Biometrics-As-A-Service Market

Global Biometrics-As-A-Service Market Size, Share & Trends Analysis Report, By Scanner Type (Fingerprint Recognition, Iris Recognition, Palm Recognition, Facial Recognition, and Others), By Verticals (BFSI, IT and Telecommunication, Healthcare, Government and Utilities, Retail, and Others), and Forecast 2019-2025 Update Available - Forecast 2025-2035

The global biometrics-as-a-service market is projected to grow at a CAGR of 14.0% during 2019-2025. The market growth is attributed to the increasing complex IoT landscape, a growing number of cyber-attacks, and the rise in demand for cost-efficient biometric solutions among several industry verticals. Further, increasing the adoption of cloud-based biometrics is expected to give a boost to the growth of the global biometrics-as-a-service industry. Moreover, an increasing number of employees in organizations led to the growing interest of the organizations in providing enhanced banking security to the customers, which in turn, increase the demand for biometric devices and hence spurs the growth of the global biometrics-as-a-service market.

Further, government initiatives for the betterment of public and encouragement to adopt biometric solutions tend to drive the growth of the market. For instance, Aadhaar is an initiative taken by the Indian government aimed at getting the entire population of a country on to a single biometric card system. Such initiatives, by the government, create an ample opportunity for the growth of the market in near future.

Segmental Outlook

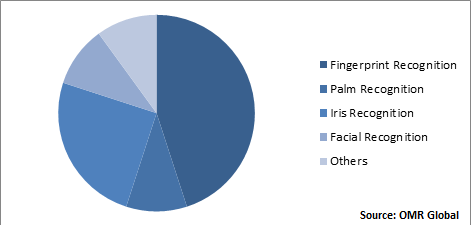

The global biometrics-as-a-service market is segmented on the basis of scanner types and verticals. Based on scanner type, the market is segmented into fingerprint recognition, iris recognition, palm recognition, facial recognition, and others. Fingerprint recognition is projected to hold a major market share during the forecast period, owing to its high reliability and cost-efficiency. While iris and face recognition are expected to grow at a significant rate during the forecast period. On the basis of verticals, the market is further segmented into BFSI, IT and telecommunication, healthcare, government and utilities, retail, and others.

Global Biometrics-As-A-Service Market Share by Scanner Type, 2018 (%)

BFSI will be the Largest Segment by Verticals

By verticals, the biometrics-as-a-service market is divided into BFSI, government, and utilities, healthcare, IT and telecommunication, retail and others. BFSI is expected to hold the largest share during the forecast period. It is due to the high number of online frauds along with frauds at e-commerce websites and wallets. It is followed by government and law enforcement as government agencies data and their website is the prime target of hackers. BFSI is further expected to be the fastest-growing market in the biometrics-as-a-service market followed by IT and telecommunications. IT and telecommunication market is increasing due to significant data loss of people which include their personal information.

Regional Outlook

The global biometrics-as-a-service market is further segmented on the basis of geography into North America, Europe, Asia-Pacific and the Rest of the World. North America is projected to have a significant share in the market during the forecast period, owing to the presence of well-developed infrastructure. The US is the major country in North America holding considerable market share in 2018. The well-established economy of the country laid the ground for the growth of the biometrics-as-a-service market. Moreover, the high adoption of advanced technologies including IoT devices, high penetration of mobile phones, computers and other IP based devices coupled with increasing cyber-attacks and digital crimes are the major factor for high market share in North America. North America is followed by Europe and the Asia Pacific is expected to be the fastest-growing market during the forecasted period.

Asia-Pacific will Augment with the Highest Rate in the Global Biometrics-As-A-Service Market

The highest growth of the region is attributed to the high internet penetration rate which results in the increasing digital crimes and cyber-attacks in the region. The government initiative for Digital India is one of the major factors behind the adoption of such technologies in emerging economies such as India. China is a major economy in the region which contributes majorly to the growth of the market in the region, owing to the high penetration of smartphones in the region. As per the ITU, in 2017, the total number of mobile phone subscriptions recorded in China was nearly 1.4 billion as compared to 1.36 billion in 2016. India and Japan is also a significant contributor to the Asia-pacific biometrics-as-a-service market.

Market Players Outlook

Some of the major market players of the global biometrics-as-a-service market include Aware Inc., BioEnable Technologies Pvt. Ltd., NEC Corp., Nuance Communications Inc., Certibio, Fujitsu Ltd., and others. These players are actively adopting growth strategies such as mergers and acquisitions, partnerships and collaboration, and agreements to improve their dominance among competitors.

Technological innovation and new product launching are the core strength of key market players in the biometrics-as-a-service market. For instance, in May 2017, Nuance Communications, Inc. upgraded its biometrics security suite with artificial intelligence (AI) to reduce frauds across voice and digital channels. The new nuance security suite includes voice biometrics technology along with advancement in facial and behavioral biometrics to offer advanced protection against frauds across customer service channels.

The Report Covers

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global biometrics-as-a-service market. Based on the availability of data, information related to products and services, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

1.2.3. By Stakeholders

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Fujitsu Ltd.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Aware, Inc.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. NEC Corp.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Nuance Communications, Inc.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. ImageWare Systems, Inc.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Biometrics-As-A-Service Market by Scanner Type

5.1.1. Fingerprint Recognition

5.1.2. Iris Recognition

5.1.3. Palm Recognition

5.1.4. Facial Recognition

5.1.5. Others

5.2. Global Biometrics-As-A-Service Market by Verticals

5.2.1. BFSI

5.2.2. IT And Telecommunication

5.2.3. Healthcare

5.2.4. Government & Utilities

5.2.5. Retail

5.2.6. Others

6. Regional Analysis

6.1. North America

6.1.1. US

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Accenture PLC

7.2. Aware, Inc.

7.3. BioEnable Technologies Pvt. Ltd.

7.4. BioID GmbH

7.5. Certibio

7.6. Fujitsu Ltd.

7.7. Fulcrum Biometrics, LLC

7.8. HYPR Corp.

7.9. IDEMIA France

7.10. ImageWare Systems, Inc.

7.11. Iritech, Inc.

7.12. Leidos Inc.

7.13. M2SYS Technology (A Kernello Company)

7.14. Mobbeel Solutions S.L.L.

7.15. NEC Corp.

7.16. Nuance Communications, Inc.

7.17. Phonexia s.r.o.

7.18. Precise Biometrics AB

7.19. SIC Biometrics, Inc.

7.20. SmilePass Ltd.

1. GLOBAL BIOMETRICS-AS-A-SERVICE MARKET RESEARCH AND ANALYSIS BY SCANNER TYPE, 2018-2025 ($ MILLION)

2. GLOBAL FINGERPRINT RECOGNITION-AS-A-SERVICE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL IRIS RECOGNITION-AS-A-SERVICE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL PALM RECOGNITION-AS-A-SERVICE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

5. GLOBAL FACIAL RECOGNITION-AS-A-SERVICE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

6. GLOBAL OTHER BIOMETRIC-AS-A-SERVICE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

7. GLOBAL BIOMETRICS-AS-A-SERVICE MARKET RESEARCH AND ANALYSIS BY VERTICALS, 2018-2025 ($ MILLION)

8. GLOBAL BIOMETRICS-AS-A-SERVICE IN BFSI MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

9. GLOBAL BIOMETRICS-AS-A-SERVICE IN IT AND TELECOMMUNICATION MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

10. GLOBAL BIOMETRICS-AS-A-SERVICE IN HEALTHCARE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

11. GLOBAL BIOMETRICS-AS-A-SERVICE IN GOVERNMENT AND UTILITIES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

12. GLOBAL BIOMETRICS-AS-A-SERVICE IN RETAIL MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

13. GLOBAL BIOMETRICS-AS-A-SERVICE IN OTHER VERTICALS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

14. GLOBAL BIOMETRICS-AS-A-SERVICE MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

15. NORTH AMERICAN BIOMETRICS-AS-A-SERVICE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

16. NORTH AMERICAN BIOMETRICS-AS-A-SERVICE MARKET RESEARCH AND ANALYSIS BY SCANNER TYPE, 2018-2025 ($ MILLION)

17. NORTH AMERICAN BIOMETRICS-AS-A-SERVICE MARKET RESEARCH AND ANALYSIS BY VERTICALS, 2018-2025 ($ MILLION)

18. EUROPEAN BIOMETRICS-AS-A-SERVICE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

19. EUROPEAN BIOMETRICS-AS-A-SERVICE MARKET RESEARCH AND ANALYSIS BY SCANNER TYPE, 2018-2025 ($ MILLION)

20. EUROPEAN BIOMETRICS-AS-A-SERVICE MARKET RESEARCH AND ANALYSIS BY VERTICALS, 2018-2025 ($ MILLION)

21. ASIA-PACIFIC BIOMETRICS-AS-A-SERVICE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

22. ASIA-PACIFIC BIOMETRICS-AS-A-SERVICE MARKET RESEARCH AND ANALYSIS BY SCANNER TYPE, 2018-2025 ($ MILLION)

23. ASIA-PACIFIC BIOMETRICS-AS-A-SERVICE MARKET RESEARCH AND ANALYSIS BY VERTICALS, 2018-2025 ($ MILLION)

24. REST OF THE WORLD BIOMETRICS-AS-A-SERVICE MARKET RESEARCH AND ANALYSIS BY SCANNER TYPE, 2018-2025 ($ MILLION)

25. REST OF THE WORLD BIOMETRICS-AS-A-SERVICE MARKET RESEARCH AND ANALYSIS BY VERTICALS, 2018-2025 ($ MILLION)

1. GLOBAL BIOMETRICS-AS-A-SERVICE MARKET SHARE BY SCANNER TYPE, 2018 VS 2025 (%)

2. GLOBAL BIOMETRICS-AS-A-SERVICE MARKET SHARE BY VERTICALS, 2018 VS 2025 (%)

3. GLOBAL BIOMETRICS-AS-A-SERVICE MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

4. US BIOMETRICS-AS-A-SERVICE MARKET SIZE, 2018-2025 ($ MILLION)

5. CANADA BIOMETRICS-AS-A-SERVICE MARKET SIZE, 2018-2025 ($ MILLION)

6. UK BIOMETRICS-AS-A-SERVICE MARKET SIZE, 2018-2025 ($ MILLION)

7. FRANCE BIOMETRICS-AS-A-SERVICE MARKET SIZE, 2018-2025 ($ MILLION)

8. GERMANY BIOMETRICS-AS-A-SERVICE MARKET SIZE, 2018-2025 ($ MILLION)

9. ITALY BIOMETRICS-AS-A-SERVICE MARKET SIZE, 2018-2025 ($ MILLION)

10. SPAIN BIOMETRICS-AS-A-SERVICE PRODUCTS MARKET SIZE, 2018-2025 ($ MILLION)

11. ROE BIOMETRICS-AS-A-SERVICE MARKET SIZE, 2018-2025 ($ MILLION)

12. INDIA BIOMETRICS-AS-A-SERVICE MARKET SIZE, 2018-2025 ($ MILLION)

13. CHINA BIOMETRICS-AS-A-SERVICE MARKET SIZE, 2018-2025 ($ MILLION)

14. JAPAN BIOMETRICS-AS-A-SERVICE MARKET SIZE, 2018-2025 ($ MILLION)

15. REST OF ASIA-PACIFIC BIOMETRICS-AS-A-SERVICE MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF THE WORLD BIOMETRICS-AS-A-SERVICE MARKET SIZE, 2018-2025 ($ MILLION)