Bioprocess Container Market

Bioprocess Container Market Size, Share & Trends Analysis Report, By Type (2D Bioprocess Containers, 3D Bioprocess Containers, and Other Containers and Accessories), By Type (Upstream Processes, Downstream, Processes, and Process Development), By End-User (Pharmaceutical & Biopharmaceutical Companies, CROs & CMOs, and Academic & Research Institutes), Forecast Period (2022-2028) Update Available - Forecast 2025-2031

Bioprocess container market is anticipated to grow at a CAGR of 14.0% during the forecast period. Bioprocess containers are containers utilized for critical sterile liquid-handling applications in the biopharmaceutical industry. The volume capacity of bioprocess containers available on the market can range from 50mL to 10,000L. Large volume flexible container systems are often used as alternatives to traditional stainless steel bioprocessing systems. Small volume flexible containers are increasingly used as a replacement for glass or rigid plastic containers which are widely used for applications such as sampling and storage. These systems are time-saving and are used to speed up the current biopharmaceutical production process and are useful in storage, fluid management, and media preparation. The containers are cost-effective and are widely used for vaccine manufacturing and media preparation in the pharmaceutical industry.

Bioprocess containers have wide applications in the pharmaceutical industry, agro-industries, consumer health, coatings and composite industry, and others along with drug discovery, cell cultures, and others. Rising demand for biologics and the growing use of bioprocess containers in R&D is expected to drive the growth of the global bioprocess container market. Additionally, the rising production of medicines and vaccines on a global scale to meet the demand is anticipated to further raise the demand for bioprocess containers. Moreover, increased use of single-use technology owing to the factors such as affordability, cost-effectiveness, and reduction in cross-contamination are further expected to accelerate the demand for bioprocess containers. For instance, in May 2019, Thermo Fisher laid down plans to expand its bioproduction equipment capacity through a $50 million investment on the back of growing demand for its single-use bioprocess container (BPC) systems.

Segmental Outlook

The global bioprocess container market is segmented based on the type, application and end-user. Based on the type, the market is segmented into 2D bioprocess containers, 3D bioprocess containers, and other containers and accessories. Based on the application, the market is segmented into upstream processes, downstream, processes, and process development. Based on the end-user, the market is segmented into pharmaceutical and biopharmaceutical companies, CROs & CMOs, and academic & research institutes.

Bioprocess Containers Find Significant Application in Pharmaceutical and Biopharmaceutical Companies

Pharmaceutical and biopharmaceuticals accounted for the dominant share in the market owing to the rising R&D for the discovery of new drugs. The rising prevalence of various diseases and disorders that can be treated using biologics is a primary factor for the rapid growth of the segment. Further, the increasing focus of biopharmaceutical companies on developing affordable biologics at lower costs is pushing the demand for bioprocess containers. Also, the growing use of bioprocess containers by end-use industries for wide applications in research & process development in the development and manufacturing of biologics and biosimilars is set to drive the growth of the market during the forecast period.

Regional Outlook

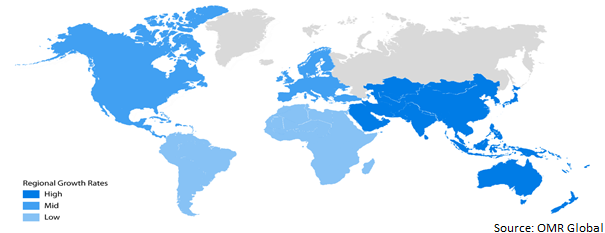

The global bioprocess container market is further segmented based on geography including North America (the US and Canada), Europe (UK, Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East & Africa and Latin America). The market can be analyzed for a particular region or country level as per the requirement.

Global Bioprocess Container Market Growth, by Region 2022-2028

North America Holds Considerable Share in the Global Bioprocess Container Market

North America holds a prominent share in the market followed by Europe and the Asia Pacific region. The presence of key players, growing investment in biopharmaceutical R&D, and rising demand for single-use technologies are key drivers for the market growth in the region. However, Asia-Pacific region Is anticipated to register the highest growth during the forecast period owing to the large population and expansion of pharmaceutical industries in the region. Additionally, the growing application of advanced technology in emerging economies such as China, Japan, and India and the presence of labor at cost-effective prices attract pharmaceutical companies to invest in the region. For instance, in July 2022, Hyderabad-based Biopharmaceutical Biological E announced its expansion plans for vaccine manufacturing with an overall investment of more than $225.2 million. The expansion is primarily targeted to ramp up the manufacturing of vaccines along with generic Injectables and R&D.

Market Players Outlook

The major companies serving the global bioprocess container market include Danaher Corp., Thermo Fisher Scientific, Inc., Lonza Group AG, Merck KGaA, and Sartorius AG. The market players are contributing to the market growth by the adoption of various strategies including mergers and acquisitions, collaborations, and new product launches, to stay competitive in the market. For instance, in October 2021, the internationally active life science company Eppendorf, headquartered in Hamburg, Germany, completed its conversion to the European legal form Societas Europaea (SE) as of October 19, 2021. The company will operate as Eppendorf SE with immediate effect. The new company name as Eppendorf SE demonstrates the company's further development into a modern, progressive, and internationally active European company.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global bioprocess container market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Lonza Group AG

3.1.1.1. Overview

3.1.1.2. Financial Analysis

3.1.1.3. SWOT Analysis

3.1.1.4. Recent Developments

3.1.2. Danaher Corp.

3.1.2.1. Overview

3.1.2.2. Financial Analysis

3.1.2.3. SWOT Analysis

3.1.2.4. Recent Developments

3.1.3. Merck KGaA

3.1.3.1. Overview

3.1.3.2. Financial Analysis

3.1.3.3. SWOT Analysis

3.1.3.4. Recent Developments

3.1.4. Thermo Fisher Scientific Inc.

3.1.4.1. Overview

3.1.4.2. Financial Analysis

3.1.4.3. SWOT Analysis

3.1.4.4. Recent Developments

3.1.5. Sartorius AG

3.1.5.1. Overview

3.1.5.2. Financial Analysis

3.1.5.3. SWOT Analysis

3.1.5.4. Recent Developments

3.2. Key Strategy Analysis

4. Market Segmentation

4.1. Global Bioprocess Container Market by Type

4.1.1. 2D Bioprocess Containers

4.1.2. 3D Bioprocess Containers

4.1.3. Other Containers and Accessories

4.2. Global Bioprocess Container Market by Application

4.2.1. Upstream Processes

4.2.2. Downstream Processes

4.2.3. Process Development

4.3. Global Bioprocess Container Market by End-User

4.3.1. Pharmaceutical & Biopharmaceutical Companies

4.3.2. CROs & CMOs

4.3.3. Academic & Research Institutes

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Avantor, Inc.

6.2. Broadley-James Corp.

6.3. Eppendorf AG

6.4. GE Healthcare

6.5. Meissner Filtration Products

6.6. Merck Millipore

6.7. Parker Hannifin Corporation

6.8. PBS Biotech

6.9. Saint Gobain S.A.

6.10. Sentinel Process Systems

1. GLOBAL BIOPROCESS CONTAINER MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

2. GLOBAL 2D BIOPROCESS CONTAINERS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL 3D BIOPROCESS CONTAINERS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL OTHER BIOPROCESS CONTAINERS AND ACCESSORIES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

5. GLOBAL BIOPROCESS CONTAINER MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

6. GLOBAL BIOPROCESS CONTAINER MARKET FOR PHARMACEUTICAL & BIOPHARMACEUTICAL COMPANIES RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7. GLOBAL BIOPROCESS CONTAINER MARKET FOR CROS & CMOS RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

8. GLOBAL BIOPROCESS CONTAINER MARKET FOR ACADEMIC & RESEARCH INSTITUTES. RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

9. GLOBAL BIOPROCESS CONTAINER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

10. GLOBAL BIOPROCESS CONTAINER FOR UPSTREAM PROCESSES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

11. GLOBAL BIOPROCESS CONTAINER FOR DOWNSTREAM PROCESSES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

12. GLOBAL BIOPROCESS CONTAINER FOR PROCESS DEVELOPMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

13. GLOBAL BIOPROCESS CONTAINER MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2021-2028 ($ MILLION)

14. NORTH AMERICAN BIOPROCESS CONTAINER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

15. NORTH AMERICAN BIOPROCESS CONTAINER MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

16. NORTH AMERICAN BIOPROCESS CONTAINER MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

17. NORTH AMERICAN BIOPROCESS CONTAINER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

18. EUROPEAN BIOPROCESS CONTAINER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

19. EUROPEAN BIOPROCESS CONTAINER MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

20. EUROPEAN BIOPROCESS CONTAINER MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

21. EUROPEAN BIOPROCESS CONTAINER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

22. ASIA-PACIFIC BIOPROCESS CONTAINER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

23. ASIA-PACIFIC BIOPROCESS CONTAINER MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

24. ASIA-PACIFIC BIOPROCESS CONTAINER MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

25. ASIA-PACIFIC BIOPROCESS CONTAINER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

26. REST OF THE WORLD BIOPROCESS CONTAINER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

27. REST OF THE WORLD BIOPROCESS CONTAINER MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

28. REST OF THE WORLD BIOPROCESS CONTAINER MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

29. REST OF THE WORLD BIOPROCESS CONTAINER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

1. GLOBAL BIOPROCESS CONTAINER MARKET SHARE BY TYPE, 2021 VS 2028 (%)

2. GLOBAL 2D BIOPROCESS CONTAINERS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

3. GLOBAL 3D BIOPROCESS CONTAINERS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

4. GLOBAL OTHER BIOPROCESS CONTAINERS AND ACCESSORIES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

5. GLOBAL BIOPROCESS CONTAINER MARKET SHARE BY END-USER, 2021 VS 2028 (%)

6. GLOBAL BIOPROCESS CONTAINER FOR PHARMACEUTICAL & BIOPHARMACEUTICAL COMPANIES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

7. GLOBAL BIOPROCESS CONTAINER FOR CROS & CMOS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

8. GLOBAL BIOPROCESS CONTAINER FOR ACADEMIC & RESEARCH INSTITUTES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

9. GLOBAL BIOPROCESS CONTAINER MARKET SHARE BY APPLICATION, 2021 VS 2028 (%)

10. GLOBAL BIOPROCESS CONTAINER FOR UPSTREAM PROCESSES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

11. GLOBAL BIOPROCESS CONTAINER FOR DOWNSTREAM PROCESSES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

12. GLOBAL BIOPROCESS CONTAINER FOR PROCESS DEVELOPMENT MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

13. GLOBAL BIOPROCESS CONTAINER MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

14. US BIOPROCESS CONTAINER MARKET SIZE, 2021-2028 ($ MILLION)

15. CANADA BIOPROCESS CONTAINER MARKET SIZE, 2021-2028 ($ MILLION)

16. UK BIOPROCESS CONTAINER MARKET SIZE, 2021-2028 ($ MILLION)

17. FRANCE BIOPROCESS CONTAINER MARKET SIZE, 2021-2028 ($ MILLION)

18. GERMANY BIOPROCESS CONTAINER MARKET SIZE, 2021-2028 ($ MILLION)

19. ITALY BIOPROCESS CONTAINER MARKET SIZE, 2021-2028 ($ MILLION)

20. SPAIN BIOPROCESS CONTAINER MARKET SIZE, 2021-2028 ($ MILLION)

21. REST OF EUROPE BIOPROCESS CONTAINER MARKET SIZE, 2021-2028 ($ MILLION)

22. INDIA BIOPROCESS CONTAINER MARKET SIZE, 2021-2028 ($ MILLION)

23. CHINA BIOPROCESS CONTAINER MARKET SIZE, 2021-2028 ($ MILLION)

24. JAPAN BIOPROCESS CONTAINER MARKET SIZE, 2021-2028 ($ MILLION)

25. SOUTH KOREA BIOPROCESS CONTAINER MARKET SIZE, 2021-2028 ($ MILLION)

26. REST OF ASIA-PACIFIC BIOPROCESS CONTAINER MARKET SIZE, 2021-2028 ($ MILLION)

27. REST OF THE WORLD BIOPROCESS CONTAINER MARKET SIZE, 2021-2028 ($ MILLION)