Boiler Water Treatment Chemicals Market

Global Boiler Water Treatment Chemicals Market Size, Share & Trends Analysis Report by Chemical Type (Corrosion & Scale Inhibitors, Coagulants & Flocculants, pH Booster Agents, Oxygen Scavengers, and Others) and by End-User (Steel and Metal Industry, Oil & Gas, Chemical & Petrochemical, Power Generation, Pulp & Paper, and Others) and Forecast 2019-2025 Update Available - Forecast 2025-2031

The global boiler water treatment chemicals market is growing significantly, at a CAGR of more than 5.0% during the forecast period (2019-2025). The detrimental effects of oxygen-related corrosion in industrial boiler systems which enables plant to reduce maintenance costs, maintain boiler efficiency and extend plant and equipment life. This surges the demand for boiler water treatment chemicals in various oil & gas industries and chemical industries across the globe. There are various pivotal factors that are driving the global boiler water treatment chemicals market, which includes increasing demand for energy and growing industrialization in emerging economies, such as China and India.

The demand for energy is closely related to the population and wealth of human societies, and it varies from one country to another. Due to the increasing population, the demand for energy is increasing on a daily basis. According to World Population Balance, the population of the US was 324 million in 2017 and the energy required to fulfill their demand was more than 16,000 million barrels of oil equivalent. Similarly, China's population was 1,387 million and its energy demand was more than 23,000 million barrels of oil equivalent. Therefore, the increasing demand for energy is necessitating the demand for boiler water treatment chemicals in the power generation industrial area.

Segmental Outlook

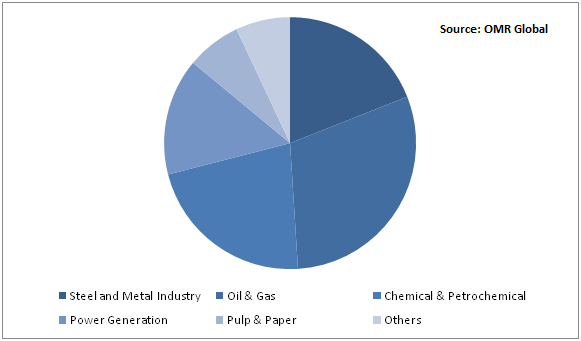

The boiler water treatment chemicals market is classified on the basis of chemical type and end-user. Based on chemical type, the market is segmented into corrosion & scale inhibitors, coagulants & flocculants, ph booster agents, oxygen scavengers, and others. Based on end-user, the market is segmented into steel and metal industry, oil & gas, chemical & petrochemical, power generation, pulp & paper, and others.

Global Boiler Water Treatment Chemicals Market Share by End-User, 2018(%)

Boiler water treatment chemicals find its significant application in power generation industry

Power generation industry is one of the major end-users of the boiler water treatment chemicals. The demand for water boiler treatment chemicals is increasing due to several factors such as increasing demand for power generation and rapid industrialization. The boiler is one of the key components of the power plants generating electricity, owing to this the operational efficiency of boilers also need to be increased. Water treatment chemicals improve the resistance of boilers to corrosion by improving the quality of feed water. As the demand for energy increases across the globe, the need for improving the operational efficiency of the power plants is expected to increase in future.

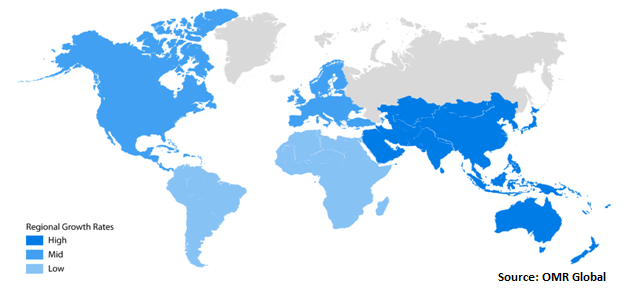

Regional Outlook

The global boiler water treatment chemicals market is classified on the basis of geography,which includes North America, Europe, Asia-Pacific, and Rest of the World. North America and Europe will project a significant CAGR in the global boiler water treatment chemicals market. Major factors that augment the growth of boiler water treatment chemicals market growth in the region include well-developed energy and power sector, increasing natural gas production. As per the US Department of Energy, industrial manufacturing consumes 36% of all energy consumed in the US. As a result, the government is providing grants and tax benefits to the industries for the adoption of energy-efficient solutions, which in turn, will drive the growth of the boiler water treatment chemicals market in these regions.

Global Boiler Water Treatment Chemicals Market Growth, by Region 2019-2025

Asia-Pacific holds a considerable share in the global boiler water treatment chemicals market

Asia-Pacific significantly contributes in the global boiler water treatment chemicals market. The emerging economies of Asia-Pacific, such as China, India, and Japan, have been contributing majorly in the growth of the market in the region. This dominance is backed by the growing industrialization and significant growth in the power generation, and oil and gas sector. According to the BP PLC, the natural gas production in Asia-Pacific stood at 481.5 Mtoe (millions of tonnes oil equivalent) in 2015 which substantially increased to 543.2 Mtoe in 2018, accounting for an increase of around 12.8% over the period 2015-2018. In addition, the cohesive government policy to promote industrialization is making significant contribution to the market growth in China.

The major factors that drive the growth of the boiler water treatment chemicals market in China include the rapid industrialization in the country and substantial rise in the manufacturing sector in the country. Announced in 2015, the “Made in China 2025” is one of the ambitious projects aimed at increasing the competitiveness of Chinese manufacturing industries including electronics, chemical, automotive, and so on. The goal of the project is to foster Chinese brands, boost innovation and reduce the country’s reliance on foreign technology by making the nation a major or dominant global manufacturer of various technologies. For instance, the government of the country plans to achieve 40% of domestically manufactured basic components and basic materials by 2020 and 70% by 2025. Such initiatives will increase the industrial sector in the country, which in turn, offers growth to the boiler water treatment chemicals market in the region.

Market Players Outlook

The key players in the boiler water treatment chemicals market are contributing significantly by providing advanced technology-based chemicals and through expanding their geographical presence across the globe. The key players operating in the global boiler water treatment chemicals market include BASF SE, Arkema SA, Ecolab Inc., KemiraOyj, and Suez Water Technologies & Solutions. Apart from these key market players, several other companies are contributing significant share in the market, including Veolia Water Solutions & Technologies, ZI-CHEM, Thermax Ltd., Wilhelmsen Holding ASA, Coventya Holding SAS, and Kurita Water Industries Ltd. These market players adopt various strategies such as product launch, partnerships, collaborations, merger, and acquisitions to sustain a strong position in the market.

The Report Covers

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global boiler water treatment chemicals market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. BASF SE

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Arkema SA

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Ecolab Inc.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. KemiraOyj

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Suez Water Technologies & Solutions

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Boiler Water Treatment Chemicals Market by Chemical Type

5.1.1. Corrosion & Scale Inhibitors

5.1.2. Coagulants & Flocculants

5.1.3. pH Booster Agents

5.1.4. Oxygen Scavengers

5.1.5. Others (Foam Control Agents)

5.2. Global Boiler Water Treatment Chemicals Market by End-User

5.2.1. Steel and Metal Industry

5.2.2. Oil & Gas

5.2.3. Chemical & Petrochemical

5.2.4. Power Generation

5.2.5. Pulp & Paper

5.2.6. Others (Food & Beverages)

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Accepta Ltd.

7.2. Accepta, Ltd.

7.3. Aries Chemical, Inc.

7.4. Arkema SA

7.5. BASF SE

7.6. Buckman Laboratories, Inc.

7.7. Chemco Industries, Inc.

7.8. ChemTreat, Inc.

7.9. Coventya Holding SAS

7.10. Eastman Chemical Co.

7.11. Ecolab Inc.

7.12. Feedwater Ltd.

7.13. KemiraOyj

7.14. Kurita Water Industries Ltd.

7.15. Solenis International LP

7.16. Suez Water Technologies & Solutions

7.17. Thermax Ltd.

7.18. Veolia Water Solutions & Technologies

7.19. Wasser Chemicals and Systems Pvt Ltd.

7.20. Wilhelmsen Holding ASA

7.21. ZI-CHEM

1. GLOBAL BOILER WATER TREATMENT CHEMICALS MARKET RESEARCH AND ANALYSIS BY CHEMICAL TYPE, 2018-2025 ($ MILLION)

2. GLOBAL CORROSION & SCALE INHIBITORS FOR BOILER WATER TREATMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL COAGULANTS & FLOCCULANTS FOR BOILER WATER TREATMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL PH BOOSTER AGENTS FOR BOILER WATER TREATMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

5. GLOBAL OXYGEN SCAVENGERS FOR BOILER WATER TREATMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

6. GLOBAL OTHER CHEMICALS FOR BOILER WATER TREATMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

7. GLOBAL BOILER WATER TREATMENT CHEMICALS MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

8. GLOBAL BOILER WATER TREATMENT CHEMICALS IN STEEL AND METAL INDUSTRY MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

9. GLOBAL BOILER WATER TREATMENT CHEMICALS IN OIL & GAS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

10. GLOBAL BOILER WATER TREATMENT CHEMICALS IN CHEMICAL & PETROCHEMICAL MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

11. GLOBAL BOILER WATER TREATMENT CHEMICALS IN PULP & PAPER MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

12. GLOBAL BOILER WATER TREATMENT CHEMICALS IN POWER GENERATION MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

13. GLOBAL BOILER WATER TREATMENT CHEMICALS IN OTHER END-USE INDUSTRIES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

14. GLOBAL BOILER WATER TREATMENT CHEMICALS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

15. NORTH AMERICAN BOILER WATER TREATMENT CHEMICALS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

16. NORTH AMERICAN BOILER WATER TREATMENT CHEMICALS MARKET RESEARCH AND ANALYSIS BY CHEMICAL TYPE, 2018-2025 ($ MILLION)

17. NORTH AMERICAN BOILER WATER TREATMENT CHEMICALS MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

18. EUROPEAN BOILER WATER TREATMENT CHEMICALS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

19. EUROPEAN BOILER WATER TREATMENT CHEMICALS MARKET RESEARCH AND ANALYSIS BY CHEMICAL TYPE, 2018-2025 ($ MILLION)

20. EUROPEAN BOILER WATER TREATMENT CHEMICALS MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

21. ASIA-PACIFIC BOILER WATER TREATMENT CHEMICALS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

22. ASIA-PACIFIC BOILER WATER TREATMENT CHEMICALS MARKET RESEARCH AND ANALYSIS BY CHEMICAL TYPE, 2018-2025 ($ MILLION)

23. ASIA-PACIFIC BOILER WATER TREATMENT CHEMICALS MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

24. REST OF THE WORLD BOILER WATER TREATMENT CHEMICALS MARKET RESEARCH AND ANALYSIS BY CHEMICAL TYPE, 2018-2025 ($ MILLION)

25. REST OF THE WORLD BOILER WATER TREATMENT CHEMICALS MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

1. GLOBAL BOILER WATER TREATMENT CHEMICALS MARKET SHARE BY CHEMICAL TYPE, 2018 VS 2025 (%)

2. GLOBAL BOILER WATER TREATMENT CHEMICALS MARKET SHARE BY END-USER, 2018 VS 2025 (%)

3. GLOBAL BOILER WATER TREATMENT CHEMICALS MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

4. US BOILER WATER TREATMENT CHEMICALS MARKET SIZE, 2018-2025 ($ MILLION)

5. CANADA BOILER WATER TREATMENT CHEMICALS MARKET SIZE, 2018-2025 ($ MILLION)

6. UK BOILER WATER TREATMENT CHEMICALS MARKET SIZE, 2018-2025 ($ MILLION)

7. FRANCE BOILER WATER TREATMENT CHEMICALS MARKET SIZE, 2018-2025 ($ MILLION)

8. GERMANY BOILER WATER TREATMENT CHEMICALS MARKET SIZE, 2018-2025 ($ MILLION)

9. ITALY BOILER WATER TREATMENT CHEMICALS MARKET SIZE, 2018-2025 ($ MILLION)

10. SPAIN BOILER WATER TREATMENT CHEMICALS MARKET SIZE, 2018-2025 ($ MILLION)

11. ROE BOILER WATER TREATMENT CHEMICALS MARKET SIZE, 2018-2025 ($ MILLION)

12. INDIA BOILER WATER TREATMENT CHEMICALS MARKET SIZE, 2018-2025 ($ MILLION)

13. CHINA BOILER WATER TREATMENT CHEMICALS MARKET SIZE, 2018-2025 ($ MILLION)

14. JAPAN BOILER WATER TREATMENT CHEMICALS MARKET SIZE, 2018-2025 ($ MILLION)

15. REST OF ASIA-PACIFIC BOILER WATER TREATMENT CHEMICALS MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF THE WORLD BOILER WATER TREATMENT CHEMICALS MARKET SIZE, 2018-2025 ($ MILLION)