Blockchain Technology in Manufacturing Market

Blockchain Technology in Manufacturing Market Size, Share & Trends Analysis Report, By Application (Predictive Maintenance, Asset Tracking and Management, Business Process Optimization, Logistics and Supply Chain Management, Real-Time Workforce Tracking and Management, and Quality Control and Compliance), By End-Use (Energy & Power, Industrial, Automotive, Pharmaceuticals, and Others), Forecast Period (2022-2028). Update Available - Forecast 2025-2035

Blockchain technology in manufacturing market is anticipated to grow at a significant CAGR of 68.0% during the forecast period. Blockchain technology is an advanced database mechanism that allows transparent information sharing within a business network. A blockchain database stores data in blocks that are linked together in a chain. The technology supports the creation of an unalterable or immutable ledger for tracking orders, payments, accounts, and other transactions. The integration of emerging technologies such as IoT, AI and 5G and the growing need to improve asset tracking and supply chain management are leading factors for the growth of blockchain technology in manufacturing.

For instance, in October 2021, H&M, a Swedish-based multinational clothing company, launched a blockchain-enabled clothing rental service which has scannable IoT labels on the products. The technology is used by customers for instant selection of products by scanning IoT-connected stickers with their smartphones. Thus renting alongside innovation in materials is helping create sustainable consumption patterns.

Segmental Outlook

The global blockchain technology in manufacturing market is segmented based on the application and end-use. Based on the application, the market is segmented into predictive maintenance, asset tracking and management, business process optimization, logistics and supply chain management, real-time workforce tracking and management, and quality control and compliance. Based on the end-use, the market is segmented into energy & power, industrial, automotive, pharmaceuticals, and others.

Logistics and Supply Chain Management is Expected to Hold Significant Share in the Market During the Forecast Period

Among all applications, logistics and supply chain management applications are anticipated to hold a potential share in the market during the forecast period. Blockchain supports supply chain management by providing users with reliable data management and supports in minimizing fraudulent activities. A blockchain-enabled supply chain offers an intelligent, interconnected network that binds together multiple tiers of suppliers, manufacturers, service providers, distributors, and customers access to an efficient and transparent supply chain of products. These are some factors that are anticipated to drive the demand for blockchain technology in logistics and supply chain management. For instance, in December 2021, Trackgood, a blockchain technology provider company, partnered with Caffe Barbara to provide complete traceability and transparency to their supply processes and improve its customers' experience and relationship of trust with the company.

Regional Outlook

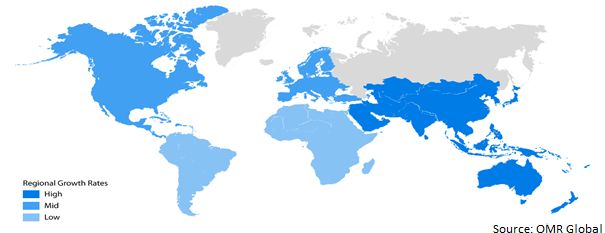

The global blockchain technology in manufacturing market is further segmented based on geography including North America (the US and Canada), Europe (UK, Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East &Africa and Latin America). The market can be analyzed for a particular region or country level as per the requirement. North American region holds a dominant share in the market followed by Europe and Asia-Pacific region, however, the Asia-Pacific region is anticipated to register the fastest growth rate in the market during the forecast period. Rapid growth in the manufacturing sector and deployment of emerging technologies are expected to drive the use of blockchain technology in these regions.

Global Blockchain Technology in Manufacturing Market, by Region 2022-2028

Market Players Outlook

The major companies serving the global blockchain technology in manufacturing market include IBM Corp., Microsoft Corp., Intel Corp., NVIDIA Corp., and Oracle Corp. The market players are contributing to the market growth by the adoption of various strategies including mergers and acquisitions, collaborations, and new product launches, to stay competitive in the market. For instance, in December 2020, Blockchains Management, Inc., an affiliate of Blockchains, LLC, a blockchain software development company announced its acquisition of Cambridge Blockchain, Inc., a blockchain-based identity management and compliance software solutions provider. Cambridge Blockchain's solutions harness blockchain's potential to globally deliver strong digital identities and meet increasingly stringent data privacy obligations. The company has experience designing software to share identity data across systems, specifically, European financial institutions.

The acquisition of Cambridge Blockchain further increases Blockchains' capacity to deliver an ecosystem of products set to prepare individuals for web 3.0 and the emerging digital economy, with a blockchain-powered digital identity solution at the core. The companies' shared ethos of returning control of personal data to users while delivering the benefits of a trusted, distributed digital identity to consumers, organizations, and government institutions solidified the union.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global blockchain technology in manufacturing market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. IBM Corp.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Intel Corp.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Microsoft Corp.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. NVIDIA Corp.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Oracle Corp.

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Blockchain in Manufacturing Market by Application

4.1.1. Predictive Maintenance

4.1.2. Asset Tracking and Management

4.1.3. Business Process Optimization

4.1.4. Logistics and Supply Chain Management

4.1.5. Real-Time Workforce Tracking and Management

4.1.6. Quality Control and Compliance

4.1.7. Counterfeit Management

4.2. Global Blockchain in Manufacturing Market By End-Use

4.2.1. Energy & Power

4.2.2. Industrial

4.2.3. Automotive

4.2.4. Pharmaceuticals

4.2.5. Others

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Advanced Micro Devices, Inc.

6.2. Amazon.Com, Inc.

6.3. Bigchaindb GmbH

6.4. Blockchain Foundry Inc.

6.5. Chronicled, Inc.

6.6. Factom, Inc.

6.7. Grid Singularity GmbH

6.8. LO3 Energy, Inc.

6.9. Riddle&Code GmbH

6.10. ShipChain Inc.

6.11. Wipro Ltd.

6.12. Xain AG.

1. GLOBAL BLOCKCHAIN IN MANUFACTURING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

2. GLOBAL BLOCKCHAIN IN MANUFACTURING FOR PREDICTIVE MAINTENANCE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL BLOCKCHAIN IN MANUFACTURING FOR ASSET TRACKING AND MANAGEMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL BLOCKCHAIN IN MANUFACTURING FOR BUSINESS PROCESS OPTIMIZATION MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

5. GLOBAL BLOCKCHAIN IN MANUFACTURING MARKET RESEARCH AND ANALYSIS BY END-USE, 2021-2028 ($ MILLION)

6. GLOBAL BLOCKCHAIN FOR ENERGY & POWER MANUFACTIURING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7. GLOBAL BLOCKCHAIN FOR INDUSTRIAL MANUFACTURING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

8. GLOBAL BLOCKCHAIN FOR AUTOMOTIVE MANUFACTURING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

9. GLOBAL BLOCKCHAIN FOR MANUFACTURING IN OTHER END-USE INDUSTRIES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

10. GLOBAL BLOCKCHAIN IN MANUFACTURING MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2021-2028 ($ MILLION)

11. NORTH AMERICAN BLOCKCHAIN IN MANUFACTURING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

12. NORTH AMERICAN BLOCKCHAIN IN MANUFACTURING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

13. NORTH AMERICAN BLOCKCHAIN IN MANUFACTURING MARKET RESEARCH AND ANALYSIS BY END-USE, 2021-2028 ($ MILLION)

14. EUROPEAN BLOCKCHAIN IN MANUFACTURING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

15. EUROPEAN BLOCKCHAIN IN MANUFACTURING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

16. EUROPEAN BLOCKCHAIN IN MANUFACTURING MARKET RESEARCH AND ANALYSIS BY END-USE, 2021-2028 ($ MILLION)

17. ASIA-PACIFIC BLOCKCHAIN IN MANUFACTURING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

18. ASIA-PACIFIC BLOCKCHAIN IN MANUFACTURING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

19. ASIA-PACIFIC BLOCKCHAIN IN MANUFACTURING MARKET RESEARCH AND ANALYSIS BY END-USE, 2021-2028 ($ MILLION)

20. REST OF THE WORLD BLOCKCHAIN IN MANUFACTURING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

21. REST OF THE WORLD BLOCKCHAIN IN MANUFACTURING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

22. REST OF THE WORLD BLOCKCHAIN IN MANUFACTURING MARKET RESEARCH AND ANALYSIS BY END-USE, 2021-2028 ($ MILLION)

1. GLOBAL BLOCKCHAIN IN MANUFACTURING MARKET SHARE BY APPLICATION, 2021 VS 2028 (%)

2. GLOBAL BLOCKCHAIN IN MANUFACTURING FOR PREDICTIVE MAINTENANCE MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

3. GLOBAL BLOCKCHAIN IN MANUFACTURING FOR ASSET TRACKING AND MANAGEMENT MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

4. GLOBAL BLOCKCHAIN IN MANUFACTURING FOR BUSINESS PROCESS OPTIMIZATION MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

5. GLOBAL BLOCKCHAIN IN MANUFACTURING FOR LOGISTICS AND SUPPLY CHAIN MANAGEMENTMARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

6. GLOBAL BLOCKCHAIN IN MANUFACTURING FOR QUALITY CONTROL AND COMPLIANCE MARKET SHARE GEOGRAPHY, 2021 VS 2028 (%)

7. GLOBAL BLOCKCHAIN IN MANUFACTURING FOR COUNTERFEIT MANAGEMENT MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

8. GLOBAL BLOCKCHAIN IN MANUFACTURING MARKET SHARE BY END-USE, 2021 VS 2028 (%)

9. GLOBAL BLOCKCHAIN FOR ENERGY & POWER MANUFACTURING MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

10. GLOBAL BLOCKCHAIN FOR INDUSTRIAL MANUFACTURING MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

11. GLOBAL BLOCKCHAIN FOR AUTOMOTIVE MANUFACTURING MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

12. GLOBAL BLOCKCHAIN FOR MANUFACTURING IN OTHER END-USE INDUSTRIES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

13. GLOBAL BLOCKCHAIN IN MANUFACTURING MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

14. US BLOCKCHAIN IN MANUFACTURING MARKET SIZE, 2021-2028 ($ MILLION)

15. CANADA BLOCKCHAIN IN MANUFACTURING MARKET SIZE, 2021-2028 ($ MILLION)

16. UK BLOCKCHAIN IN MANUFACTURING MARKET SIZE, 2021-2028 ($ MILLION)

17. FRANCE BLOCKCHAIN IN MANUFACTURING MARKET SIZE, 2021-2028 ($ MILLION)

18. GERMANY BLOCKCHAIN IN MANUFACTURING MARKET SIZE, 2021-2028 ($ MILLION)

19. ITALY BLOCKCHAIN IN MANUFACTURING MARKET SIZE, 2021-2028 ($ MILLION)

20. SPAIN BLOCKCHAIN IN MANUFACTURING MARKET SIZE, 2021-2028 ($ MILLION)

21. REST OF EUROPE BLOCKCHAIN IN MANUFACTURING MARKET SIZE, 2021-2028 ($ MILLION)

22. INDIA BLOCKCHAIN IN MANUFACTURING MARKET SIZE, 2021-2028 ($ MILLION)

23. CHINA BLOCKCHAIN IN MANUFACTURING MARKET SIZE, 2021-2028 ($ MILLION)

24. JAPAN BLOCKCHAIN IN MANUFACTURING MARKET SIZE, 2021-2028 ($ MILLION)

25. SOUTH KOREA BLOCKCHAIN IN MANUFACTURING MARKET SIZE, 2021-2028 ($ MILLION)

26. REST OF ASIA-PACIFIC BLOCKCHAIN IN MANUFACTURING MARKET SIZE, 2021-2028 ($ MILLION)

27. REST OF THE WORLD BLOCKCHAIN IN MANUFACTURING MARKET SIZE, 2021-2028 ($ MILLION)