Biosimilars Market

Global Biosimilars Market Size, Share & Trends Analysis Report by Product (Recombinant Non-Glycosylated Proteins and Recombinant Glycosylated Proteins), by Applications (Oncology, Chronic and Autoimmune Disease, Blood Disorders, Growth Hormone Deficiency, and Other Diseases), and Forecast 2019-2025 Update Available - Forecast 2025-2031

The global biosimilars market is estimated to grow at a significant CAGR during the forecast period. Biosimilars are a biologic medical product that is similar to biological medicines and acts as an alternative to biomedicines. According to the Biosimilars Council, biosimilars are priced 10% to 35% lesser than branded biological medicines, and a sum of $250 billion could be saved through the application of biosimilars in the next decade.

Biosimilars will increase patient access to important life-saving medication by reducing overall costs in the pharmaceutical industry. The factor that contributes to the growth of the market includes the rise in the geriatric population and the growing demand for pharmaceuticals. According to the UN in 2017, approximately 962 million people were over 60 years which is projected to approximately 2.1 billion by 2050. These populations suffer from such problems and diseases that require regular treatment diagnosis, and medication. Thus, the geriatrics population is potentially the largest consumer base for key players operating in the market during the forecast period.

Segmental Outlook

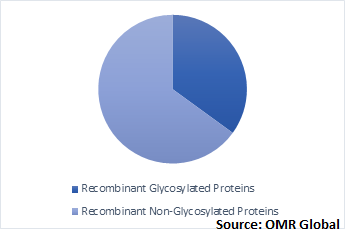

The global biosimilar market is segmented on the basis of products and applications. Based on the products, the market is bifurcated into recombinant non-glycosylated proteins, and recombinant glycosylated proteins. Based on the applications, the market is segmented into oncology, chronic and autoimmune disease, blood disorders, growth hormone deficiency, and other diseases.

Global Biosimilars Market by product, 2018 (%)

Based on the product, the recombinant glycosylated proteins market is estimated to grow at a significant rate during the forecast period. The growth is attributed to the wide therapeutic areas and solutions offered by these proteins and the presence of biosimilar versions of monoclonal antibodies at lower prices compared to reference products. Whereas, based on the applications, oncology holds the major share in the market, attributing to the increased prevalence of cancer-related diseases. In addition, the increasing incidence of blood disorders and the rising pressure to reduce healthcare expenditure along with the less cost of biosimilars compared to biologics are among the key factors that foster the overall growth of the market.

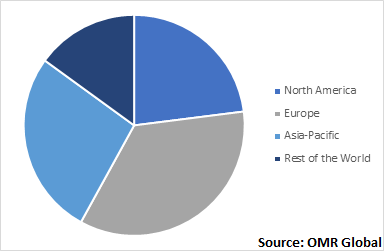

Regional Outlook

The global biosimilars market is segmented into North America, Europe, Asia-Pacific and the Rest of the World. Europe is expected to hold a significant share in the global biosimilars market. This is attributed to the enhanced healthcare structure and biosimilar industry. The country has almost 36 patented biosimilars in the region. In Europe, countries such as UK and Nordics are particularly active in the market owing to the rapid R&D activities in the region along with the key players contributing to the market growth. Amgevita, Imraldi, Halimatoz, Hyrimoz, Hefiya, Hulio, Binocrit, Epoetin Alfa Hexal, Retacrit, Nivestim, Ratiograstim, Tevagrastim, Zarzio are some of the biosimilars that are approved in Europe.

Global Biosimilars Market, by Region 2018 (%)

Further, North America is also expected to register a momentous growth in the market attributing to several governmental initiatives and key players' contributions in the region. In addition, in 2018, the US FDA released a Biosimilars Action Plan to implement regulations from the BPCI, which includes reducing abuse of the Risk Evaluation and Mitigation Strategy (REMS) system to transit insulin and human growth hormone to regulation as biologics.

Market Players Outlook

Some of the prominent players functioning in the global biosimilars market include Eli Lilly and Co., Merck & Co. Inc., Mylan NV, Biocon Ltd., Novartis International AG, Allergan Plc., Amgen Inc., F. Hoffmann-La Roche Ltd., Teva Pharmaceuticals Ltd., and Pfizer Inc., among others. These players are providing various biosimilars in the market and are contributing significantly to the market growth.

These key manufacturers are adopting various strategies such as new product launches and approvals, merger and acquisition, partnerships and collaborations, and many others in order to thrive in a competitive environment. For instance, in October 2019, Biocon and Mylan launched the novel insulin glargine biosimilar Semglee in Australia. Semglee is the insulin glargine biosimilar accessible via Pharmaceutical Benefits Scheme (PBS) in Australia, the companies said in a joint statement. The launch of the novel insulin enhanced the product portfolio of the company and the company’s growth.

The Report Covers

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global biosimilars market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Competitive Dashboard

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. F. Hoffmann-La Roche Ltd

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Teva Pharmaceuticals Ltd.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Pfizer Inc.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Amgen Inc.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Novartis International AG

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Biosimilars Market by Product

5.1.1. Recombinant Non-Glycosylated Proteins

5.1.2. Recombinant Glycosylated Proteins

5.2. Global Biosimilars Market by Application

5.2.1. Oncology

5.2.2. Chronic and Autoimmune Disease

5.2.3. Blood Disorders

5.2.4. Growth Hormone Deficiency

5.2.5. Other Diseases

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Allergan Plc

7.2. AMEGA Biotech SA

7.3. Amgen Inc.

7.4. Biocon Ltd.

7.5. Biogen Inc.

7.6. Boehringer Ingelheim International GmbH

7.7. Celltrion Healthcare Co. Ltd.

7.8. Dr. Reddy's Laboratories Ltd.

7.9. Eli Lilly and Co.

7.10. F. Hoffmann-La Roche Ltd.

7.11. Fresenius Kabi AG

7.12. Intas Pharmaceuticals Ltd.

7.13. JCR Pharmaceuticals Co. Ltd.

7.14. Merck & Co. Inc.

7.15. Mylan NV

7.16. Novartis International AG

7.17. Pfizer Inc.

7.18. Samsung Bioepis Co. Ltd.

7.19. Stada Arzneimittel AG

7.20. Teva Pharmaceutical Industries Ltd.

1. GLOBAL BIOSIMILARS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2018-2025 ($ MILLION)

2. GLOBAL RECOMBINANT NON-GLYCOSYLATED PROTEINS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL RECOMBINANT GLYCOSYLATED PROTEINS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL BIOSIMILARS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

5. GLOBAL BIOSIMILARS FOR ONCOLOGY MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

6. GLOBAL BIOSIMILARS FOR CHRONIC AND AUTOIMMUNE DISEASE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

7. GLOBAL BIOSIMILARS FOR BLOOD DISORDERS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

8. GLOBAL BIOSIMILARS FOR GROWTH HORMONE DEFICIENCY MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

9. GLOBAL BIOSIMILARS FOR OTHER DISEASES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

10. GLOBAL BIOSIMILARS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

11. NORTH AMERICAN BIOSIMILARS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

12. NORTH AMERICAN BIOSIMILARS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2018-2025 ($ MILLION)

13. NORTH AMERICAN BIOSIMILARS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

14. EUROPEAN BIOSIMILARS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

15. EUROPEAN BIOSIMILARS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2018-2025 ($ MILLION)

16. EUROPEAN BIOSIMILARS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

17. ASIA-PACIFIC BIOSIMILARS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

18. ASIA-PACIFIC BIOSIMILARS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2018-2025 ($ MILLION)

19. ASIA-PACIFIC BIOSIMILARS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

20. REST OF THE WORLD BIOSIMILARS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2018-2025 ($ MILLION)

21. REST OF THE WORLD BIOSIMILARS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

1. GLOBAL BIOSIMILARS MARKET SHARE BY PRODUCT, 2018 VS 2025 (%)

2. GLOBAL BIOSIMILARS MARKET SHARE BY APPLICATION, 2018 VS 2025 (%)

3. GLOBAL BIOSIMILARS MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

4. US BIOSIMILARS MARKET SIZE, 2018-2025 ($ MILLION)

5. CANADA BIOSIMILARS MARKET SIZE, 2018-2025 ($ MILLION)

6. UK BIOSIMILARS MARKET SIZE, 2018-2025 ($ MILLION)

7. FRANCE BIOSIMILARS MARKET SIZE, 2018-2025 ($ MILLION)

8. GERMANY BIOSIMILARS MARKET SIZE, 2018-2025 ($ MILLION)

9. ITALY BIOSIMILARS MARKET SIZE, 2018-2025 ($ MILLION)

10. SPAIN BIOSIMILARS MARKET SIZE, 2018-2025 ($ MILLION)

11. ROE BIOSIMILARS MARKET SIZE, 2018-2025 ($ MILLION)

12. INDIA BIOSIMILARS MARKET SIZE, 2018-2025 ($ MILLION)

13. CHINA BIOSIMILARS MARKET SIZE, 2018-2025 ($ MILLION)

14. JAPAN BIOSIMILARS MARKET SIZE, 2018-2025 ($ MILLION)

15. REST OF ASIA-PACIFIC BIOSIMILARS MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF THE WORLD BIOSIMILARS MARKET SIZE, 2018-2025 ($ MILLION)