Biocontrol Agent Market

Global Biocontrol Agent Market Size, Share & Trends Analysis Report By Active Substance (Microbials, and Macro-organisms), By Target Pest (Arthropods, Weeds, and Micro-Organisms), By Application (Seed Treatment, On-field, and Post-Harvest), Forecast 2020-2026 Update Available - Forecast 2025-2035

The biocontrol agent market is anticipated to grow at a CAGR of 9% during the forecast period. Biocontrol agents are used for pest management in the agriculture fields. The usage of biocontrol agents is increasing constantly owing to the fact that it causes less environmental side effects. The changing trend toward non-chemical pest control is a key factor for the growth of the biocontrol agent market during the forecast period. The biocontrol agents are specific with their target pests, unlike chemicals they do not kill the beneficial bacterial. Hence, the adoption of biocontrol agents will be high which in turn will impact the biocontrol agent industry.

However, the action of biocontrol agents is very slow in comparison to chemical control which can restrict the framers to switch to biocontrol usage. In addition, sometimes there is a risk of biocontrol agents itself becoming a pest. Additionally, there are also several other associated risks such as a rise in the introduced predator’s population, and these predators may not stay in the target area and many more. All these factors are anticipated to present restraint for the biocontrol agent market growth during the forecast period.

Segmental Outlook

The global biocontrol agent market is segmented based on active substance, target pest, and application. Based on the active substance, the market is bifurcated into microbial, and macro-organisms. Based on the target pest, the market is segmented into arthropods, weeds, and micro-organisms. Further, based on the application, the market is sub-segmented into seed treatment, on-field, and post-harvest.

The Microbial segment will be the fastest-growing segment by active substance

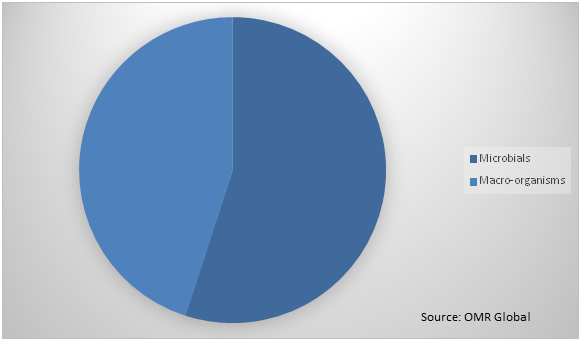

Microbial segment is anticipated to grow with a significant CAGR during the forecast period. Microbial biocontrol agents found application in both covered and field crops as efficient tools to control various diseases, agents and crop pests. Microbial biocontrol agents are beneficial from environmental attribute also. Hence; their adoption is considerably high in the biocontrol agents’ market. In addition to this, microbial biocontrol agents also exhibit high target-specificity in comparison with synthetic agents which will also significantly aid to the growth of the microbial segment. Moreover, absence of harmful residues coupled with low production cost will also foster the growth of the segment during the forecast period. Global Biocontrol Agents Market Share by Active Substance, 2019 (%)

Regional Outlooks

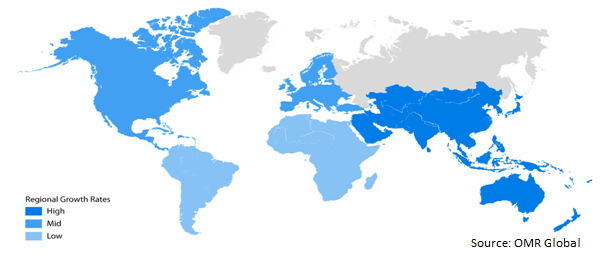

The global biocontrol agent market is further segmented based on geography including North America, Europe, Asia-Pacific, and the Rest of the World. North America is expected to hold the major market share in the biocontrol agent market. Strict regulatory frameworks for restricting the usage of chemical pesticides is increasing the adoption of biocontrol agents in the region. Additionally, the high awareness regarding the efficiency of microbial pesticides across the region will also fuel the biocontrol agent market significantly during the forecast period.

Global Biocontrol Agent Market Growth, by Region 2020-2026

Asia-Pacific will augment with the fastest growth rate in the biocontrol agent market

Asia-Pacific is expected to show the fastest growth rate in the biocontrol agent market owing to the increasing awareness among common people regarding the harmful effects of synthetic pesticides on health. Due to this, an increase in demands for organic food in the developing economies including India and China has been witnessed. Moreover, the increasing cost of chemical pesticides is also turning the farmers towards the use of biocontrol agents. Al these factors are anticipated to augment the biocontrol agent market across the region.

Market Players Outlook

The key players of the biocontrol agents market include Andermatt Biocontrol AG, Biobest Group NV, Marrone Bio Innovations, Inc., Vestaron Corp., Viridaxis SA, Precision Laboratories, LLC, Syngenta AG, and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers, & acquisitions, collaborations with government, and new product launch to stay competitive in the market. For instance, in November 2018, Corteva AgriScience (Dow AgroSciences) released its first micro-toxic seed treatment agent Lumingwei. This is aimed at improving the maize pest control effect and helping growers increase corn yield to create a higher value. Moreover, in May 2020, the company collaborated with M2i for research and global commercialization of pheromone-based insect control solutions.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global biocontrol agent market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Competitive Dashboard

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Isagro S.p.a.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Bayer CropScience Ltd.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Marrone Bio Innovations, Inc.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. BASF SE

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Corteva Agriscience

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Biocontrol Agents Market by Active Substance

5.1.1. Microbials

5.1.2. Macro-organisms

5.2. Global Biocontrol Agents Market by Target Pest

5.2.1. Arthropods

5.2.2. Weeds

5.2.3. Micro-Organisms

5.3. Global Biocontrol Agents Market by Application

5.3.1. Seed Treatment

5.3.2. On-field

5.3.3. Post-Harvest

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Andermatt Biocontrol AG

7.2. BASF SE

7.3. Bayer CropScience Ltd.

7.4. Biobest Group NV

7.5. CBC (Europe) S.r.l.

7.6. Certis USA L.L.C.

7.7. Chr. Hansen Holding A/S

7.8. Corteva Agriscience

7.9. Isagro S.p.a.

7.10. Koppert Biological Systems

7.11. Lallemand Inc.

7.12. Manidharma Biotech Private Ltd.

7.13. Marrone Bio Innovations, Inc.

7.14. Novozymes A/S

7.15. Syngenta AG

7.16. The Monsanto Co.

7.17. Valent BioSciences LLC

7.18. Verdesian Life Sciences, LLC

7.19. Vestaron Corp.

7.20. Viridaxis SA

1. GLOBAL BIOCONTROL AGENTS MARKET RESEARCH AND ANALYSIS BY ACTIVE SUBSTANCE, 2019-2026 ($ MILLION)

2. GLOBAL MICROBIALS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL MACRO-ORGANISMS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL BIOCONTROL AGENTS MARKET RESEARCH AND ANALYSIS BY TARGET PEST, 2019-2026 ($ MILLION)

5. GLOBAL ARTHROPODS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL WEEDS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

7. GLOBAL MICRO-ORGANISMS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

8. GLOBAL BIOCONTROL AGENTS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

9. GLOBAL SEED TREATMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

10. GLOBAL ON-FIELD MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

11. GLOBAL POST-HARVEST MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

12. GLOBAL BIOCONTROL AGENTS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

13. NORTH AMERICAN BIOCONTROL AGENTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

14. NORTH AMERICAN BIOCONTROL AGENTS MARKET RESEARCH AND ANALYSIS BY ACTIVE SUBSTANCE, 2019-2026 ($ MILLION)

15. NORTH AMERICAN BIOCONTROL AGENTS MARKET RESEARCH AND ANALYSIS BY TARGET PEST, 2019-2026 ($ MILLION)

16. NORTH AMERICAN BIOCONTROL AGENTS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

17. EUROPEAN BIOCONTROL AGENTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

18. EUROPEAN BIOCONTROL AGENTS MARKET RESEARCH AND ANALYSIS BY ACTIVE SUBSTANCE, 2019-2026 ($ MILLION)

19. EUROPEAN BIOCONTROL AGENTS MARKET RESEARCH AND ANALYSIS BY TARGET PEST, 2019-2026 ($ MILLION)

20. EUROPEAN BIOCONTROL AGENTS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

21. ASIA-PACIFIC BIOCONTROL AGENTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

22. ASIA-PACIFIC BIOCONTROL AGENTS MARKET RESEARCH AND ANALYSIS BY ACTIVE SUBSTANCE, 2019-2026 ($ MILLION)

23. ASIA-PACIFIC BIOCONTROL AGENTS MARKET RESEARCH AND ANALYSIS BY TARGET PEST, 2019-2026 ($ MILLION)

24. ASIA-PACIFIC BIOCONTROL AGENTS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

25. REST OF THE WORLD BIOCONTROL AGENTS MARKET RESEARCH AND ANALYSIS BY ACTIVE SUBSTANCE, 2019-2026 ($ MILLION)

26. REST OF THE WORLD BIOCONTROL AGENTS MARKET RESEARCH AND ANALYSIS BY TARGET PEST, 2019-2026 ($ MILLION)

27. REST OF THE WORLD BIOCONTROL AGENTS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

1. GLOBAL BIOCONTROL AGENTS MARKET SHARE BY ACTIVE SUBSTANCE, 2019 VS 2026(%)

2. GLOBAL BIOCONTROL AGENTS MARKET SHARE BY TARGET PEST, 2019 VS 2026(%)

3. GLOBAL BIOCONTROL AGENTS MARKET SHARE BY APPLICATION, 2019 VS 2026(%)

4. GLOBAL BIOCONTROL AGENTS MARKET SHARE BY GEOGRAPHY, 2019 VS 2026(%)

5. US BIOCONTROL AGENTS MARKET SIZE, 2019-2026 ($ MILLION)

6. CANADA BIOCONTROL AGENTS MARKET SIZE, 2019-2026 ($ MILLION)

7. UK BIOCONTROL AGENTS MARKET SIZE, 2019-2026 ($ MILLION)

8. FRANCE BIOCONTROL AGENTS MARKET SIZE, 2019-2026 ($ MILLION)

9. GERMANY BIOCONTROL AGENTS MARKET SIZE, 2019-2026 ($ MILLION)

10. ITALY BIOCONTROL AGENTS MARKET SIZE, 2019-2026 ($ MILLION)

11. SPAIN BIOCONTROL AGENTS MARKET SIZE, 2019-2026 ($ MILLION)

12. ROE BIOCONTROL AGENTS MARKET SIZE, 2019-2026 ($ MILLION)

13. INDIA BIOCONTROL AGENTS MARKET SIZE, 2019-2026 ($ MILLION)

14. CHINA BIOCONTROL AGENTS MARKET SIZE, 2019-2026 ($ MILLION)

15. JAPAN BIOCONTROL AGENTS MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF ASIA-PACIFIC BIOCONTROL AGENTS MARKET SIZE, 2019-2026 ($ MILLION)