Biologics Market

Global Biologics Market Size, Share & Trends Analysis Report, By Product (Antibody Therapeutics, Vaccines, Cell Therapy, Gene Therapy, and Others), By Application (Cancer, Autoimmune Diseases, Infectious Diseases, and Others) and Forecast Period, 2020-2026 Update Available - Forecast 2025-2031

The global biologics market is estimated to grow at a CAGR of 8.6% during the forecast period. Some pivotal factors encouraging market growth include the rising incidences of cancer and rising investments in the development of biologics. Rising cancer incidences are the major factor accelerating the demand for biologics. As per the World Health Organization (WHO), the cancer burden globally is estimated to have increased to 18.1 million new incidences in 2018. 1 in 5 men and 1 in 6 women globally develop cancer during their lifetime. The total number of people globally who are alive within 5 years of a cancer diagnosis, known as a 5-year prevalence, is estimated to be 43.8 million in 2018.

This is resulting in an increasing demand for biological drugs for cancer therapeutics. These drugs are immune system substances that support to augment the body’s ability to fight against cancer. Types of biological drugs comprise vaccines, allergens, blood, tissues, recombinant proteins, blood components, cells, and genes. Biologic drugs are utilized to treat multiple conditions and are the most available advanced therapies. Biologic products may comprise genes that control the development of vital proteins, proteins that support to control the action of other proteins and cellular processes, cells, or modified human hormones, that develop substances that activate or suppress components of the immune system. Apart from cancer, biologic drugs are utilized for the treatment of rheumatoid arthritis, Crohn's disease, ulcerative colitis, and other autoimmune diseases.

Biologics are potential drugs that can be produced from tiny components such as proteins, sugars, or DNA or can be tissues or whole cells. Such drugs are developed from living sources, including plants, birds, mammals, insects, and even bacteria. Biological drugs are at the forefront of medical developments. Cellular and gene-based biologics make it possible for the treatment of certain illnesses where no other treatments were available. Chimeric antigen receptor (CAR) T cell therapies are a kind of cell therapy that also acts as immunotherapy that comprises a one-time infusion of a patient’s immune cells. These immune cells are genetically modified to find and attack cancer. The US FDA approved two CAR T therapies, which include Gilead Sciences’ Yescarta (axicabtagene ciloleucel), which is firstly approved in 2017 for the treatment of diffuse large B-cell lymphoma, and Novartis’ Kymriah (tisagenlecleucel), the first CAR T therapy that is approved by the FDA in 2017 to treat certain kinds of leukemia.

Market Segmentation

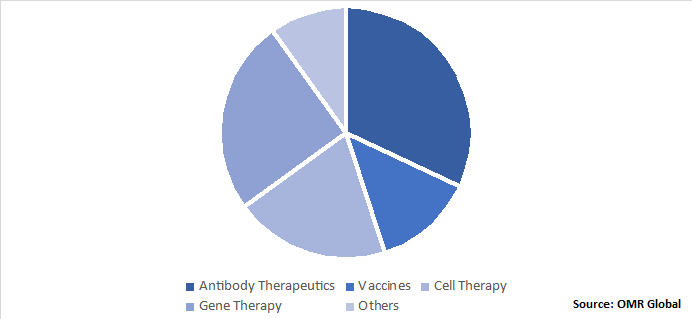

The global biologics market is segmented based on product and application. Based on the product, the market is segmented into antibody therapeutics, vaccines, cell therapy, gene therapy, and others. Based on application, the market is segmented into cancer, autoimmune diseases, infectious diseases, and others.

Antibody Therapeutics to Witness Largest Share in the Market

In 2019, antibody therapeutics have witnessed a potential share in the market. A large number of biologics available in the market are monoclonal antibodies and several products are in the pipeline. Over the decades, advances in the improvement of the humanization of monoclonal antibodies have been witnessed, which, in turn, improves efficacy and decreasing immunogenicity. Monoclonal antibodies are regarded as highly targeted drugs, binds to the cancerous cells, and poison the tumor to destroy it. One instance of a biological drug includes Trastuzumab, which is utilized in particular for metastatic breast cancer in women. Another instance is Rituxan, which is utilized to support the treatment of non-Hodgkin’s lymphoma.

Global Biologics Market Share by Product, 2019 (%)

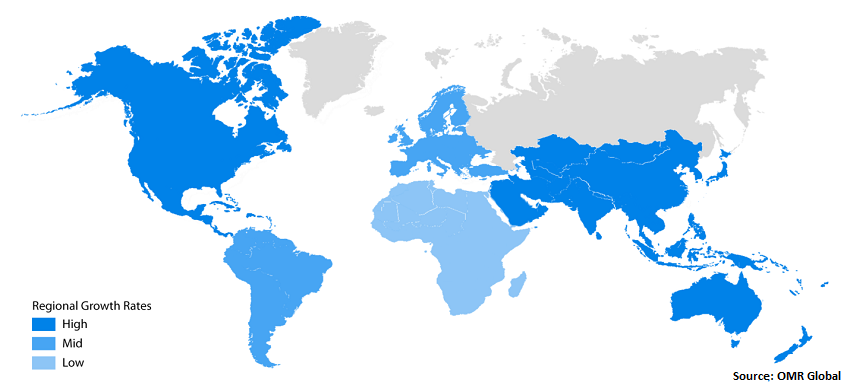

Regional Outlook

In 2019, North America held the largest share in the market owing to the rising cancer incidences and significant FDA approvals for monoclonal antibodies. For instance, as per the Centers for Disease Control and Prevention (CDC), the number of new cancer incidences in the US is expected to grow from nearly 1.5 million annually in 2010 to 1.9 million annually in 2020. The rising cancer incidences are leading to increasing demand for biologics which comprises a comprehensive range of drugs that particularly target cancer cells, encourage the immune response, and support in the recovery from cancer treatment. These drugs are normally utilized in combination with other therapies, including chemotherapy.

Global Biologics Market Growth, by Region 2020-2026

Market Players Outlook

Some prominent players in the market include AbbVie Inc., Amgen Inc., Eli Lilly and Co., F. Hoffman-La Roche AG, and Boehringer Ingelheim GmbH. The market players are using some key strategies to increase their market share. For instance, in September 2019, H. Lundbeck A/S declared a definitive agreement for Lundbeck to acquire Alder, a clinical-stage biopharmaceutical company that is committed to transforming migraine treatment ranging from the discovery, development, and commercialization of novel therapeutic antibodies. With this acquisition, Lundbeck will constantly widen the range of brain disorders. By acquiring Alder, Lundbeck will further increase its capabilities to offer future biological innovations in brain diseases. In February 2019, Alder presented a Biologics License Application (BLA) to the US FDA for eptinezumab. During 2020, Lundbeck expects to present eptinezumab for European Union approval, followed by proposals for approval in other regions across the globe including Japan and China. This acquisition will accelerate Lundbeck’s late-stage pipeline and offering access to novel capabilities in the field of monoclonal antibody treatment.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global biologics market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules and Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. AbbVie, Inc.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Amgen, Inc.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Eli Lilly and Co.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. F. Hoffman-La Roche AG

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Boehringer Ingelheim GmbH

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.3 Opportunities

5. Market Segmentation

5.1. Global Biologics Market by Product

5.1.1. Antibody Therapeutics

5.1.2. Vaccines

5.1.3. Cell Therapy

5.1.4. Gene Therapy

5.1.5. Others

5.2. Global Biologics Market by Application

5.2.1. Cancer

5.2.2. Autoimmune Diseases

5.2.3. Infectious Diseases

5.2.4. Others

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. AbbVie Inc.

7.2. Amgen Inc.

7.3. AstraZeneca plc (UK)

7.4. Aurobindo Pharma Ltd.

7.5. Baxter International Inc. (US)

7.6. Biocon Ltd.

7.7. Biological E. Limited (BE)

7.8. Boehringer Ingelheim GmbH (Germany)

7.9. Bristol Myers Squibb Co. (UK)

7.10. Cipla Ltd. (India)

7.11. Daiichi Sankyo Company, Ltd. (Japan)

7.12. Eli Lilly and Co.

7.13. F. Hoffmann-La Roche AG

7.14. GlaxoSmithKline PLC

7.15. H. Lundbeck A/S

7.16. Johnson & Johnson Services, Inc.

7.17. Merck & Co., Inc.

7.18. Novo Nordisk A/S

7.19. Pfizer Inc.

7.20. Sanofi SA

7.21. Smith & Nephew PLC

1. GLOBAL BIOLOGICS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2019-2026 ($ MILLION)

2. GLOBAL ANTIBODY THERAPEUTICS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL VACCINES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL CELL THERAPY MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

5. GLOBAL GENE THERAPY MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL OTHER BIOLOGICS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

7. GLOBAL BIOLOGICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

8. GLOBAL BIOLOGICS IN CANCER MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

9. GLOBAL BIOLOGICS IN AUTOIMMUNE DISEASES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

10. GLOBAL BIOLOGICS IN INFECTIOUS DISEASES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

11. GLOBAL BIOLOGICS IN OTHER APPLICATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

12. GLOBAL BIOLOGICS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

13. NORTH AMERICAN BIOLOGICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

14. NORTH AMERICAN BIOLOGICS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2019-2026 ($ MILLION)

15. NORTH AMERICAN BIOLOGICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

16. EUROPEAN BIOLOGICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

17. EUROPEAN BIOLOGICS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2019-2026 ($ MILLION)

18. EUROPEAN BIOLOGICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

19. ASIA-PACIFIC BIOLOGICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

20. ASIA-PACIFIC BIOLOGICS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2019-2026 ($ MILLION)

21. ASIA-PACIFIC BIOLOGICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

22. REST OF THE WORLD BIOLOGICS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2019-2026 ($ MILLION)

23. REST OF THE WORLD BIOLOGICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

1. GLOBAL BIOLOGICS MARKET SHARE BY PRODUCT, 2019 VS 2026 (%)

2. GLOBA LBIOLOGICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

3. GLOBAL BIOLOGICS MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

4. US BIOLOGICS MARKET SIZE, 2019-2026 ($ MILLION)

5. CANADA BIOLOGICS MARKET SIZE, 2019-2026 ($ MILLION)

6. UK BIOLOGICS MARKET SIZE, 2019-2026 ($ MILLION)

7. FRANCE BIOLOGICS MARKET SIZE, 2019-2026 ($ MILLION)

8. GERMANY BIOLOGICS MARKET SIZE, 2019-2026 ($ MILLION)

9. ITALY BIOLOGICS MARKET SIZE, 2019-2026 ($ MILLION)

10. SPAIN BIOLOGICS MARKET SIZE, 2019-2026 ($ MILLION)

11. ROE BIOLOGICS MARKET SIZE, 2019-2026 ($ MILLION)

12. INDIA BIOLOGICS MARKET SIZE, 2019-2026 ($ MILLION)

13. CHINA BIOLOGICS MARKET SIZE, 2019-2026 ($ MILLION)

14. JAPAN BIOLOGICS MARKET SIZE, 2019-2026 ($ MILLION)

15. REST OF ASIA-PACIFIC BIOLOGICS MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF THE WORLD BIOLOGICS MARKET SIZE, 2019-2026 ($ MILLION)