Bipolar Disorder Treatment Market

Bipolar Disorder Treatment Market Size, Share & Trends Analysis Report by Drug Class (Mood stabilizer, Anticonvulsant, Antipsychotic Drug, Antidepressant Drug, and Other), and by Distribution Channel (Hospitals and Clinics, Retail Pharmacies, and Online Pharmacies) Forecast Period (2023-2030) Update Available - Forecast 2025-2035

Bipolar disorder treatment market is anticipated to grow at a CAGR of 2.6% during the forecast period owing to the rising prevalence of bipolar disorder, along with the rising awareness about mental health. Other factors, such as increased government initiatives and increased demand for innovative treatment choices, are likely to boost market expansion. Additionally, advancements in technology have also played a significant role in the growth of the bipolar disorder treatment market. Digital health tools, such as telemedicine and online counselling platforms, have made bipolar illness treatment more accessible to patients who may have difficulty accessing traditional in-person care. This has increased the accessibility of bipolar illness treatment and helped to fulfil the rising demand for treatments.

Segmental Outlook

The global bipolar disorder treatment market is segmented based on the drug class and distribution channel. Based on the drug class, the market is sub-segmented into mood stabilizer, anticonvulsant, antipsychotic drug, antidepressant drug, other. Based on, distribution channel, the market is sub-segmented into on hospitals and clinics, retail pharmacies, and online pharmacies. Among the distribution channel, the hospitals and clinics sub-segment is anticipated to hold a considerable share of the market as clinics or hospitals are primary provider of bipolar disorder treatment. Additionally, presence of large number of hospitals or clinics as compared to retail pharmacies is driving the growth of this segment.

Antipsychotic Drug Sub-Segment is Anticipated to Hold a Prominent Share in the Global Bipolar Disorder treatment Market

Among the drug class, antipsychotic drug is anticipated to hold a prominent share of the market. Antipsychotic medicines are used in the short term to manage psychotic symptoms of bipolar illness, such as hallucinations, delusions, or manic symptoms. These symptoms can emerge as a result of severe depression or extreme mania. Some additionally treat bipolar depression to avoid future bouts of mania or despair. The National Institute of Mental Health predicts approximately 2.8% of individuals in the United States have bipolar illness, according to an article titled "Medications for bipolar disorder: What you should know" released in May 2022. Aripiprazole, Cariprazine, Lurasidone, Olanzapine, and other 2nd-generation antipsychotics are increasingly being used to treat acute manic psychosis. Although any of these medicines may produce akathisia due to extrapyramidal side effects, the risk is reduced with more sedating drugs such as olanzapine and quetiapine. Antipsychotics are also used "off labels" as narcotics for a sleeping difficulty, stress, or probable disruption in people with bipolar illness. They are frequently used with a temperament balancing medicine and help reduce the negative effects of mania until mood stabilizers provide complete benefits. A few antipsychotics appear to help with relaxing states of mind all along. As a result, they might be used as a stand-alone therapy for those who can’t tolerate or respond to lithium and anticonvulsants.

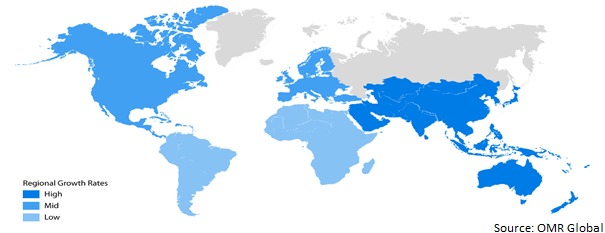

Regional Outlook

The global bipolar disorder treatment market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East & Africa, and Latin America). Among these, the European regional market is expected to grow considerably over the forecast period owing to factors such as the increasing awareness of mental health issue coupled with and government initiatives. Additionally, the region has established healthcare system, which supports the delivery of bipolar disorder treatment.

Global Bipolar Disorder Treatment Market Growth, by Region 2023-2030

North America is Expected to Hold a Prominent Share in the Global Bipolar disorder treatment

North America is dominating the bipolar disorder treatment market over the forecast period and expected to show a similar trend over the forecast period. The major factors propelling market growth include the rising prevalence of bipolar disorders due to insufficient sleep, trend of substance abuse, and high-stress levels amongst the population. Additionally, government initiatives aimed at raising awareness and support for patients suffering from mental disorder are expected to boost the market growth in the region. For instance, the Department of Health and Human Services (HHS), through the Substance Abuse and Mental Health Services Administration (SAMHSA), and the Office of Minority Health (OMH) funded $35 million to strengthen and expand community behavioural & mental health services including software for America's children and young adults in 2022. Such initiative is expected to enhance market expansion during the forecast period. Furthermore, the presence of modern healthcare infrastructure, together with rising healthcare expenditure, will contribute to market expansion. According to the National Alliance on Mental Illness, approximately 1 in every 5 adults in the US suffers from mental illness in any given year. Severe periods of mania and depression require hospitalisation to prevent individuals from hurting themselves or others.

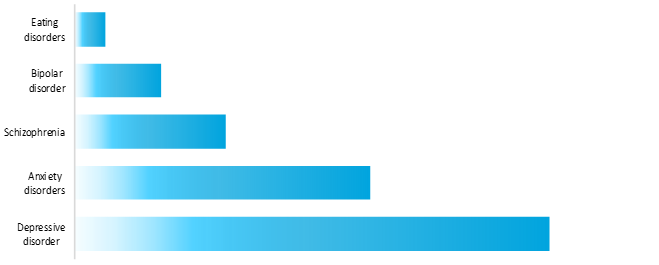

Burden of Disease from Each Category of Mental Illness, US, 2019

Estimated Number of Disability-Adjusted Life Years (DALYs) per 100,000 people by mental illness.

Source- Institute for Health Metrics and Evaluation

Market Players Outlook

The major companies serving the global bipolar disorder treatment market include AbbVie Inc., Pfizer Inc., AstraZeneca, BrainsWay, Ltd., GlaxoSmithKline Plc, Janssen Pharmaceuticals Inc., Allergan PLC, Eli Lilly and Company, GlaxoSmithKline Plcand others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in July 2021, Alembic Pharmaceuticals received approval from US Food and Drug Administration (USFDA) for its abbreviated new drug application (ANDA) Desipramine Hydrochloride tablets USP in the strength of 10 mg, 25 mg, 50 mg, 75 mg, 100 mg, and 150 mg. Desipramine Hydrochloride tablets is used in the treatment of depression. The approved product is therapeutically equivalent to the reference listed drug product Norpramin tablets of Validus Pharmaceuticals LLC.

The Report Covers

- Market value data analysis of 2022 and forecast to 2030.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global bipolar disorder treatment market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. AbbVie Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.2.5.

3.3. AstraZeneca Plc

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Pfizer Inc.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Bipolar Disorder Treatment Market by Drug Class

4.1.1. Mood stabilizer

4.1.2. Anticonvulsant

4.1.3. Antipsychotic Drug

4.1.4. Antidepressant Drug

4.1.5. Other Classes of Drug (Benzodiazepines, Symbyax)

4.2. Global Bipolar Disorder Treatment Market by Distribution Channel

4.2.1. Hospitals & Clinics

4.2.2. Retail Pharmacies

4.2.3. Online Pharmacies

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Abbott

6.2. Allergan PLC

6.3. BrainsWay, Ltd.

6.4. Bristol Myers Squibb

6.5. Eli Lilly and Company

6.6. GlaxoSmithKline Plc

6.7. GlaxoSmithKline Plc

6.8. Janssen Pharmaceuticals Inc.

6.9. Johnson & Johnson Services, Inc.

6.10. Lupin Ltd.

6.11. Novartis AG6

6.12. Otsuka Holdings Co. Ltd

6.13. Pfizer Inc.

6.14. Proteus Digital Health, Inc.

6.15. Sunovion Pharmaceuticals Inc.

1. GLOBAL BIPOLAR DISORDER TREATMENT MARKET RESEARCH AND ANALYSIS BY DRUG CLASS, 2022-2030 ($ MILLION)

2. GLOBAL MOOD STABILIZER FOR BIPOLAR DISORDER TREATMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

3. GLOBAL ANTICONVULSANT FOR BIPOLAR DISORDER TREATMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

4. GLOBAL ANTIPSYCHOTIC DRUG FOR BIPOLAR DISORDER TREATMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

5. GLOBAL ANTIDEPRESSANT DRUG FOR BIPOLAR DISORDER TREATMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

6. GLOBAL OTHER DRUGS FOR BIPOLAR DISORDER TREATMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

7. GLOBAL BIPOLAR DISORDER TREATMENT MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2022-2030 ($ MILLION)

8. GLOBAL BIPOLAR DISORDER TREATMENT BY HOSPITALS & CLINICS MARKET RESEARCH AND ANALYSIS, 2022-2030 ($ MILLION)

9. GLOBAL BIPOLAR DISORDER TREATMENT BY RETAIL PHARMACIES MARKET RESEARCH AND ANALYSIS, 2022-2030 ($ MILLION)

10. GLOBAL BIPOLAR DISORDER TREATMENT BY ONLINE PHARMACIES MARKET RESEARCH AND ANALYSIS, 2022-2030 ($ MILLION)

11. GLOBAL BIPOLAR DISORDER TREATMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

12. NORTH AMERICAN BIPOLAR DISORDER TREATMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

13. NORTH AMERICAN BIPOLAR DISORDER TREATMENT MARKET RESEARCH AND ANALYSIS BY DRUG CLASS, 2022-2030 ($ MILLION)

14. NORTH AMERICAN BIPOLAR DISORDER TREATMENT MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2022-2030 ($ MILLION)

15. EUROPEAN BIPOLAR DISORDER TREATMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

16. EUROPEAN BIPOLAR DISORDER TREATMENT MARKET RESEARCH AND ANALYSIS BY DRUG CLASS, 2022-2030 ($ MILLION)

17. EUROPEAN BIPOLAR DISORDER TREATMENT MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2022-2030 ($ MILLION)

18. ASIA-PACIFIC BIPOLAR DISORDER TREATMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

19. ASIA-PACIFIC BIPOLAR DISORDER TREATMENT MARKET RESEARCH AND ANALYSIS BY DRUG CLASS, 2022-2030 ($ MILLION)

20. ASIA-PACIFIC BIPOLAR DISORDER TREATMENT MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2022-2030 ($ MILLION)

21. REST OF THE WORLD BIPOLAR DISORDER TREATMENT MARKET RESEARCH AND ANALYSIS BY DRUG CLASS, 2022-2030 ($ MILLION)

22. REST OF THE WORLD BIPOLAR DISORDER TREATMENT MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2022-2030 ($ MILLION)

1. GLOBAL BIPOLAR DISORDER TREATMENT MARKET SHARE BY DRUG CLASS, 2022 VS 2030 (%)

2. GLOBAL MOOD STABILIZER FOR BIPOLAR DISORDER TREATMENT MARKET SHARE BY REGION, 2022 VS 2030 (%)

3. GLOBAL ANTICONVULSANT FOR BIPOLAR DISORDER TREATMENT ANTICONVULSANT MARKET SHARE BY REGION, 2022 VS 2030 (%)

4. GLOBAL ANTIPSYCHOTIC FOR BIPOLAR DISORDER TREATMENT ANTIPSYCHOTIC DRUG MARKET SHARE BY REGION, 2022 VS 2030 (%)

5. GLOBAL ANTIDEPRESSANT FOR BIPOLAR DISORDER TREATMENT ANTIDEPRESSANT MARKET SHARE BY REGION, 2022 VS 2030 (%)

6. GLOBAL OTHER DRUGS FOR BIPOLAR DISORDER TREATMENT MARKET SHARE BY REGION, 2022 VS 2030 (%)

7. GLOBAL BIPOLAR DISORDER TREATMENT MARKET SHARE BY DISTRIBUTION CHANNEL, 2022 VS 2030 ($ MILLION)

8. GLOBAL BIPOLAR DISORDER TREATMENT BY HOSPITALS & CLINICS MARKET SHARE BY REGION, 2022 VS 2030 (%)

9. GLOBAL BIPOLAR DISORDER TREATMENT BY RETAIL PHARMACIES MARKET SHARE BY REGION, 2022 VS 2030 (%)

10. GLOBAL BIPOLAR DISORDER TREATMENT BY ONLINE PHARMACIES MARKET SHARE BY REGION, 2022 VS 2030 (%)

11. GLOBAL BIPOLAR DISORDER TREATMENT MARKET SHARE BY REGION, 2022 VS 2030 (%)

12. US BIPOLAR DISORDER TREATMENT MARKET SIZE, 2022-2030 ($ MILLION)

13. CANADA BIPOLAR DISORDER TREATMENT MARKET SIZE, 2022-2030 ($ MILLION)

14. UK BIPOLAR DISORDER TREATMENT MARKET SIZE, 2022-2030 ($ MILLION)

15. FRANCE BIPOLAR DISORDER TREATMENT MARKET SIZE, 2022-2030 ($ MILLION)

16. GERMANY BIPOLAR DISORDER TREATMENT MARKET SIZE, 2022-2030 ($ MILLION)

17. ITALY BIPOLAR DISORDER TREATMENT MARKET SIZE, 2022-2030 ($ MILLION)

18. SPAIN BIPOLAR DISORDER TREATMENT MARKET SIZE, 2022-2030 ($ MILLION)

19. REST OF EUROPE BIPOLAR DISORDER TREATMENT MARKET SIZE, 2022-2030 ($ MILLION)

20. INDIA BIPOLAR DISORDER TREATMENT MARKET SIZE, 2022-2030 ($ MILLION)

21. CHINA BIPOLAR DISORDER TREATMENT MARKET SIZE, 2022-2030 ($ MILLION)

22. JAPAN BIPOLAR DISORDER TREATMENT MARKET SIZE, 2022-2030 ($ MILLION)

23. SOUTH KOREA BIPOLAR DISORDER TREATMENT MARKET SIZE, 2022-2030 ($ MILLION)

24. REST OF ASIA-PACIFIC BIPOLAR DISORDER TREATMENT MARKET SIZE, 2022-2030 ($ MILLION)

25. REST OF THE WORLD BIPOLAR DISORDER TREATMENT MARKET SIZE, 2022-2030 ($ MILLION)