Biostimulants Market

Biostimulants Market Size, Share, and Trends Analysis Report by Product Type (Acid-Based, Extract-Based, and Other Active Ingredients), Crop Type (Grains and Cereals, Pulses and Oilseeds, Commercial Crops, Fruits and Vegetables, and Other Crops), Application (Foliar Spray, Soil, and Seed), and Forecast Period (2023–2030) Update Available - Forecast 2025-2031

Biostimulants market is anticipated to grow at a considerable CAGR of 11.2% during the forecast period. The growth is attributed to the increased demand from various end-use applications, such as seed, soil, and foliar treatment. Biostimulants are organic fertilizers that are used to nourish agricultural goods as well as enhance plant growth and output. From seed germination through plant maturity, the product supports plant growth and development. These fertilizers improve soil fertility by fostering the establishment of interdependent soil microorganisms that help in nutrient transport, absorption, and use. Hence, the growing need to increase crop yield and quality, growing organic farming and demand for organic food, the wide range of advantages of biostimulant use in crop production, and increasing awareness about environmental safety with biostimulant use are the key factors driving the biostimulants market's growth.

Segmental Outlook

The global biostimulants market is segmented by product type, crop type, and application. Based on product type, the market is sub-segmented into acid-based, extract-based, and other active ingredients. Based on crop type, the market is sub-segmented into grains and cereals, pulses and oilseeds, commercial crops, fruits and vegetables, and other crops. Based on application, the market is sub-segmented into foliar spray, soil, and seed. Among product types, the acid-based biostimulant segment is estimated to account for the majority of the biostimulants market. This segment's huge share is mostly due to its ease of availability, wide variety of plant advantages, and increased efficacy. The extract-based biostimulants market, on the other hand, is predicted to rise significantly throughout the projection period.

The Foliar Spray Sub-Segment Holds a Prominent Share in the Global Biostimulant Market

Based on application, the market is sub-segmented into foliar spray, soil, and seed. Among these, the foliar spray segment holds a significant share of the market. In terms of application, the foliar spray segment is expected to lead the global market during the forecast period. Foliar spray is the most common way of administering biostimulants to crops. The spraying approach allows the farmer to cover the majority of the field while using the least quantity of biostimulant. The spraying method also reduces biostimulant waste. As a result, the agricultural industry around the world chooses and adapts the use of foliar spray to disseminate biostimulants in crops. Hence, the increasing usage of foliar spray has fueled the expansion of the worldwide biostimulants market in the foliar spray category.

Regional Outlook

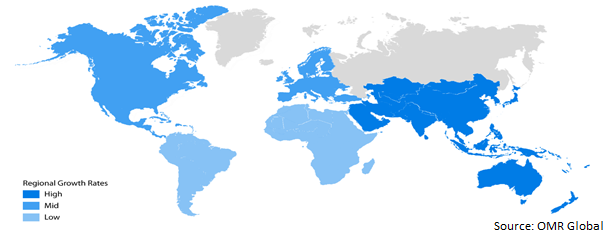

The global biostimulants market is segmented based on geography, including North America (the US and Canada), Europe (Italy, Spain, Germany, France, and others), Asia-Pacific (India, China, Japan, South Korea, and others), and the rest of the world (the Middle East and Africa and Latin America). The market can be analyzed for a particular region or country level as per the requirement. Among the regions, the Asia-Pacific region is expected to generate the highest market share. However, the European market is also expected to grow significantly in the forecast period, owing to the growth of organic and sustainable farming in the region.

Global Biostimulants Market Growth, by Region (2023-2030)

The Asia-Pacific Region is Expected to Dominate the Global Biostimulants Market

The presence of vast agricultural land and organic farmers in countries such as India, Japan, Thailand, the Philippines, Indonesia, China, and others is contributing to positive growth in the Asia-Pacific’s biostimulants market. According to the International Federation of Organic Agriculture Movements (IFOAM) and the Research Institute of Organic Agriculture (FiBL), China's organic agricultural area totaled 3.14 million hectares in 2020. The great focus placed by governments and other stakeholders on organic and sustainable farming practices has raised the acceptability of biostimulants. Moreover, the National Centre for Organic and Natural Farming of India estimated that there were 3.1 million organic farmers globally in 2019, with India having the biggest number of producers (1,366,000). According to the same source, over 2.3 million hectares of farmland in India were under organic farming as of 2019. Besides, according to the European Commission, the organic agriculture land in Asia was more than 6.1 million hectares in 2020. These factors show a significant need for biostimulants in the region for organic and sustainable farming.

Market Players Outlook

The major companies serving the global biostimulants market include Biovert S.L., Hello Nature, Isagro S.p.A., Italpollina SAP, Koppert B.V., and others. These companies are considerably contributing to the market’s growth through the adoption of various strategies, including mergers and acquisitions, partnerships, collaborations, investments, and new biostimulant launches to stay competitive in the market. For instance, in September 2022, Evonik Industries revealed plans to introduce a biostimulant that would allow farmers to cut fertilizer consumption in half while maintaining 93% of yields. The company plans to launch the biostimulant around 2025-2027, with a focus on non-leguminous crops such as wheat and corn. With crops requiring half the fertilizer to obtain comparable yields, it will assist farmers in the EU in meeting the European Commission's aim of lowering fertilizer consumption by 20% by 2030.

The Report Covers-

- Market value data analysis for 2022 and forecast to 2030.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global biostimulants market. Based on the availability of data, information related to new product launches and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market entry and market expansion strategies.

- Competitive strategies by identifying ‘who stands where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight and Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

4. Market Segmentation

4.1. Global Biostimulants Market by Product Type

4.1.1. Acid-Based

4.1.2. Extract-Based

4.1.3. Other Active Ingredients

4.2. Global Biostimulants Market by Crop Type

4.2.1. Grains and Cereals

4.2.2. Pulses and Oilseeds

4.2.3. Commercial Crops

4.2.4. Fruits and Vegetables

4.2.5. Other Crops

4.3. Global Biostimulants Market by Application

4.3.1. Foliar Spray

4.3.2. Soil

4.3.3. Seed

5. Regional Analysis

5.1. North America

5.1.1. US

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1 BASF SE

6.2 Biolchim S.p.A.

6.3 Biostadt India Ltd.

6.4 Biovert S.L.

6.5 Hello Nature

6.6 Isagro S.p.A.

6.7 Italpollina SAP

6.8 Koppert B.V.

6.9 Lallemand, Inc.

6.10 Marrone Bio Innovations

6.11 Novozymes A/S

6.12 Platform Specialty Products Corp.

6.13 Syngenta AG

6.14 Tradecorp International

6.15 UPL Ltd.

6.16 Valagro S.p.A.