Bone Densitometer Market

Bone Densitometer Market Size, Share & Trends Analysis Report By Technology (Axial Bone Densitometry, and Peripheral Bone Densitometry), Application (Osteoporosis and Osteopenia Diagnosis, Cystic Fibrosis Diagnosis, Chronic Kidney Diseases Diagnosis, Rheumatoid Arthritis Diagnosis, and Body Composition Measurement), and End-User (Hospitals, Orthopedic Clinics, and Diagnostic Imaging Centers) Forecast Period (2025-2035)

Industry Overview

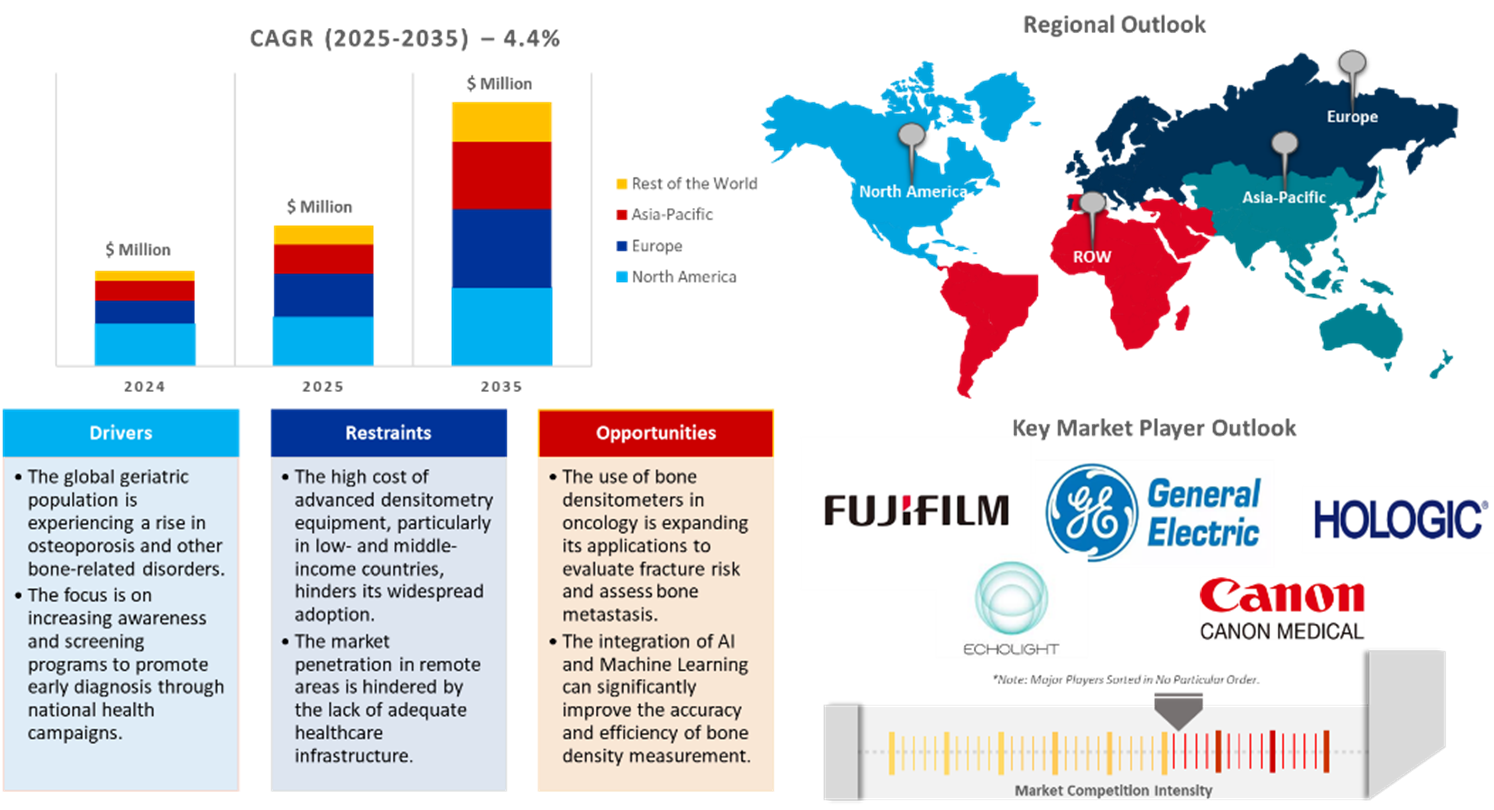

Bone densitometer market is anticipated to grow at a CAGR of 4.4% during the forecast period (2025-2035). The increasing prevalence of osteoporosis and osteopenia globally, coupled with a growing geriatric population, is a key demand driver for bone densitometry. Increased healthcare spending combined with technological advancement, awareness programs, and promotion have made it more accessible. In emerging markets, increased healthcare expenditure has driven better diagnostics infrastructure and adoption of advanced equipment. Preventive care is additionally driving routine BMD testing. Sports-related injuries and lifestyle diseases are on the increase, with broader clinical utilization of bone densitometry for conditions such as rheumatoid arthritis, chronic kidney disease, and obesity-related bone disorders.

Market Dynamics

Rising Prevalence of Osteoporosis

The International Osteoporosis Foundation reports a global rise in osteoporosis cases, especially among the aging population, with women at a higher risk post-menopause. According to the International Osteoporosis Foundation, in February 2024, osteoporosis has a significant influence on older adults, with one in two women and up to one in four men over age 50 likely to experience a bone fracture due to the condition. It is estimated that 75 million people in Europe, the US, and Japan are affected by osteoporosis. Most hip fractures occur in elderly patients whose bones have become weakened by osteoporosis. The US experiences approximately 300,000 hip fractures annually, with a 25% mortality rate within a year post-fracture. Additionally, 25% of patients transition from the hospital to a nursing home permanently, while the remaining 50% are unable to regain their previous level of function. Six months after a hip fracture, only 15% of individuals can walk across a room unaided. Projections estimate that between 2018 and 2040, annual fractures will increase by 68% from 1.9 million to 3.2 million, with related costs increasing annually from $57 billion to more than $95 billion.

Rising Aging Population Driving Market Growth

The increasing aging population is increasing the demand for bone health diagnostics, as older adults are at a higher risk of osteoporosis and fractures due to declining bone density. According to the World Health Organization, in October 2024, all countries encountered significant challenges in preparing their health and social systems for the demographic transition ahead. By 2050, 80% of older adults will reside in low- and middle-income countries, and the aging process is accelerating more rapidly than before. In 2020, the population aged 60 years or over surpassed the number of children under 5 years old, and between 2015 and 2050, the proportion of the global population aged 60 years or over will increase from 12% to 22%. One in six people in the world will be 60 years or older by 2030, and the population aged 60 years or over will rise from 1 billion in 2020 to 1.4 billion.

Market Segmentation

- Based on the technology, the market is segmented into axial bone densitometry, dual-energy X-ray absorptiometry (DEXA), quantitative computed tomography (QCT), peripheral bone densitometry, single-energy X-ray absorptiometry (SEXA), peripheral dual energy X-Ray absorptiometry (pDEXA), radiographic absorptiometry (RA), quantitative ultrasound (QUS), and peripheral quantitative computed tomography (pQCT).

- Based on the application, the market is segmented into osteoporosis and osteopenia diagnosis, cystic fibrosis diagnosis, chronic kidney disease diagnosis, rheumatoid arthritis diagnosis, and body composition measurement.

- Based on the end-user, the market is segmented into hospitals, orthopedic clinics, and diagnostic imaging centers.

Axial Bone Densitometry Segment to Lead the Market with the Largest Share

Axial bone densitometry is a procedure used to measure the density of the central skeleton, which includes the spine, pelvis, and hip. It is utilized for the diagnosis of osteoporosis, monitoring the treatment of osteoporosis, evaluation of fracture risk, assessment of bone loss, and detection of metabolic bone disorders. It is most helpful for postmenopausal women, elderly patients, and patients with risk factors such as history of fractures or family history. The technique is recommended for high-risk populations such as postmenopausal women, elderly people, low-trauma fracture survivors, and individuals with specific risk factors.

Osteoporosis and Osteopenia Diagnosis: A Key Segment in Market Growth

Bone densitometry tests, or DEXA scans, diagnose osteoporosis and osteopenia by determining bone mineral density (BMD). These tests detect bone degeneration diseases, such as osteoarthritis, osteomalacia, and osteoporotic fractures. The results are compared with the average BMD of a healthy individual. Testing can predict future fractures, monitor the effects of treatment, and confirm the diagnosis of osteoporosis in post-fracture patients. In elderly patients, early treatment prevents severe complications.

Regional Outlook

The global bone densitometer market is further divided by geography, including North America (the US and Canada), Europe (the UK, Germany, France, Italy, Spain, Russia, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, Australia and New Zealand, ASEAN Countries, and the Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America)

Government and Private Healthcare Initiatives in Asia-Pacific

In Asia-Pacific, osteoporosis is greatly underdiagnosed and undertreated. Public health programs on bone health and the prevention of osteoporosis are essential in reducing healthcare costs and improving quality of life, especially when government agencies collaborate with private healthcare providers. For instance, in October 2024, the India Bone Health Initiative, IBHI, was recently launched by Pharmed Ltd. and coincided with World Osteoporosis Day. The initiative targets the improvement of the health and well-being of the Indian population by creating an awareness of osteoporosis, educating patients, making BMD testing accessible, early detection and prevention strategies, and collaborating with healthcare professionals. The initiative capitalizes on Pharmed's history of success with bone health initiatives, including conducting free BMD screening camps and collaborating with orthopaedicians. It seeks to develop a setting in which patients are better informed about bone health, yet less able to have meaningful discussions with healthcare providers.

North America Region Dominates the Market with Major Share

North America holds a significant share owing to the aging North American population increasing the demand for bone densitometers, which are vital diagnostic tools for monitoring bone health. According to the Population Reference Bureau’s (PRB) Org., in January 2024, the American population aged 65 and older is expected to grow significantly, from 58 million in 2022 to 82 million by 2050, representing a 47% increase. This age group’s proportion of the total population is anticipated to rise from 17% to 23%. Additionally, the median age of the US population has increased from 30.0 in 1980 to 38.9 in 2022, with 17 states having a median age above 40, led by Maine at 44.8 and New Hampshire at 43.3. The older population is also growing more racially and ethnically diverse, with the percentage of people who identify as non-Hispanic white expected to decline from 75 percent in 2022 to 60 percent by 2050.

Market Players Outlook

The major companies operating in the global bone densitometer market include General Electric Co., Hitachi, Ltd., Hologic, Inc., FUJIFILM Holdings Corp., Echolight S.p.a., JNC International Ltd., and Xingaoyi Medical Equipment Co., Ltd. among others. Market players are leveraging partnerships, collaborations, mergers and acquisition strategies for business expansion and innovative product development to maintain their market positioning.

Recent Developments

- In November 2024, Siemens Healthineers agreed with Echolight to be a reseller of Echolight bone densitometers, including the EchoStation. The REMS technology from Echolight measures bone density and microarchitecture without X-ray scans. This allows the physician to conduct repeated scans to monitor long-term bone health. A portable solution measures bone quantity and quality simultaneously and provides common parameters for osteoporosis diagnosis and fragility score evaluation.

The Report Covers

- Market value data analysis of 2024 and forecast to 2035.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global bone densitometer market. Based on the availability of data, information related to new products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Industry Overview

• Current Industry Analysis and Growth Potential Outlook

• Global Bone Densitometers Market Sales Analysis – Technology| Application | End-User ($ Million)

• Bone Densitometers Market Sales Performance of Top Countries

1.2. Research Methodology

• Primary Research Approach

• Secondary Research Approach

1.3. Market Snapshot

2. Market Overview and Insights

2.1. Scope of the Study

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Bone Densitometer Industry Trends

2.2.2. Market Recommendations

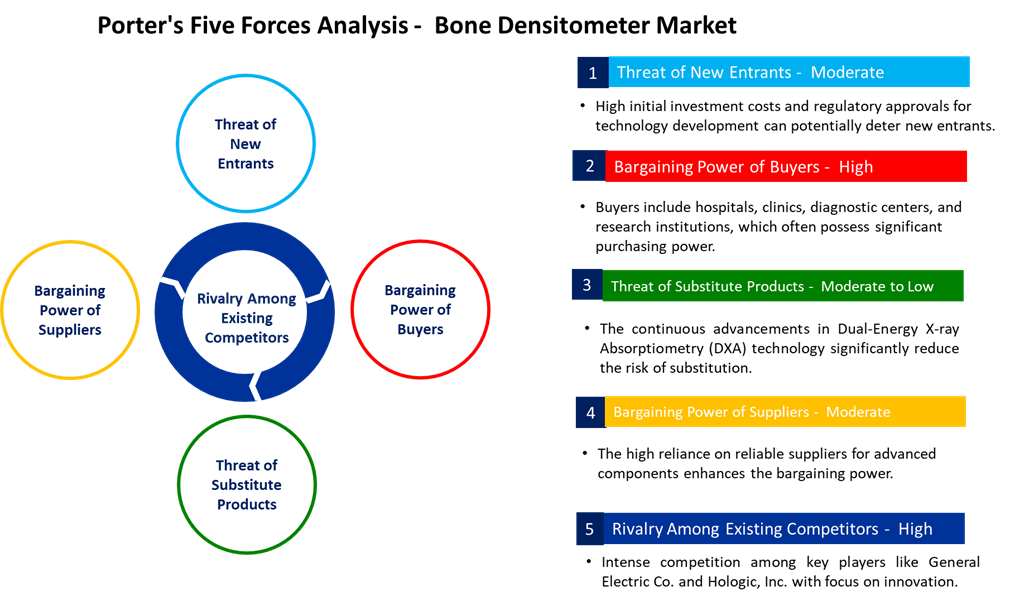

2.3. Porter's Five Forces Analysis for the Bone Densitometers Market

2.3.1. Competitive Rivalry

2.3.2. Threat of New Entrants

2.3.3. Bargaining Power of Suppliers

2.3.4. Bargaining Power of Buyers

2.3.5. Threat of Substitutes

3. Market Determinants

3.1. Market Drivers

3.1.1. Drivers For Global Bone Densitometers Market: Impact Analysis

3.2. Market Pain Points and Challenges

3.2.1. Restraints For Global Bone Densitometers Market: Impact Analysis

3.3. Market Opportunities

4. Competitive Landscape

4.1. Competitive Dashboard – Bone Densitometers Market Revenue and Share by Manufacturers

• Bone Densitometers Product Comparison Analysis

• Top Market Player Ranking Matrix

4.2. Key Company Analysis

4.3. General Electric Co.

4.3.1. Overview

4.3.2. Product Portfolio

4.3.3. Financial Analysis (Subject to Data Availability)

4.3.4. SWOT Analysis

4.3.5. Business Strategy

4.4. FUJIFILM Holdings Corp.

4.4.1. Overview

4.4.2. Product Portfolio

4.4.3. Financial Analysis (Subject to Data Availability)

4.4.4. SWOT Analysis

4.4.5. Business Strategy

4.5. Hologic, Inc.

4.5.1. Overview

4.5.2. Product Portfolio

4.5.3. Financial Analysis (Subject to Data Availability)

4.5.4. SWOT Analysis

4.5.5. Business Strategy

4.6. Top Winning Strategies by Market Players

4.6.1. Merger and Acquisition

4.6.2. Product Launch

4.6.3. Partnership And Collaboration

5. Global Bone Densitometers Market Sales Analysis by Technology ($ Million)

5.1. Axial Bone Densitometry

5.1.1. Dual Energy X-Ray Absorptiometry (DEXA)

5.1.2. Quantitative Computed Tomography (QCT)

5.2. Peripheral Bone Densitometry

5.2.1. Single Energy X-Ray Absorptiometry (SEXA)

5.2.2. Peripheral Dual Energy X-Ray Absorptiometry (pDEXA)

5.2.3. Radiographic Absorptiometry (RA)

5.2.4. Quantitative Ultrasound (QUS)

5.2.5. Peripheral Quantitative Computed Tomography (pQCT)

6. Global Bone Densitometers Market Sales Analysis by Application ($ Million)

6.1. Osteoporosis and Osteopenia Diagnosis

6.2. Cystic Fibrosis Diagnosis

6.3. Chronic Kidney Diseases Diagnosis

6.4. Rheumatoid Arthritis Diagnosis

6.5. Body Composition Measurement

7. Global Bone Densitometers Market Sales Analysis by End-User ($ Million)

7.1. Hospitals

7.2. Orthopedic Clinics

7.3. Diagnostic Imaging Centers

8. Regional Analysis

8.1. North American Bone Densitometers Market Sales Analysis – Technology| Application | End-User| Country ($ Million)

• Macroeconomic Factors for North America

8.1.1. United States

8.1.2. Canada

8.2. European Bone Densitometers Market Sales Analysis – Technology| Application | End-User| Country ($ Million)

• Macroeconomic Factors for Europe

8.2.1. UK

8.2.2. Germany

8.2.3. Italy

8.2.4. Spain

8.2.5. France

8.2.6. Russia

8.2.7. Rest of Europe

8.3. Asia-Pacific Bone Densitometers Market Sales Analysis – Technology| Application | End-User| Country ($ Million)

• Macroeconomic Factors for Asia-Pacific

8.3.1. China

8.3.2. Japan

8.3.3. South Korea

8.3.4. India

8.3.5. Australia & New Zealand

8.3.6. ASEAN Countries (Thailand, Indonesia, Vietnam, Singapore, And Other)

8.3.7. Rest of Asia-Pacific

8.4. Rest of the World Bone Densitometers Market Sales Analysis – Technology| Application | End-User | Country ($ Million)

• Macroeconomic Factors for the Rest of the World

8.4.1. Latin America

8.4.2. Middle East and Africa

9. Company Profiles

9.1. Aarna Systems and Wellness Pvt. Ltd.

9.1.1. Quick Facts

9.1.2. Company Overview

9.1.3. Product Portfolio

9.1.4. Business Strategies

9.2. BeamMed Inc.

9.2.1. Quick Facts

9.2.2. Company Overview

9.2.3. Product Portfolio

9.2.4. Business Strategies

9.3. BMTech Co., Ltd.

9.3.1. Quick Facts

9.3.2. Company Overview

9.3.3. Product Portfolio

9.3.4. Business Strategies

9.4. Canon Medical Systems Corp.

9.4.1. Quick Facts

9.4.2. Company Overview

9.4.3. Product Portfolio

9.4.4. Business Strategies

9.5. DMS Group

9.5.1. Quick Facts

9.5.2. Company Overview

9.5.3. Product Portfolio

9.5.4. Business Strategies

9.6. Echolight S.p.a.

9.6.1. Quick Facts

9.6.2. Company Overview

9.6.3. Product Portfolio

9.6.4. Business Strategies

9.7. Eurotec Medical Systems Srl.

9.7.1. Quick Facts

9.7.2. Company Overview

9.7.3. Product Portfolio

9.7.4. Business Strategies

9.8. FUJIFILM Holdings Corp.

9.8.1. Quick Facts

9.8.2. Company Overview

9.8.3. Product Portfolio

9.8.4. Business Strategies

9.9. Furuno Electric Co., Ltd.

9.9.1. Quick Facts

9.9.2. Company Overview

9.9.3. Product Portfolio

9.9.4. Business Strategies

9.10. General Electric Co.

9.10.1. Quick Facts

9.10.2. Company Overview

9.10.3. Product Portfolio

9.10.4. Business Strategies

9.11. Hitachi, Ltd.

9.11.1. Quick Facts

9.11.2. Company Overview

9.11.3. Product Portfolio

9.11.4. Business Strategies

9.12. Hologic, Inc.

9.12.1. Quick Facts

9.12.2. Company Overview

9.12.3. Product Portfolio

9.12.4. Business Strategies

9.13. JNC International Ltd.

9.13.1. Quick Facts

9.13.2. Company Overview

9.13.3. Product Portfolio

9.13.4. Business Strategies

9.14. Life Medical Equipment Co., Ltd.

9.14.1. Quick Facts

9.14.2. Company Overview

9.14.3. Product Portfolio

9.14.4. Business Strategies

9.15. Medonica Co. Ltd.

9.15.1. Quick Facts

9.15.2. Company Overview

9.15.3. Product Portfolio

9.15.4. Business Strategies

9.16. OSTEOSYS Corp.

9.16.1. Quick Facts

9.16.2. Company Overview

9.16.3. Product Portfolio

9.16.4. Business Strategies

9.17. Swissray Global

9.17.1. Quick Facts

9.17.2. Company Overview

9.17.3. Product Portfolio

9.17.4. Business Strategies

9.18. Xingaoyi Medical Equipment Co., Ltd.

9.18.1. Quick Facts

9.18.2. Company Overview

9.18.3. Product Portfolio

9.18.4. Business Strategies

1. Global Bone Densitometers Market Research And Analysis By Technology, 2024-2035 ($ Million)

2. Global Axial Bone Densitometry Market Research And Analysis By Region, 2024-2035 ($ Million)

3. Global Dual Energy X-Ray Absorptiometry (DEXA) Market Research And Analysis By Region, 2024-2035 ($ Million)

4. Global Quantitative Computed Tomography (QCT) Bone Densitometers Market Research And Analysis By Region, 2024-2035 ($ Million)

5. Global Peripheral Bone Densitometry Market Research And Analysis By Region, 2024-2035 ($ Million)

6. Global Single Energy X-Ray Absorptiometry (SEXA) Market Research And Analysis By Region, 2024-2035 ($ Million)

7. Global Peripheral Dual Energy X-Ray Absorptiometry (pDEXA) Market Research And Analysis By Region, 2024-2035 ($ Million)

8. Global Radiographic Absorptiometry (RA) Market Research And Analysis By Region, 2024-2035 ($ Million)

9. Global Quantitative Ultrasound (QUS) Bone Densitometers Market Research And Analysis By Region, 2024-2035 ($ Million)

10. Global Peripheral Quantitative Computed Tomography (pQCT) Market Research And Analysis By Region, 2024-2035 ($ Million)

11. Global Bone Densitometers Market Research And Analysis By Application, 2024-2035 ($ Million)

12. Global Bone Densitometers In Osteoporosis And Osteopenia Diagnosis Market Research And Analysis By Region, 2024-2035 ($ Million)

13. Global Bone Densitometers In Cystic Fibrosis Diagnosis Market Research And Analysis By Region, 2024-2035 ($ Million)

14. Global Bone Densitometers In Chronic Kidney Diseases Diagnosis Market Research And Analysis By Region, 2024-2035 ($ Million)

15. Global Bone Densitometers In Rheumatoid Arthritis Diagnosis Market Research And Analysis By Region, 2024-2035 ($ Million)

16. Global Bone Densitometers In Body Composition Measurement Market Research And Analysis By Region, 2024-2035 ($ Million)

17. Global Bone Densitometers Market Research And Analysis By End-User, 2024-2035 ($ Million)

18. Global Bone Densitometers For Hospitals Market Research And Analysis By Region, 2024-2035 ($ Million)

19. Global Bone Densitometers For Orthopedic Clinics Market Research And Analysis By Region, 2024-2035 ($ Million)

20. Global Bone Densitometers For Diagnostic Imaging Centers Market Research And Analysis By Region, 2024-2035 ($ Million)

21. Global Bone Densitometers Market Research And Analysis By Region, 2024-2035 ($ Million)

22. North American Bone Densitometers Market Research And Analysis By Country, 2024-2035 ($ Million)

23. North American Bone Densitometers Market Research And Analysis By Technology, 2024-2035 ($ Million)

24. North American Bone Densitometers Market Research And Analysis By Application, 2024-2035 ($ Million)

25. North American Bone Densitometers Market Research And Analysis By End-User, 2024-2035 ($ Million)

26. European Bone Densitometers Market Research And Analysis By Country, 2024-2035 ($ Million)

27. European Bone Densitometers Market Research And Analysis By Technology, 2024-2035 ($ Million)

28. European Bone Densitometers Market Research And Analysis By Application, 2024-2035 ($ Million)

29. European Bone Densitometers Market Research And Analysis By End-User, 2024-2035 ($ Million)

30. Asia-Pacific Bone Densitometers Market Research And Analysis By Country, 2024-2035 ($ Million)

31. Asia-Pacific Bone Densitometers Market Research And Analysis By Technology, 2024-2035 ($ Million)

32. Asia-Pacific Bone Densitometers Market Research And Analysis By Application, 2024-2035 ($ Million)

33. Asia-Pacific Bone Densitometers Market Research And Analysis By End-User, 2024-2035 ($ Million)

34. Rest Of The World Bone Densitometers Market Research And Analysis By Region, 2024-2035 ($ Million)

35. Rest Of The World Bone Densitometers Market Research And Analysis By Technology, 2024-2035 ($ Million)

36. Rest Of The World Bone Densitometers Market Research And Analysis By Application, 2024-2035 ($ Million)

37. Rest Of The World Bone Densitometers Market Research And Analysis By End-User, 2024-2035 ($ Million)

1. Global Bone Densitometers Market Share By Technology, 2024 Vs 2035 (%)

2. Global Axial Bone Densitometry Market Share By Region, 2024 Vs 2035 (%)

3. Global Dual Energy X-Ray Absorptiometry (DEXA) Market Share By Region, 2024 Vs 2035 (%)

4. Global Quantitative Computed Tomography (QCT) Bone Densitometers Market Share By Region, 2024 Vs 2035 (%)

5. Global Peripheral Bone Densitometry Market Share By Region, 2024 Vs 2035 (%)

6. Global Single Energy X-Ray Absorptiometry (SEXA) Market Share By Region, 2024 Vs 2035 (%)

7. Global Peripheral Dual Energy X-Ray Absorptiometry (pDEXA) Market Share By Region, 2024 Vs 2035 (%)

8. Global Radiographic Absorptiometry (RA) Market Share By Region, 2024 Vs 2035 (%)

9. Global Quantitative Ultrasound (QUS) Bone Densitometers Market Share By Region, 2024 Vs 2035 (%)

10. Global Peripheral Quantitative Computed Tomography (pQCT) Market Share By Region, 2024 Vs 2035 (%)

11. Global Bone Densitometers Market Share By Application, 2024 Vs 2035 (%)

12. Global Bone Densitometers In Osteoporosis And Osteopenia Diagnosis Market Share By Region, 2024 Vs 2035 (%)

13. Global Optical Digitizer and Scanner In Cystic Fibrosis Diagnosis Market Share By Region, 2024 Vs 2035 (%)

14. Global Bone Densitometers In Chronic Kidney Diseases Diagnosis Market Share By Region, 2024 Vs 2035 (%)

15. Global Bone Densitometers In Rheumatoid Arthritis Diagnosis Market Share By Region, 2024 Vs 2035 (%)

16. Global Bone Densitometers In Body Composition Measurement Market Share By Region, 2024 Vs 2035 (%)

17. Global Bone Densitometers Market Share By End-User, 2024 Vs 2035 (%)

18. Global Bone Densitometers For Hospitals Market Share By Region, 2024 Vs 2035 (%)

19. Global Bone Densitometers For Orthopedic Clinics Market Share By Region, 2024 Vs 2035 (%)

20. Global Bone Densitometers For Diagnostic Imaging Centers Market Share By Region, 2024 Vs 2035 (%)

21. Global Bone Densitometers Market Share By Region, 2024 Vs 2035 (%)

22. US Bone Densitometers Market Size, 2024-2035 ($ Million)

23. Canada Bone Densitometers Market Size, 2024-2035 ($ Million)

24. UK Bone Densitometers Market Size, 2024-2035 ($ Million)

25. France Bone Densitometers Market Size, 2024-2035 ($ Million)

26. Germany Bone Densitometers Market Size, 2024-2035 ($ Million)

27. Italy Bone Densitometers Market Size, 2024-2035 ($ Million)

28. Spain Bone Densitometers Market Size, 2024-2035 ($ Million)

29. Russia Bone Densitometers Market Size, 2024-2035 ($ Million)

30. Rest Of Europe Bone Densitometers Market Size, 2024-2035 ($ Million)

31. India Bone Densitometers Market Size, 2024-2035 ($ Million)

32. China Bone Densitometers Market Size, 2024-2035 ($ Million)

33. Japan Bone Densitometers Market Size, 2024-2035 ($ Million)

34. South Korea Bone Densitometers Market Size, 2024-2035 ($ Million)

35. Australia and New Zealand Bone Densitometers Market Size, 2024-2035 ($ Million)

36. ASEAN Bone Densitometers Market Size, 2024-2035 ($ Million)

37. Rest Of Asia-Pacific Bone Densitometers Market Size, 2024-2035 ($ Million)

38. Latin America Bone Densitometers Market Size, 2024-2035 ($ Million)

39. Middle East And Africa Bone Densitometers Market Size, 2024-2035 ($ Million)