Biorefinery Market

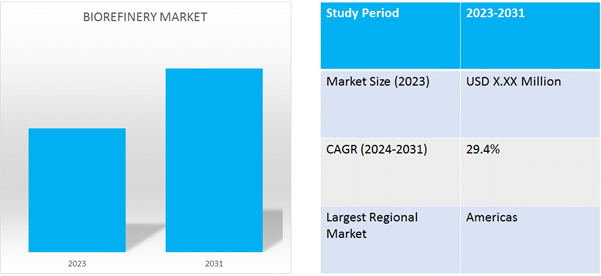

Biorefinery Market Size, Share & Trends Analysis Report by Type (First Generation, Second Generation, and Third Generation), by Product (Energy Driven and Material Drive), and by Technology (Industrial Biotechnology, Physico-Chemical, and Thermochemical) Forecast Period (2024-2031) Update Available - Forecast 2025-2035

Biorefinery market is anticipated to grow at a CAGR of 29.4% during the forecast period (2024-2031). Biorefinery is a framework in which biomass is utilized in an optimal manner to produce multiple products and tries to be self-sustaining and not harmful to the environment.

Market Dynamics

Growing demand for cleaner fuels

Biofuels are fuels made of organic materials such as plants, agricultural products, algae, and animal waste. They are suitable replacements for petroleum-derived gasoline or any conventional fuel. There is a considerable increase in the investment for clean energy around the globe. The following fuels and technologies are known to be clean for health at the point of use and are categorized as clean for PM and CO household emissions, which include solar, electric, biogas, natural gas, liquefied petroleum gas (LPG), and alcohol fuels including ethanol. For instance, in January 2023, the US Department of Energy (DoE) awarded $118 million to accelerate domestic biofuel production. This funding has been awarded to 17 projects that will fulfill America’s transportation and manufacturing requirements.

A rising number of permitting the partial use of biofuels and bio-based polymers

Globally, there is a trend of achieving net zero goals. The biorefinery is considered a financial tool to reduce carbon emissions by storing carbons for future and later use. Thus, several industries are heavily investing in the biorefinery industry which will support them to achieve net-zero emissions in coming years. For instance, in May 2022, the Panama government and energy companies, including SGP BioEnergy, plan to develop a major, advanced biorefinery to increase the supply of lower-carbon aviation fuel.

Market Segmentation

Our in-depth analysis of the global biorefinery market includes the following segments:

- Based on type, the market is sub-segmented into first generation, second generation, and third generation.

- Based on product, the market is bifurcated into energy driven and material driven.

- Based on technology, the market is augmented into Industrial biotechnology, physico-chemical, thermochemical

Industrial Biotechnology is Projected to Emerge as the Largest Segment

Based on the technology, the global biorefinery market is sub-segmented into industrial biotechnology, physico-chemical, and thermochemical. Among these, the industrial biotechnology sub-segment is expected to hold the largest share of the market. The primary factor supporting the segment's growth includes the capacity of industrial biotechnology to produce numerous products and value streams. It comprises both the production of bio-based products and biotechnology-based tools.

Energy Driven Sub-segment to Hold a Considerable Market Share

Rising investments in the renewable energy sector have propelled the number of renewable energy plants around the globe, which in turn has increased the production of bioenergy and the establishment of biorefinery. For instance, in December 2021, The Geismar renewable diesel refinery located in the US expanded to increase its annual production capacity from the current 90 million gallons to 340 million gallons by 2024. Renewable Energy Group (REG), a biofuels producer based in Iowa, US, is the owner and operator of the Geismar renewable diesel facility. The biorefinery came on stream with 75 million gallons a year of biodiesel production capacity in October 2010. It was the first large-scale renewable diesel facility built in the US.

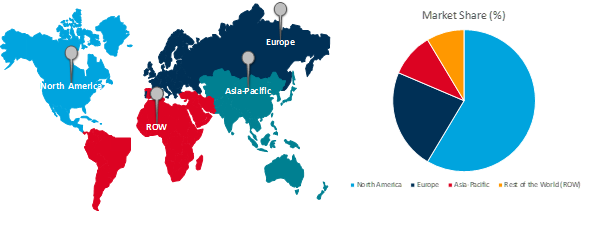

Regional Outlook

The global biorefinery market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America).

European countries to invest in biofuels and biorefineries

- Germany is the key investor and user of biofuels and biorefinery based products around the globe.

- The UK is shifting from oil or coal-based energy consumption to renewable energy consumption.

Global Biorefinery Market Growth by Region 2024-2031

North America Holds Major Market Share

Among all the regions, North America holds a significant share owing to the presence of rising demand for electricity. Total end-use power consumption in the US was around 3% in 2022. Retail electricity sales to the residential sector were around 4%, while retail power sales to the commercial sector were approximately 3% in 2022.

Apart from this, there is an increase in the number of biorefineries in North America which is further propelling the regional market growth. According to the VERBIO North America, there are 199 operating ethanol biorefineries in North America as of 2022. Furthermore, the region also consumes a high amount of biofuels, according to the Environmental Impact Assessment (EIA), in 2021, about 17.5 billion gallons of biofuels were produced in the United States and about 16.8 billion gallons were consumed. The United States was a net exporter of about 0.8 billion gallons of biofuels in 2021, with fuel ethanol accounting for the largest share of gross and net exports of biofuels.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global biorefinery market include Cargill, Inc., Valero Energy Corp., Wilmar International Ltd., Afyren SAS, Clariant AG, and Sekab, among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in 2022, Afyren SAS announced the launch of Afyren NEOXY, the first large biorefinery plant in France. In 2024, the production of bio-based carboxylic acids is expected to increase by 16,000 metric tons, saving 30,000 tons of carbon dioxide (CO2).

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global biorefinery market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Cargill, Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Valero Energy Corp.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Wilmar International Ltd.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Biorefinery Market by Type

4.1.1. First Generation

4.1.2. Second Generation

4.1.3. Third Generation

4.2. Global Biorefinery Market by Product

4.2.1. Energy Driven

4.2.2. Material Driven

4.3. Global Biorefinery Market by Technology

4.3.1. Industrial Biotechnology

4.3.2. Physico-Chemical

4.3.3. Thermochemical

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Abengoa, S.A.

6.2. Afyren SAS

6.3. Borregaard

6.4. Chempolis Ltd.

6.5. Clariant AG

6.6. Godavari Biorefineries Ltd. (The Godavari Sugar Mills Ltd.)

6.7. Green Plains Inc.

6.8. Neste Oyj

6.9. Red River Biorefinery

6.10. Renewable Energy Group

6.11. Sekab

6.12. SGP BioEnergy Holdings, LLC

6.13. Veolia Environnement SA

6.14. Vivergo Fuels

1. GLOBAL BIOREFINERY MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

2. GLOBAL FIRST GENERATION BIOREFINERY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL SECOND GENERATION BIOREFINERY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL THIRD GENERATION BIOREFINERY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL BIOREFINERY MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

6. GLOBAL BIOREFINERY FOR ENERGY DRIVEN MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL BIOREFINERY FOR MATERIAL DRIVEN MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL BIOREFINERY MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2031 ($ MILLION)

9. GLOBAL INDUSTRIAL BIOTECHNOLOGY IN BIOREFINERY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL INDUSTRIAL BIOTECHNOLOGY IN BIOREFINERY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL PHYSICO-CHEMICAL IN BIOREFINERY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL THERMOCHEMICAL IN BIOREFINERY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL BIOREFINERY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. NORTH AMERICAN BIOREFINERY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

15. NORTH AMERICAN BIOREFINERY MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

16. NORTH AMERICAN BIOREFINERY MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

17. NORTH AMERICAN BIOREFINERY MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2031 ($ MILLION)

18. EUROPEAN BIOREFINERY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

19. EUROPEAN BIOREFINERY MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

20. EUROPEAN BIOREFINERY MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

21. EUROPEAN BIOREFINERY MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2031 ($ MILLION)

22. ASIA-PACIFIC BIOREFINERY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

23. ASIA-PACIFIC BIOREFINERY MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

24. ASIA-PACIFIC BIOREFINERY MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

25. ASIA-PACIFIC BIOREFINERY MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2031 ($ MILLION)

26. REST OF THE WORLD BIOREFINERY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

27. REST OF THE WORLD BIOREFINERY MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

28. REST OF THE WORLD BIOREFINERY MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

29. REST OF THE WORLD BIOREFINERY MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2031 ($ MILLION)

1. GLOBAL BIOREFINERY MARKET SHARE BY TYPE, 2023 VS 2031 (%)

2. GLOBAL FIRST GENERATION BIOREFINERY MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL SECOND GENERATION BIOREFINERY MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL THIRD GENERATION BIOREFINERY MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL BIOREFINERY MARKET SHARE BY PRODUCT, 2023 VS 2031 (%)

6. GLOBAL BIOREFINERY FOR ENERGY DRIVEN MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL BIOREFINERY FOR MATERIAL DRIVEN MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL BIOREFINERY MARKET SHARE BY TECHNOLOGY, 2023 VS 2031 (%)

9. GLOBAL INDUSTRIAL BIOTECHNOLOGY IN BIOREFINERY MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL PHYSICO-CHEMICAL IN BIOREFINERY MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL THERMOCHEMICAL IN BIOREFINERY MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL BIOREFINERY MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. US BIOREFINERY MARKET SIZE, 2023-2031 ($ MILLION)

14. CANADA BIOREFINERY MARKET SIZE, 2023-2031 ($ MILLION)

15. UK BIOREFINERY MARKET SIZE, 2023-2031 ($ MILLION)

16. FRANCE BIOREFINERY MARKET SIZE, 2023-2031 ($ MILLION)

17. GERMANY BIOREFINERY MARKET SIZE, 2023-2031 ($ MILLION)

18. ITALY BIOREFINERY MARKET SIZE, 2023-2031 ($ MILLION)

19. SPAIN BIOREFINERY MARKET SIZE, 2023-2031 ($ MILLION)

20. REST OF EUROPE BIOREFINERY MARKET SIZE, 2023-2031 ($ MILLION)

21. INDIA BIOREFINERY MARKET SIZE, 2023-2031 ($ MILLION)

22. CHINA BIOREFINERY MARKET SIZE, 2023-2031 ($ MILLION)

23. JAPAN BIOREFINERY MARKET SIZE, 2023-2031 ($ MILLION)

24. SOUTH KOREA BIOREFINERY MARKET SIZE, 2023-2031 ($ MILLION)

25. REST OF ASIA-PACIFIC BIOREFINERY MARKET SIZE, 2023-2031 ($ MILLION)

26. LATIN AMERICA BIOREFINERY MARKET SIZE, 2023-2031 ($ MILLION)

27. MIDDLE EAST AND AFRICA BIOREFINERY MARKET SIZE, 2023-2031 ($ MILLION)