Blood Warmer Market

Global Blood Warmer Market Size, Share & Trends Analysis Report by Product (Portable Blood Warmers and Non-Portable Blood Warmers), by Applications (Newborn Care, Preoperative Care, Acute Care, and Home Care), and by End-User (Hospitals/Clinic, Ambulatory Services, Defense Forces, and Rescue Forces) Forecast Period (2022-2028) Update Available - Forecast 2025-2035

The global blood warmer market is anticipated to grow at a significant CAGR of 8.9% during the forecast period. A blood warmer is a device used to warm blood, blood products, colloids, and other fluids which reduces the risk of hypothermia. To prevent the blood from the breakdown of the blood cells or hemolysis the refrigerated blood is warmed. The major factor driving the market growth is the increasing number of trauma cases and surgeries across the globe are propelling the use of blood warmer during the treatment of the injury. According to data published by the World Health Organization (WHO), in June 2021, around 20 to 40 million people suffer severe injuries out of which several physical disabilities are increasing. Hence, such factors are considerably contributing to the growth of the blood warmer market during the forecast period.

Segmental Outlook

The global blood warmer market is segmented based on product, application, and end-user. Based on the product, the market is segmented into portable blood warmer and non-portable blood warmer. Based on the application, the market is sub-segmented into newborn care, preoperative care, acute care, and homecare. Based on the end-user, the market is segmented into hospitals/clinics, ambulatory services, defense forces, and rescue forces. Among the product, the portable blood warmer segment is anticipated to grow at a significant rate over the forecast period. Owing to the rising demand from ambulatory services, defense sectors, and rescue forces the segment is anticipated to grow at a remarkable pace. The above-mentioned segments can be customized as per the requirements.

The Hospitals/ Clinics Segment is Expected to Hold a Significant Share in the Global Blood Warmer Market

Among the end-user, the hospitals/ clinics segment is expected to hold a significant share in the blood warmer market across the globe. Owing to the increasing surgical operation globally due to the rising number of accidents, injuries, and surgeries in hospitals are some of the major factors supporting ti the growth of the market. Bood warmers support surgeons and healthcare professionals to keep the body temperature of the patient normal while doing the treatment. According to the National Library of Medicine(NIH) report, in 2020, around 310 million major surgeries were performed, out of which approximately 35-50 million were conducted in the US and 21 million in Europe. In addition, most of the surgeries are conducted in hospitals which has increased the utilization and demand for blood warmer in hospitals. Furthermore, these devices are also used to warm other fluids such as intravenous fluids within the intravenous therapy intending to restore the electrolyte balance.

Regional Outlooks

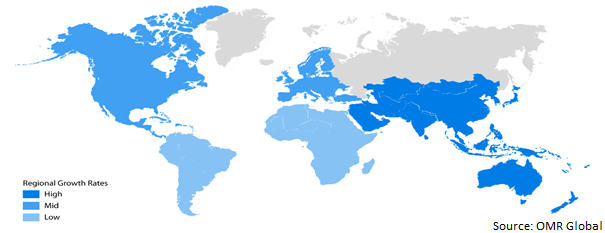

The global blood warmer market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East & Africa, and Latin America). The market can be analyzed for a particular region or country level as per the requirement. North America region is anticipated to hold a prominent share in the market owing to the presence of key players in the region.

Global Blood Warmer Market Growth, by Region 2022-2028

The Asia-Pacific Region is Expected to Grow at a Considerable CAGR Over the Forecast Period

The Asia-Pacific region is expected to grow at a considerable CAGR during the forecast period globally. The rising death of newborn infants due to hypothermia is increasing the demand for blood warmers in the region. Hypothermia is a condition in which the body temperature decreases rapidly and is unable to produce heat in the body. According to UNICEF, in India, the five major reasons for the deaths of infants include hypothermia, pre-maturity, neo-natal infection, birth asphyxia, and congenital malformations, among others. Further, as per the same source, in 2021, Varanasi (a city in India) reported 11 deaths due to hypothermia. The deaths of newborns are rising especially in low and middle-income countries of Asia-Pacific. As a result of which, the demand for blood warmer has increased across the region.

Market Players Outlook

The major companies serving the global blood warmer market include 3M Co., Geratherm Medical AG, Smiths Group plc, Stryker Corp., Vyaire Medical, Inc., and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in October 2019, 3M Co. acquired Acelity, Inc. Through this acquisition, the company is anticipated to deliver safe and effective solutions and facilities such as blood warmers and others for improving healthcare economies. The acquired firm is designated to provide acute wound care dressings and products, medical tapes, sterilization products, and patient prep and warming products.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global blood warmer market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Recovery Scenario of Global Blood Warmer Market

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. 3M Co.

3.1.1.1. Overview

3.1.1.2. Financial Analysis

3.1.1.3. SWOT Analysis

3.1.1.4. Recent Developments

3.1.2. Geratherm Medical AG

3.1.2.1. Overview

3.1.2.2. Financial Analysis

3.1.2.3. SWOT Analysis

3.1.2.4. Recent Developments

3.1.3. Smiths Group plc

3.1.3.1. Overview

3.1.3.2. Financial Analysis

3.1.3.3. SWOT Analysis

3.1.3.4. Recent Developments

3.1.4. Stryker Corp

3.1.4.1. Overview

3.1.4.2. Financial Analysis

3.1.4.3. SWOT Analysis

3.1.4.4. Recent Developments

3.1.5. Vyaire Medical, Inc.

3.1.5.1. Overview

3.1.5.2. Financial Analysis

3.1.5.3. SWOT Analysis

3.1.5.4. Recent Developments

3.2. Key Strategy Analysis

4. Market Segmentation

4.1. Global Blood Warmer Market by Product

4.1.1. Portable Blood Warmers

4.1.2. Non-portable Blood Warmers

4.2. Global Blood Warmer Market by Applications

4.2.1. Newborn Care

4.2.2. Preoperative Care

4.2.3. Acute Care

4.2.4. Homecare

4.3. Global Blood Warmer Market by End User

4.3.1. Hospitals/Clinics

4.3.2. Ambulatory Services

4.3.3. Defense Forces

4.3.4. Rescue Forces

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Biegler GmbH

6.2. Barkey GmbH & Co. KG

6.3. Belmont Medical Technologies

6.4. Biegler GmbH

6.5. Estill Medical Technologies, Inc.

6.6. Keewell Medical Technology Co., Ltd.

6.7. Life Warmer

6.8. MEQU A/S

6.9. Narang Medical Ltd.

6.10. Quality In Flow Ltd.

6.11. Remi Elektrotechnik Ltd.

6.12. REMI Sales & Engineering Ltd.

6.13. Sarstedt AG & Co. KG

6.14. Shenzhen Bestman Instrument Co., Ltd.

6.15. Smisson-Cartledge Biomedical

6.16. The Surgical Co.

1. GLOBAL BLOOD WARMER MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

2. GLOBAL PORTABLE BLOOD WARMER MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL NON-PORTABLE BLOOD WARMER MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL BLOOD WARMER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

5. GLOBAL BLOOD WARMER FOR NEWBORN CARE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

6. GLOBAL BLOOD WARMER FOR PREOPERATIVE CARE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7. GLOBAL BLOOD WARMER FOR ACUTE CARE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

8. GLOBAL BLOOD WARMER FOR HOMECARE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

9. GLOBAL BLOOD WARMER MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

10. GLOBAL BLOOD WARMER IN HOSPITALS/CLINICS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

11. GLOBAL BLOOD WARMER IN AMBULATORY SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

12. GLOBAL BLOOD WARMER IN DEFENSE FORCES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

13. GLOBAL BLOOD WARMER IN RESCUE FORCES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

14. GLOBAL BLOOD WARMER MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2021-2028 ($ MILLION)

15. NORTH AMERICAN BLOOD WARMER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

16. NORTH AMERICAN BLOOD WARMER MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

17. NORTH AMERICAN BLOOD WARMER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

18. NORTH AMERICAN BLOOD WARMER MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

19. EUROPEAN BLOOD WARMER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

20. EUROPEAN BLOOD WARMER MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

21. EUROPEAN BLOOD WARMER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

22. EUROPEAN BLOOD WARMER MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

23. ASIA-PACIFIC BLOOD WARMER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

24. ASIA-PACIFIC BLOOD WARMER MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

25. ASIA-PACIFIC BLOOD WARMER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

26. ASIA-PACIFIC BLOOD WARMER MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

27. REST OF THE WORLD BLOOD WARMER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

28. REST OF THE WORLD BLOOD WARMER MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

29. REST OF THE WORLD BLOOD WARMER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

30. REST OF THE WORLD BLOOD WARMER MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

1. GLOBAL BLOOD WARMER MARKET SHARE BY PRODUCT, 2021 VS 2028 (%)

2. GLOBAL PORTABLE BLOOD WARMER MARKET SHARE BY REGION, 2021 VS 2028 (%)

3. GLOBAL NON-PORTABLE BLOOD WARMER MARKET SHARE BY REGION, 2021 VS 2028 (%)

4. GLOBAL BLOOD WARMER MARKET SHARE BY APPLICATIONS, 2021 VS 2028 (%)

5. GLOBAL BLOOD WARMER FOR NEWBORN CARE MARKET SHARE BY REGION, 2021 VS 2028 (%)

6. GLOBAL BLOOD WARMER FOR PREOPERATIVE CARE MARKET SHARE BY REGION, 2021 VS 2028 (%)

7. GLOBAL BLOOD WARMER FOR ACUTE CARE MARKET SHARE BY REGION, 2021 VS 2028 (%)

8. GLOBAL BLOOD WARMER FOR HOMECARE MARKET SHARE BY REGION, 2021 VS 2028 (%)

9. GLOBAL BLOOD WARMER MARKET SHARE BY END-USER, 2021 VS 2028 (%)

10. GLOBAL BLOOD WARMER IN HOSPITALS/CLINIC MARKET SHARE BY REGION, 2021 VS 2028 (%)

11. GLOBAL BLOOD WARMER IN AMBULATORY SERVICES MARKET SHARE BY REGION, 2021 VS 2028 (%)

12. GLOBAL BLOOD WARMER IN DEFENSE FORCES MARKET SHARE BY REGION, 2021 VS 2028 (%)

13. GLOBAL BLOOD WARMER IN RESCUE FORCES MARKET SHARE BY REGION, 2021 VS 2028 (%)

14. GLOBAL BLOOD WARMER MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

15. US BLOOD WARMER MARKET SIZE, 2021-2028 ($ MILLION)

16. CANADA BLOOD WARMER MARKET SIZE, 2021-2028 ($ MILLION)

17. UK BLOOD WARMER MARKET SIZE, 2021-2028 ($ MILLION)

18. FRANCE BLOOD WARMER MARKET SIZE, 2021-2028 ($ MILLION)

19. GERMANY BLOOD WARMER MARKET SIZE, 2021-2028 ($ MILLION)

20. ITALY BLOOD WARMER MARKET SIZE, 2021-2028 ($ MILLION)

21. SPAIN BLOOD WARMER MARKET SIZE, 2021-2028 ($ MILLION)

22. REST OF EUROPE BLOOD WARMER MARKET SIZE, 2021-2028 ($ MILLION)

23. INDIA BLOOD WARMER MARKET SIZE, 2021-2028 ($ MILLION)

24. CHINA BLOOD WARMER MARKET SIZE, 2021-2028 ($ MILLION)

25. JAPAN BLOOD WARMER MARKET SIZE, 2021-2028 ($ MILLION)

26. SOUTH KOREA BLOOD WARMER MARKET SIZE, 2021-2028 ($ MILLION)

27. REST OF ASIA-PACIFIC BLOOD WARMER MARKET SIZE, 2021-2028 ($ MILLION)

28. REST OF THE WORLD BLOOD WARMER MARKET SIZE, 2021-2028 ($ MILLION)