Bioinformatics Market

Bioinformatics Market Size, Share & Trends Analysis by Product & Services (Knowledge Management Tools, Bioinformatics Platforms, Data Analysis Structural Analysis and Bioinformatics Services), By Application (Metabolomics, Transcriptomics, Proteomics, Genomics and Others) Forecast Period (2025-2035)

Industry Overview

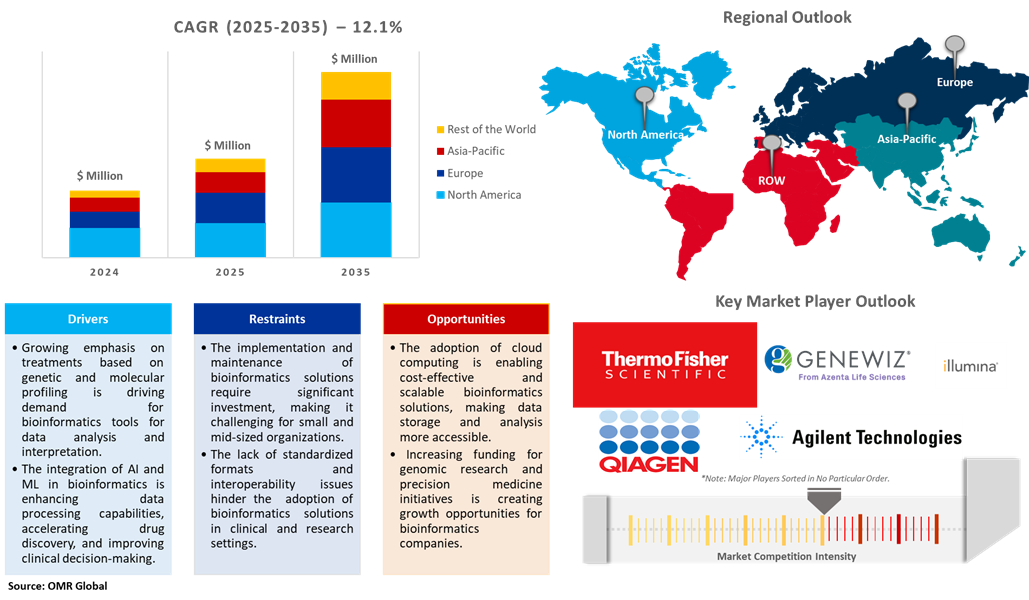

Bioinformatics market was valued at $12.8 billion in 2024 and is projected to reach $44.9 billion by 2035, growing at a CAGR of 12.1% from 2025 to 2035. The bioinformatics industry growth is driven by increased R&D investments due to the growing need for advanced data analysis in genomics, personalized medicine, and drug discovery. Additionally, governments, biotech firms, and pharmaceutical companies are heavily funding bioinformatics research to accelerate innovations. For instance, Genomic analysis of conotruncal heart defects is a collaborative research grant funded by the DBT, Government of India to the IOB and Mazumdar Shaw Medical Centre (MSMC), Narayana Hrudayalaya for the project entitled “Genetics of syndromic and non-syndromic conotruncal heart defects”. IOB will focus on the genetic and genomic analysis of patients with conotruncal heart defects and bioinformatic analysis. The main objective of this project is to investigate the genetic basis of CTDs and identify novel genetic causes in the patients.

Market Dynamics

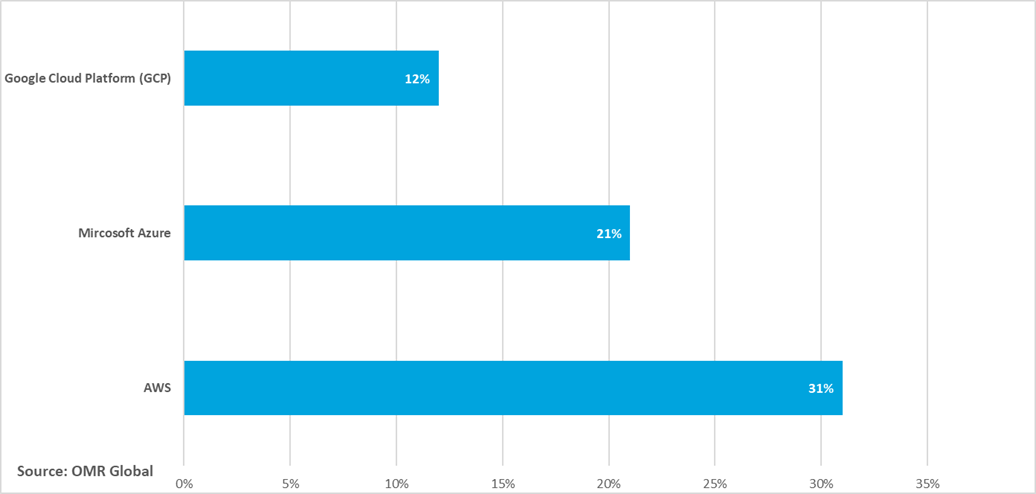

Cloud Computing for Bioinformatics

Advances in genomic sequencing have a positive effect on public health surveillance. Cloud computing offers a powerful, flexible, and scalable approach to big data analysis. It helps bioinformatics researchers to overcome the challenges and limitations of traditional computing and to achieve new insights and discoveries in biology and medicine. However, cloud computing also requires careful planning and management, and users need to be aware of the benefits and risks of using cloud services. AWS and AWS Partners have purpose-built services, tools, and solutions to help users migrate and securely store genomic data in the AWS cloud, accelerate secondary and tertiary analysis, and integrate genomic data into multi-modal datasets. Industry leaders such as AstraZeneca, Illumina, DNAnexus, Genomics England, GRAIL, and others leverage AWS to accelerate time to insights while reducing costs and keeping their data secure.

Market Share of Leading Cloud Providers

Advancements in Bioinformatics: Transforming Precision Oncology and Cancer Treatment

The market is expanding, driven by advancements in technologies such as next-generation sequencing (NGS), which enables comprehensive analysis of genetic alterations such as SNPs, gene expression, and protein levels. Companies like Eurofins offer NHS services on different instruments which allows users to combine the best technologies. Precision oncology, which tailors cancer treatments based on individual genetic profiles, is a major application of bioinformatics. Tools for genomic profiling, such as whole-genome sequencing (WGS) and whole-exome sequencing (WES), combined with bioinformatics platforms for variant annotation, pathway analysis, and biomarker discovery, are transforming cancer research and treatment. These technologies are acute for identifying actionable mutations, predicting disease progression, and enabling the development of personalized therapies that improve patient outcomes.

Market Segmentation

- Based on the product & services, the market is segmented into knowledge management tools, bioinformatics platforms, data analysis structural analysis, and bioinformatics services.

- Based on the application, the market is segmented into metabolomics, transcriptomics, proteomics, genomics, and others.

Bioinformatics Platforms Segment to Lead the Market with the Largest Share

The bioinformatics platforms segment is poised to lead the market with the largest share, driven by the increasing demand for efficient, collaborative tools in omics data analysis. Biological research is becoming more data-intensive, which underlines the growing need for platforms that bridge the gap between biologists and bioinformaticians. Biologists possess in-depth biological knowledge, but they often lack the bioinformatics expertise required to analyze complex datasets. Bioinformaticians, on the other hand, are skilled in data analysis however, may not fully grasp the biological context of the data. Bioinformatics platforms that facilitate collaboration and communication between these two groups are crucial in overcoming this challenge, enabling more efficient and accurate data analysis. These platforms streamline the process, allowing for iterative analysis and immediate feedback, ultimately reducing the need for multiple rounds of analysis and interpretation.

Genomics: A Key Segment in Market Growth

Genomics involves the use of bioinformatics tools and platforms to sequence, assemble, and analyze the genetic material (DNA) of organisms. These tools are pivotal in understanding the structure, function, and evolution of genomes, providing insights into genetic variations, mutations, and their implications for health and disease. In addition to sequencing technologies, CRISPR-Cas9, and other gene editing techniques further transformed genomics by enabling precise modifications to DNA. In November 2023, the UK’s Medicines and Healthcare Products Regulatory Agency approved Casgevy for the treatment of SCD and TDT in patients aged 12. The US Food and Drug Administration (FDA) followed with approval for SCD in December 2023. These were the first-ever approvals of a CRISPR-based therapy. Casgevy has since been approved in the US for the treatment of TDT, approved in the EU, and given conditional approval in Bahrain. A regulatory submission is in review with the Saudi FDA, with submission planned in Canada in 2024.

Regional Outlook

The global bioinformatics market is further divided by geography, including North America (the US and Canada), Asia-Pacific (India, China, Japan, South Korea, Australia and New Zealand, ASEAN Countries, and the Rest of Asia-Pacific), Europe (the UK, Germany, France, Italy, Spain, Russia, and the Rest of Europe), and the Rest of the World (the Middle East & Africa, and Latin America).

Funding and Advancements in US Bioinformatics Research for Precision Medicine

The bioinformatics research background in the US is placed at the forefront of transformative medical innovations, particularly in the case of precision medicine. In an upcoming AAPM Annual Meeting 2024, funding for bioinformatics research is increasingly recognized as essential to advancing the understanding and application of genomics, omics data analysis, and personalized healthcare solutions. The event emphasizes the need for investment in bioinformatics to enable the development of technologies and solutions that can address the complexities of clinical and omics data from data collection and analysis to secure storage and transfer. These innovations are pivotal for accelerating the integration of precision medicine into healthcare, driving better patient outcomes, and reducing overall costs within the US healthcare system. In March 2025, Ataraxis AI, an AI precision medicine company, raised $20.4 million in Series A funding led by AIX Ventures, with participation from Thiel Bio, Founders Fund, and others. The funding will support the launch of Ataraxis Breast, an AI-powered prognostic platform for breast cancer that has been clinically validated to be 30% more accurate than current methods. The company's AI model, Kestrel, uncovers complex patterns in patient data, improving cancer diagnosis and treatment.

Asia Pacific is Poised to be the Fastest Growing

QIAGEN’s establishment of a new data center in Melbourne, Australia, shows the growing importance of the Asia-Pacific region within the bioinformatics sector. The company also expanded the current QIAGEN network of seven data centers strategically located across the US, UK, Denmark, Turkey, South Korea, Japan, and China. This strategic expansion reflects QIAGEN’s commitment to strengthening its infrastructure in the region, ensuring the provision of high-quality, scalable, and secure bioinformatics solutions for Omics analysis and genomic testing. The new facility highlights the region's increasing demand for advanced bioinformatics services, driven by the expansion of clinical next-generation sequencing (NGS) and personalized medicine. The data center is designed to support genomic testing laboratories and researchers while ensuring compliance with evolving data sovereignty regulations.

Market Players Outlook

The major companies operating in the global bioinformatics market include Thermo Fisher Scientific, Inc., GENEWIZ, Illumina, Inc., QIAGEN Bioinformatics, and Agilent Technologies, Inc. among others. Market players are leveraging partnerships, collaborations, mergers and acquisition strategies for business expansion and innovative product development to maintain their market positioning.

Recent Development

In April 2024, SOPHiA GENETICS announced a strategic partnership with Strand Life Sciences, a pioneer in bioinformatics and diagnostics, to deliver innovative solutions that will fuel the use of precision medicine globally. The collaboration will leverage the strengths of both companies to provide access to advanced genomics technologies, bioinformatics services, and innovative diagnostics solutions.

The Report Covers

- Market value data analysis for 2024 and forecast to 2035.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global bioinformatics market. Based on the availability of data, information related to new products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Global Bioinformatics Market Sales Analysis – Product & Services | Application ($ Million)

• Bioinformatics Market Sales Performance of Top Countries

1.1. Research Methodology

• Primary Research Approach

• Secondary Research Approach

1.2. Market Snapshot

2. Market Overview and Insights

2.1. Scope of the Study

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Bioinformatics Market Industry Trends

2.2.2. Market Recommendations

2.3. Porter's Five Forces Analysis for the Bioinformatics Market

2.3.1. Competitive Rivalry

2.3.2. Threat of New Entrants

2.3.3. Bargaining Power of Suppliers

2.3.4. Bargaining Power of Buyers

2.3.5. Threat of Substitutes

3. Market Determinants

3.1. Market Drivers

3.1.1. Drivers For Global Bioinformatics Market: Impact Analysis

3.1.1.1. Advancements in Genomic Research

3.1.1.2. Increased R&D Investments

3.2. Market Pain Points and Challenges

3.2.1. Restraints For Bioinformatics Market: Impact Analysis

3.3. Market Opportunities

4. Competitive Landscape

4.1. Competitive Dashboard – Bioinformatics Market Revenue and Share by Manufacturers

• Bioinformatics Market Comparison Analysis

• Top Market Player Ranking Matrix

4.2. Key Company Analysis

4.2.1. Thermo Fisher Scientific, Inc.

4.2.1.1. Overview

4.2.1.2. Product Portfolio

4.2.1.3. Financial Analysis (Subject to Data Availability)

4.2.1.4. SWOT Analysis

4.2.1.5. Business Strategy

4.2.2. Illumina, Inc.

4.2.2.1. Overview

4.2.2.2. Product Portfolio

4.2.2.3. Financial Analysis (Subject to Data Availability)

4.2.2.4. SWOT Analysis

4.2.2.5. Business Strategy

4.2.3. QIAGEN Bioinformatics

4.2.3.1. Overview

4.2.3.2. Product Portfolio

4.2.3.3. Financial Analysis (Subject to Data Availability)

4.2.3.4. SWOT Analysis

4.2.3.5. Business Strategy

4.2.4. Agilent Technologies, Inc.

4.2.4.1. Overview

4.2.4.2. Product Portfolio

4.2.4.3. Financial Analysis (Subject to Data Availability)

4.2.4.4. SWOT Analysis

4.2.4.5. Business Strategy

4.3. Top Winning Strategies by Market Players

4.3.1. Merger and Acquisition

4.3.2. Product Launch

4.3.3. Partnership And Collaboration

5. Global Bioinformatics Market Sales Analysis by Product & Services ($ Million)

5.1. Knowledge Management Tools Bioinformatics Platforms

5.2. Data Analysis Structural Analysis

5.3. Bioinformatics Services

6. Global Bioinformatics Market Sales Analysis by Application ($ Million)

6.1. Metabolomics

6.2. Transcriptomics

6.3. Proteomics

6.4. Genomics

6.5. Others

7. Regional Analysis

7.1. North American Bioinformatics Market Sales Analysis – Product & Services | Application ($ Million)

• Macroeconomic Factors for North America

7.1.1. United States

7.1.2. Canada

7.2. European Bioinformatics Market Sales Analysis – Product & Services | Application ($ Million)

• Macroeconomic Factors for Europe

7.2.1. UK

7.2.2. Germany

7.2.3. Italy

7.2.4. Spain

7.2.5. France

7.2.6. Russia

7.2.7. Rest of Europe

7.3. Asia-Pacific Bioinformatics Market Sales Analysis – Product & Services | Application ($ Million)

• Macroeconomic Factors for Asia-Pacific

7.3.1. China

7.3.2. Japan

7.3.3. South Korea

7.3.4. India

7.3.5. Australia & New Zealand

7.3.6. ASEAN Countries (Thailand, Indonesia, Vietnam, Singapore, And Others)

7.3.7. Rest of Asia-Pacific

7.4. Rest of the World Bioinformatics Market – Product & Services | Application ($ Million)

• Macroeconomic Factors for the Rest of the World

7.4.1. Latin America

7.4.2. Middle East and Africa

8. Company Profiles

8.1. ArrayGen Technologies Pvt. Ltd.

8.1.1. Quick Facts

8.1.2. Company Overview

8.1.3. Product Portfolio

8.1.4. Business Strategies

8.2. BGI Group

8.2.1. Quick Facts

8.2.2. Company Overview

8.2.3. Product Portfolio

8.2.4. Business Strategies

8.3. BioLizard nv.

8.3.1. Quick Facts

8.3.2. Company Overview

8.3.3. Product Portfolio

8.3.4. Business Strategies

8.4. Charles River Laboratories

8.4.1. Quick Facts

8.4.2. Company Overview

8.4.3. Product Portfolio

8.4.4. Business Strategies

8.5. DNAnexus, Inc.

8.5.1. Quick Facts

8.5.2. Company Overview

8.5.3. Product Portfolio

8.5.4. Business Strategies

8.6. DNASTAR

8.6.1. Quick Facts

8.6.2. Company Overview

8.6.3. Product Portfolio

8.6.4. Business Strategies

8.7. Eurofins Genomics

8.7.1. Quick Facts

8.7.2. Company Overview

8.7.3. Product Portfolio

8.7.4. Business Strategies

8.8. Firalis Molecular Precision

8.8.1. Quick Facts

8.8.2. Company Overview

8.8.3. Product Portfolio

8.8.4. Business Strategies

8.9. Genedata AG

8.9.1. Quick Facts

8.9.2. Company Overview

8.9.3. Product Portfolio

8.9.4. Business Strategies

8.10. Genohub Inc.

8.10.1. Quick Facts

8.10.2. Company Overview

8.10.3. Product Portfolio

8.10.4. Business Strategies

8.11. GenoScreen

8.11.1. Quick Facts

8.11.2. Company Overview

8.11.3. Product Portfolio

8.11.4. Business Strategies

8.12. Lexogen GmbH.

8.12.1. Quick Facts

8.12.2. Company Overview

8.12.3. Product Portfolio

8.12.4. Business Strategies

8.13. PREMIER Biosoft

8.13.1. Quick Facts

8.13.2. Company Overview

8.13.3. Product Portfolio

8.13.4. Business Strategies

8.14. Nucleome Informatics

8.14.1. Quick Facts

8.14.2. Company Overview

8.14.3. Product Portfolio

8.14.4. Business Strategies

8.15. QLUCORE

8.15.1. Quick Facts

8.15.2. Company Overview

8.15.3. Product Portfolio

8.15.4. Business Strategies

8.16. SEQme s.r.o.

8.16.1. Quick Facts

8.16.2. Company Overview

8.16.3. Product Portfolio

8.16.4. Business Strategies

8.17. Seven Bridges Genomics (Velsera)

8.17.1. Quick Facts

8.17.2. Company Overview

8.17.3. Product Portfolio

8.17.4. Business Strategies

8.18. Source BioScience

8.18.1. Quick Facts

8.18.2. Company Overview

8.18.3. Product Portfolio

8.18.4. Business Strategies

8.19. Strand Life Sciences

8.19.1. Quick Facts

8.19.2. Company Overview

8.19.3. Product Portfolio

8.19.4. Business Strategies

1. Global Bioinformatics Market Research And Analysis Market Research And Analysis By Product & Services, 2024-2035 ($ Million)

2. Global Bioinformatics Knowledge Management Tools Market Research And Analysis By Region, 2024-2035 ($ Million)

3. Global Bioinformatics Platforms Market Research And Analysis By Region, 2024-2035 ($ Million)

4. Global Data Analysis Structural Analysis Market Research And Analysis By Region, 2024-2035 ($ Million)

5. Global Bioinformatics Services Market Research And Analysis By Region, 2024-2035 ($ Million)

6. Global Bioinformatics Market Research And Analysis By Application, 2024-2035 ($ Million)

7. Global Bioinformatics For Metabolomics Market Research And Analysis, 2024-2035 ($ Million)

8. Global Bioinformatics For Transcriptomics Market Research And Analysis, 2024-2035 ($ Million)

9. Global Bioinformatics For Proteomics Market Research And Analysis, 2024-2035 ($ Million)

10. Global Bioinformatics For Genomics Market Research And Analysis, 2024-2035 ($ Million)

11. Global Bioinformatics For Other Market Research And Analysis, 2024-2035 ($ Million)

12. Global Bioinformatics Market Research And Analysis By Region, 2024-2035 ($ Million)

13. North American Bioinformatics Market Research And Analysis By Country, 2024-2035 ($ Million)

14. North American Bioinformatics Market Research And Analysis By Country, 2024-2035 ($ Million)

15. North American Bioinformatics Market Research And Analysis By Product & Services, 2024-2035 ($ Million)

16. North American Bioinformatics Market Research And Analysis By Application, 2024-2035 ($ Million)

17. European Bioinformatics Market Research And Analysis By Country, 2024-2035 ($ Million)

18. European Bioinformatics Market Research And Analysis By Product & Services, 2024-2035 ($ Million)

19. European Bioinformatics Market Research And Analysis By Application, 2024-2035 ($ Million)

20. Asia-Pacific Bioinformatics Market Research And Analysis By Country, 2024-2035 ($ Million)

21. Asia-Pacific Bioinformatics Market Research And Analysis By Product & Services, 2024-2035 ($ Million)

22. Asia-Pacific Bioinformatics Market Research And Analysis By Application, 2024-2035 ($ Million)

23. Rest Of The World Bioinformatics Market Research And Analysis By Country, 2024-2035 ($ Million)

24. Rest Of The World Bioinformatics Market Research And Analysis By Product & Services, 2024-2035 ($ Million)

25. Rest Of The World Bioinformatics Market Research And Analysis By Application, 2024-2035 ($ Million)

26. Global Bioinformatics Market Research And Analysis By Product & Services, 2024 Vs 2035 (%)

27. Global Bioinformatics Knowledge Management Tools Market Research And Analysis By Region, 2024 Vs 2035 (%)

28. Global Bioinformatics Platforms Market Research And Analysis By Region, 2024 Vs 2035 (%)

29. Global Bioinformatics Services Market Research And Analysis By Region, 2024 Vs 2035 (%)

30. Global Bioinformatics Market Research And Analysis By Application, 2024 Vs 2035 (%)

31. Global Bioinformatics For Metabolomics Market Research And Analysis, 2024 Vs 2035 (%)

32. Global Bioinformatics For Transcriptomics Market Research And Analysis, 2024 Vs 2035 (%)

33. Global Bioinformatics For Proteomics Market Research And Analysis, 2024 Vs 2035 (%)

34. Global Bioinformatics For Genomics Market Research And Analysis, 2024 Vs 2035 (%)

35. Global Bioinformatics For Other Market Research And Analysis, 2024 Vs 2035 (%)

36. Global Bioinformatics Market Share By Region, 2024 Vs 2035 (%)

37. Us Bioinformatics Market Size, 2024-2035 ($ Million)

38. Canada Bioinformatics Market Size, 2024-2035 ($ Million)

39. UK Bioinformatics Market Size, 2024-2035 ($ Million)

40. France Bioinformatics Market Size, 2024-2035 ($ Million)

41. Germany Bioinformatics Market Size, 2024-2035 ($ Million)

42. Italy Bioinformatics Market Size, 2024-2035 ($ Million)

43. Spain Bioinformatics Market Size, 2024-2035 ($ Million)

44. Rest Of Europe Bioinformatics Market Size, 2024-2035 ($ Million)

45. India Bioinformatics Market Size, 2024-2035 ($ Million)

46. China Bioinformatics Market Size, 2024-2035 ($ Million)

47. Japan Bioinformatics Market Size, 2024-2035 ($ Million)

48. South Korea Bioinformatics Market Size, 2024-2035 ($ Million)

49. Rest Of Asia-Pacific Bioinformatics Market Size, 2024-2035 ($ Million)

50. Rest Of The World Bioinformatics Market Size, 2024-2035 ($ Million)

1. Global Bioinformatics Market Share By Product & Services, 2024 Vs 2035 (%)

2. Global Bioinformatics Market Share By Application, 2024 Vs 2035 (%)

3. Global Bioinformatics Market Share By Region, 2024 Vs 2035 (%)

4. Global Knowledge Management Tools Market Share By Region, 2024 Vs 2035 (%)

5. Global Bioinformatics Platforms Market Share By Region, 2024 Vs 2035 (%)

6. Global Data Analysis Structural Analysis Market Share By Region, 2024 Vs 2035 (%)

7. Global Bioinformatics Services Market Share By Region, 2024 Vs 2035 (%)

8. Global Metabolomics Drugs Market Share By Region, 2024 Vs 2035 (%)

9. Global Transcriptomics Market Share By Region, 2024 Vs 2035 (%)

10. Global Proteomics Market Share By Region, 2024 Vs 2035 (%)

11. Global Genomics (Nutritional Products And Packaging) Market Share By Region, 2024 Vs 2035 (%)

12. Global Others Market Share By Region, 2024 Vs 2035 (%)

13. US Bioinformatics Market Size, 2024-2035 ($ Million)

14. Canada Bioinformatics Market Size, 2024-2035 ($ Million)

15. UK Bioinformatics Market Size, 2024-2035 ($ Million)

16. France Bioinformatics Market Size, 2024-2035 ($ Million)

17. Germany Bioinformatics Market Size, 2024-2035 ($ Million)

18. Italy Bioinformatics Market Size, 2024-2035 ($ Million)

19. Spain Bioinformatics Market Size, 2024-2035 ($ Million)

20. Russia Bioinformatics Market Size, 2024-2035 ($ Million)

21. Rest Of Europe Bioinformatics Market Size, 2024-2035 ($ Million)

22. India Bioinformatics Market Size, 2024-2035 ($ Million)

23. China Bioinformatics Market Size, 2024-2035 ($ Million)

24. Japan Bioinformatics Market Size, 2024-2035 ($ Million)

25. South Korea Bioinformatics Market Size, 2024-2035 ($ Million)

26. ASEAN Bioinformatics Market Size, 2024-2035 ($ Million)

27. Australia and New Zealand Bioinformatics Market Size, 2024-2035 ($ Million)

28. Rest Of Asia-Pacific Bioinformatics Market Size, 2024-2035 ($ Million)

29. Latin America Bioinformatics Market Size, 2024-2035 ($ Million)

30. Middle East And Africa Bioinformatics Market Size, 2024-2035 ($ Million)

FAQS

The size of the Bioinformatic market in 2024 is estimated to be around $12.8 billion.

Asia Pacific holds the largest share in the Bioinformatic market.

Leading players in the Bioinformatic market include Thermo Fisher Scientific, Inc., GENEWIZ, Illumina, Inc., QIAGEN Bioinformatics, and Agilent Technologies, Inc. among others.

Bioinformatic market is expected to grow at a CAGR of 12.1% from 2025 to 2035.

Rising demand for personalized medicine, genomics research, and AI-driven data analysis is fueling growth in the bioinformatics market.