Bioprocess Monitoring Market

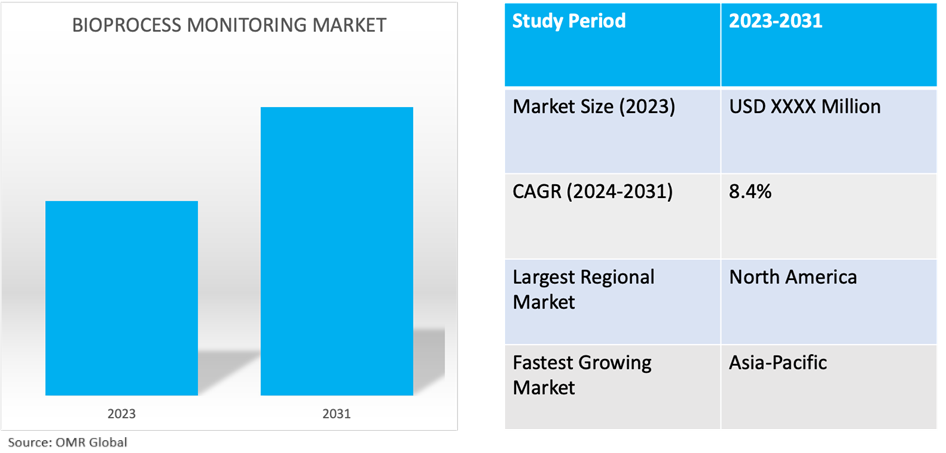

Bioprocess Monitoring Market Size, Share & Trends Analysis Report by Product (Reagents & Kits, Instruments and Software), by Application (Host Cell Residual DNA/Protein Quantitation, Mycoplasma Detection, Viral Titer Determination, and Adventitious Virus Testing), and by End-Use (Pharmaceutical & Biotechnology Companies, CROs & CMOs, and Academic & Research Institutes), Forecast Period (2024-2031)

Bioprocess monitoring market is anticipated to grow at a CAGR of 8.4% during the forecast period (2024-2031). Bioprocess monitoring refers to the systematic observation, measurement, and control of various parameters during a bioprocess to ensure optimal conditions for the production of biological products. The market growth is attributed in large part to the growing adoption of biopharmaceuticals and biotechnology processes. As a result, there is a growing need for more reliable and accurate bioprocess monitoring instruments.

Market Dynamics

Rising Demand for Biopharmaceuticals Driving Growth in Bioprocess Monitoring

The demand for biopharmaceuticals is rapidly increasing, driven by the growing need for effective treatments for chronic diseases, cancer, and infectious diseases. Biopharmaceuticals, such as monoclonal antibodies, vaccines, and cell therapies, offer targeted and personalized treatment options, which are increasingly preferred over traditional pharmaceuticals. As the global population ages and the prevalence of these conditions rises, the biopharmaceutical industry is expanding. This expansion necessitates robust bioprocess monitoring to ensure the quality, efficacy, and safety of biopharmaceutical products with stringent regulatory standards to meet market demands.

Technological Advancements Reshaping the Bioprocess Monitoring Landscape

Technological advancements are revolutionizing the bioprocess monitoring market. Innovations in sensor technologies, real-time monitoring systems, and data analytics are enhancing the precision and efficiency of bioprocesses. Automation and advanced control systems enable continuous monitoring and optimization of bioprocess parameters, leading to improved product quality and yield. Additionally, the integration of artificial intelligence and machine learning in bioprocess monitoring provides predictive insights and advanced analytics, further optimizing production processes. These technological breakthroughs are crucial in meeting the complex requirements of modern biopharmaceutical manufacturing, driving the adoption of advanced bioprocess monitoring solutions across the industry. For instance, in October 2022, Cambridge Molecular Diagnostics Limited introduced a new lateral flow test engineered for the swift detection of Mycoplasma contamination. This pioneering test offers rapid and user-friendly applications, providing precise results within minutes. It employs an enhanced PCR methodology.

Market Segmentation

- Based on product, the market is segmented into reagents & kits, instruments, and software.

- Based on application, the market is segmented into host cell residual DNA/protein quantitation, mycoplasma detection, viral titer determination, and adventitious virus testing.

- Based on end-use, the market is segmented into pharmaceutical & biotechnology companies, CROs & CMOs, and academic & research institutes.

Reagents & Kits is Projected to Emerge as the Largest Segment

The reagents & kits segment is expected to hold the largest share of the market. The primary factor supporting the segment's growth includes the increasing demand for biopharmaceuticals and personalized medicine. As the development and production of biologics, such as vaccines, monoclonal antibodies, and gene therapies, continue to rise, there is a growing need for precise and reliable bioprocess monitoring tools. Reagents and kits are essential for ensuring the quality, efficacy, and safety of these biopharmaceutical products, driving their demand in the market. For instance, in July 2022, QIAGEN, a leading supplier of testing technology and materials, expanded its QIAcuity PCR portfolio by introducing 13 new kits and assays These state-of-the-art instruments simplify the quantification of residual host cell DNA within cells and enhance the accuracy of viral titer measurement for the Adeno-Associated Virus.

Pharmaceutical & Biotechnology Segment to Hold a Considerable Market Share

The pharmaceutical & biotechnology segment holds a significant market share due to the rising demand for biopharmaceuticals, such as vaccines and gene therapies, which require precise monitoring for quality and efficacy. Technological advancements, stringent regulatory compliance, and substantial R&D investments further drive the adoption of advanced monitoring solutions. Additionally, the growth of biotech startups and the shift towards personalized medicine increase the need for sophisticated bioprocess monitoring tools, solidifying the importance of this segment in the market.

Regional Outlook

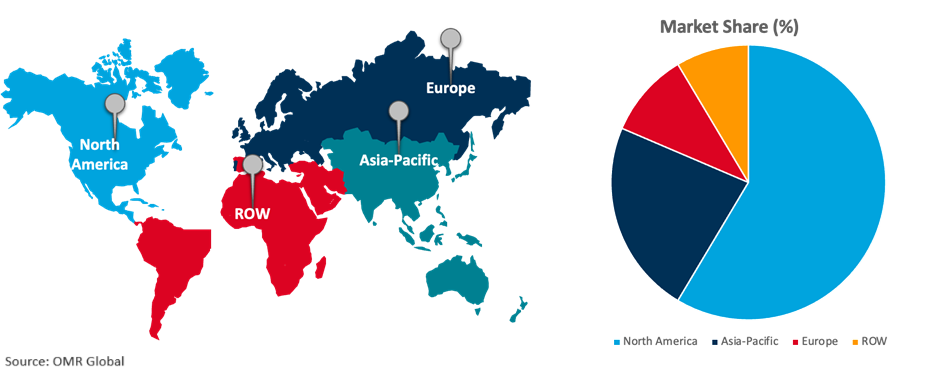

The global bioprocess monitoring market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Asia-Pacific: A Catalyst for Rapid Growth in the Bioprocess Monitoring Market

Asia-Pacific emerges as the fastest-growing market due to the biopharmaceutical industry, driven by increasing healthcare expenditures and a growing patient population, fuels the demand for advanced bioprocess monitoring technologies and also the supportive government initiatives and investments in biotechnology and life sciences sectors across countries like China, India, and South Korea foster innovation and development in bioprocess monitoring solutions. Additionally, the outsourcing of pharmaceutical manufacturing to Asia-Pacific countries, owing to cost advantages and a skilled workforce, further propels market growth in the region. For instance, in November 2023, Asahi Kasei Medical unveiled the Asahi Kasei (China) Bioprocess Technical Center in Jiangsu, China, marking its official inauguration. As an integral part of Asahi Kasei Medical's bioprocess division, the center is dedicated to providing an extensive array of offerings encompassing bioprocessing, including biotherapeutic manufacturing, biosafety testing, and contract development and manufacturing organization (CDMO) services.

Global Bioprocess Monitoring Market Growth by Region 2024-2031

North America Holds Major Market Share

Among all the regions, North America holds a significant share due to a robust and mature biopharmaceutical industry, with leading companies investing significantly in research and development, driving the demand for cutting-edge bioprocess monitoring technologies. Secondly, North America is home to a dense concentration of biotechnology and pharmaceutical companies, particularly in key hubs like the US. These companies prioritize innovation and efficiency, necessitating advanced bioprocess monitoring solutions to maintain competitiveness and compliance with stringent regulatory standards set by agencies like the FDA. For instance, in July 2021, Cygnus Technologies, a division of Maravai LifeSciences, and Gyros Protein Technologies, a Swedish leader in automated nanoliter-scale immunoassays, disclosed an expansion of their partnership. A significant milestone in their collaborative endeavors was marked by the release of an upgraded HEK 293 HCP immunoassay solution, a direct outcome of their joint efforts.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global bioprocess monitoring market include Thermo Fisher Scientific Inc., Bio-Rad Laboratories, Inc., Maravai LifeSciences, Merck KGaA, and Bio-Techne, among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers and acquisitions to stay competitive in the market. For instance, in October 2023, the US Pharmacopeia (USP) and the American Type Culture Collection (ATCC) formed a strategic alliance aimed at advancing quality control measures for vaccines and biological medicines. This partnership has resulted in the introduction of six innovative products designed to improve the identification and measurement of residual host cell DNA, enhancing the overall quality assurance processes in the biopharmaceutical industry.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global bioprocess monitoring market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Bio-Rad Laboratories, Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. GE HealthCare

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Thermo Fisher Scientific Inc.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Bioprocess Monitoring Market by Product

4.1.1. Reagents & Kits

4.1.2. Instruments

4.1.3. Software

4.2. Global Bioprocess Monitoring Market by Application

4.2.1. Host Cell Residual DNA/Protein Quantitation

4.2.2. Mycoplasma Detection

4.2.3. Viral Titer Determination

4.2.4. Adventitious Virus Testing

4.3. Global Bioprocess Monitoring Market by End-Use

4.3.1. Pharmaceutical & Biotechnology Companies

4.3.2. CROs & CMOs

4.3.3. Academic & Research Institutes

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East & Africa

6. Company Profiles

6.1. Applied Biological Materials Inc.

6.2. Bio-Techne

6.3. Boehringer Ingelheim

6.4. Charles River Laboratories

6.5. Corning Incorporated

6.6. DH Life Sciences, LLC

6.7. Enzo Life Sciences, Inc.

6.8. Eppendorf SE

6.9. F. Hoffmann-La Roche Ltd.

6.10. GE Healthcare

6.11. Hamilton Company

6.12. Lonza Group Ltd.

6.13. Maravai LifeSciences

6.14. Meissner Filtration Products, Inc.

6.15. Merck KGaA

6.16. QIAGEN

6.17. Sartorius AG

1. GLOBAL BIOPROCESS MONITORING MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

2. GLOBAL BIOPROCESS MONITORING REAGENTS & KITS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL BIOPROCESS MONITORING INSTRUMENTS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL BIOPROCESS MONITORING SOFTWARE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL BIOPROCESS MONITORING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

6. GLOBAL BIOPROCESS MONITORING FOR HOST CELL RESIDUAL DNA/PROTEIN QUANTITATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL BIOPROCESS MONITORING FOR MYCOPLASMA DETECTION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL BIOPROCESS MONITORING FOR VIRAL TITER DETERMINATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL BIOPROCESS MONITORING FOR ADVENTITIOUS VIRUS TESTING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL BIOPROCESS MONITORING MARKET RESEARCH AND ANALYSIS BY END-USE, 2023-2031 ($ MILLION)

11. GLOBAL BIOPROCESS MONITORING IN PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL BIOPROCESS MONITORING IN CROS & CMOS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL BIOPROCESS MONITORING IN ACADEMIC & RESEARCH INSTITUTES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL BIOPROCESS MONITORING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. NORTH AMERICAN BIOPROCESS MONITORING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

16. NORTH AMERICAN BIOPROCESS MONITORING MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

17. NORTH AMERICAN BIOPROCESS MONITORING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

18. NORTH AMERICAN BIOPROCESS MONITORING MARKET RESEARCH AND ANALYSIS BY END-USE, 2023-2031 ($ MILLION)

19. EUROPEAN BIOPROCESS MONITORING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

20. EUROPEAN BIOPROCESS MONITORING MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

21. EUROPEAN BIOPROCESS MONITORING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

22. EUROPEAN BIOPROCESS MONITORING MARKET RESEARCH AND ANALYSIS BY END-USE, 2023-2031 ($ MILLION)

23. ASIA-PACIFIC BIOPROCESS MONITORING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

24. ASIA-PACIFIC BIOPROCESS MONITORING MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

25. ASIA-PACIFIC BIOPROCESS MONITORING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

26. ASIA-PACIFIC BIOPROCESS MONITORING MARKET RESEARCH AND ANALYSIS BY END-USE, 2023-2031 ($ MILLION)

27. REST OF THE WORLD BIOPROCESS MONITORING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

28. REST OF THE WORLD BIOPROCESS MONITORING MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

29. REST OF THE WORLD BIOPROCESS MONITORING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

30. REST OF THE WORLD BIOPROCESS MONITORING MARKET RESEARCH AND ANALYSIS BY END-USE, 2023-2031 ($ MILLION)

1. GLOBAL BIOPROCESS MONITORING MARKET SHARE BY PRODUCT, 2023 VS 2031 (%)

2. GLOBAL BIOPROCESS MONITORING REAGENTS & KITS MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL BIOPROCESS MONITORING INSTRUMENTS MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL BIOPROCESS MONITORING SOFTWARE MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL BIOPROCESS MONITORING MARKET SHARE BY APPLICATION, 2023 VS 2031 (%)

6. GLOBAL BIOPROCESS MONITORING FOR HOST CELL RESIDUAL DNA/PROTEIN QUANTITATION MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL BIOPROCESS MONITORING FOR MYCOPLASMA DETECTION MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL BIOPROCESS MONITORING FOR VIRAL TITER DETERMINATION MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL BIOPROCESS MONITORING FOR ADVENTITIOUS VIRUS TESTING MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL BIOPROCESS MONITORING MARKET SHARE BY END-USE, 2023 VS 2031 (%)

11. GLOBAL BIOPROCESS MONITORING IN PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL BIOPROCESS MONITORING IN CROS & CMOS MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL BIOPROCESS MONITORING IN ACADEMIC & RESEARCH INSTITUTES MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. GLOBAL BIOPROCESS MONITORING MARKET SHARE BY REGION, 2023 VS 2031 (%)

15. US BIOPROCESS MONITORING MARKET SIZE, 2023-2031 ($ MILLION)

16. CANADA BIOPROCESS MONITORING MARKET SIZE, 2023-2031 ($ MILLION)

17. UK BIOPROCESS MONITORING MARKET SIZE, 2023-2031 ($ MILLION)

18. FRANCE BIOPROCESS MONITORING MARKET SIZE, 2023-2031 ($ MILLION)

19. GERMANY BIOPROCESS MONITORING MARKET SIZE, 2023-2031 ($ MILLION)

20. ITALY BIOPROCESS MONITORING MARKET SIZE, 2023-2031 ($ MILLION)

21. SPAIN BIOPROCESS MONITORING MARKET SIZE, 2023-2031 ($ MILLION)

22. REST OF EUROPE BIOPROCESS MONITORING MARKET SIZE, 2023-2031 ($ MILLION)

23. INDIA BIOPROCESS MONITORING MARKET SIZE, 2023-2031 ($ MILLION)

24. CHINA BIOPROCESS MONITORING MARKET SIZE, 2023-2031 ($ MILLION)

25. JAPAN BIOPROCESS MONITORING MARKET SIZE, 2023-2031 ($ MILLION)

26. SOUTH KOREA BIOPROCESS MONITORING MARKET SIZE, 2023-2031 ($ MILLION)

27. REST OF ASIA-PACIFIC BIOPROCESS MONITORING MARKET SIZE, 2023-2031 ($ MILLION)

28. LATIN AMERICA BIOPROCESS MONITORING MARKET SIZE, 2023-2031 ($ MILLION)

29. MIDDLE EAST AND AFRICA BIOPROCESS MONITORING MARKET SIZE, 2023-2031 ($ MILLION)