Biodegradable Film Market

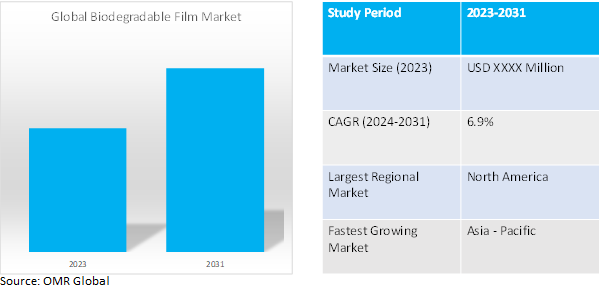

Biodegradable Film Market Size, Share & Trends Analysis Report by Type (PLA, Starch Blends, Biodegradable Polyesters, PHA, and Others), and by Application (Food Packaging, Agriculture & Horticulture, Cosmetic & Personal Care Products Packaging, Industrial Packaging, and Others), Forecast Period (2024-2031)

Biodegradable film market is anticipated to grow at a considerable CAGR of 6.9% during the forecast period (2024-2031). Biodegradable film is a thin, decomposable plastic alternative derived from renewable resources, minimizing waste and environmental impact. The biodegradable film market is experiencing robust growth due to several factors such as heightened environmental concerns, coupled with stringent regulations aimed at reducing plastic waste. Biodegradable films offer an eco-friendly alternative to traditional plastic films, as they are derived from renewable resources and decompose naturally, mitigating environmental pollution.

Market Dynamics

Environmental Imperatives: The Rise of Biodegradable Films

Environmental concerns are propelling the surge in the biodegradable film market. Heightened public awareness about plastic pollution has sparked widespread concern over its harmful impact on ecosystems. Disturbing images of plastic harming marine life and filling up landfills have amplified these worries. This mounting concern is driving both consumers and industries towards sustainable alternatives. For instance, Chocolate companies are responding to consumer demand for eco-friendly packaging by innovating sustainable solutions. Parkside and Mummy Meegz introduce home-compostable packaging, featuring vibrant designs on Park2Nature™ material. Sun Chemical and Qualvis Packaging develop bio-renewable ink cartons for Whitaker’s truffles, prioritizing eco-friendly materials. Mars Incorporated trials paper packaging for Mars Bars, aligning with their commitment to sustainability. These efforts lead to a more eco-conscious chocolate industry. People are increasingly demanding eco-friendly options, prompting companies to acknowledge the necessity for biodegradable packaging solutions. This shift towards sustainability is a significant factor driving the growth of the biodegradable film market.

Stringent Regulatory Landscape: A Boon for Biodegradable Films

The global biodegradable film market is experiencing a significant boost due to the implementation of stricter regulations by governments globally. For instance, in April 2024, the regulation, endorsed with 476 votes in favor, 129 against, and 24 abstentions, aims to combat escalating waste, standardize market rules, and promote a circular economy in the EU. It mandates packaging reduction targets, bans specific single-use plastics by 2030, and restricts "forever chemicals" in food packaging. Rapporteur Frédérique Ries emphasizes the regulation's importance in curbing excess packaging and safeguarding consumer health. These regulations aim to curb plastic waste and its detrimental environmental impact. This evolving regulatory landscape creates a distinct market advantage for biodegradable films. As traditional plastic films face restrictions and potential bans, biodegradable alternatives emerge as a compliant and responsible solution. This shift in regulations incentivizes manufacturers and consumers to embrace biodegradable films, ultimately propelling market growth.

Market Segmentation

Our in-depth analysis of the global biodegradable film market includes the following segments by type, and application:

- Based on type, the market is segmented into PLA (polylactic acid), starch blends, biodegradable polyesters, PHA (polyhydroxyalkanoates), and others (regenerated cellulose, and cellulose derivatives).

- Based on the application, the market is segmented into food packaging, agriculture & horticulture, cosmetic & personal care products packaging, industrial packaging, and others (composting, service ware, and carrier bags).

Biodegradable Polyesters: A Standout Performer in the Sustainable Packaging Revolution

Biodegradable polyesters are the fastest growing segment in the biodegradable film market due to advancements in production technology. These innovations have resulted in superior properties, including increased mechanical strength, enhanced barrier function against elements like moisture and oxygen, and improved performance across varying temperatures. This improved functionality makes them more competitive with traditional plastic films across a wider range of applications. For instance, The University of Michigan introduces a groundbreaking microencapsulation technique for slow-release peptide drugs. Utilizing biodegradable polymers, the method extends drug efficacy without frequent injections. Led by Professor Steven Schwendeman, the study demonstrates encapsulation without organic solvents, enabling sustained drug release for over a month. The approach shows promise for various peptide drugs, including leuprolide for prostate cancer treatment. Ongoing research aims to expand the application to other large molecular drugs. Additionally, their impressive versatility suits various film types, appealing to diverse industries. Many biodegradable polyesters derive raw materials from renewable resources, reinforcing their eco-friendly credentials. This combination of enhanced properties, adaptability, and sustainability is driving significant growth in the biodegradable polyesters segment.

Food Packaging Takes the Lead: Biodegradable Films Drive Sustainable Change

The food packaging segment stands as one of the fastest-growing sectors within the biodegradable film market, primarily propelled by escalating consumer concerns about environmental sustainability. With a heightened awareness of plastic pollution and its impact on ecosystems, consumers are increasingly demanding eco-friendly packaging solutions, particularly in the food industry. Stringent regulations and corporate sustainability initiatives further accelerate this shift towards biodegradable films. For instance, in January 2024, proposed UK regulations may revolutionize supermarket shelves by eliminating plastic packaging for fruits and vegetables. Spearheaded by wrap, the plan aims to increase loose produce sales to 50.0% by 2030, reducing plastic waste. Major supermarkets are expected to comply by 2024, offering recyclable bags for loose items. Soft fruits might still be packaged to maintain freshness. Moreover, advancements in technology have enhanced the performance and quality of these films, making them increasingly viable alternatives to traditional plastic packaging. As a result, the food packaging segment experiences significant growth as industries strive to meet both regulatory mandates and consumer preferences for sustainable packaging options.

Regional Outlook

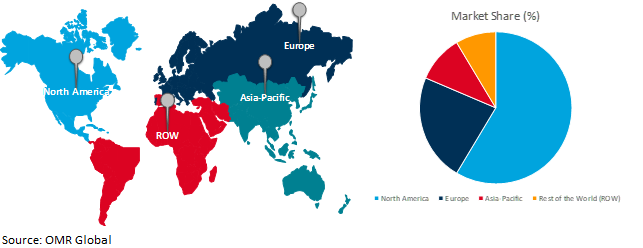

The global biodegradable film market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Global Biodegradable Film Growth by Region 2024-2031

Asia Pacific: The Undisputed Leader in Biodegradable Film Market Growth

The Asia-Pacific region reigns supreme in the biodegradable film market, holding both the top spot for growth and the largest market share. This dominance stems from a powerful cocktail of factors. Public anxieties about plastic pollution and its ecological devastation are particularly strong here, driving a robust shift towards sustainable solutions with biodegradable films as a frontrunner. Furthermore, stricter regulations to curb plastic waste are being implemented by governments, effectively incentivizing the use of these eco-friendly alternatives. For instance, In July 2022, India enforced a ban on single-use plastics, targeting items such as straws, cutlery, and packaging films, in response to mounting pollution concerns. Despite opposition from food and beverage companies, the government proceeded with the restriction. Plastic bags were temporarily exempted, with a requirement for increased thickness to promote reuse. Control rooms were established to monitor illegal use, sale, and distribution. The region's booming economy and population explosion also contribute, as the surging demand for packaged goods necessitates vast amounts of packaging materials. Finally, the existing plastic film manufacturing base in Asia-Pacific facilitates a smooth transition towards sustainable practices by readily adapting to produce biodegradable films. In conclusion, environmental concerns, stricter regulations, a booming economy, and an established manufacturing base all propel the Asia-Pacific region to the forefront of the biodegradable film market.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global biodegradable film market include Avery Dennison Corporation, BASF SE, Futamura Chemical Co. Ltd., and Taghleef Industries, among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in September 2023, Futamura inaugurated a new cellulose film production line at its Wigton facility, enhancing capacity by 25.0% to meet the rising demand for NatureFlex films. The achievement reflects Futamura's commitment to sustainable packaging solutions. Andrew Duckworth, Operations Director, praises the team's dedication, anticipating long-term benefits for customers and the company. NatureFlex films, derived from renewable sources, align with global composting standards, reinforcing Futamura's environmental stewardship.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global biodegradable film market based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Current Industry Analysis and Growth Potential Outlook

1.2. Research Methods and Tools

1.3. Market Breakdown

1.3.1. By Segments

1.3.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Avery Dennison Corp.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. BASF SE

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Futamura Chemical Co. Ltd.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Taghleef Industries

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Key Strategy Analysis

4. Market Segmentation

4.1. Global Biodegradable Film Market by Type

4.1.1. PLA(Polylactic acid)

4.1.2. Starch Blends

4.1.3. Biodegradable Polyesters

4.1.4. PHA(Polyhydroxyalkanoates)

4.1.5. Others(Regenerated Cellulose, and Cellulose Derivatives)

4.2. Global Biodegradable Film Market by Application

4.2.1. Food Packaging

4.2.2. Agriculture & Horticulture

4.2.3. Cosmetic & Personal Care Products Packaging

4.2.4. Industrial Packaging

4.2.5. Others (Composting, Service Ware, and Carrier Bags)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. The Middle East & Africa

6. Company Profiles

6.1. Amtrex Nature Care Pvt Ltd

6.2. Aquapak Polymers.

6.3. Bi-Ax International Inc.

6.4. BioBag International AS

6.5. Cortec Corporation

6.6. ENVIPLAST

6.7. Magical Film Enterprise Co., Ltd

6.8. Kingfa Sci. & Tech. Co., Ltd.

6.9. Plascon Group

6.10. POLYNOVA Industries Inc

6.11. Roberts Mart & Co Ltd.

6.12. SOLOS POLYMERS PVT. LTD

6.13. Suprabha

6.14. Tilak Polypack Private Litd.

6.15. Walki Group Oy

6.16. Xinle Huabao Medical Products Co., Ltd.

1. GLOBAL BIODEGRADABLE FILM MARKET RESEARCH AND ANALYSIS BYTYPE, 2023-2031 ($ MILLION)

2. GLOBAL PLA BIODEGRADABLE FILM MARKETRESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL STARCH BLENDS BIODEGRADABLE FILM MARKETRESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL BIODEGRADABLE POLYESTERSFILM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBALPHABIODEGRADABLE FILM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL OTHERSBIODEGRADABLE FILM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL BIODEGRADABLE FILM MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

8. GLOBAL BIODEGRADABLE FILM MARKETFOR FOOD PACKAGINGRESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL BIODEGRADABLE FILM MARKET FOR AGRICULTURE & HORTICULTURERESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL BIODEGRADABLE FILM MARKET FOR COSMETIC & PERSONAL CARE PRODUCTS PACKAGING RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBALBIODEGRADABLE FILM MARKET FOR INDUSTRIAL PACKAGINGRESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL BIODEGRADABLE FILM MARKET FOR OTHERAPPLICATION RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBALBIODEGRADABLE FILM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. NORTH AMERICAN BIODEGRADABLE FILM MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

15. NORTH AMERICAN BIODEGRADABLE FILM MARKET RESEARCH AND ANALYSIS BYTYPE 2023-2031 ($ MILLION)

16. NORTH AMERICAN BIODEGRADABLE FILM MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

17. EUROPEAN BIODEGRADABLE FILM MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

18. EUROPEAN BIODEGRADABLE FILM MARKET RESEARCH AND ANALYSIS BYTYPE2023-2031 ($ MILLION)

19. EUROPEAN BIODEGRADABLE FILM MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

20. ASIA-PACIFIC BIODEGRADABLE FILM MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

21. ASIA-PACIFICBIODEGRADABLE FILM MARKET RESEARCH AND ANALYSIS BYTYPE, 2023-2031 ($ MILLION)

22. ASIA-PACIFICBIODEGRADABLE FILM MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

23. REST OF THE WORLD BIODEGRADABLE FILM MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

24. REST OF THE WORLD BIODEGRADABLE FILM MARKET RESEARCH AND ANALYSIS BYTYPE, 2023-2031 ($ MILLION)

25. REST OF THE WORLD BIODEGRADABLE FILM MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

1. GLOBAL BIODEGRADABLE FILM MARKET RESEARCH AND ANALYSIS BY TYPE, 2023 VS 2031 (%)

2. GLOBALPLABIODEGRADABLE FILM MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

3. GLOBAL STARCH BLENDSBIODEGRADABLE FILM MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

4. GLOBAL BIODEGRADABLE POLYESTERS FILM MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

5. GLOBAL PHABIODEGRADABLE FILM MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

6. GLOBAL OTHERSBIODEGRADABLE FILM MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

7. GLOBAL BIODEGRADABLE FILM MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023 VS 2031 (%)

8. GLOBALBIODEGRADABLE FILM MARKETFOR FOOD PACKAGINGRESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

9. GLOBALBIODEGRADABLE FILM MARKETFOR AGRICULTURE & HORTICULTURERESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

10. GLOBAL BIODEGRADABLE FILM MARKET FORCOSMETIC & PERSONAL CARE PRODUCTS PACKAGINGRESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

11. GLOBAL BIODEGRADABLE FILM MARKET FOR INDUSTRIAL PACKAGING RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

12. GLOBAL BIODEGRADABLE FILM MARKET FOR OTHERS RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

13. GLOBAL BIODEGRADABLE FILM MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

14. US BIODEGRADABLE FILM MARKET SIZE, 2023-2031 ($ MILLION)

15. CANADA BIODEGRADABLE FILM MARKETSIZE, 2023-2031 ($ MILLION)

16. UK BIODEGRADABLE FILM MARKETSIZE, 2023-2031 ($ MILLION)

17. FRANCE BIODEGRADABLE FILM MARKETSIZE, 2023-2031 ($ MILLION)

18. GERMANY BIODEGRADABLE FILM MARKETSIZE, 2023-2031 ($ MILLION)

19. ITALY BIODEGRADABLE FILM MARKETSIZE, 2023-2031 ($ MILLION)

20. SPAIN BIODEGRADABLE FILM MARKET SIZE, 2023-2031 ($ MILLION)

21. REST OF EUROPE BIODEGRADABLE FILM MARKETSIZE, 2023-2031 ($ MILLION)

22. INDIA BIODEGRADABLE FILM MARKETSIZE, 2023-2031 ($ MILLION)

23. CHINA BIODEGRADABLE FILM MARKET SIZE, 2023-2031 ($ MILLION)

24. JAPAN BIODEGRADABLE FILM MARKET SIZE, 2023-2031 ($ MILLION)

25. SOUTH KOREA BIODEGRADABLE FILM MARKETSIZE, 2023-2031 ($ MILLION)

26. REST OF ASIA-PACIFIC BIODEGRADABLE FILM MARKETSIZE, 2023-2031 ($ MILLION)

27. LATIN AMERICA BIODEGRADABLE FILM MARKET SIZE, 2023-2031 ($ MILLION)

28. THE MIDDLE EAST & AFRICA BIODEGRADABLE FILM MARKET SIZE, 2023-2031 ($ MILLION)