Biometric Systems Market

Global Biometric Systems Market Size, Share & Trends Analysis Report by Technology (Face Recognition, Fingerprint Recognition, Iris Recognition, Palm Print Recognition, Signature Recognition, and Others), by Function (Contact-based, Contactless, and Hybrid), by Authentication Level (Single-factor Authentication and Multi-level Authentication), by Component (Hardware and Software), and by Application (Banking & Finance, Home Security, Travel & Immigration, Military Defense, Healthcare, Government, and Others) Forecast Period 2021-2027 Update Available - Forecast 2025-2031

The global biometric systems market is anticipated to grow at a significant CAGR of 12.4% during the forecast period. The market is expected to grow modestly due to variety of factors which includes cohesive support from governments across the globe and favorable regulations that triggers the adoption of biometric market in varied domains and organization. Other factors such as a need for security, rapid adoption of e-passport by countries, theft and security concerns and so forth are contributing in the growth of the biometric systems market. Huge demand is emerging from varied sectors which includes government, military & defense, transport & logistics, commercial safety & security, healthcare, banking & finance, consumer electronics, business organizations and so forth will continue to contribute in the growth of biometric systems market. Adoption of biometrics market in smartphone, PCs, passport offices, banks will continue to contribute significantly in the growth of Biometrics market.

The market for biometric market is expected to see new highs in future due to rapid growth seen in the e-commerce segment. The online buyers are continually increasing which is leading to a totally digitized shopping experience. This increases lot of theft and fraud chances. The biometric systems are being seen getting adopted in e-commerce which can be seen as a solid growth for the biometric systems market during the forecast period. Biometrics system market by technology such as face recognition, fingerprint recognition, iris recognition, palm print/hand recognition, hand geometry recognition, voice recognition, signature recognition and so forth are widely adopted across the globe.

Impact of COVID-19 Pandemic on Global Biometric Systems Market

The fear of the spread of COVID-19 had cessation the contact-based biometric systems market. Additionally, the shut down of various companies across the globe had reduced the requirement of biometric systems. However, the demand for contactless biometric systems increased. The biometric systems with body temperature detection sensors are getting popular as the organizations have to follow COVID-19 guidelines. Soon as the COVID-19 situation normalizes and the industries and organizations get to work, the market of biometric systems will gain momentum in its growth.

Segmental Outlook

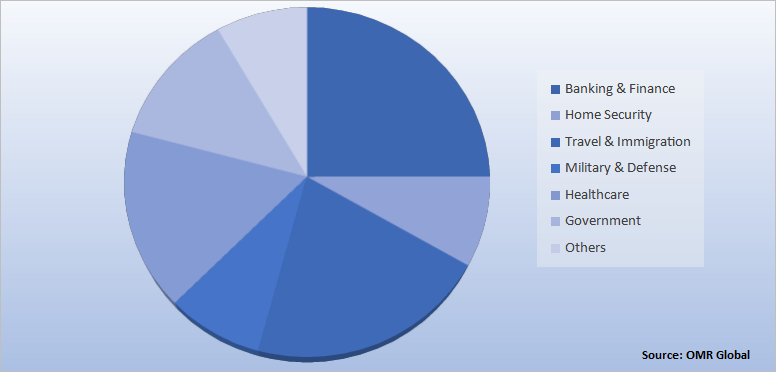

The global biometric systems market is segmented based on technology, function, component, and end-user. Based on the technology, the market is segmented into face recognition, fingerprint recognition, iris recognition, palm print recognition, signature recognition, and others. Based on the function, the market is segmented into contact-based, contactless, and hybrid. Based on the authentication level, the market is segmented into single-factor authentication and multi-level authentication. Based on the component, the market is segmented into hardware and software. Based on the disposable devices, the market is segmented into banking & finance, home security, travel & immigration, military defense, healthcare, government, and others.

Global Biometric Systems Market Share by Application, 2020 (%)

The Outbreak of COVID-19 had given Upthrust to the Temperature Segment of the Global Biometric Systems Market.

The single-factor authentication systems hold the major market share attributing to the economical and fast responsiveness. Government, travel & immigration, and banks are the major users of single-factor authentication systems.

The increasing demand for efficient and reliable biometric systems is boosting the growth of hybrid biometric systems. Such systems provide enhanced safety and security against spoofing and forgery through multi-level authentication. The countries including the US, India, and UK are using this technology at security checkpoints of country borders due to the high threat of terrorist attacks. NEC had developed such a product in May 2020 which has a multimodal biometric authentication terminal.

Banks and financial institutes are the major users of biometric systems. JP Morgan and Wells Fargo are amongst the few banks that offer their customers to log in to mobile banking through fingerprint authentication.

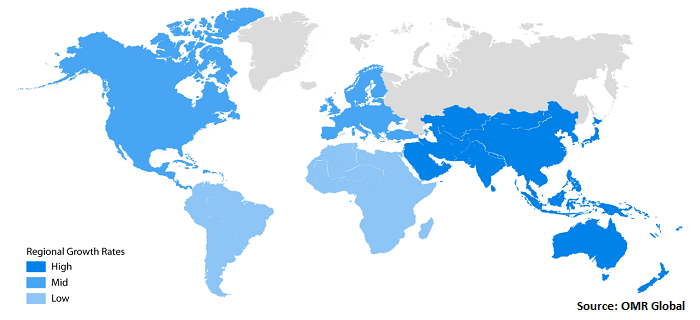

Regional Outlooks

The global biometric systems market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others, and the Rest of the World (the Middle East and Africa, and Latin America).

Global Biometric Systems Market Growth, by Region 2021-2027

North America and Europe are the Dominant Market of Biometric Systems.

North America is the clear leader in the biometric systems market and is expected to retain its position during the forecast period as well due to the growing usage and adoption of biometric systems in the region. The biometric systems in North America are rapidly finding usage in various fields such as homeland security & employee scrutiny. The adoption of biometric systems in the defense has also created solid opportunities for the market in past and with the growing technological advancement biometric systems are further expected to be absorbed more in the defense during the forecast period. Moving further, according to our estimates the Asia-Pacific region is shining brighter than any other region and is expected to be the fastest growing region during the forecast period. The reason behind this estimate is the growing security concerns which is leading the government in India and China to promote biometric systems and creating more awareness among the masses which are hesitant or reluctant to the use of biometric systems so far.

Market Players Outlook

The major companies serving the global biometric systems market include BIO-key International, Fujitsu Ltd., DelaneyBiometrics – Fulcrum Biometrics, Ltd., Suprema, Inc., NEC Corp., and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers & acquisitions, collaborations, funding, and new product launches, to stay competitive in the market. For instance, Thales had acquired Gemalto in April 2019 for around $5.3 billion. This had enabled Thales to provide biometric systems to critical infrastructure providers including banks, telecom operators, and government agencies.

The Report Covers

- Market value data analysis of 2020 and forecast to 2027.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global biometric systems market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global Biometric Systems Market

• Recovery Scenario of Global Biometric Systems Market

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. BY Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

3.3. Impact of COVID-19 on Key Players

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Biometric Systems Market by Technology

5.1.1. Face Recognition

5.1.2. Fingerprint Recognition

5.1.3. Iris Recognition

5.1.4. Palm Print Recognition

5.1.5. Signature Recognition

5.1.6. Others

5.2. Global Biometric Systems Market by Function

5.2.1. Contact-based

5.2.2. Contactless

5.2.3. Hybrid

5.3. Global Biometric Systems Market by Authentication Level

5.3.1. Single-factor Authentication

5.3.2. Multi-level Authentication

5.4. Global Biometric Systems Market by Component

5.4.1. Hardware

5.4.2. Software

5.5. Global Biometric Systems Market by End-User

5.5.1. Banking & Finance

5.5.2. Home Security

5.5.3. Travel & Immigration

5.5.4. Military& Defense

5.5.5. Healthcare

5.5.6. Government

5.5.7. Others

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. South Korea

6.3.5. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. 01 Systems

7.2. Access, Ltd.

7.3. Accurate Biometric, Inc.

7.4. Accu-Time Systems, Inc.

7.5. AD&S, Inc.

7.6. Advance System Inc.

7.7. Allevate, Ltd.

7.8. AmpleTrails

7.9. Anviz Global, Inc.

7.10. Applied Recognition Corp.

7.11. Argus TrueID

7.12. Authentik Systems

7.13. Aware, Inc.

7.14. Bayometric

7.15. Baztech Inc. (Pvt) Ltd.

7.16. BiATM, Ltd.

7.17. Bioconnect

7.18. BioID Technologies Ltd.

7.19. BIO-key International

7.20. BioMax Security

7.21. Biometrics Research Group, Inc.

7.22. Certify Global, Inc.

7.23. Choice Biometrics LLC

7.24. Croma Security Solution Group

7.25. DelaneyBiometrics – Fulcrum Biometrics, Ltd.

7.26. Diamond Fortress Technologies, Inc.

7.27. Fingerprint Cards AB

7.28. Fujitsu Ltd.

7.29. HID Global Corp.

7.30. ImageWare Systems, Inc

7.31. Intelligent Biometric Controls, Inc.

7.32. Iris ID, Inc.

7.33. IrisGuard UK, Ltd.

7.34. LexisNexis Risk Solutions Group

7.35. Morpho Safran Group

7.36. NEC Corp.

7.37. SecuGen Corp.

7.38. SIC Biometrics

7.39. Smartmatic

7.40. Suprema, Inc.

7.41. Thales Group

7.42. Touchless Biometric Systems AG

7.43. Trac-Tech (Pty) Ltd.

7.44. UnionCommunity Co., Ltd.

7.45. Vision RT

7.46. Warwick Warp Ltd.

7.47. ZKTECO Co., Ltd.

7.48. Zvetco, LLC

7.49. Zwipe AS

1. GLOBAL BIOMETRIC SYSTEMS MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2020-2027 ($ MILLION)

2. GLOBAL FACE RECOGNITION BIOMETRIC SYSTEMS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

3. GLOBAL FINGERPRINT RECOGNITION BIOMETRIC SYSTEMS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

4. GLOBAL IRIS RECOGNITION BIOMETRIC SYSTEMS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

5. GLOBAL PALM RECOGNITION BIOMETRIC SYSTEMS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

6. GLOBAL SIGNATURE RECOGNITION BIOMETRIC SYSTEMS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

7. GLOBAL OTHER RECOGNITION BIOMETRIC SYSTEMS RESPIRATORY DIAGNOSTIC DEVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

8. GLOBAL BIOMETRIC SYSTEMS MARKET RESEARCH AND ANALYSIS BY FUNCTION, 2020-2027 ($ MILLION)

9. GLOBAL CONTACT-BASED BIOMETRIC SYSTEMS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

10. GLOBAL CONTACTLESS BIOMETRIC SYSTEMS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

11. GLOBAL HYBRID BIOMETRIC SYSTEMS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

12. GLOBAL BIOMETRIC SYSTEMS MARKET RESEARCH AND ANALYSIS BY AUTHENTICATION LEVEL, 2020-2027 ($ MILLION)

13. GLOBAL SINGLE-FACTOR AUTHENTICATION BIOMETRIC SYSTEMS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

14. GLOBAL MULTI-LEVEL AUTHENTICATION BIOMETRIC SYSTEMS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

15. GLOBAL BIOMETRIC SYSTEMS MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2020-2027 ($ MILLION)

16. GLOBAL BIOMETRIC HARDWARE MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

17. GLOBAL BIOMETRIC SOFTWARE MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

18. GLOBAL BIOMETRIC SYSTEMS MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

19. GLOBAL BANKING & FINANCE BIOMETRIC SYSTEMS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

20. GLOBAL HOME SECURITY BIOMETRIC SYSTEMS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

21. GLOBAL TRAVEL & IMMIGRATION BIOMETRIC SYSTEMS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

22. GLOBAL MILITARY& DEFENSE BIOMETRIC SYSTEMS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

23. GLOBAL HEALTHCARE BIOMETRIC SYSTEMS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

24. GLOBAL GOVERNMENT BIOMETRIC SYSTEMS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

25. GLOBAL OTHER BIOMETRIC DEVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

26. GLOBAL BIOMETRIC SYSTEMS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2020-2027 ($ MILLION)

27. NORTH AMERICAN BIOMETRIC SYSTEMS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

28. NORTH AMERICAN BIOMETRIC SYSTEMS MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2020-2027 ($ MILLION)

29. NORTH AMERICAN BIOMETRIC SYSTEMS MARKET RESEARCH AND ANALYSIS BY FUNCTION, 2020-2027 ($ MILLION)

30. NORTH AMERICAN BIOMETRIC SYSTEMS MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2020-2027 ($ MILLION)

31. NORTH AMERICAN BIOMETRIC SYSTEMS MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

32. EUROPEAN BIOMETRIC SYSTEMS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

33. EUROPEAN BIOMETRIC SYSTEMS MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2020-2027 ($ MILLION)

34. EUROPEAN BIOMETRIC SYSTEMS MARKET RESEARCH AND ANALYSIS BY FUNCTION, 2020-2027 ($ MILLION)

35. EUROPEAN BIOMETRIC SYSTEMS MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2020-2027 ($ MILLION)

36. EUROPEAN BIOMETRIC SYSTEMS MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

37. ASIA-PACIFIC BIOMETRIC SYSTEMS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

38. ASIA-PACIFIC BIOMETRIC SYSTEMS MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2020-2027 ($ MILLION)

39. ASIA-PACIFIC BIOMETRIC SYSTEMS MARKET RESEARCH AND ANALYSIS BY FUNCTION, 2020-2027 ($ MILLION)

40. ASIA-PACIFIC BIOMETRIC SYSTEMS MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2020-2027 ($ MILLION)

41. ASIA-PACIFIC BIOMETRIC SYSTEMS MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

42. REST OF THE WORLD BIOMETRIC SYSTEMS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

43. REST OF THE WORLD BIOMETRIC SYSTEMS MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2020-2027 ($ MILLION)

44. REST OF THE WORLD BIOMETRIC SYSTEMS MARKET RESEARCH AND ANALYSIS BY FUNCTION, 2020-2027 ($ MILLION)

45. REST OF THE WORLD BIOMETRIC SYSTEMS MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2020-2027 ($ MILLION)

46. REST OF THE WORLD BIOMETRIC SYSTEMS MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL BIOMETRIC SYSTEMS MARKET, 2020-2027 ($ MILLION)

2. IMPACT OF COVID-19 ON GLOBAL BIOMETRIC SYSTEMS MARKET BY SEGMENT, 2020-2027 ($ MILLION)

3. RECOVERY OF GLOBAL BIOMETRIC SYSTEMS MARKET, 2021-2027 (%)

4. GLOBAL BIOMETRIC SYSTEMS MARKET SHARE BY TECHNOLOGY, 2020 VS 2027 (%)

5. GLOBAL FACE RECOGNITION BIOMETRIC SYSTEMS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

6. GLOBAL FINGERPRINT RECOGNITION BIOMETRIC SYSTEMS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

7. GLOBAL IRIS RECOGNITION BIOMETRIC SYSTEMS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

8. GLOBAL PALM RECOGNITION BIOMETRIC SYSTEMS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

9. GLOBAL SIGNATURE RECOGNITION BIOMETRIC SYSTEMS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

10. GLOBAL OTHER RECOGNITION BIOMETRIC SYSTEMS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

11. GLOBAL BIOMETRIC SYSTEMS MARKET SHARE BY FUNCTION, 2020 VS 2027 (%)

12. GLOBAL CONTACT-BASED BIOMETRIC SYSTEMS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

13. GLOBAL CONTACTLESS BIOMETRIC SYSTEMS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

14. GLOBAL HYBRID BIOMETRIC SYSTEMS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

15. GLOBAL BIOMETRIC SYSTEMS MARKET SHARE BY AUTHENTICATION LEVEL, 2020 VS 2027 (%)

16. GLOBAL SINGLE-FACTOR AUTHENTICATION BIOMETRIC SYSTEMS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

17. GLOBAL MULTI-LEVEL AUTHENTICATION BIOMETRIC SYSTEMS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

18. GLOBAL BIOMETRIC SYSTEMS MARKET SHARE BY COMPONENT, 2020 VS 2027 (%)

19. GLOBAL BIOMETRIC HARDWARE MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

20. GLOBAL BIOMETRIC SOFTWARE MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

21. GLOBAL BIOMETRIC SYSTEMS MARKET SHARE BY END-USER, 2020 VS 2027 (%)

22. GLOBAL BANKING & FINANCE BIOMETRIC SYSTEMS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

23. GLOBAL HOME SECURITY BIOMETRIC SYSTEMS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

24. GLOBAL TRAVEL & IMMIGRATION BIOMETRIC SYSTEMS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

25. GLOBAL MILITARY & DEFENSE BIOMETRIC SYSTEMS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

26. GLOBAL HEALTHCARE BIOMETRIC SYSTEMS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

27. GLOBAL GOVERNMENT BIOMETRIC SYSTEMS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

28. GLOBAL OTHER BIOMETRIC SYSTEMS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

29. GLOBAL BIOMETRIC SYSTEMS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

30. US BIOMETRIC SYSTEMS MARKET SIZE, 2020-2027 ($ MILLION)

31. CANADA BIOMETRIC SYSTEMS MARKET SIZE, 2020-2027 ($ MILLION)

32. UK BIOMETRIC SYSTEMS MARKET SIZE, 2020-2027 ($ MILLION)

33. FRANCE BIOMETRIC SYSTEMS MARKET SIZE, 2020-2027 ($ MILLION)

34. GERMANY BIOMETRIC SYSTEMS MARKET SIZE, 2020-2027 ($ MILLION)

35. ITALY BIOMETRIC SYSTEMS MARKET SIZE, 2020-2027 ($ MILLION)

36. SPAIN BIOMETRIC SYSTEMS MARKET SIZE, 2020-2027 ($ MILLION)

37. REST OF EUROPE BIOMETRIC SYSTEMS MARKET SIZE, 2020-2027 ($ MILLION)

38. INDIA BIOMETRIC SYSTEMS MARKET SIZE, 2020-2027 ($ MILLION)

39. CHINA BIOMETRIC SYSTEMS MARKET SIZE, 2020-2027 ($ MILLION)

40. JAPAN BIOMETRIC SYSTEMS MARKET SIZE, 2020-2027 ($ MILLION)

41. SOUTH KOREA BIOMETRIC SYSTEMS MARKET SIZE, 2020-2027 ($ MILLION)

42. REST OF ASIA-PACIFIC BIOMETRIC SYSTEMS MARKET SIZE, 2020-2027 ($ MILLION)

43. REST OF THE WORLD BIOMETRIC SYSTEMS MARKET SIZE, 2020-2027 ($ MILLION)