Brandy Market

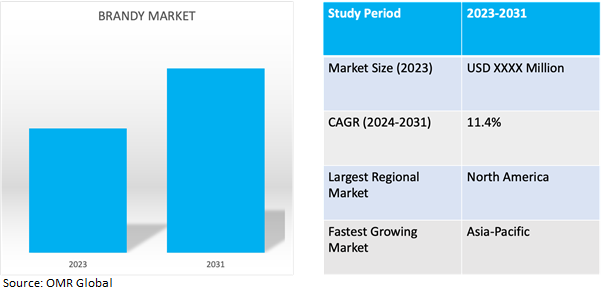

Brandy Market Size, Share & Trends Analysis Report by Product (Flavoured and Regular), by Price (Economy, Premium and Luxury), and by Distribution Channel (On Trade and Off Trade) Forecast Period (2024-2031)

Brandy market is anticipated to grow at a CAGR of 11.4% during the forecast period (2024-2031). Brandy is a type of distilled spirit made from fermented fruit juice, most commonly grapes. However, it can also be produced from other fruits such as apples, pears, and berries. The process involves fermenting the fruit juice and then distilling it to increase its alcohol content. Brandy is typically aged in oak barrels, which impart flavor and color to the final product. It can range in color from pale yellow to deep amber and in flavor from fruity and floral to rich and complex, depending on factors such as the fruit used, the distillation process, and the length of aging.

Market Dynamics

Evolution of Consumer Preferences and Innovation in the Brandy Market

Consumer preferences are continually evolving, driven by factors such as lifestyle changes, cultural influences, and health-consciousness. There is a growing demand for premium and craft brandy products as consumers seek high-quality and innovative offerings. Additionally, trends such as the rise of cocktail culture and the popularity of mixology contribute to changing consumer preferences, influencing the types of brandy products sought by consumers. For instance, in October 2023, Burnt Faith, a distillery renowned for its brandy, unveiled a new cocktail bar open to consumers at its brandy house situated in Walthamstow, East London, thereby enhancing the vibrancy of the Blackhorse Road Beer Mile. The cocktail menu showcases a selection of classic cocktails with a local twist, exemplified by offerings such as the Aged Negroni, which features Burnt Faith British Brandy, VRSD London Vermouth, and Select Aperitivo. Additionally, patrons can enjoy a Sazerac crafted with Burnt Faith British Brandy, Rittenhouse Rye, Devils Botany Absinthe, and Peychaud’s Bitters.

Innovation Trends in the Brandy Industry

Industry innovation in the brandy sector involves the continuous development and introduction of new products, processes, and marketing strategies to meet evolving consumer preferences and market trends. This innovation encompasses various aspects, including product formulation, packaging design, production techniques, and distribution channels. Brandy producers innovate by introducing new flavors, experimenting with aging techniques, and incorporating unique ingredients to create differentiated offerings that appeal to discerning consumers. Additionally, advancements in marketing and branding initiatives, such as experiential events, digital campaigns, and collaborations with influencers, contribute to industry innovation by enhancing brand visibility and consumer engagement. For instance, in September 2022, Stella Rosa celebrated as the leading imported wine in America and expanded its portfolio into the spirits sector in collaboration with its parent company, Riboli Family Wines. Together, they introduce a collection of premium imported flavored brandies, including offerings such as Stella Rosa Smooth Black, Tropical Passion, and Honey Peach Brandy.

Market Segmentation

Our in-depth analysis of the global brandy market includes the following segments by product, price, and distribution channel:

- Based on product, the market is sub-segmented into flavored and regular.

- Based on price, the market is sub-segmented into economy, premium, and luxury.

- Based on the distribution channel, the market is sub-segmented into on-trade and off-trade.

Regular is Projected to Emerge as the Largest Segment

Based on the product, the global brandy market is sub-segmented into flavored and regular. Among these, the regular sub-segment is expected to hold the largest share of the market. The primary factor supporting the segment's growth includes its versatility and appeal to a wide range of consumers. Regular brandy, characterized by its balanced flavor profile and accessibility, attracts both seasoned brandy enthusiasts and casual drinkers alike. Additionally, regular brandy's popularity as a standalone drink and as a key ingredient in various cocktails and culinary recipes contributes to its steady demand and growth in the market.

Off-Trade Sub-segment to Hold a Considerable Market Share

The Off-Trade sub-segment commands a significant market share in the global brandy market due to its convenience and accessibility to consumers through retail stores, supermarkets, and e-commerce platforms. These channels offer a diverse selection of brandy brands and variants, catering to both connoisseurs and budget-conscious consumers. Off-trade platforms also serve as effective marketing avenues for brandy producers to promote their products through strategies such as discounts and promotional campaigns.

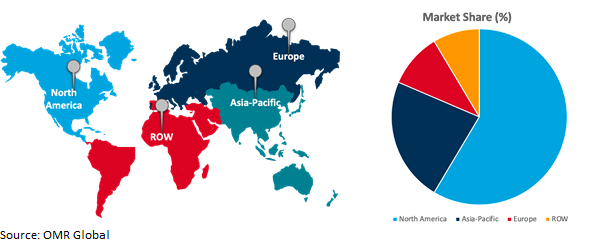

Regional Outlook

The global brandy market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Emergence of Asia-Pacific as the Fastest-Growing Market in the Global Brandy Sector

The Asia-Pacific region is emerging as the fastest-growing market in the global brandy sector due to increasing disposable incomes and evolving consumer tastes, particularly in countries like China, India, and Japan, which are driving a surge in brandy consumption. Additionally, the influence of Western lifestyle trends and international travel has sparked a growing interest in premium spirits, including brandy, among affluent and adventurous consumers. The expansion of distribution networks and the rise of retail outlets and e-commerce platforms have also made brandy more accessible to a wider audience. Furthermore, the growing cocktail culture and the establishment of upscale bars and restaurants further contribute to the region's rapid growth in the brandy market. For instance, in November 2023, Tilaknagar Industries Limited (TI), a prominent Indian-Made Foreign Liquor Manufacturer (IMFL), unveiled its premiumization strategy with the debut of Mansion House Chambers Brandy, a refined variation of its well-established brand, Mansion House. Renowned as one of India's foremost producers of premium brandy, Tilaknagar Industries intends to leverage this introduction to enhance its market presence and attract discerning consumers seeking elevated spirits offerings.

Global Brandy Market Growth by Region 2024-2031

North America Holds Major Market Share

Among all the regions, North America holds a significant share due to its rich history of brandy production, countries like the United States and Mexico have established themselves as prominent producers and consumers of the spirit. The region's large and affluent consumer base, coupled with strong purchasing power, drives robust demand for high-quality brandy products. For instance, in March 2022, E. & J. Gallo Winery unveiled Spirit of Gallo, a fresh brand aimed at highlighting its acclaimed array of spirits, which encompasses gin, whiskey, brandy, tequila, and vodka.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global brandy market include Diageo, Jas Hennessy & Cie, Rémy Cointreau, E & J Gallo, Emperador, Paul Masson, and others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, In June 2022, Emperador introduced a limited edition, Presidente Brandy, to commemorate a significant milestone in the history of the Philippines.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global brandy market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Jas Hennessy & Cie

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Diageo PLC

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Rémy Cointreau

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Brandy Market by Product

4.1.1. Flavored

4.1.2. Regular

4.2. Global Brandy Market by Price

4.2.1. Economy

4.2.2. Premium

4.2.3. Luxury

4.3. Global Brandy Market by Distribution Channel

4.3.1. On Trade

4.3.2. Off Trade

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. Baron Otard

6.2. Bisquit (Campari)

6.3. Bolero & Company Group

6.4. Camus

6.5. Changyu

6.6. Christian Brothers

6.7. Courvoisier

6.8. Dreher (Italy)

6.9. E & J Gallo

6.10. Emperador (Alliance Global Group, Inc.)

6.11. F. Korbel & Bros.

6.12. Gautier

6.13. Germain-Robin

6.14. Golden Grape

6.15. Gran Matador

6.16. Hardy

6.17. Honey Bee (Beehive)

6.18. Louis Royer

6.19. Maison BRILLET

6.20. Mansion House

6.21. Martell

6.22. Men's Club

6.23. Meukow

6.24. Old Admiral (Radico Khaitan Ltd.)

6.25. Old Kenigsberg

6.26. Paul Masson

6.27. Salignac

6.28. Silver Cup Brandy

6.29. Speciality Brands Ltd.

6.30. St-Rémy

6.31. Thomas HINE & Co.

6.32. Torres

6.33. Vecchia Romagna

6.34. Yantai Changyu Pioneer Wine Co. Ltd.

1. GLOBAL BRANDY MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

2. GLOBAL FLAVORED BRANDY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL REGULAR BRANDY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL BRANDY MARKET RESEARCH AND ANALYSIS BY PRICE, 2023-2031 ($ MILLION)

5. GLOBAL ECONOMY BRANDY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL PREMIUM BRANDY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL LUXURY BRANDY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL BRANDY MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

9. GLOBAL ON TRADE BRANDY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL OFF TRADE BRANDY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL BRANDY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. NORTH AMERICAN BRANDY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

13. NORTH AMERICAN BRANDY MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

14. NORTH AMERICAN BRANDY MARKET RESEARCH AND ANALYSIS BY PRICE, 2023-2031 ($ MILLION)

15. NORTH AMERICAN BRANDY MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

16. EUROPEAN BRANDY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

17. EUROPEAN BRANDY MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

18. EUROPEAN BRANDY MARKET RESEARCH AND ANALYSIS BY PRICE, 2023-2031 ($ MILLION)

19. EUROPEAN BRANDY MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

20. ASIA-PACIFIC BRANDY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

21. ASIA-PACIFIC BRANDY MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

22. ASIA-PACIFIC BRANDY MARKET RESEARCH AND ANALYSIS BY PRICE, 2023-2031 ($ MILLION)

23. ASIA-PACIFIC BRANDY MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

24. REST OF THE WORLD BRANDY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

25. REST OF THE WORLD BRANDY MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

26. REST OF THE WORLD BRANDY MARKET RESEARCH AND ANALYSIS BY PRICE, 2023-2031 ($ MILLION)

27. REST OF THE WORLD BRANDY MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

1. GLOBAL BRANDY MARKET SHARE BY PRODUCT, 2023 VS 2031 (%)

2. GLOBAL FLAVORED BRANDY MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL REGULAR BRANDY MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL BRANDY MARKET SHARE BY PRICE, 2023 VS 2031 (%)

5. GLOBAL ECONOMY BRANDY MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL PREMIUM BRANDY MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL LUXURY BRANDY MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL BRANDY MARKET SHARE BY DISTRIBUTION CHANNEL, 2023 VS 2031 (%)

9. GLOBAL ON TRADE BRANDY MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL OFF TRADE BRANDY MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL BRANDY MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. US BRANDY MARKET SIZE, 2023-2031 ($ MILLION)

13. CANADA BRANDY MARKET SIZE, 2023-2031 ($ MILLION)

14. UK BRANDY MARKET SIZE, 2023-2031 ($ MILLION)

15. FRANCE BRANDY MARKET SIZE, 2023-2031 ($ MILLION)

16. GERMANY BRANDY MARKET SIZE, 2023-2031 ($ MILLION)

17. ITALY BRANDY MARKET SIZE, 2023-2031 ($ MILLION)

18. SPAIN BRANDY MARKET SIZE, 2023-2031 ($ MILLION)

19. REST OF EUROPE BRANDY MARKET SIZE, 2023-2031 ($ MILLION)

20. INDIA BRANDY MARKET SIZE, 2023-2031 ($ MILLION)

21. CHINA BRANDY MARKET SIZE, 2023-2031 ($ MILLION)

22. JAPAN BRANDY MARKET SIZE, 2023-2031 ($ MILLION)

23. SOUTH KOREA BRANDY MARKET SIZE, 2023-2031 ($ MILLION)

24. REST OF ASIA-PACIFIC BRANDY MARKET SIZE, 2023-2031 ($ MILLION)

25. LATIN AMERICA BRANDY MARKET SIZE, 2023-2031 ($ MILLION)

26. MIDDLE EAST AND AFRICA BRANDY MARKET SIZE, 2023-2031 ($ MILLION)