Bio Electronics Market

Global Bioelectronics Market Size, Share & Trends Analysis by Product (Biochips, Implantable Medical Devices, Prosthetic Devices, Artificial Organs/Bionic Organs, and Other) Forecast Period (2022-2028) Update Available - Forecast 2025-2035

The global bioelectronics market is anticipated to grow at a significant CAGR of 9.7% during the forecast period. Bioelectronics plays a prominent role in the medical device industry owing to the new technologies such as biosensors and nanotechnology that support the expansion of the life science domain. Various key factors are contributing to the growth of the global bioelectronics market which includes growing demand for bioelectronics products for cancer treatment and detection and increasing demand for prosthetics such as neural and tissue implants. The prevalence of chronic diseases is growing across the globe which creates the demand for bioelectronics products that are driving the growth of the market.

Cardiovascular disease such as cardiac arrhythmia is increasing across the globe, and the demand for innovative technologies such as implantable cardiac rhythm management devices is increasing. Further, it propels the application of bioelectronics such as optical sensors, biosensors, and CMOS platforms. The increasing advancements in semiconductor technology and surface chemistry are related to interface biology and man-made devices. There are various areas of application including prosthetics, disease detection, disease prevention, and power sources. Furthermore, technological advancements are made to identify the function of proteins such as the development of the nanoscale an electrical measurement device that is used in genomics and proteomics.

The lab-on-a-chip technology has significant potential in the disease diagnosis and prevention field which creates the demand for bioelectronics. The development of point-of-care, micro-flow, and micro-chemical cytometry point-of-care metabolism, and devices for identification & isolation of rare circulating tumor cells massive parallel microfluidics immunoassays are also contributing to the global bioelectronics market growth.

Impact of COVID-19 Pandemic on Global Bioelectronics Market

The COVID-19 pandemic has had a considerable impact on the bioelectronics market. The spread of COVID-19 had a detrimental influence on the market due to supply chain disruptions as a result of protracted plant closures around the world. The COVID-19 pandemic has broken out, and the situation is still uncertain. However, there are facts to consider. The impact of the impending pandemic on the biotech business was very minor in the first quarter of 2020. The most crucial indices — venture capital (VC) firm new money raised, clinical trial pace, mergers and acquisitions, and regulatory approvals (or rejections) — did not change significantly. Important dislocations happened in late March. Companies quarantined themselves (although many continued skeletal lab operations). VC firms started working from their homes. Clinical study sites, in particular, ceased activities as hospitals struggled to cope with the pandemic.

Segmental Outlook

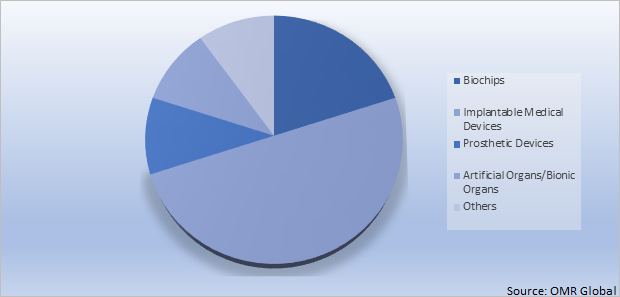

The global bioelectronics market is segmented based on the product. Based on the product, the market is segmented into biochips, implantable medical devices, prosthetic devices, artificial organs/bionic organs, and others.

Global Bioelectronics Market Share by Product, 2021 (%)

The Implantable Medical Devices Segment is Anticipated to Hold Prominent Share in the Global Bioelectronics Market

The implantable medical devices segment is expected to hold a prominent share. This is due to the rising applications and demand for high-throughput implantable devices in the treatment of cardiovascular diseases. This device utilizes the power of biosensors and nanotechnology due to which it is widely used in monitoring the progress of the patient. The demand for biosensors is significantly increasing due to the rising integration of biotechnology with the electronics field including biocomputing which has resulted in smart bioelectrical systems for homeland security, and medical and environmental applications. Implantable devices utilize biosensors that enable control of the rate of diseases (neural degeneration, cancer). Blood glucose meters, heart rate meters, magnetic resonance imaging, and cardiac pacemaker utilize biosensors that drive the growth of the global bioelectronics market.

Regional Outlooks

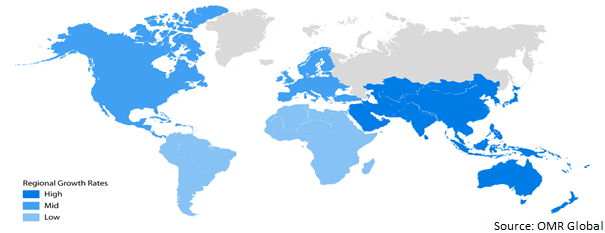

The global bioelectronics market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East & Africa, and Latin America). The market can be analyzed for a particular region or country level as per the requirement. Among these, the North American regional market is expected to cater to considerable growth during the forecast period. Factors contributing to the regional growth of the market are the increasing applications such as implantable medical devices, prosthetic devices, and artificial organs/bionic organs. Asia-Pacific is anticipated to grow due to the rising technological development of emerging companies such as India and China.

Global Bioelectronics Market Growth, by Region 2022-2028

The North America Region is Expected to Hold a Prominent Share in the Global Bioelectronics Market

The North American region is expected to hold a prominent share in the global Bioelectronics market due to the increasing prevalence of diseases, risks, and incidences of chronic disorders. Increasing investment into R&D for biomedicine and semiconductors in the region will further boost the bioelectronics market of North America. The rising population of older people, growing incidence and prevalence rate of chronic diseases, and increasing investment in the development of advanced bioelectronics from government and private players will boost the bioelectronics market. For instance, GSK PLC and Microsoft Corp. In 2016, both companies created a new company Galvani Bioelectronics. An investment of $715 million is expected in the next seven years for R&D programs. Around 55% stake is owned by GSK PLC whereas 45% by Microsoft Corp.

Market Players Outlook

The major companies serving the global bioelectronics market include Abbott Laboratories, Inc., Bioelectronics Corp., Danaher Corp., Siemens AG, Boston Scientific Corp., and F. Hoffmann-La Roche Ltd., among others. Market players are constantly focusing on gaining major market share by adopting strategies such as mergers and acquisitions, product launches, partnerships, and collaboration. For instance, in April 2019, iHEAR Medical launched next-generation iHEARhd. It is a home-programmable invisible hearing aid made for mild to moderate hearing loss. The product offers four new pre-set sound profiles with better durable housing.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global bioelectronics market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global Bioelectronics Market

• Recovery Scenario of Global Bioelectronics Market

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

3.3. Impact of Covid-19 on Key Players

4. Market Segmentation

4.1. Global Bioelectronics Market by Product Type

4.1.1. Biochips

4.1.2. Implantable Medical Devices

4.1.3. Prosthetic Devices

4.1.4. Artificial Organs/Bionic Organs

4.1.5. Other

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Abbott Laboratories, Inc.

6.2. Agamatrix, Inc.

6.3. Bioelectronics Corp.

6.4. BIOTRONIKSE & Co. KG

6.5. Boston Scientific Corp.

6.6. Cala Health, Inc.

6.7. Cochlear,Ltd.

6.8. Danaher Corp.

6.9. Demant A/S

6.10. Electrocore, Inc.

6.11. F. Hoffmann-La Roche A.G.

6.12. Medtronic PLA

6.13. MicronitMicrotechnologies B.V.

6.14. Nova Biomedical Corp.

6.15. OmniVision Technologies, Inc.

6.16. Second Sight Medical Products, Inc.

6.17. Siemens AG

6.18. Sotera Wireless, Inc.

6.19. Universal Biosensors Pty. Ltd.

6.20. ZOLL Medical Corp.