Black Beer Market

Global Black Beer Market Size, Share & Trends Analysis Report by Product Type (Pasteurized Beer, and Draft Beer), By Packaging Type (Glass Bottle, Cans, and Others), By Sales Channel (On-Trade and Off-Trade), and Forecast 2020-2026 Update Available - Forecast 2025-2035

The global black beer market is projected to grow at a significant CAGR during the forecast period. Beer is considered as one of the commonly consumed alcoholic beverages and even one of the most commonly consumed alcoholic beverages across the globe. According to the WHO, the beer held more than 51% of share in the overall alcoholic beverage consumption in 2018. Beer is brewed from cereal grains including barley, wheat, maize, cassava, sorghum, millet, and rice among others.

Emerging demand for premium beer is primarily contributing to the growth of the market. The adoption of craft beer is being significantly driven by the rising purchasing power of consumers and increasing demand for beverages with natural flavors. The companies are adding natural flavors to improve the quality of the flavor of drinks. Apart from product launches, the companies are acquiring premium alcoholic beverage products of other companies to increase their premium product portfolio.

However, the increased adoption of non-alcoholic beverages is growing significantly, owing to the rising harmful effects of alcohol consumption and the increasing presence of non-alcoholic beer products in the market. Some long-term effects of alcohol consumption include liver disease, nerve damage, cancer of the mouth and throat, and heart-related problems. Therefore, an inclination towards consuming a low amount of carbonated sugary drinks and a requirement for non-alcoholic cold refreshment across the countries is likely to hamper the overall growth of the market during the forecast period.

Segmental Outlook

The global black beer market is segmented on the basis of product type, packaging type, and sales channel. Based on the product type, the market is segmented into pasteurized beer and draft beer. Based on the packaging type, the market is sectioned into glass bottle, cans, and others. Based on the sales channel, the market is segmented into on-trade and off-trade.

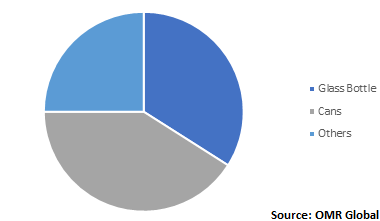

Global Black beer Market, 2019 (%)

Cans Segment to Hold Significant Market Share

Amongst the packaging type segment of the market, cans are likely to hold a considerable share in the market. The growth of the market is attributed to the fact that metal cans can provide greater protection from light and oxidation; therefore, the alcoholic drink is kept fresh and flavorful inside for a longer period when compared to bottles. If these drinks are exposed to light and ultraviolet radiation, an unpleasant flavor comes in them due to oxidation. Amber and brown glass can prevent a substantial amount of light from entering into the bottle. Thus, this is projected to witness growth in the near future.

Regional Outlook

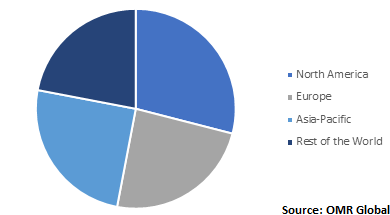

The global black beer market is geographically segmented into North America, Europe, Asia-Pacific, and the Rest of the World. North America region is estimated to grow significantly during the forecast period. The growth of the region is backed by several factors including the presence of high-income countries, namely the US. The huge population base, with large population aged 15 years and above is another factor that is propelling the growth of the market in North America. The region has major consumption of recorded alcoholic beverages, as several companies majorly manufacture premium alcohols. Further, Asia-Pacific is estimated to follow North America, attributing to the changing social norms and the growing acceptability of alcohol that has led to high and regular alcohol consumption among people in the region.

Global Black beer Market, by Region 2019 (%)

Market Players Outlook

Some of the prominent players operating in the global black beer market include Anheuser-Busch InBev SA/NV, Great Lakes Brewing Co., Heineken N.V., Molson Coors Beverage Co., Phillips Brewing & Malting Co., The Boston Beer Co., and others. These are the key companies adopting several organic and inorganic growth strategies such as product launches & developments, partnerships, agreements, and acquisitions to strengthen their product portfolios and maintain a competitive position in the global black beer market.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global black beer market. Based on the availability of data, information related to products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Key Strategy Analysis

3.2. Key Company Analysis

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Black Beer Market by Product Type

5.1.1. Pasteurized Beer

5.1.2. Draft Beer

5.2. Global Black Beer Market by Packaging Type

5.2.1. Glass Bottle

5.2.2. Cans

5.2.3. Others

5.3. Global Black Beer Market by Sales Channel

5.3.1. On-Trade

5.3.2. Off-Trade

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Allagash Brewing Co.

7.2. Anheuser-Busch InBev SA/NV

7.3. Asahi Group Holdings Ltd.

7.4. Blue Ridge Beverage Co.

7.5. Bent Paddle Brewing Co.

7.6. Funky Buddha Brewery

7.7. Great Lakes Brewing Co.

7.8. Heineken N.V.

7.9. Hill Farmstead Brewery

7.10. Left Hand Brewing Co.

7.11. Marshall Brewing Co.

7.12. Molson Coors Beverage Co.

7.13. Nashville Brewing Co.

7.14. New Belgium Brewing Co.

7.15. Phillips Brewing & Malting Co.

7.16. Port Brewing Co.

7.17. Sapporo Breweries Ltd.

7.18. St. Killian Importing Co.

7.19. The Boston Beer Co.

1. GLOBAL BLACK BEER MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2019-2026 ($ MILLION)

2. GLOBAL PASTEURIZED BLACK BEER MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL DRAFT BLACK BEER MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL BLACK BEER MARKET RESEARCH AND ANALYSIS BY PACKAGING TYPE, 2019-2026 ($ MILLION)

5. GLOBAL BLACK BEER IN GLASS BOTTLE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL BLACK BEER IN CANS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

7. GLOBAL BLACK BEER IN OTHER PACKAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

8. GLOBAL BLACK BEER MARKET RESEARCH AND ANALYSIS BY SALES CHANNEL, 2019-2026 ($ MILLION)

9. GLOBAL BLACK BEER VIA ON-TRADE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

10. GLOBAL BLACK BEER VIA OFF-TRADE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

11. GLOBAL BLACK BEER MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

12. NORTH AMERICAN BLACK BEER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

13. NORTH AMERICAN BLACK BEER MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2019-2026 ($ MILLION)

14. NORTH AMERICAN BLACK BEER MARKET RESEARCH AND ANALYSIS BY PACKAGING TYPE, 2019-2026 ($ MILLION)

15. NORTH AMERICAN BLACK BEER MARKET RESEARCH AND ANALYSIS BY SALES CHANNEL, 2019-2026 ($ MILLION)

16. EUROPEAN BLACK BEER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

17. EUROPEAN BLACK BEER MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2019-2026 ($ MILLION)

18. EUROPEAN BLACK BEER MARKET RESEARCH AND ANALYSIS BY PACKAGING TYPE, 2019-2026 ($ MILLION)

19. EUROPEAN BLACK BEER MARKET RESEARCH AND ANALYSIS BY SALES CHANNEL, 2019-2026 ($ MILLION)

20. ASIA-PACIFIC BLACK BEER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

21. ASIA-PACIFIC BLACK BEER MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2019-2026 ($ MILLION)

22. ASIA-PACIFIC BLACK BEER MARKET RESEARCH AND ANALYSIS BY PACKAGING TYPE, 2019-2026 ($ MILLION)

23. ASIA-PACIFIC BLACK BEER MARKET RESEARCH AND ANALYSIS BY SALES CHANNEL, 2019-2026 ($ MILLION)

24. REST OF THE WORLD BLACK BEER MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2019-2026 ($ MILLION)

25. REST OF THE WORLD BLACK BEER MARKET RESEARCH AND ANALYSIS BY PACKAGING TYPE, 2019-2026 ($ MILLION)

26. REST OF THE WORLD BLACK BEER MARKET RESEARCH AND ANALYSIS BY SALES CHANNEL, 2019-2026 ($ MILLION)

1. GLOBAL BLACK BEER MARKET SHARE BY PRODUCT TYPE, 2019 VS 2026 (%)

2. GLOBAL BLACK BEER MARKET SHARE BY PACKAGING TYPE, 2019 VS 2026 (%)

3. GLOBAL BLACK BEER MARKET SHARE BY SALES CHANNEL, 2019 VS 2026 (%)

4. GLOBAL BLACK BEER MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

5. US BLACK BEER MARKET SIZE, 2019-2026 ($ MILLION)

6. CANADA BLACK BEER MARKET SIZE, 2019-2026 ($ MILLION)

7. UK BLACK BEER MARKET SIZE, 2019-2026 ($ MILLION)

8. FRANCE BLACK BEER MARKET SIZE, 2019-2026 ($ MILLION)

9. GERMANY BLACK BEER MARKET SIZE, 2019-2026 ($ MILLION)

10. ITALY BLACK BEER MARKET SIZE, 2019-2026 ($ MILLION)

11. SPAIN BLACK BEER MARKET SIZE, 2019-2026 ($ MILLION)

12. ROE BLACK BEER MARKET SIZE, 2019-2026 ($ MILLION)

13. INDIA BLACK BEER MARKET SIZE, 2019-2026 ($ MILLION)

14. CHINA BLACK BEER MARKET SIZE, 2019-2026 ($ MILLION)

15. JAPAN BLACK BEER MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF ASIA-PACIFIC BLACK BEER MARKET SIZE, 2019-2026 ($ MILLION)

17. REST OF THE WORLD BLACK BEER MARKET SIZE, 2019-2026 ($ MILLION)