established industries, such as healthcare, hygiene products, and automotive, drive the demand for bicomponent fibers. In addition, North America strongly emphasizes product innovation and sustainability. The increasing demand for eco-friendly materials and stringent quality standards in healthcare contribute to the growth of bicomponent fiber usage in this region.

Global Biocomponent Fiber Market Growth by Region 2024-2031

Asia-Pacific Holds Major Market Share

Among all the regions, Asia-Pacific holds a significant share owing to theregion's population growth, urbanization, and increasing disposable income. Countries like China and India have robust manufacturing sectors. The region's booming hygiene product industry and growth in the automotive and construction sectors significantly contribute to the demand for bicomponent fibers.Several diaper manufacturing companies in India are focusing on product innovation and expansion, which is further likely to drive the demand for bicomponent fibers. For instance, in January 2023, Kimberly-Clark announced the relaunch of its iconic diaper brand, Huggies, with the new ‘Huggies Complete Comfort’ range in Inida.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global biocomponent fiber market include TORAY Industries Inc., Far Eastern New Century Corp., Huvis Corp., Indorama Ventures Public Company Ltd. among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in October 2022, Teijin Frontier Co. Ltd, a subsidiary company of Teijin Limited, opened a new manufacturing facility for the highly efficient production of polyester filaments. The company invested JPY 1 million (USD 0.01 million) in constructing this facility, and it is expected to produce 1,500 tons of polyester filaments, including bicomponent fiber, annually by the end of the year 2024.

The Report Covers

- Market value data analysis of 2023and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global biocomponent fiber market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Far Eastern New Century Corp.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Huvis Corp.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Indorama Ventures Public Company Limited

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. TORAY Industries Inc.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Key Strategy Analysis

4. Market Segmentation

4.1. Global Biocomponent Fiber Market by Material

4.1.1. PE/PP

4.1.2. PE/PET

4.1.3. Co-PET/PET

4.1.4. Polyester/PBT5

4.2. Global Biocomponent Fiber Market by Structure Types

4.2.1. Sheath-core

4.2.2. Side-by-Side

4.2.3. Islands in the Sea

4.2.4. Other Structure Types

4.3. Global Biocomponent Fiber Market by End-user Industry

4.3.1. Non-Woven Textiles

4.3.2. Automotive

4.3.3. Hygiene

4.3.4. Construction

4.3.5. Medical

4.3.6. Other End-user Industries

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Avgol Nonwovens

6.2. CHA Technologies Group

6.3. EMS-chemie Holding AG

6.4. Freudenberg Performance Materials

6.5. JNC Corporation

6.6. Kimberly-Clark Corp.

6.7. Kolon Glotech

6.8. Kuraray Co. Ltd.

6.9. Mitsui Chemicals, Inc.

6.10. OC Oerlikon Management AG

6.11. PTT Global Chemical Public Company Ltd.

6.12. Shaoxing Yaolong Spunbonded Nonwoven Technology Co. Ltd.

6.13. Suominen Corp.

6.14. TEIJIN Ltd.

6.15. WPT Nonwovens Corp.

1. GLOBAL BIOCOMPONENT FIBER MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2023-2031 ($ MILLION)

2. GLOBAL PE/PP BIOCOMPONENT FIBER MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBALPE/PET BIOCOMPONENT FIBER MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL CO-PET/PET BIOCOMPONENT FIBER MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL POLYESTER/PBT5 BIOCOMPONENT FIBER MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL BIOCOMPONENT FIBER MARKET RESEARCH AND ANALYSIS BY STRUCTURE TYPES, 2023-2031 ($ MILLION)

7. GLOBAL SHEATH-CORE BIOCOMPONENT FIBER MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL SIDE-BY-SIDE BIOCOMPONENT FIBER MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL ISLANDS IN THE SEA BIOCOMPONENT FIBER MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBALOTHER REGION BIOCOMPONENT FIBER MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL BIOCOMPONENT FIBER MARKETRESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2023-2031 ($ MILLION)

12. GLOBAL BIOCOMPONENT FIBER MARKET FOR NON-WOVEN TEXTILESRESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL BIOCOMPONENT FIBER MARKET FOR AUTOMOTIVERESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL BIOCOMPONENT FIBER MARKET FORHYGIENE RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. GLOBAL BIOCOMPONENT FIBER MARKET FOR CONSTRUCTION RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

16. GLOBAL BIOCOMPONENT FIBER MARKET FOR MEDICALRESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

17. GLOBAL BIOCOMPONENT FIBER MARKET FOR OTHER END-USER INDUSTRIES RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

18. GLOBAL BIOCOMPONENT FIBER MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

19. NORTH AMERICAN BIOCOMPONENT FIBER MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2023-2031 ($ MILLION)

20. NORTH AMERICAN BIOCOMPONENT FIBER MARKET RESEARCH AND ANALYSIS BY STRUCTURE TYPES, 2023-2031 ($ MILLION)

21. NORTH AMERICAN BIOCOMPONENT FIBER MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY,2023-2031 ($ MILLION)

22. EUROPEAN BIOCOMPONENT FIBER MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2023-2031 ($ MILLION)

23. EUROPEAN BIOCOMPONENT FIBER MARKET RESEARCH AND ANALYSIS BY STRUCTURE TYPES, 2023-2031 ($ MILLION)

24. EUROPEAN BIOCOMPONENT FIBER MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2023-2031 ($ MILLION)

25. ASIA-PACIFICBIOCOMPONENT FIBER MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2023-2031 ($ MILLION)

26. ASIA-PACIFICBIOCOMPONENT FIBER MARKET RESEARCH AND ANALYSIS BY STRUCTURE TYPES, 2023-2031 ($ MILLION)

27. ASIA-PACIFICBIOCOMPONENT FIBER MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2023-2031 ($ MILLION)

28. REST OF THE WORLD BIOCOMPONENT FIBER MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2023-2031 ($ MILLION)

29. REST OF THE WORLD BIOCOMPONENT FIBER MARKET RESEARCH AND ANALYSIS BY STRUCTURE TYPES, 2023-2031 ($ MILLION)

30. REST OF THE WORLD BIOCOMPONENT FIBER MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2023-2031 ($ MILLION)

1. GLOBAL BIOCOMPONENT FIBER MARKET SHARE BY MATERIAL, 2023 VS 2031 (%)

2. GLOBAL PE/PP BIOCOMPONENT FIBER MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL PE/PETBIOCOMPONENT FIBER MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBALCO-PET/PETBIOCOMPONENT FIBER MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBALPOLYESTER/PBT5 BIOCOMPONENT FIBER MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL BIOCOMPONENT FIBER MARKET SHARE BY STRUCTURE TYPES, 2023 VS 2031 (%)

7. GLOBAL SHEATH-COREBIOCOMPONENT FIBER MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBALSIDE-BY-SIDEBIOCOMPONENT FIBER MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBALISLANDS IN THE SEABIOCOMPONENT FIBER MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBALOTHER REGION BIOCOMPONENT FIBER MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL BIOCOMPONENT FIBER MARKET SHARE BY END-USER INDUSTRY, 2023 VS 2031 (%)

12. GLOBAL BIOCOMPONENT FIBER MARKET FOR NON-WOVEN TEXTILESSHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL BIOCOMPONENT FIBER MARKET FORAUTOMOTIVESHARE BY REGION, 2023 VS 2031 (%)

14. GLOBAL BIOCOMPONENT FIBER MARKET FORHYGIENE SHARE BY REGION, 2023 VS 2031 (%)

15. GLOBAL BIOCOMPONENT FIBER MARKET FOR CONSTRUCTION SHARE BY REGION, 2023 VS 2031 (%)

16. GLOBAL BIOCOMPONENT FIBER MARKET FORMEDICALSHARE BY REGION, 2023 VS 2031 (%)

17. GLOBAL BIOCOMPONENT FIBER MARKET FOR OTHER END-USER INDUSTRIES SHARE BY REGION, 2023 VS 2031 (%)

18. GLOBAL BIOCOMPONENT FIBER MARKET SHARE BY REGION, 2023 VS 2031 (%)

19. US BIOCOMPONENT FIBER MARKET SIZE, 2023-2031 ($ MILLION)

20. CANADA BIOCOMPONENT FIBER MARKET SIZE, 2023-2031 ($ MILLION)

21. UK BIOCOMPONENT FIBER MARKET SIZE, 2023-2031 ($ MILLION)

22. FRANCE BIOCOMPONENT FIBER MARKET SIZE, 2023-2031 ($ MILLION)

23. GERMANY BIOCOMPONENT FIBER MARKET SIZE, 2023-2031 ($ MILLION)

24. ITALY BIOCOMPONENT FIBER MARKET SIZE, 2023-2031 ($ MILLION)

25. SPAIN BIOCOMPONENT FIBER MARKET SIZE, 2023-2031 ($ MILLION)

26. REST OF EUROPE BIOCOMPONENT FIBER MARKET SIZE, 2023-2031 ($ MILLION)

27. INDIA BIOCOMPONENT FIBER MARKET SIZE, 2023-2031 ($ MILLION)

28. CHINA BIOCOMPONENT FIBER MARKET SIZE, 2023-2031 ($ MILLION)

29. JAPAN BIOCOMPONENT FIBER MARKET SIZE, 2023-2031 ($ MILLION)

30. SOUTH KOREA BIOCOMPONENT FIBER MARKET SIZE, 2023-2031 ($ MILLION)

31. REST OF ASIA-PACIFIC BIOCOMPONENT FIBER MARKET SIZE, 2023-2031 ($ MILLION)

32. LATIN AMERICABIOCOMPONENT FIBER MARKET SIZE, 2023-2031 ($ MILLION)

33. MIDDLE EAST AND AFRICABIOCOMPONENT FIBER MARKET SIZE, 2023-2031 ($ MILLION)