Biosurgery Market

Global Biosurgery Market Size, Share & Trends Analysis Report by Products (Adhesion Barriers, Soft Tissue Management(mesh/patch), Bone Graft Substitutes, Surgical Sealants, Hemostatic Agents, and Staple Line Reinforcement Static Agents), By Applications (Neurological Surgeries, General Surgeries, Cardiovascular Surgeries, Orthopedic Surgeries, Gynecology Surgeries, Urological Surgery, Thoracic Surgeries, and Others (Ophthalmic Surgeries) Forecast, 2021-2027 Update Available - Forecast 2025-2031

The global biosurgery market is anticipated to grow at a CAGR of 6.8% during the forecast period. The major factors that are driving the growth of the market include an increasing number of surgeries and sports-related and trauma surgeries, rising demand for technologically upgraded surgical processes, and rising adoption of minimally invasive surgeries across the globe. Biosurgery has increasingly being adopted by surgeons in cardiovascular surgery, thoracic surgery, orthopedic surgery, and ophthalmic surgery, among others. It involves various surgical techniques which include natural or synthetic materials to seal surgical incisions that are biodegradable. Hemostatic agents and sealants provided by the biosurgery market players are used during the surgeries to stop bleeding and seal wounds in surgery. The various advantages associated with Biosurgery such as safety, easy usability, and efficacy in several conditions in different tissues. Moreover, it promotes wound healing and significantly removes the requirement of sutures and staples.

Besides, the rising prevalence of chronic disease, the number of surgeries has increased as most of the chronic diseases in later stages demand surgeries. For instance, as per Dementia Australia, around 459,000 Australians were living with dementia in 2020, and about 1.6 million were involved in their centre for care. It is estimated to reach 1.1 million by 2058. The high cost associated with Biosurgery and adhesives in the low- and middle-income economies is the major factor restraining the growth of the global biosurgery market. Increasing clearance of biosurgery products by regulatory authorities, increasing investments by major players in emerging economies, and the growing need for effective blood loss management in patients are likely to fuel the market growth during the forecast period.

Impact of COVID-19 Pandemic on Global Biosurgery Market

The global biosurgery market is hardly hit by the outbreak of COVID-19 since December 2019. The pandemic has had an impact on how people function and how different surgical procedures are performed. For surgeons to continue to provide safe and appropriate treatment to their patients during the COVID-19 pandemic, stringent guidelines specific to each speciality must be enforced and followed. The number of surgeries has significantly declined during the pandemic, due to the strict guidelines by the regulatory authorities to avoid all non-emergent surgeries. This would have an impact on the procurement of biosurgery in surgical centres. The outbreak of COVID-19 has disrupted the supply of raw materials and products across the globe, hence impacted the biosurgery market negatively. To fight the pandemic the key players were focusing on the manufacturing of various products such as fibrin sealants, surgical sealants, soft tissue patches, among others, and get approved by the regulatory. The market will witness “V” shape recovery in near future owing to the restart of key industries in major economies.

Segmental Outlook

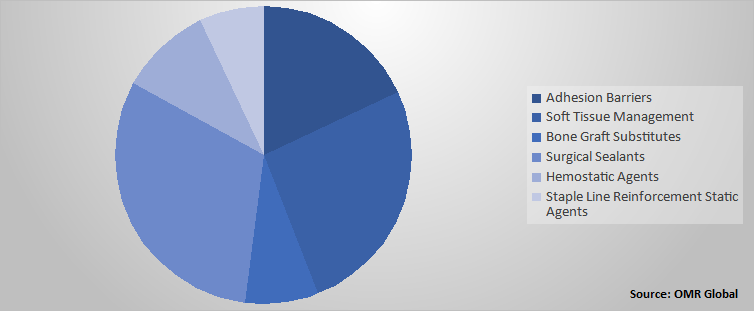

The global biosurgery market is segmented based on product and application. Based on the product, the market is segmented into adhesion barriers, soft tissue management(mesh/patch), bone graft substitutes, surgical sealants, hemostatic agents, and staple line reinforcement static agents. Among the segments, surgical sealants and adhesive segments are expected to grow at a significant CAGR during the forecast period. the bone graft substitutes are further segmented into cell-based matrices, bone morphogenetic proteins, demineralized bone matrix, and synthetic graft extender. Surgical sealants are classified into fibrin sealants, collagen-based adhesives, synthetic agents, and tissue–adhesive glues. Further, based on the application, the market is segmented into neurological surgeries, general surgeries, cardiovascular surgeries, orthopedic surgeries, gynecology surgeries, urological surgery, thoracic surgeries, and others.

Global Biosurgery Market Share by Type, 2020 (%)

Surgical Sealants Segment holds the significant share in the Market

Among the product, the surgical sealants segments held the major share in 2020 and are also anticipated to grow during the forecast period. Surgical sealants are further classified into fibrin sealants, collagen-based adhesives, synthetic agents, and tissue –adhesive glues. Sealants and adhesives have evolved to become useful accompaniments in modern surgical procedures. Surgical sealants are used during the surgeries to avoid the complication in surgery such as air, blood, among others. The growth of surgical sealants is driven by the increasing awareness about the benefits of surgical sealants in surgical procedures. Fibrin sealants held the largest market share in the year 2020, due to their applications in medical practice. Biosurgery effective for various applications include thoracic, cardiovascular surgery, orthopedic surgery, neurology surgery, general surgery, gynecology surgery, and reconstructive surgeries. Among other sealants, fibrin is the only product to have received approval from the FDA, to be used under all three groups, namely hemostats, sealants, and adhesives.

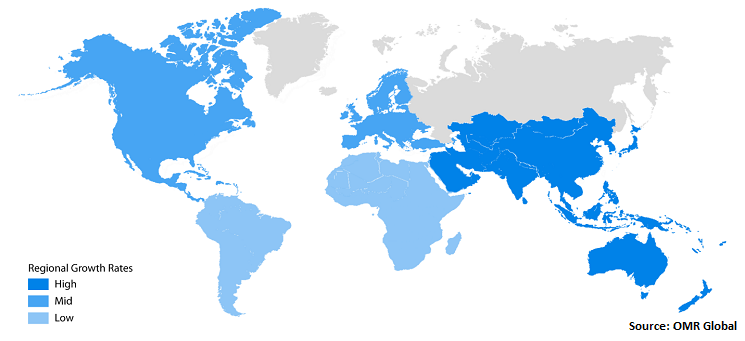

Regional Outlooks

The global biosurgery market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, France, Spain, Germany, and Rest of Europe), Asia-Pacific (India, Japan, China, and the Rest of Asia-Pacific), and the Rest of the World (the Middle East and Africa, and Latin America). North America holds a dominant position in the global biosurgery market in 2020. The availability of a sophisticated healthcare system, increasing investment in R&D expenditure, rising healthcare spending, and rising adoption of technologically upgraded surgeries and devices are driving the biosurgery market in the region. Moreover, the sedentary lifestyle of the population has significantly increased the surgical procedures in the region, which in turn fuels the market growth in the region.

Global Biosurgery Market Growth, by Region 2021-2027

Asia-Pacific is projected to have considerable growth in the global Biosurgery market

Asia-Pacific is projected to exhibit the fastest growth in the global biosurgery market during the forecast period. This is mainly owing to the presence of a huge pool of patients especially people over 65 years, and increasing healthcare spending by government authorities and individuals. For instance, as per the World Health Organization, in 2018, around 6.8% of GDP was the healthcare expenditure in Asia-pacific. Besides, as per the World Bank, in 2019, around 28% of the Japanese population is more than 65 years. And around 11.47% of the China population is over 65 years. The elderly are at a greater risk of developing chronic disease which required surgery. Thus, the huge population base and rapid development in the healthcare sector are assisting the companies to develop their market in the Asia-pacific region.

Market Players Outlook

The key players of the Biosurgery market include Baxter International Inc., B. Braun Melsungen AG, Cohera Medical, Inc., CryoLife Inc., CSL Limited (CSL Behring), Johnson & Johnson (Ethicon, Inc.), among others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers & acquisitions, geographical expansion, collaborations, and new product launches, to stay competitive in the market. For instance, in September 2020, Aroa Biosurgery Ltd., a soft tissue regeneration company, has received new clearance in the US and Europe, for expansion of commercial and production capacity.

The Report Covers

- Market value data analysis of 2020 and forecast to 2027.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global biosurgery market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global Biosurgery Industry

• Recovery Scenario of Global Biosurgery Industry

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. BY Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.2. Key Strategy Analysis

3.3. Impact of COVID-19 on Key Players

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Biosurgery Market, By Products

5.1.1. Adhesion Barriers

5.1.2. Soft Tissue Management (mesh/patch)

5.1.2.1. Biological

5.1.2.2. Synthetic

5.1.3. Bone graft substitutes

5.1.3.1. Cell-based matrices

5.1.3.2. Bone morphogenetic proteins

5.1.3.3. Demineralized bone matrix

5.1.3.4. Synthetic graft extender

5.1.4. Surgical Sealants

5.1.4.1. Fibrin Sealants

5.1.4.2. Collagen Based Adhesives

5.1.4.3. Synthetic agents

5.1.4.4. Tissue –Adhesive Glues

5.1.5. Hemostatic Agents

5.1.6. Staple Line Reinforcement Static Agents

5.2. Global Biosurgery Market, By Application

5.2.1. Neurological Surgeries

5.2.2. General Surgeries

5.2.3. Cardiovascular Surgeries

5.2.4. Orthopedic Surgeries

5.2.5. Gynecology Surgeries

5.2.6. Urological Surgery

5.2.7. Thoracic Surgeries

5.2.8. Others (Ophthalmic Surgeries)

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. South Korea

6.3.5. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Aroa Biosurgery Ltd.

7.2. Atrium Medical Corp.

7.3. B. Braun Melsungen AG

7.4. Baxter International, Inc.

7.5. Becton, Dickinson, and Co. (BD)

7.6. Biom’Up USA, Inc.

7.7. Cohera Medical, Inc.

7.8. CSL Ltd.

7.9. CryoLife, Inc.

7.10. Ethicon US, LLC (Johnson & Johnson)

7.11. Hemostasis, LLC

7.12. Integra LifeSciences Corp.

7.13. Kuros BiosciencesA.G.

7.14. MAQUET Holding B.V. & Co. Kg. (Getinge AB)

7.15. Medtronic Plc

7.16. Osiris Therapeutics, Inc.

7.17. Pfizer Inc.

7.18. Sanofi SA

7.19. Stryker Corp.

7.20. Takeda Pharmaceutical Co. Ltd.

1. GLOBAL BIOSURGERY MARKET RESEARCH AND ANALYSIS, 2020-2027 ($ MILLION)

2. GLOBAL BIOSURGERY MARKET RESEARCH AND ANALYSIS BY PRODUCTS, 2020-2027 ($ MILLION)

3. GLOBAL ADHESIVE BARRIERS FOR BIOSURGERY MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

4. GLOBAL SOFT TISSUE MANAGEMENT FOR BIOSURGERY MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

5. GLOBAL SOFT TISSUE MANAGEMENT FOR BIOSURGERY MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

6. GLOBAL BONE GRAFT SUBSTITUTES FOR BIOSURGERY MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

7. GLOBAL BONE GRAFT SUBSTITUTES FOR BIOSURGERY MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

8. GLOBAL SURGICAL SEALANTS FOR BIOSURGERY MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

9. GLOBAL SURGICAL SEALANTS FOR BIOSURGERY MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

10. GLOBAL HEMOSTATIC AGENTS FOR BIOSURGERY MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

11. GLOBAL STAPLE LINE REINFORCEMENT STATIC AGENTS FOR BIOSURGERY MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

12. GLOBAL BIOSURGERY MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

13. GLOBAL NEUROLOGICAL SURGERIES MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

14. GLOBAL GENERAL SURGERIES MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

15. GLOBAL CARDIOVASCULAR SURGERIES MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

16. GLOBAL ORTHOPEDIC SURGERIES MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

17. GLOBAL GYNECOLOGY SURGERIES MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

18. GLOBAL UROLOGICAL SURGERIES MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

19. GLOBAL THORACIC SURGERIES MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

20. GLOBAL OTHERS APPLICATION IN BIOSURGERY MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

21. GLOBAL BIOSURGERY MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2020-2027 ($ MILLION)

22. NORTH AMERICAN BIOSURGERY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

23. NORTH AMERICAN BIOSURGERY MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2020-2027 ($ MILLION)

24. NORTH AMERICAN BIOSURGERY MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

25. EUROPEAN BIOSURGERY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

26. EUROPEAN BIOSURGERY MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2020-2027 ($ MILLION)

27. EUROPEAN BIOSURGERY MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

28. ASIA-PACIFIC BIOSURGERY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

29. ASIA-PACIFIC BIOSURGERY MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2020-2027 ($ MILLION)

30. ASIA-PACIFIC BIOSURGERY MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

31. REST OF THE WORLD BIOSURGERY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

32. REST OF THE WORLD BIOSURGERY MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2020-2027 ($ MILLION)

33. REST OF THE WORLD BIOSURGERY MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL BIO SURGERY MARKET, 2020-2027 ($ MILLION)

2. IMPACT OF COVID-19 ON GLOBAL BIO SURGERY MARKET BY SEGMENT, 2020-2027 ($ MILLION)

3. RECOVERY OF GLOBAL BIO SURGERY MARKET, 2021-2027 (%)

4. GLOBAL BIO SURGERY MARKET SHARE BY PRODUCT, 2020 VS 2027 (%)

5. GLOBAL BIO SURGERY MARKET SHARE BY APPLICATION, 2020 VS 2027 (%)

6. GLOBAL BIO SURGERY MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

7. GLOBAL ADHESION BARRIERS FOR BIO SURGERY MARKET SHARE BY REGION, 2020 VS 2027 (%)

8. GLOBAL SOFT TISSUE MANAGEMENT FOR BIO SURGERY MARKET SHARE BY REGION, 2020 VS 2027 (%)

9. GLOBAL BONE GRAFT SUBSTITUTES FOR BIO SURGERY MARKET SHARE BY REGION, 2020 VS 2027 (%)

10. GLOBAL SURGICAL SEALANTS FOR BIO SURGERY MARKET SHARE BY REGION, 2020 VS 2027 (%)

11. GLOBAL HEMOSTATIC AGENTS FOR BIO SURGERY MARKET SHARE BY REGION, 2020 VS 2027 (%)

12. GLOBAL STAPLE LINE REINFORCEMENT STATIC AGENTS FOR BIO SURGERY MARKET SHARE BY REGION, 2020 VS 2027 (%)

13. GLOBAL NEUROLOGICAL SURGERIES MARKET SHARE BY REGION, 2020 VS 2027 (%)

14. GLOBAL GENERAL SURGERIES MARKET SHARE BY REGION, 2020 VS 2027 (%)

15. GLOBAL CARDIOVASCULAR SURGERIES MARKET SHARE BY REGION, 2020 VS 2027 (%)

16. GLOBAL ORTHOPEDIC SURGERIES MARKET SHARE BY REGION, 2020 VS 2027 (%)

17. GLOBAL GYNECOLOGY SURGERIES MARKET SHARE BY REGION, 2020 VS 2027 (%)

18. GLOBAL UROLOGICAL SURGERIES MARKET SHARE BY REGION, 2020 VS 2027 (%)

19. GLOBAL THORACIC SURGERIES MARKET SHARE BY REGION, 2020 VS 2027 (%)

20. GLOBAL OTHERS APPLICATION IN BIO SURGERY MARKET SHARE BY REGION, 2020 VS 2027 (%)

21. US BIO SURGERY MARKET SIZE, 2020-2027 ($ MILLION)

22. CANADA BIO SURGERY MARKET SIZE, 2020-2027 ($ MILLION)

23. UK BIO SURGERY MARKET SIZE, 2020-2027 ($ MILLION)

24. FRANCE BIO SURGERY MARKET SIZE, 2020-2027 ($ MILLION)

25. GERMANY BIO SURGERY MARKET SIZE, 2020-2027 ($ MILLION)

26. ITALY BIO SURGERY MARKET SIZE, 2020-2027 ($ MILLION)

27. SPAIN BIO SURGERY MARKET SIZE, 2020-2027 ($ MILLION)

28. REST OF EUROPE BIO SURGERY MARKET SIZE, 2020-2027 ($ MILLION)

29. INDIA BIO SURGERY MARKET SIZE, 2020-2027 ($ MILLION)

30. CHINA BIO SURGERY MARKET SIZE, 2020-2027 ($ MILLION)

31. JAPAN BIO SURGERY MARKET SIZE, 2020-2027 ($ MILLION)

32. SOUTH KOREA BIO SURGERY MARKET SIZE, 2020-2027 ($ MILLION)

33. REST OF ASIA-PACIFIC BIO SURGERY MARKET SIZE, 2020-2027 ($ MILLION)

34. REST OF THE WORLD BIO SURGERY MARKET SIZE, 2020-2027 ($ MILLION)