Bioreactor Market

Global Bioreactor Market Size, Share & Trends Analysis Report by Material (Stainless Steel, and Single-use), By Production (Lab-Scale Production, Pilot-Scale Production, Full-Scale Production) By End-User (Biopharmaceutical Companies and Contract Research Organizations (CRO)) Forecast Period 2021-2027 Update Available - Forecast 2025-2035

The global bioreactor market is anticipated to grow at a significant CAGR of 10.3% during the forecast period (2021-2027). The bioreactors are large vessels in which aerobic or anaerobic reactions take place and are used for growing organisms such as yeast, bacteria, or animal cells in a biologically active environment. With the growing life science industry globally, bioreactors are extensively being used in the production of monoclonal antibodies, recombinant therapeutics, drug discovery, and so forth. Bioreactors enable the control over temperature, moisture, pH, oxygen, and stirring rate for optimal cell growth and productivity. The factors contributing to the growth of the market are the growing technological advancements in bioreactor design, the growing demand for therapeutically effective vaccines, and new products in development.

Increasing demand for personalized medicine for effective treatment is one of the major reasons for the growth of this market. The development of precision medicine that is modifying the medical treatment to the individual characteristics, needs, and preferences of each patient has seen positive growth. The bioreactors had proven effective to store medicines for autoimmune disorders, cancer, asthma, and organ rejection. This is augmenting the demand for bioreactors in medical facilities. However, challenges associated with the use of bioreactors such as non-customizable and difficult to scale may hinder the global bioreactor market growth. Additionally, the short shelf-life of industrial microbiology reagents is also creating challenges as well as an opportunity for the bioreactors market. Though, increasing adoption of single-use bioreactors joined with technological innovation and enhanced capabilities are expected to significantly contribute in the near future.

Impact of COVID-19 Pandemic on Global Bioreactor Market

The need to vaccinate around 7.9 billion human population across the globe against COVID-19 had boosted the market of bioreactors. According to Eppendorf AG, the COVID-19 had increased the market value of the vaccine industry to around $50 billion. The vaccine industry covers around 80% of human vaccines while the rest 20% for animals. Apart from vaccines, the demand for other medical drugs had also been increased in the COVID-19 pandemic that increased the demand for bioreactors for the storage of those drugs. The continuous research and developments for overcoming the COVID-19 challenge will further require more bioreactors that can provide long shelf life to the chemicals stored in it.

Segmental Outlook

The global bioreactor market is segmented based on material, production, and end-user. Based on the material, the market is segmented into stainless steel and single-use bioreactor. Based on the production, the market is segmented into lab-scale production, pilot-scale production, full-scale production. Apart from this, by end-user, the market is segmented into Biopharmaceutical Companies and Contract Research Organizations (CROs).

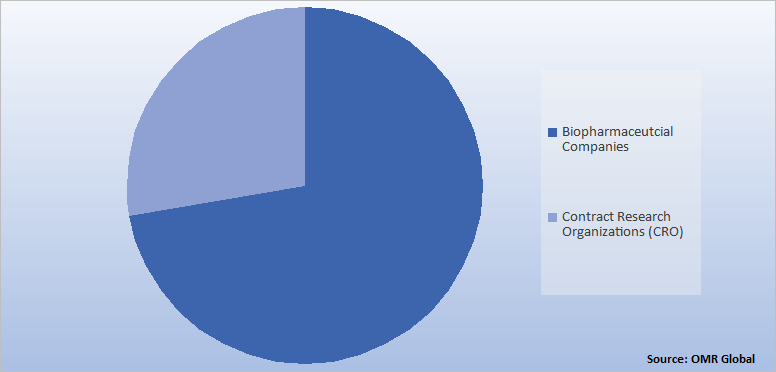

Global Bioreactor Market Share by End-User, 2020 (%)

Biopharmaceutical Industries holds a significant share in the Global Bioreactors Market

The biopharmaceutical industries hold a major market share in the bioreactors market. The development of single-use and stainless-steel bioreactors had boosted growth in this segment. Distek Inc. had created a benchtop single used bioreactor system for mammalian cell growth and recombinant protein production. The single used bioreactors are also enabling industries in continuous production and reduce bottleneck situations. However, there are several government regulations on single used bioreactors due to their vulnerability and limited storage which is restraining the market growth of bioreactors.

The developments in genome sequencing biotechnology had additionally given new opportunities to the bioreactors market. The revive&restore organization is working on biotechnological projects which aim to revive the distinguished animal species. One of their such projects is "Wooly Mammoth Revival" to stop the melting of permafrost and create a balanced ecosystem. A huge number of such projects are in progress across the globe which had added a new segment to the bioreactors market as bioreactors provide a controllable environment, in terms of pH, temperature, nutrient supply, and shear stress for any cells or cellular constructs incorporated into them.

Usage of bioreactors is currently in the emerging stage in the agricultural and dairy sector. In dairy industries, it is used for the fermentation of milk to create yogurt and curd. In the agricultural industry, it is used for preparing compost and manure for crops.

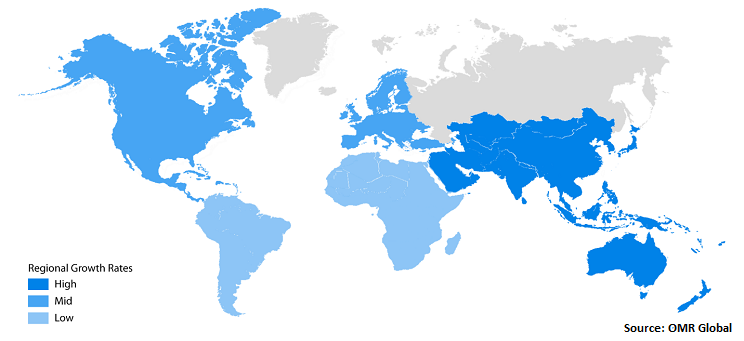

Regional Outlooks

The global bioreactor market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others, and the Rest of the World (the Middle East and Africa, and Latin America).

Global Bioreactor Market Growth, by Region 2021-2027

North America to hold a significant share in Global Bioreactors Market

The US holds the major share in North America for the increasing developments and investments in the pharmaceutical industry to strengthen their localized production will give rapid growth to the bioreactors market. Europe also has immense opportunity for the bioreactor market due to supportive government initiatives and funding. For instance, European Union had released $478 million for the WHO-guided COVID-19 vaccination.

Latin America is generating new opportunities for the bioreactor market. For instance, in subtropical southern Brazil, the invention of tilapia bio-floc is giving a new market segment to the bioreactors market. In this tilapia bio-floc ecosystem for the rapid growth of fishes is created by balancing carbon, nitrogen, and phosphorus levels to favor chlorophytes and avoid cyanophyte blooms. A high-protein diet is provided to the fishes incubated inside it. In 150 days, the fishes attain the commercial size with a 92% survival rate in these bioreactors.

Market Players Outlook

The key players of the bioreactor market Thermo Fisher Scientific, Inc., Sartorius A.G., Merck KGaA, Eppendorf AG, General Electric Co., Getinge AB, and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers & acquisitions, collaborations, funding, and new product launches with innovation in current models, to stay competitive in the market. For instance, Getinge AB had acquired Applikon Biotechnology B.V. in 2019 to expand its presence in the global market.

The Report Covers

- Market value data analysis of 2020 and forecast to 2027.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global bioreactor market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global Bioreactors Market

• Recovery Scenario of Global Bioreactors Market

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. BY Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Thermo Fisher Scientific, Inc.

3.1.1.1. Overview

3.1.1.2. Financial Analysis

3.1.1.3. SWOT Analysis

3.1.1.4. Recent Developments

3.1.2. General Electric Co.

3.1.2.1. Overview

3.1.2.2. Financial Analysis

3.1.2.3. SWOT Analysis

3.1.2.4. Recent Developments

3.1.3. Merck KGaA

3.1.3.1. Overview

3.1.3.2. Financial Analysis

3.1.3.3. SWOT Analysis

3.1.3.4. Recent Developments

3.1.4. Eppendorf AG

3.1.4.1. Overview

3.1.4.2. Financial Analysis

3.1.4.3. SWOT Analysis

3.1.4.4. Recent Developments

3.1.5. Sartorius AG

3.1.5.1. Overview

3.1.5.2. Financial Analysis

3.1.5.3. SWOT Analysis

3.1.5.4. Recent Developments

3.2. Key Strategy Analysis

3.3. Impact of COVID-19 on Key Players

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Bioreactors Market by Material

5.1.1. Stainless Steel

5.1.2. Single-Use

5.2. Global Bioreactors Market by Production

5.2.1. Lab-Scale Production

5.2.2. Pilot-Scale Production

5.2.3. Full-Scale Production

5.3. Global Bioreactors Market by End-User

5.3.1. Biopharmaceutical Companies

5.3.2. Contract Research Organizations (CRO)

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. South Korea

6.3.5. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Andel Equipment Pvt. Ltd.

7.2. bbi-biotech GmbH

7.3. Bioengineering AG

7.4. Cellexus, Ltd.

7.5. CerCell A/S

7.6. CESCO Bioengineering Co. Ltd.

7.7. GEA Group Aktiengesellschaft

7.8. General Electric Co.

7.9. Getinge AB

7.10. LAMBDA CZ, s.r.o.

7.11. MDX Biotechnik International GmbH

7.12. Merck KGaA

7.13. Pall Corp.

7.14. PBS Biotech, Inc.

7.15. Pierre Guerin SAS

7.16. Sartorius A.G.

7.17. Shanghai Bailun Biological Technology Co., Ltd.

7.18. Solaris Biotechnology Srl.

7.19. Techniserv, Inc.

7.20. Thermo Fisher Scientific, Inc.

1. GLOBAL BIOREACTORS MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2020-2027 ($ MILLION)

2. GLOBAL STAINLESS STEEL BIOREACTORS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

3. GLOBAL SINGLE-USE BIOREACTORS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

4. GLOBAL BIOREACTORS MARKET RESEARCH AND ANALYSIS BY PRODUCTION, 2020-2027 ($ MILLION)

5. GLOBAL LAB-SCALE PRODUCTION MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

6. GLOBAL PILOT-SCALE PRODUCTION MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

7. GLOBAL FULL-SCALE PRODUCTION MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

8. GLOBAL BIOREACTORS MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

9. GLOBAL BIOREACTORIN CRO MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

10. GLOBAL BIOREACTORIN BIOPHARMACEUTICAL COMPANIES MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

11. GLOBAL BIOREACTORS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2020-2027 ($ MILLION)

12. NORTH AMERICAN BIOREACTORS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

13. NORTH AMERICAN BIOREACTORS MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2020-2027 ($ MILLION)

14. NORTH AMERICAN BIOREACTORS MARKET RESEARCH AND ANALYSIS BY PRODUCTION, 2020-2027 ($ MILLION)

15. NORTH AMERICAN BIOREACTORS MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

16. EUROPEAN BIOREACTORS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

17. EUROPEAN BIOREACTORS MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2020-2027 ($ MILLION)

18. EUROPEAN BIOREACTORS MARKET RESEARCH AND ANALYSIS BY PRODUCTION, 2020-2027 ($ MILLION)

19. EUROPEAN BIOREACTORS MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

20. ASIA-PACIFIC BIOREACTORS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

21. ASIA-PACIFIC BIOREACTORS MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2020-2027 ($ MILLION)

22. ASIA-PACIFIC BIOREACTORS MARKET RESEARCH AND ANALYSIS BY PRODUCTION, 2020-2027 ($ MILLION)

23. ASIA-PACIFIC BIOREACTORS MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

24. REST OF THE WORLD BIOREACTORS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

25. REST OF THE WORLD BIOREACTORS MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2020-2027 ($ MILLION)

26. REST OF THE WORLD BIOREACTORS MARKET RESEARCH AND ANALYSIS BY PRODUCTION, 2020-2027 ($ MILLION)

27. REST OF THE WORLD BIOREACTORS MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL BIOREACTORS MARKET, 2020-2027 ($ MILLION)

2. IMPACT OF COVID-19 ON GLOBAL BIOREACTORS MARKET BY SEGMENT, 2020-2027 ($ MILLION)

3. RECOVERY OF GLOBAL BIOREACTORS MARKET, 2021-2027 (%)

4. UNITED STATES BIOREACTORS MARKET SIZE, 2020-2027 ($ MILLION)

5. CANADA BIOREACTORS MARKET SIZE, 2020-2027 ($ MILLION)

6. EUROPEAN BIOREACTORS MARKET SIZE, 2020-2027 ($ MILLION)

7. UK BIOREACTORS MARKET SIZE, 2020-2027 ($ MILLION)

8. GERMANY BIOREACTORS MARKET SIZE, 2020-2027 ($ MILLION)

9. SPAIN BIOREACTORS MARKET SIZE, 2020-2027 ($ MILLION)

10. FRANCE BIOREACTORS MARKET SIZE, 2020-2027 ($ MILLION)

11. ITALY BIOREACTORS MARKET SIZE, 2020-2027 ($ MILLION)

12. ROE BIOREACTORS MARKET SIZE, 2020-2027 ($ MILLION)

13. ASIA-PACIFIC BIOREACTORS MARKET SIZE, 2020-2027 ($ MILLION)

14. INDIA BIOREACTORS MARKET SIZE, 2020-2027 ($ MILLION)

15. CHINA BIOREACTORS MARKET SIZE, 2020-2027 ($ MILLION)

16. JAPAN BIOREACTORS MARKET SIZE, 2020-2027 ($ MILLION)

17. SOUTH KOREA BIOREACTORS MARKET SIZE, 2020-2027 ($ MILLION)

18. REST OF ASIA-PACIFIC BIOREACTORS MARKET SIZE, 2020-2027 ($ MILLION)

19. REST OF THE WORLD BIOREACTORS MARKET SIZE, 2020-2027 ($ MILLION)